Federal minimum wage is the lowest wage an employer is allowed to pay their employees. The Federal Labor Standards Act (FLSA) was established in 1938 to protect workers and ensure they earn a fair wage for their work.

The minimum wage rate is determined by the government. Some states adhere to the federal guidelines, while others set their own minimum wage rates. Because of this, it can be challenging for businesses with employees across multiple states to stay on top of all the minimum wage changes.

Minimum Wage Guidelines

The federal minimum wage is currently $7.25 an hour. This rate has been in place since July 24, 2009, when it was increased from $6.55 an hour.

Regardless of the federal rate, each state can set its own minimum wage for workers, and sometimes these wages can even vary by city and county. State minimum wage rates are typically governed by each individual state’s legislative activities.

According to the Department of Labor (DOL), states have to adhere to the federal minimum wage law if their state minimum wage is lower than the federal rate.

If a state, city, or county has a minimum wage greater than $7.25, employers are required to pay that higher rate to employees.

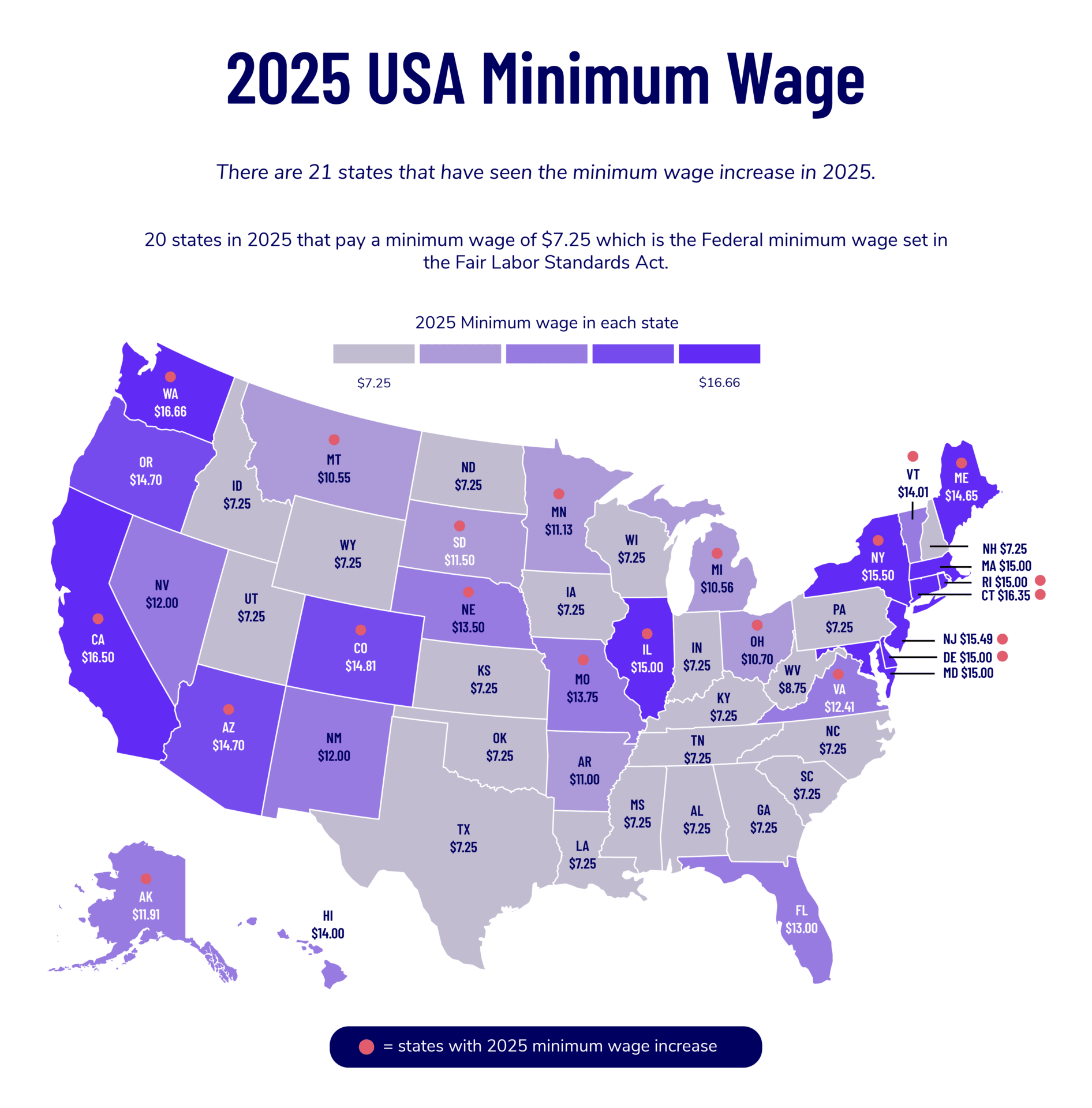

Here are some minimum wage increases to be aware of for 2025.

2025 Minimum Wage Increases

| State | 2024 | 2025 | 25 vs. 24 |

|---|---|---|---|

| Michigan | $10.33 | $12.48 | $2.15 |

| Delaware | $13.25 | $15.00 | $1.75 |

| Nebraska | $12.00 | $13.50 | $1.50 |

| Missouri | $12.30 | $13.75 | $1.45 |

| Illinois | $14.00 | $15.00 | $1.00 |

| Rhode Island | $14.00 | $15.00 | $1.00 |

| Connecticut | $15.69 | $16.35 | $0.66 |

| California | $16.00 | $16.50 | $0.50 |

| Maine | $14.15 | $14.65 | $0.50 |

| New York | $15.00 | $15.50 | $0.50 |

| Virginia | $12.00 | $12.41 | $0.41 |

| Colorado | $14.42 | $14.81 | $0.39 |

| Washington | $16.28 | $16.66 | $0.38 |

| New Jersey | $15.13 | $15.49 | $0.36 |

| Arizona | $14.35 | $14.70 | $0.35 |

| Vermont | $13.67 | $14.01 | $0.34 |

| South Dakota | $11.20 | $11.50 | $0.30 |

| Minnesota | $10.85 | $11.13 | $0.28 |

| Montana | $10.30 | $10.55 | $0.25 |

| Ohio | $10.45 | $10.70 | $0.25 |

| Alaska | $11.73 | $11.91 | $0.18 |

| District of Columbia | $17.50 | TBD | |

| Florida | $13.00 | TBD | |

| Nevada | $12.00 | TBD | |

| Oregon | $14.70 | TBD |

Looking for detailed State Minimum Wage & Tax Details? Select Your State below.

Alabama Wage and Tax Facts | ||

| State – Effective 7/24/09 | Federal – Effective 7/24/09 | |

Alabama Minimum Wage | ||

| Minimum Wage | $7.25* | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $2.13* | $2.13 |

| Maximum Tip Credit | $5.12* | $5.12 |

| Youth Minimum Wage | $4.25* | $4.25 |

Alabama State Income Tax | ||

| Wage Withholding | Tables | |

| Supplemental Wage / Bonus Rate | 5.00% | |

Alabama Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Unchanged from 2024) | $8,000 | |

| Employee 2025 Deduction | None | |

| Employer 2025 Tax Rates (Plus 0.06% employment security assessment) | 0.20 – 5.4% | |

| Standard 2025 New Employer Rate | 2.70% | |

| Voluntary Contribution Permitted | No | |

State Resources | ||

| Dept. of Labor: https://labor.alabama.gov | ||

| Dept. of Revenue: http://revenue.alabama.gov | ||

Alaska Wage and Tax Facts | ||

| State Effective 1/1/25 | Federal Effective 7/24/09 | |

Alaska Minimum Wage | ||

| Minimum Wage | $11.91 | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $11.91 | $2.13 |

| Maximum Tip Credit | Not Allowed | $5.12 |

| Youth Minimum Wage | $7.25 | $4.25 |

Alaska State Income Tax | ||

| Wage Withholding | None | |

| Supplemental Wage / Bonus Rate | None | |

Alaska Unemployment Insurance | ||

| Employer 2025 Tax Rates | 1.0 – 5.4% | |

| Standard 2025 New Employer Rate | 1.00% | |

| Voluntary Contribution Permitted | No | |

| Maximum 2025 Taxable Earnings (Increased from $49,700 in 2024) | $51,700 | |

| Employee 2025 Deduction (Unchanged in 2024) | 0.50% | |

State Resources | ||

| Dept. of Labor and Workforce Development: http://www.labor.state.ak.us | ||

| Dept. of Revenue: http://www.revenue.state.ak.us | ||

Arizona Wage and Tax Facts | ||

| State Effective 1/1/25 | Federal Effective 7/24/09 | |

Arizona Minimum Wage | ||

| Minimum Wage | $14.70 | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $11.70 | $2.13 |

| Maximum Tip Credit | $3.00 | $5.12 |

Arizona State Income Tax | ||

| Wage Withholding | % of AZ Gross Taxable Wages | |

| Supplemental Wage / Bonus Rate | No Provision | |

Arizona Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Unchanged from 2024) | $8,000 | |

| Employee 2025 Deduction | None | |

| Employer 2025 Tax Rates | 0.04 – 9.72% | |

| Standard 2025 New Employer Rate | 2.00% | |

| Voluntary Contribution Permitted | Yes | |

State Resources | ||

| Dept. of Economic Security: https://des.az.gov | ||

| Dept. of Revenue: https://www.azdor.gov | ||

Arkansas Wage and Tax Facts | ||

| State Effective 1/1/21 | Federal Effective 7/24/09 | |

Arkansas Minimum Wage | ||

| Minimum Wage | $11.00 | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $2.63 | $2.13 |

| Maximum Tip Credit | $8.37 | $5.12 |

Arkansas State Income Tax | ||

| Wage Withholding | Tables | |

| Supplemental Wage / Bonus Rate | 3.90% | |

Arkansas Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Unchanged from 2024) | $7,000 | |

| Employee 2025 Deduction | None | |

| Employer 2025 Tax Rates (Includes 0.1% administrative assessment) | 0.200 – 10.100% | |

| Standard 2025 New Employer Rate (Includes 0.1% administrative assessment) | 2.00% | |

| Voluntary Contribution Permitted | Yes | |

State Resources | ||

| Dept. of Workforce Services: http://dws.arkansas.gov | ||

| Dept. of Finance and Administration: http://www.dfa.arkansas.gov | ||

California Wage and Tax Facts | ||

| State Effective 1/1/25 | Federal Effective 7/24/09 | |

California Minimum Wage | ||

| Minimum Wage | $16.50 | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $16.50 | $2.13 |

| Maximum Tip Credit | Not Allowed | $5.12 |

California State Income Tax | ||

| Wage Withholding | Tables | |

| Supplemental Wage / Bonus Rate | 6.6%, except 10.23% for BONUSES and earnings from STOCK OPTIONS | |

California Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Unchanged from 2024) | $7,000 | |

| Employee 2025 Deduction | None | |

| Employer 2025 Tax Rates (Plus 0.1% employment training tax assessed on most employers) | 1.5 – 6.2% | |

| Standard 2025 New Employer Rate (Plus 0.1% employment training tax) | 3.40% | |

| Voluntary Contribution Permitted | No | |

State Resources | ||

| Employment Development Dept: http://www.edd.ca.gov | ||

| Franchise Tax Board: https://www.ftb.ca.gov | ||

Colorado Wage and Tax Facts | ||

| State Effective 1/1/25 | Federal Effective 7/24/09 | |

Colorado Minimum Wage | ||

| Minimum Wage | $14.81 | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $11.79 | $2.13 |

| Maximum Tip Credit | $3.02 | $5.12 |

| Youth Minimum Wage | $12.59 | $4.25 |

Colorado State Income Tax | ||

| Wage Withholding | 4.40% | |

| Supplemental Wage / Bonus Rate | 4.40% | |

Colorado Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Increased from $23,800 in 2024) | $27,200 | |

| Employee 2025 Deduction | None | |

| Employer 2025 Tax Rates (plus support rate and solvency surcharge) | 0.64 – 8.68% | |

| Standard 2025 New Employer Rate (includes support rate and solvency surcharge) | 3.05% | |

| Voluntary Contribution Permitted | Yes | |

State Resources | ||

| Dept. of Revenue: https://www.colorado.gov/revenue | ||

| Dept. of Labor and Employment: https://www.colorado.gov/cdle | ||

Connecticut Wage and Tax Facts | ||

| State Effective 1/1/25 | Federal Effective 7/24/09 | |

Connecticut Minimum Wage | ||

| Minimum Wage | $16.35 | $7.25 |

| Minimum Cash Wage (Tipped): Tipped hotel or restaurant employees only | $6.38 | |

| Minimum Cash Wage (Tipped): Tipped bartenders only | $8.23 | |

| Minimum Cash Wage (Tipped): All other tipped employees | $16.00 | |

| Maximum Tip Credit (Tipped): Tipped hotel or restaurant employees only | $9.97 | |

| Maximum Tip Credit (Tipped): Minimum Cash Wage: Tipped bartenders only | $8.12 | |

| Maximum Tip Credit (Tipped): All other tipped employees | $0.35 | |

| Youth Minimum Wage | $13.90 | $4.25 |

Connecticut State Income Tax | ||

| Wage Withholding (Net of exemption and credit table) | Wage % | |

| Supplemental Wage / Bonus Rate | No Provision | |

Connecticut Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Increased from $25,000 in 2024) | $26,100 | |

| Employee 2025 Deduction | None | |

| Employer 2025 Tax Rates(Includes 1.0% fund solvency surtax) | 1.1 – 8.9% | |

| Standard 2025 New Employer Rate | 2.20% | |

| Voluntary Contribution Permitted | No | |

State Resources | ||

| Dept. of Labor: http://www.ctdol.state.ct.us | ||

| Dept. of Revenue Services: http://www.ct.gov/DRS | ||

Delaware Wage and Tax Facts | ||

| State Effective 1/1/25 | Federal Effective 7/24/09 | |

Delaware Minimum Wage | ||

| Minimum Wage | $15.00 | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $2.23 | $2.13 |

| Maximum Tip Credit | $12.77 | $5.12 |

Delaware State Income Tax | ||

| Wage Withholding | Tables | |

| Supplemental Wage / Bonus Rate | No Provision | |

Delaware Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Increased from $10,500 in 2024) | $12,500 | |

| Employee 2025 Deduction | None | |

| Employer 2024 Tax Rates (Includes 0.2% supplemental assessment rate) | 0.3 – 6.5% | |

| Standard 2024 New Employer Rate | 1.20% | |

| Voluntary Contribution Permitted | No | |

State Resources | ||

| Dept. of Labor: https://ui.delawareworks.com | ||

| Division of Revenue: http://revenue.delaware.gov | ||

District of Columbia Wage and Tax Facts | ||

| State Effective 7/1/24 | Federal Effective 7/24/09 | |

District of Columbia Minimum Wage | ||

| Minimum Wage | $17.50 | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $10.00 | $2.13 |

| Maximum Tip Credit | $7.50 | $5.12 |

| Youth Minimum Wage | $4.25 for the first 90 calendar days. $7.25 after 90 calendar days. | $4.25 |

District of Columbia State Income Tax | ||

| Wage Withholding | Tables | |

| Supplemental Wage / Bonus Rate | No Provision | |

District of Columbia Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Unchanged from 2024) | $9,000 | |

| Employee 2025 Deduction | None | |

| Employer 2025 Tax Rates (Plus 0.2% administrative funding assessment) | 1.9 – 7.4% | |

| Standard 2025 New Employer Rate (Plus 0.2% administrative funding assessment) | 2.70% | |

| Voluntary Contribution Permitted | No | |

State Resources | ||

| Dept. of Employment Services: http://does.dc.gov | ||

| Office of Tax and Revenue: http://otr.cfo.dc.gov | ||

Florida Wage and Tax Facts | State Effective 9/30/24 | Federal Effective 7/24/09 |

Florida Minimum Wage | ||

| Minimum Wage | $13.00 | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $9.98 | $2.13 |

| Maximum Tip Credit | $3.02 | $5.12 |

| Youth Minimum Wage | 4.25* | $4.25 |

Florida State Income Tax | ||

| Wage Withholding | None | |

| Supplemental Wage / Bonus Rate | None | |

Florida Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Unchanged from 2024) | $7,000 | |

| Employee 2025 Deduction | None | |

| Employer 2025 Tax Rates | 0.1 – 5.4% | |

| Standard 2025 New Employer Rate | 2.70% | |

| Voluntary Contribution Permitted | No | |

State Resources | ||

| Dept. of Revenue: http://floridarevenue.com | ||

| Dept. of Economic Opportunity: http://www.floridajobs.org | ||

Georgia Wage and Tax Facts | ||

| State Effective 9/1/97 | Federal Effective 7/24/09 | |

Georgia Minimum Wage | ||

| Minimum Wage | 5.15* | $7.25 |

| Minimum Cash Wage (Tipped Employee) | No Minimum | $2.13 |

| Maximum Tip Credit | No Maximum | $5.12 |

Georgia State Income Tax | ||

| Wage Withholding | 5.39% | |

| Supplemental Wage / Bonus Rate | 5.39% | |

Georgia Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Unchanged from 2024) | $9,500 | |

| Employee 2025 Deduction | None | |

| Employer 2025 Tax Rates (Includes 0.06% administrative assessment except lowest and highest rates) | 0.04 – 8.1% | |

| Standard 2025 New Employer Rate (Includes 0.06% administrative assessment) | 2.70% | |

| Voluntary Contribution Permitted | Yes | |

State Resources | ||

| Dept. of Labor: http://dol.georgia.gov | ||

| Dept. of Revenue: http://dor.georgia.gov/taxes | ||

Hawaii Wage and Tax Facts | ||

| State Effective 1/1/24 | Federal Effective 7/24/09 | |

Hawaii Minimum Wage | ||

| Minimum Wage | $14.00 | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $12.75 | $2.13 |

| Maximum Tip Credit | $1.25 | $5.12 |

Hawaii State Income Tax | ||

| Wage Withholding | Tables | |

| Supplemental Wage / Bonus Rate | No Provision | |

Hawaii Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (increase from $59,100 in 2024) | $62,000 | |

| Employee 2025 Deduction | None | |

| Employer 2025 Tax Rates (plus 0.01% E&T surcharge) | 0.0 – 5.60% | |

| Standard 2025 New Employer Rate | 2.40% | |

| Voluntary Contribution Permitted | No | |

State Resources | ||

| Dept. of Taxation: http://tax.hawaii.gov | ||

| Dept. of Labor and Industrial Relations: http://labor.hawaii.gov | ||

Idaho Wage and Tax Facts | ||

| State Effective 7/24/09 | Federal Effective 7/24/09 | |

Idaho Minimum Wage | ||

| Minimum Wage | $7.25 | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $3.35 | $2.13 |

| Maximum Tip Credit | $3.90 | $5.12 |

| Youth Minimum Wage | $4.25 | $4.25 |

Idaho State Income Tax | ||

| Wage Withholding | Tables | |

| Supplemental Wage / Bonus Rate | 5.70% | |

Idaho Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Increased from $53,500 in 2024) | $55,300 | |

| Employee 2025 Deduction | None | |

| Employer 2025 Tax Rates (Includes variable Workforce Development & Admin. Rate) | 0.22500 – 5.4% | |

| Standard 2025 New Employer Rate (Includes Workforce Development & Admin Rate) | 1.00% | |

| Voluntary Contribution Permitted | No | |

State Resources | ||

| Dept. of Labor: http://labor.idaho.gov | ||

| State Tax Commission: https://tax.idaho.gov | ||

Illinois Wage and Tax Facts | ||

| State Effective 1/1/25 | Federal Effective 7/24/09 | |

Illinois Minimum Wage | ||

| Minimum Wage | $15.00 | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $9.00 | $2.13 |

| Maximum Tip Credit | $6.00 | $5.12 |

| Youth Minimum Wage (more than 650 hours) | $15.00 | |

Illinois State Income Tax | ||

| Wage Withholding | 4.95% | |

| Supplemental Wage / Bonus Rate | 4.95% | |

Illinois Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (increased from $13,590 in 2024) | $13,916 | |

| Employee 2025 Deduction | None | |

| Employer 2025 Tax Rates (Includes 0.55% fund-building surtax) | 0.750 – 7.850% | |

| Standard 2025 New Employer Rate (Includes 0.55% fund-building surtax) | 3.65% | |

| Voluntary Contribution Permitted | No | |

State Resources | ||

| Dept. of Employment Security: http://www.ides.illinois.gov | ||

| Dept. of Revenue: http://www2.illinois.gov/rev/Pages/default.aspx | ||

Indiana Wage and Tax Facts | ||

| State Effective 7/24/09 | Federal Effective 7/24/09 | |

Indiana Minimum Wage | ||

| Minimum Wage | $7.25 | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $2.13 | $2.13 |

| Maximum Tip Credit | $5.12 | $5.12 |

| Youth Minimum Wage | $4.25 | $4.25 |

Indiana State Income Tax | ||

| Wage Withholding | 3.00% | |

| Supplemental Wage / Bonus Rate | 3.00% | |

Indiana Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Unchanged from 2024) | $9,500 | |

| Employee 2025 Deduction | None | |

| Employer 2025 Tax Rates | 0.5 – 7.4% | |

| Standard 2025 New Employer Rate | 1.6% or 2.5% | |

| Voluntary Contribution Permitted | Yes | |

State Resources | ||

| Dept. of Revenue: http://www.in.gov/dor | ||

| Dept. of Workforce Development: http://www.in.gov/dwd | ||

Iowa Wage and Tax Facts | ||

| State Effective 1/1/08 | Federal Effective 7/24/09 | |

Iowa Minimum Wage | ||

| Minimum Wage | $7.25 | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $4.35 | $2.13 |

| Maximum Tip Credit | $2.90 | $5.12 |

Iowa State Income Tax | ||

| Wage Withholding | Tables | |

| Supplemental Wage / Bonus Rate | 3.80% | |

Iowa Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Increased from $38,200 in 2024) | $39,500 | |

| Employee 2025 Deduction | None | |

| Employer 2025 Tax Rates | 0.0 – 7.0% | |

| Standard 2025 New Employer Rate | 1.00% | |

| Voluntary Contribution Permitted | No | |

State Resources | ||

| Dept. of Revenue: https://tax.iowa.gov | ||

| Dept. of Workforce Development: https://www.iowaworkforcedevelopment.gov | ||

Kansas Wage and Tax Facts | ||

| State Effective 1/1/10 | Federal Effective 7/24/09 | |

Kansas Minimum Wage | ||

| Minimum Wage | $7.25 | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $2.13 | $2.13 |

| Maximum Tip Credit | $5.12 | $5.12 |

Kansas State Income Tax | ||

| Wage Withholding | Tables | |

| Supplemental Wage / Bonus Rate | 5.00% | |

Kansas Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Unchanged from 2024) | $14,000 | |

| Employee 2025 Deduction | None | |

| Employer 2025 Tax Rates | 0.00 – 6.65% | |

| Standard 2025 New Employer Rate | 1.75% | |

| Voluntary Contribution Permitted | Yes | |

State Resources | ||

| Dept. of Labor: http://www.dol.ks.gov | ||

| Dept. of Revenue: http://www.ksrevenue.org | ||

Kentucky Wage and Tax Facts | ||

| State Effective 7/1/09 | Federal Effective 7/24/09 | |

Kentucky Minimum Wage | ||

| Minimum Wage | $7.25 | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $2.13 | $2.13 |

| Maximum Tip Credit | $5.12 | $5.12 |

Kentucky State Income Tax | ||

| Wage Withholding | 4.00% | |

| Supplemental Wage / Bonus Rate | 4.00% | |

Kentucky Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Increased from $11,400 in 2024) | $11,700 | |

| Employee 2025 Deduction | None | |

| Employer 2025 Tax Rates (plus SCUF of 0.075%) | 0.225 – 8.925% | |

| Standard 2025 New Employer Rate | 2.63% | |

| Voluntary Contribution Permitted | Yes | |

State Resources | ||

| Office of Employment & Training: http://kcc.ky.gov | ||

| Dept. of Revenue: http://revenue.ky.gov | ||

Louisiana Wage and Tax Facts | ||

| State Effective 7/24/09 | Federal Effective 7/24/09 | |

Louisiana Minimum Wage | ||

| Minimum Wage | 7.25* | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $2.13* | $2.13 |

| Maximum Tip Credit | $5.12* | $5.12 |

| Youth Minimum Wage | $4.25* | $4.25 |

Louisiana State Income Tax | ||

| Wage Withholding | Tables | |

| Supplemental Wage / Bonus Rate | No Provision | |

Louisiana Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Unchanged from 2024) | $7,700 | |

| Employee 2025 Deduction | None | |

| Employer 2025 Tax Rates (Does not include social charge assessments – Non-Charge (3.6237%), Incumbent Worker Training (10.3267%), or Integrity (2.0910%)) | 0.09 – 6.2% | |

| Standard 2025 New Employer Rate | 1.14 – 2.76% | |

| Voluntary Contribution Permitted | Yes | |

State Resources | ||

| Workforce Commission: http://www.laworks.net | ||

| Dept. of Revenue: http://www.rev.state.la.us | ||

Maine Wage and Tax Facts | ||

| State Effective 1/1/25 | Federal Effective 7/24/09 | |

Maine Minimum Wage | ||

| Minimum Wage | $14.65 | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $7.33 | $2.13 |

| Maximum Tip Credit | $7.32 | $5.12 |

Maine State Income Tax | ||

| Wage Withholding | Tables | |

| Supplemental Wage / Bonus Rate | 5.00% | |

Maine Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Unchanged from 2024) | $12,000 | |

| Employee 2025 Deduction | None | |

| Employer 2025 Tax Rates (Includes 0.14% CSFF and 0.16% UPAF) | 0.00 – 5.97% | |

| Standard 2025 New Employer Rate (Includes 0.14% CSSF and 0.16% UPAF) | 2.11% | |

| Voluntary Contribution Permitted | Yes | |

State Resources | ||

| Dept. of Labor: http://www.maine.gov/labor | ||

| Revenue Services: http://www.maine.gov/revenue | ||

Maryland Wage and Tax Facts | ||

| State Effective 1/1/24 | Federal Effective 7/24/09 | |

Maryland Minimum Wage | ||

| Minimum Wage | $15.00 | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $3.63 | $2.13 |

| Maximum Tip Credit | $11.37 | $5.12 |

| Youth Minimum Wage | $12.75 | $4.25 |

Maryland State Income Tax | ||

| Wage Withholding | Tables | |

| Supplemental Wage / Bonus Rate | MD residents = 5.75% plus County W/H rate | |

Maryland Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Unchanged from 2024) | $8,500 | |

| Employee 2025 Deduction | None | |

| Employer 2024 Tax Rates | 0.30 – 7.50% | |

| Standard 2024 New Employer Rate | 2.60% | |

| Voluntary Contribution Permitted | No | |

State Resources | ||

| Comptroller of MD: http://www.comp.state.md.us | ||

| Dept. of Labor, Licensing & Regulation: http://www.dllr.state.md.us | ||

Massachusetts Wage and Tax Facts | ||

| State Effective 1/1/23 | Federal Effective 7/24/09 | |

Massachusetts Minimum Wage | ||

| Minimum Wage | $15.00 | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $6.75 | $2.13 |

| Maximum Tip Credit | $8.25 | $5.12 |

Massachusetts State Income Tax | ||

| Wage Withholding | Tables | |

| Supplemental Wage / Bonus Rate | 5% or 9% | |

Massachusetts Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Unchanged from 2024) | $15,000 | |

| Employee 2025 Deduction | None | |

| Employer 2024 Tax Rates (Plus 0.41% solvency assessment, 0.056% workforce training fund, and a COVID-19 Recovery Assessment equal to 40.15% of Employer’s UI Experience rate) | 0.73 – 11.13% | |

| Standard 2024 New Employer Rate (Plus 0.41% solvency assessment, 0.056% workforce training fund surcharge, a COVID-19 Recovery Assessment equal to 40.15% of Employer’s UI Experience Rate) | 1.87% | |

| Employer Medical Assistance Contribution 2024 Rates (0.12% fourth year of liability; 0.24% fifth year of liability; and 0.34% sixth year or later of liability) | 0.12 – 0.34% | |

| Voluntary Contribution Permitted | Yes | |

| Workforce Training Fund 2024 Rate | 0.56% | |

State Resources | ||

| Dept. of Revenue: https://www.mass.gov/dor | ||

| Labor and Workforce Development: http://www.mass.gov/lwd | ||

Michigan Wage and Tax Facts | ||

| State Effective 1/1/25 | Federal Effective 7/24/09 | |

Michigan Minimum Wage | ||

| Minimum Wage | $10.56 | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $4.01 | $2.13 |

| Maximum Tip Credit | $6.55 | $5.12 |

| Youth Minimum Wage | $8.98 | $4.25 |

Michigan State Income Tax | ||

| Wage Withholding | 4.25% | |

| Supplemental Wage / Bonus Rate | 4.25% | |

Michigan Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Decreased from $9,500 in 2024) | $9,000 Standard Wage Base | |

| Maximum 2025 Taxable Earnings (Unchanged from 2024) | $9,500 Wage Base for Delinquent Employers | |

| Employee 2024 Deduction | None | |

| Employer 2024 Tax Rates (Plus 1.16% obligation assessment rate) | 0.06 – 10.3% | |

| Standard 2024 New Employer Rate (Plus 1.16% obligation assessment rate) | 2.70% | |

| Voluntary Contribution Permitted | Yes | |

State Resources | ||

| Dept. of Treasury: http://www.michigan.gov/taxes | ||

| Unemployment Insurance Agency: http://www.michigan.gov/uia | ||

Minnesota Wage and Tax Facts | ||

| State Effective 1/1/25 | Federal Effective 7/24/09 | |

Minnesota Minimum Wage – If annual gross volume of sales are $500,000 or more:StateFederal | ||

| Minimum Wage | $11.13 | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $11.13 | $2.13 |

| Maximum Tip Credit | None | $5.12 |

| Youth Minimum Wage | $9.08 | $4.25 |

Minnesota State Income Tax | ||

| Wage Withholding | Tables | |

| Supplemental Wage / Bonus Rate | 6.25% | |

Minnesota Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Increased from $42,000 in 2024) | $43,000 | |

| Employee 2025 Deduction | None | |

| Employer 2025 Tax Rates (Includes 0.40% base rate) | 0.40 – 9.3% | |

| Standard 2025 New Employer Rate (Plus 0.40% base rate) | Industry Average | |

| Voluntary Contribution Permitted | Yes | |

State Resources | ||

| Dept. of Revenue: http://www.revenue.state.mn.us | ||

| Dept. of Employment and Economic Development: http://www.uimn.org/employers | ||

Mississippi Wage and Tax Facts | ||

| State Effective 7/24/09 | Federal Effective 7/24/09 | |

Mississippi Minimum Wage | ||

| Minimum Wage | $7.25* | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $2.13* | $2.13 |

| Maximum Tip Credit | $5.12* | $5.12 |

| Youth Minimum Wage | $4.25* | $4.25 |

Mississippi State Income Tax | ||

| Wage Withholding | Tables | |

| Supplemental Wage / Bonus Rate | No provision | |

Mississippi Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Unchanged from 2024) | $14,000 | |

| Employee 2025 Deduction | None | |

| Employer 2025 Tax Rates (Includes 0.2% workforce investment and training contribution rate) | 0.2 – 5.6% | |

| Standard 2025 New Employer Rate (New employers pay 1.2% in 1st year, 1.3% in 2nd year and 1.4% in 3rd year; includes 0.2% workforce investment and training contribution rate) | 1.2 – 1.4% | |

| Voluntary Contribution Permitted | No | |

State Resources | ||

| Dept. of Employment Security: http://mdes.ms.gov | ||

| Dept. of Revenue: http://www.dor.ms.gov | ||

Missouri Wage and Tax Facts | ||

| State Effective 1/1/25 | Federal Effective 7/24/09 | |

Missouri Minimum Wage | ||

| Minimum Wage | $13.75 | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $6.88 | $2.13 |

| Maximum Tip Credit | $6.88 | $5.12 |

Missouri State Income Tax | ||

| Wage Withholding | Tables | |

| Supplemental Wage / Bonus Rate | 4.70% | |

Missouri Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Decreased from $10,000 in 2024) | $9,500 | |

| Employee 2025 Deduction | None | |

| Employer 2025 Tax Rates | 0.0 – 8.1% | |

| Standard 2025 New Employer Rate | 2.38% | |

| Voluntary Contribution Permitted | Yes | |

State Resources | ||

| Dept of Labor: https://labor.mo.gov | ||

| Dept. of Revenue: http://dor.mo.gov | ||

Montana Wage and Tax Facts | ||

| State Effective 1/1/25 | Federal Effective 7/24/09 | |

Montana Minimum Wage – Annual Sales exceed $110,000StateFederal | ||

| Minimum Wage | $10.55 | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $10.55 | $2.13 |

| Maximum Tip Credit | None | $5.12 |

Montana State Income Tax | ||

| Wage Withholding | Tables | |

| Supplemental Wage / Bonus Rate | 5.00% | |

Montana Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Increased from $43,000 in 2024) | $45,100 | |

| Employee 2025 Deduction | None | |

| Employer 2025 Tax Rates (Plus 0.13% or 0.18% administrative fund tax) | 0.13 – 6.12% | |

| Standard 2025 New Employer Rate (plus 0.18% administrative fund tax) | 1.18 – 2.18% | |

| Voluntary Contribution Permitted | No | |

State Resources | ||

| Dept. of Revenue: http://revenue.mt.gov | ||

| Dept of Labor & Industry: http://uid.dli.mt.gov | ||

Nebraska Wage and Tax Facts | ||

| State Effective 1/1/25 | Federal Effective 7/24/09 | |

Nebraska Minimum Wage | ||

| Minimum Wage | $13.50 | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $2.13 | $2.13 |

| Maximum Tip Credit | $11.37 | $5.12 |

Nebraska State Income Tax | ||

| Wage Withholding | Tables | |

| Supplemental Wage / Bonus Rate | 5.00% | |

Nebraska Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings Category 1-19 | $9,000 | |

| Maximum 2025 Taxable Earnings Category 20 | $24,000 | |

| Employee 2025 Deduction | None | |

| Employer 2025 Tax Rates | 0.0 – 5.4% | |

| Standard 2025 New Employer Rate | 1.25% | |

| Voluntary Contribution Permitted | Yes | |

State Resources | ||

| Dept of Labor: http://dol.nebraska.gov | ||

| Dept. of Revenue: http://www.revenue.nebraska.gov | ||

Nevada Wage and Tax Facts | ||

| State Effective 7/1/23 | Federal Effective 7/24/09 | |

Nevada Minimum Wage | ||

| Minimum Wage | $12.00 | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $12.00 | $2.13 |

| Maximum Tip Credit | None | $5.12 |

Nevada State Income Tax | ||

| Wage Withholding | None | |

| Supplemental Wage / Bonus Rate | None | |

Nevada Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Increased from 40,600 in 2024) | $41,800 | |

| Employee 2025 Deduction | None | |

| Employer 2025 Tax Rates (Includes 0.05% Career Enhancement Program fee) | 0.30 – 5.4% | |

| Standard 2025 New Employer Rate (Includes 0.05% Career Enhancement Program fee) | 3.00% | |

| Voluntary Contribution Permitted | No | |

State Resources | ||

| Employment Security Division: http://detr.state.nv.us | ||

| Dept. of Taxation: https://tax.nv.gov | ||

New Hampshire Wage and Tax Facts | ||

| State Effective 9/1/08 | Federal Effective 7/24/09 | |

New Hampshire Minimum Wage | ||

| Minimum Wage | $7.25 | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $3.26 | $2.13 |

| Maximum Tip Credit | $3.99 | $5.12 |

New Hampshire State Income Tax | ||

| Wage Withholding | None | |

| Supplemental Wage / Bonus Rate | None | |

New Hampshire Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Unchanged from 2024) | $14,000 | |

| Employee 2025 Deduction | None | |

| Employer 1Q2025 Tax Rates (Includes variable administrative contribution assessment, up to 0.4%, fund balance reduction, inverse rate surcharge and emergency power surcharge, which are determined quarterly) | 0.1 – 7.5% | |

| Standard New Employer Tax Rate Eff 1Q2025 (Includes variable administrative contribution assessment, up to 0.4%, fund balance reduction, inverse rate surcharge and emergency power surcharge, which are determined quarterly) | 1.70% | |

| Voluntary Contribution Permitted | No | |

State Resources | ||

| Employment Security: https://www.nhes.nh.gov/ | ||

| Dept. of Revenue Administration: http://revenue.nh.gov | ||

New Jersey Wage and Tax Facts | ||

| State Effective 1/1/25 | Federal Effective 7/24/09 | |

New Jersey Minimum Wage | ||

| Minimum Wage | $15.49 | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $5.62 | $2.13 |

| Maximum Tip Credit | $9.87 | $5.12 |

New Jersey State Income Tax | ||

| Wage Withholding | Tables | |

| Supplemental Wage / Bonus Rate | No provision, but for taxable wages over $500,000 withhold at 9.9%. For taxable wages over $1,000,000 withhold at 11.8%. | |

New Jersey Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Increased from $42,300 in 2024) | $43,300 | |

| Employee 2025 Deduction (0.3825%-UI + 0.0425%-Workforce Dev/Supplemental Workforce) | 0.43% | |

| Maximum 2025 Employee Deduction | $184.02 | |

| Employer FY2025 Tax Rates (Includes Workforce Dev/Supplemental Workforce) | 0.60- 7.4% | |

| Standard FY2025 New Employer Rate (2.9825%-UI + 0.1175%-Workforce Dev/Supplemental Workforce) | 3.10% | |

| Voluntary Contribution Permitted | Yes | |

State Resources | ||

| Dept. of Labor and Workforce Development: http://lwd.dol.state.nj.us/labor | ||

| Division of Taxation: http://www.state.nj.us/treasury/taxation | ||

New Mexico Wage and Tax Facts | ||

| State Effective 1/1/23 | Federal Effective 7/24/09 | |

New Mexico Minimum Wage | ||

| Minimum Wage | $12.00 | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $3.00 | $2.13 |

| Maximum Tip Credit | $9.00 | $5.12 |

| Youth Minimum Wage | $12.00 | $4.25 |

New Mexico State Income Tax | ||

| Wage Withholding | Tables | |

| Supplemental Wage / Bonus Rate | 5.90% | |

New Mexico Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Increased from $31,700 in 2024) | $33,200 | |

| Employee 2025 Deduction | None | |

| Employer 2025 Tax Rates | 0.33 – 6.4% | |

| Standard 2025 New Employer Rate | 1.00% or Industry Average, whichever is higher | |

| Voluntary Contribution Permitted | No | |

| Workers Compensation Fee | Employee Assessment – $2.00 per calendar quarter Employer Assessment – $2.30 for each covered employee, per calendar quarter | |

State Resources | ||

| Dept. of Workforce Solutions: https://www.dws.state.nm.us | ||

| Taxation & Revenue Department: http://www.tax.newmexico.gov | ||

New York Wage and Tax Facts | ||

| State Effective 1/1/25 | Federal Effective 7/24/09 | |

New York Minimum Wage | ||

| Minimum Wage | 15.50* | $7.25 |

| Minimum Cash Wage (Tipped Food Service Worker) | 10.35* | |

| Maximum Tip Credit (Tipped Food Service Worker) | 5.15* | |

New York State Income Tax | ||

| Wage Withholding | Tables | |

| Supplemental Wage / Bonus Rate | 11.70% | |

New York Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Increased from $12,500 in 2024) | $12,800 | |

| Employee 2025 Deduction | None | |

| Employer 2024 Tax Rates(Includes 0.075% Re-employment Service Fund rate) | 2.1 – 9.9% | |

| Standard 2024 New Employer Rate (Includes 0.075% Re-employment Service Fund rate) | 4.10% | |

| Voluntary Contribution Permitted | Yes | |

State Resources | ||

| Dept. of Taxation and Finance: https://www.tax.ny.gov | ||

| Dept of Labor: http://www.labor.ny.gov/home | ||

North Carolina Wage and Tax Facts | ||

| State Effective 7/24/09 | Federal Effective 7/24/09 | |

North Carolina Minimum Wage | ||

| Minimum Wage | $7.25 | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $2.13 | $2.13 |

| Maximum Tip Credit | $5.12 | $5.12 |

North Carolina State Income Tax | ||

| Wage Withholding | 4.25% | |

| Supplemental Wage / Bonus Rate | 4.25% | |

North Carolina Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Increased from $31,400 in 2024) | $32,600 | |

| Employee 2025 Deduction | None | |

| Employer 2025 Tax Rates | 0.06 – 5.76% | |

| Standard 2025 New Employer Rate | 1.00% | |

| Voluntary Contribution Permitted | Yes | |

State Resources | ||

| Dept. of Revenue: http://www.dor.state.nc.us | ||

| Division of Employment Security: https://des.nc.gov/DES | ||

North Dakota Wage and Tax Facts | ||

| State Effective 7/24/09 | Federal Effective 7/24/09 | |

North Dakota Minimum Wage | ||

| Minimum Wage | $7.25 | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $4.86 | $2.13 |

| Maximum Tip Credit | $2.39 | $5.12 |

North Dakota State Income Tax | ||

| Wage Withholding | Tables | |

| Supplemental Wage / Bonus Rate | 1.50% | |

North Dakota Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Increased from $43,800 in 2024) | $45,100 | |

| Employee 2025 Deduction | None | |

| Employer 2025 Tax Rates | 0.08 – 9.69% | |

| Standard 2025 New Employer Rate | 1.03% | |

| Voluntary Contribution Permitted | Yes | |

State Resources | ||

| State Tax Commissioner: http://www.nd.gov/tax | ||

| Job Service: http://www.jobsnd.com | ||

Ohio Wage and Tax Facts | ||

| State Effective 1/1/25 | Federal Effective 7/24/09 | |

Ohio Minimum Wage – Annual Sales exceed $385,000StateFederal | ||

| Minimum Wage | $10.70 | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $5.35 | $2.13 |

| Maximum Tip Credit | $5.35 | $5.12 |

| Youth Minimum Wage | $10.70 | $4.25 |

Ohio State Income Tax | ||

| Wage Withholding | Tables | |

| Supplemental Wage / Bonus Rate | 3.50% | |

Ohio Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Unchanged from 2024) | $9,000 | |

| Employee 2025 Deduction | None | |

| Employer 2025 Tax Rates | 0.4 – 10.10% | |

| Standard 2025 New Employer Rate | 2.70% | |

| Voluntary Contribution Permitted | Yes | |

State Resources | ||

| Dept. of Taxation: http://www.tax.ohio.gov | ||

| Dept. of Job and Family Services: http://jfs.ohio.gov/ouc/uctax | ||

Oklahoma Wage and Tax Facts | ||

| State Effective 7/24/09 | Federal Effective 7/24/09 | |

Oklahoma Minimum Wage – Employers with 10 or more full-time employees at any one location or employers with annual gross sales over $100,000 irrespective of number of full-time employees | ||

| Minimum Wage | $7.25 | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $3.63 | $2.13 |

| Maximum Tip Credit | $3.63 | $5.12 |

| Youth Minimum Wage | $4.25 | $4.25 |

Oklahoma State Income Tax | ||

| Wage Withholding | Tables | |

| Supplemental Wage / Bonus Rate | 4.75% | |

Oklahoma Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Increased from $27,000 in 2024) | $28,200 | |

| Employee 2025 Deduction | None | |

| Employer 2025 Tax Rates | 0.3 – 9.2% | |

| Standard 2025 New Employer Rate | 1.50% | |

| Voluntary Contribution Permitted | No | |

State Resources | ||

| Tax Commission: https://www.ok.gov/tax | ||

| Employment Security Commission: https://www.ok.gov/oesc_web | ||

Oregon Wage and Tax Facts | ||

| State Effective 7/1/24 | Federal Effective 7/24/09 | |

Oregon Minimum Wage | ||

| Minimum Wage | $14.70* | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $14.70* | $2.13 |

| Maximum Tip Credit | None | $5.12 |

Oregon State Income Tax | ||

| Wage Withholding | Tables | |

| Supplemental Wage / Bonus Rate | 8.00% | |

| Statewide Transit Tax – Employee 2024 Deduction | 0.1% of taxable wages | |

Oregon Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Increased from $52,800 in 2024) | $54,300 | |

| Employee 2025 Deduction | None | |

| Employer 2025 Tax Rates (Includes special payroll tax offset: 0.109% for all quarters) | 0.9 – 5.4% | |

| Standard 2025 New Employer Rate | 2.40% | |

| Voluntary Contribution Permitted | No | |

| Workers’ 2025 Benefit Fund Assessment Rates | 2.0 cents per hour worked (Employer – 1.0 cents per hour, Employee – 1.0 cents per hour) | |

State Resources | ||

| Employment Dept.: http://www.oregon.gov/EMPLOY | ||

| Dept. of Revenue: http://www.oregon.gov/DOR | ||

Pennsylvania Wage and Tax Facts | ||

| State Effective 7/24/09 | Federal Effective 7/24/09 | |

Pennsylvania Minimum Wage | ||

| Minimum Wage | $7.25 | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $2.83 | $2.13 |

| Maximum Tip Credit (Different rates apply to employers with 10 or less full-time employees, effective 1/1/07) | $4.42 | |

Pennsylvania State Income Tax | ||

| Wage Withholding | 3.07% | |

| Supplemental Wage / Bonus Rate | 3.07% | |

Pennsylvania Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Unchanged from 2024) | $10,000 | |

| Employee Deduction (Wages paid x 0.07%) | Unlimited | |

| Employer 2025 Tax Rates (Includes 9.2% surcharge, 0.00% interest tax factor and 0.60% additional contribution tax) | 1.419 – 10.3734% | |

| Standard 2025 New Employer Rate (Includes 9.2% surcharge) | 3.82% | |

| Voluntary Contribution Permitted | Yes | |

State Resources | ||

| Dept. of Labor & Industry: http://www.dli.pa.gov | ||

| Dept. of Revenue: http://www.revenue.pa.gov | ||

Rhode Island Wage and Tax Facts | ||

| State Effective 1/1/25 | Federal Effective 7/24/09 | |

Rhode Island Minimum Wage | ||

| Minimum Wage | $15.00 | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $3.89 | $2.13 |

| Maximum Tip Credit | $11.11 | $5.12 |

| Youth Minimum Wage | Various rates | $4.25 |

Rhode Island State Income Tax | ||

| Wage Withholding | Tables | |

| Supplemental Wage / Bonus Rate | 5.99% | |

Rhode Island Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Increased from $29,200 in 2024) | $29,800 Tier I Employers | |

| Maximum 2025 Taxable Earnings (Increased from $30,700 in 2024) | $31,300 Tier II Employers | |

| Employee 2025 Deduction | None | |

| Employer 2025 Tax Rates | 1.1 – 9.7% | |

| Standard 2025 New Employer Rate (Includes 0.21% Job Development Assessment) | 1.21% | |

| Voluntary Contribution Permitted | Yes | |

State Resources | ||

| Division of Taxation: http://www.tax.ri.gov | ||

| Dept. of Labor and Training: http://www.dlt.ri.gov | ||

South Carolina Wage and Tax Facts | ||

| State Effective 7/24/09 | Federal Effective 7/24/09 | |

South Carolina Minimum Wage | ||

| Minimum Wage | $7.25* | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $2.13* | $2.13 |

| Maximum Tip Credit | $5.12* | $5.12 |

| Youth Minimum Wage | $4.25* | $4.25 |

South Carolina State Income Tax | ||

| Wage Withholding | Tables | |

| Supplemental Wage / Bonus Rate | 6.20% | |

South Carolina Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Unchanged from 2024) | $14,000 | |

| Employee 2025 Deduction | None | |

| Employer 2025 Tax Rates (Includes 0.0% solvency surcharge and 0.06% contingency assessment) | 0.06 – 5.46% | |

| Standard 2025 New Employer Rate (Includes 0.0% solvency surcharge and 0.06% contingency assessment) | 0.35% | |

| Voluntary Contribution Permitted | No | |

State Resources | ||

| Dept. of Employment and Workforce: https://dew.sc.gov | ||

| Dept. of Revenue: https://dor.sc.gov | ||

South Dakota Wage and Tax Facts | ||

| State Effective 1/1/25 | Federal Effective 7/24/09 | |

South Dakota Minimum Wage | ||

| Minimum Wage | $11.50 | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $5.75 | $2.13 |

| Maximum Tip Credit | $5.75 | $5.12 |

| Youth Minimum Wage | $11.50* | $4.25 |

South Dakota State Income Tax | ||

| Wage Withholding | None | |

| Supplemental Wage / Bonus Rate | None | |

South Dakota Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Unchanged from 2024) | $15,000 | |

| Employee 2025 Deduction | None | |

| Employer 2025 Tax Rates (plus 0.55% investment fee) | 0.0 – 9.5% | |

| Standard 2025 New Employer Rate (plus 0.55% investment fee) | 1.2% – 1st year; 1.0% – 2nd & 3rd years | |

| Voluntary Contribution Permitted | Yes | |

State Resources | ||

| Dept. of Labor & Regulation: http://dlr.sd.gov | ||

Tennessee Wage and Tax Facts | ||

| State Effective 7/24/09 | Federal Effective 7/24/09 | |

Tennessee Minimum Wage | ||

| Minimum Wage | $7.25* | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $2.13* | $2.13 |

| Maximum Tip Credit | $5.12* | $5.12 |

| Youth Minimum Wage | $4.25* | $4.25 |

Tennessee State Income Tax | ||

| Wage Withholding | None | |

| Supplemental Wage / Bonus Rate | None | |

Tennessee Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Unchanged from 2024) | $7,000 | |

| Employee 2025Deduction | None | |

| Employer 2025 Tax Rates | 0.01 – 10.0% | |

| Standard FY2025 New Employer Rate | 2.70% | |

| Voluntary Contribution Permitted | No | |

State Resources | ||

| Dept. of Labor and Workforce Development: http://tn.gov/workforce | ||

Texas Wage and Tax Facts | ||

| State Effective 7/24/09 | Federal Effective 7/24/09 | |

Texas Minimum Wage | ||

| Minimum Wage | $7.25 | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $2.13 | $2.13 |

| Maximum Tip Credit | $5.12 | $5.12 |

| Youth Minimum Wage | $4.25 | $4.25 |

Texas State Income Tax | ||

| Wage Withholding | None | |

| Supplemental Wage / Bonus Rate | None | |

Texas Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Unchanged from 2024) | $9,000 | |

| Employee 2025 Deduction | None | |

| Employer 2024 Tax Rates (Plus Replenishment Tax Rate 0.15%) | 0.25 – 6.25% | |

| Standard 2024 New Employer Rate | 2.7% or NAICS Industry Average, whichever is higher | |

| Voluntary Contribution Permitted | Yes | |

State Resources | ||

| Workforce Commission: http://www.twc.state.tx.us | ||

Utah Wage and Tax Facts | State Effective 7/24/09 | Federal Effective 7/24/09 |

Utah Minimum Wage | ||

| Minimum Wage | $7.25 | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $2.13 | $2.13 |

| Maximum Tip Credit | $5.12 | $5.12 |

| Youth Minimum Wage | $4.25 | $4.25 |

Utah State Income Tax | ||

| Wage Withholding | Tables | |

| Supplemental Wage / Bonus Rate | Tables | |

Utah Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Increased from $47,000 in 2024) | $48,900 | |

| Employee 2025 Deduction | None | |

| Employer 2025 Tax Rates (Includes 0.002% social cost factor and 1.10% reserve factor) | 0.2 – 7.2% | |

| Standard 2025 New Employer Rate | Industry Average | |

| Voluntary Contribution Permitted | No | |

State Resources | ||

| Dept. of Workforce Services: https://jobs.utah.gov | ||

| State Tax Commission: http://www.tax.utah.gov | ||

Vermont Wage and Tax Facts | ||

| State Effective 1/1/25 | Federal Effective 7/24/09 | |

Vermont Minimum Wage | ||

| Minimum Wage | $14.01 | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $7.01 | $2.13 |

| Maximum Tip Credit | $7.00 | $5.12 |

Vermont State Income Tax | ||

| Wage Withholding | Tables | |

| Supplemental Wage / Bonus Rate | 30% of Federal Tax | |

Vermont Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Increased from $14,300 in 2024) | $14,800 | |

| Employee 2025 Deduction | None | |

| Employer FY2025 Tax Rates | 0.4 – 5.4% | |

| Standard FY2025 New Employer Rate | 1.00% | |

| Voluntary Contribution Permitted | No | |

State Resources | ||

| Dept. of Taxes: http://tax.vermont.gov | ||

| Dept. of Labor: http://labor.vermont.gov | ||

Virginia Wage and Tax Facts | ||

| State Effective 1/1/25 | Federal Effective 7/24/09 | |

Virginia Minimum Wage | ||

| Minimum Wage | $12.41 | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $2.13 | $2.13 |

| Maximum Tip Credit | $10.28 | $5.12 |

| Youth Minimum Wage | $4.25 | $4.25 |

Virginia State Income Tax | ||

| Wage Withholding | Tables | |

| Supplemental Wage / Bonus Rate | 5.75% | |

Virginia Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Unchanged from 2024) | $8,000 | |

| Employee 2025 Deduction | None | |

| Employer 2025 Tax Rates(Includes 0.0% fund building charge and 0.00% pool cost charge) | 0.10 – 6.20% | |

| Standard 2025 New Employer Rate (Includes 0.0% fund building charge and 0.00% pool cost charge) | 2.50% | |

| Voluntary Contribution Permitted | No | |

State Resources | ||

| Employment Commission: http://www.vec.virginia.gov | ||

| Dept. of Taxation: http://www.tax.virginia.gov | ||

Washington Wage and Tax Facts | ||

| State Effective 1/1/25 | Federal Effective 7/24/09 | |

Washington Minimum Wage | ||

| Minimum Wage | $16.66 | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $16.66 | $2.13 |

| Maximum Tip Credit | None | $5.12 |

| Youth Minimum Wage (Employees who are 14 or 15 years old may be paid 85% of the adult minimum wage) | $14.16 | |

Washington State Income Tax | ||

| Wage Withholding | None | |

| Supplemental Wage / Bonus Rate | None | |

Washington Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Increased from $68,500 in 2024) | $72,800 | |

| Employee 2025 Deduction | None | |

| Employer 2024 Tax Rates (Plus 0.03% employment administrative fund and social cost surtaxes) | 0.0 – 5.4% | |

| Standard 2025 New Employer Rate | Industry Average | |

| Voluntary Contribution Permitted | Yes | |

| Workers Compensation | Employers and employees each pay half of the Stay At Work rate, the Medical Aid Fund rate and the Supplemental Pension Fund (SPF) rate. For 2025, the SPF rate is $0.1758 per hour ($0.0879 per hour, employee rate & $0.0879 per hour, employer rate). | |

State Resources | ||

| Employment Security Dept.: https://esd.wa.gov | ||

West Virginia Wage and Tax Facts | ||

| State Effective 1/1/16 | Federal Effective 7/24/09 | |

West Virginia Minimum Wage | ||

| Minimum Wage | $8.75 | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $2.62 | $2.13 |

| Maximum Tip Credit | $6.13 | $5.12 |

| Youth Minimum Wage | $6.40 | $4.25 |

West Virginia State Income Tax | ||

| Wage Withholding | Tables | |

| Supplemental Wage / Bonus Rate | 2.2% – 4.82% | |

West Virginia Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Decreased from $9,521 in 2024) | $9,500 | |

| Employee 2025 Deduction | None | |

| Employer 2025 Tax Rates | 1.5 – 8.5% | |

| Standard 2025 New Employer Rate | 2.70% | |

| Voluntary Contribution Permitted | Yes | |

State Resources | ||

| Dept. of Revenue: http://www.revenue.wv.gov | ||

| Workforce West Virginia: http://workforcewv.org | ||

Wisconsin Wage and Tax Facts | ||

| State Effective 7/24/09 | Federal Effective 7/24/09 | |

Wisconsin Minimum Wage | ||

| Minimum Wage | $7.25 | $7.25 |

| Minimum Cash Wage (Tipped Employee) | $2.33 | $2.13 |

| Maximum Tip Credit | $4.92 | $5.12 |

Wisconsin State Income Tax | ||

| Wage Withholding | Tables | |

| Supplemental Wage / Bonus Rate | 3.54%, 4.65%, 5.3% or 7.65% | |

Wisconsin Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Unchanged from 2024) | $14,000 | |

| Employee 2025 Deduction | None | |

| Employer 2025 Tax Rates (plus solvency surtax of 0.00 – 1.30%) | 0.0 – 12.0% | |

| Standard 2025 New Employer Rate | 2.9 – 3.25%* | |

| Comment | * 2.9% construction industry payrolls under $500,000, 3.05% all other industry payrolls under $500,000, 3.1% construction industry payrolls of $500,000 or more, 3.25% all other industry payrolls of $500,000 or more | |

| Voluntary Contribution Permitted | Yes | |

State Resources | ||

| Dept. of Revenue: https://www.revenue.wi.gov | ||

| Dept. of Workforce Development: http://dwd.wisconsin.gov | ||

Wyoming Wage and Tax Facts | ||

| State Effective 7/24/09 | Federal Effective 7/24/09 | |

Wyoming Minimum Wage | ||

| Minimum Wage | $5.15* | $7.25 |

| Minimum Cash Wage (Tipped Employee) | 2.13* | $2.13 |

| Maximum Tip Credit | 5.12* | $5.12 |

| Youth Minimum Wage | $4.25 | $4.25 |

Wyoming State Income Tax | ||

| Wage Withholding | None | |

| Supplemental Wage / Bonus Rate | None | |

Wyoming Unemployment Insurance | ||

| Maximum 2025 Taxable Earnings (Increase from $30,900 in 2024) | $32,400 | |

| Employee 2025 Deduction | None | |

| Employer 2025 Tax Rates (Includes 0.13% INEFF/NC adjustment factor and 0.09% Employment Support Fund factor) | 0.18 – 8.72% | |

| Standard 2025 New Employer Rates (Includes 0.13% INEFF/NC adjustment factor and 0.09% Employment Support Fund factor) | 1.22 – 8.72% | |

| Voluntary Contribution Permitted | No | |

State Resources | ||

| Dept. of Workforce Services: http://wyomingworkforce.org |

Please read our disclaimer here.