HR Software for Retail

Built for Retail, Designed for Growth

Streamline Payroll and HR so you can focus on your customers and revenue growth.

One moment you’re ensuring labor law and tax compliance; the next, you’re making sure your store has the right coverage to meet customer demand. But your role goes far beyond compliance and scheduling. You’re the engine behind your store’s growth—keeping employees engaged, reducing turnover, and delivering shopping experiences that build loyalty and drive sales. Despite the challenges, you stay focused on what matters most: creating great customer experiences that keep them coming back.

61%

Nearly 61% of retail employees will leave a company within a year, quadruple the average across other industries.

45%

Nearly 61% of retail employees will leave a company within a year, quadruple the average across other industries.

10+

Retail operators report spending 10+ hours each week on HR and compliance administration.

Stay compliant and focus on your customers.

Smarter Compliance, Greater Peace of Mind, Stronger Customer Loyalty

Streamline compliance by tracking regulations, certification expirations, and handbook acknowledgements on a single platform.

- Maintain compliance with ever-changing state and local tax codes, labor laws, and minimum wage rates.

- Track certification expirations and continuing education requirements to ensure employees stay compliant and up to date.

- Store employee handbooks digitally and track verified acknowledgements

Retaining retail employees just got easier.

Rapid Onboarding, Employee-Centric Self-Service, Streamlined HR Processes

Manage and retain your employees with ease through rapid onboarding, mobile-enabled self-service, and position-based architecture.

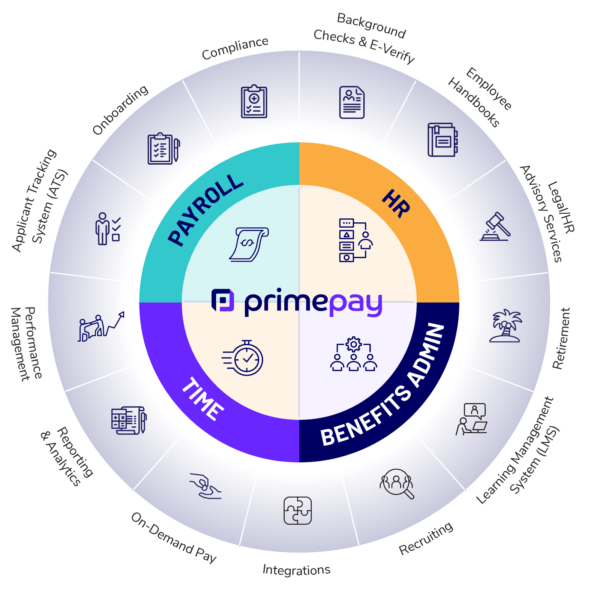

- Onboard and pay employees, manage HR, and administer benefits from a single employee system of record—making it easier to support and retain your retail team.

- Keep employees engaged and empowered with mobile self-service for managing pay, benefits, and personal information.

- Leverage position-based architecture that maintains role data through promotions, store transfers, or employee transitions.

Focus on your customers, let our payroll software do the work.

Effortless Payroll, Simplified Scheduling, On-demand Pay

Process payroll with fewer errors, handle shift scheduling with ease, and give your employees enhanced control over their wages.

- Ensure accurate pay by storing hourly, sales-based, or overtime rates in Time & Attendance, with streamlined transfer to Payroll.

- Manage complex retail schedules with smart, flexible tools that align staffing to peak hours while respecting employee availability.

- Provide flexible wage access to your employees with on-demand pay.

What Our Clients Say About Us

All a Retailer Needs in One Place

Take an On-Demand Tour

Frequently Asked Questions

How can HCM software help retail businesses manage labor costs and workforce planning?

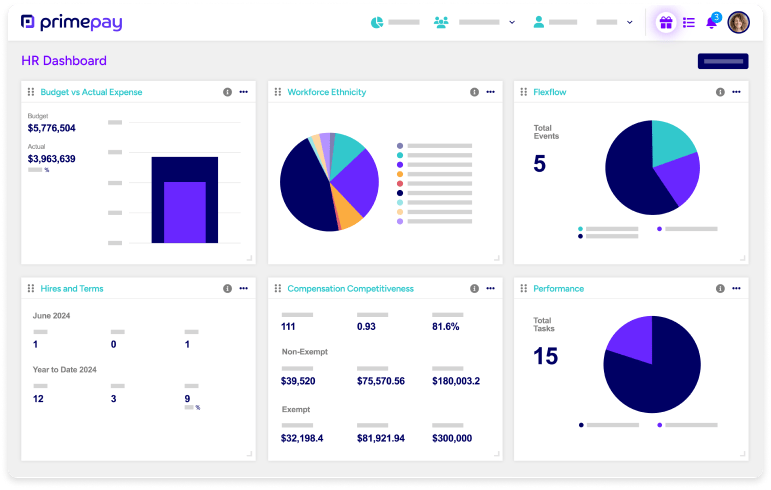

PrimePay’s HCM software helps retail organizations control labor costs by automating time tracking, shift scheduling, and overtime calculations across multiple store locations. Real-time insights help managers optimize staffing based on customer traffic and store needs, preventing overstaffing and unnecessary labor spend. Connected Payroll and HR ensure accurate labor cost reporting, helping retailers stay on budget while maintaining exceptional in-store experiences.

How does payroll software streamline wage calculations and compliance in retail?

PrimePay Payroll automates complex wage calculations for hourly retail workers, including overtime, shift differentials, and varying state labor laws. It ensures compliance with FLSA, ACA, and local labor laws by accurately tracking hours worked and applying correct pay rates. With automated tax filing and compliance reporting, retail teams reduce errors, avoid penalties, and ensure employees are paid correctly and on time.

What key HR challenges can HCM software solve for retail?

Retailers often deal with high turnover, inconsistent scheduling, and compliance across multiple jurisdictions. PrimePay’s HCM solution streamlines hiring, onboarding, benefits, and shift planning. Mobile self-service gives retail employees access to pay stubs, schedules, and benefits—boosting satisfaction and retention. With PrimePay, HR teams reduce manual tasks and focus on driving store performance.

What is position management in HCM?

Many leading HR software solutions still couple employee and position data together, meaning that HR teams lose important strategic workforce planning data anytime an employee terms. Unlike other HCM software, PrimePay’s position management core architecture keeps the position and employee profile distinct in the platform. This separation enables businesses to easily transfer employee profile information (such as contact details, performance data, and compensation history) across the organization while ensuring position data (like job title, department, and salary range) remains intact, allowing for streamlined employee movement across promotions or store transfers without losing critical position-related information. Additionally, PrimePay’s patented time relational data model provides real-time insights into staffing needs, vacancy trends, and labor costs, helping retailers optimize workforce planning and shift coverage across multiple stores.

Do most retailers typically have dedicated HR departments?

Yes—many retail chains have centralized HR teams, while smaller businesses rely on regional HR leads, owners, or store managers. These teams handle recruiting, compliance, benefits, and payroll to ensure consistent employee experiences and legal adherence across stores.

How does HR software improve operational efficiency in retail?

PrimePay’s HR software reduces time spent on manual tasks like recruiting, onboarding, benefits management, and compliance tracking. Store managers and HR leads can automate these functions while empowering employees through mobile self-service. This leads to fewer administrative headaches and more time focused on creating great customer experiences that keep them coming back.

How does HR software help retailers retain top employees in a competitive market?

PrimePay helps retailers boost employee retention with automated onboarding, mobile self-service, and built-in learning tools. By supporting career growth and empowering employees to manage their own information, retailers can reduce turnover and drive revenue growth.

Resources Made for Retailers Just Like You

We've pulled together a few resources that you may find helpful towards your HCM journey.

See All Resources