Even if you create the safest workplace environment and go above and beyond for safety training, the hard truth is that employees will get hurt on the job. Almost three million private industry employees reported nonfatal workplace injuries and illnesses in 2022. Even worse, 5,486 fatal work injuries were reported that year.

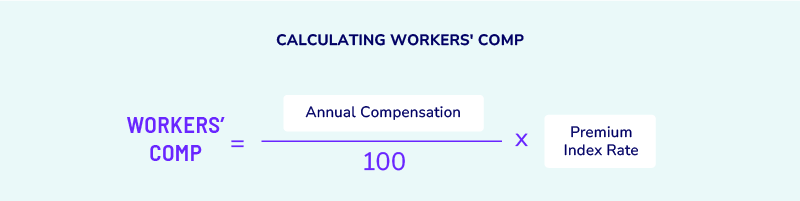

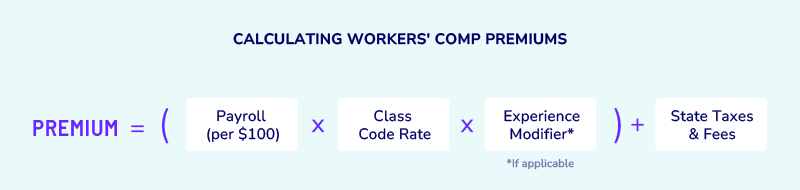

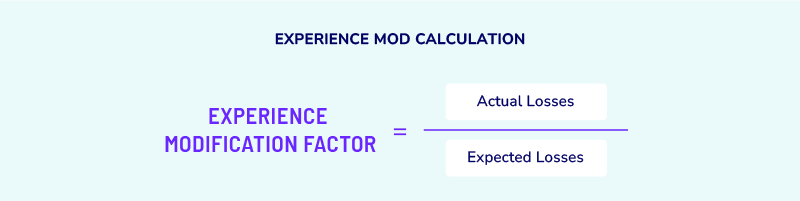

To maintain compliance (and pay injured employees the proper amount), you need to know how to calculate workers’ comp for any scenario. As a reminder, workers’ compensation is mandated by the government and covers medical treatment, disability payments, and death benefits for employees injured at work.

Since calculating workers’ comp can be complicated, we’ve listed ten common questions (and their answers) to equip you with the correct information for success.