Accrued payroll refers to wages and related expenses incurred by a business that have yet to be paid to employees.

According to IRS rules, businesses that follow the Generally Accepted Accounting Principles (GAAP) in recording and reporting their finances are required to use accrual-basis accounting, as are businesses making an average of $25 million or more in sales for the preceding three years.

Want to know more about it? You’re in the right place.

Below, we discuss the different types of payroll accrual, how to calculate them, and the benefits they provide for your organization’s financial health.

Types of Accrued Payroll

Understanding the accrued payroll types helps your organization adhere to its financial obligations and maintain accurate records – both important components of maintaining a financially healthy business.

The main types are:

- Accrued wages: This is the most common type of accrued payroll. Accrued wages include regular pay, overtime, bonuses, and commissions that employees have earned but have not received. For example, if the payroll period ends on a Friday but employees are paid the following Wednesday, those wages are considered accrued until paid.

- Accrued salaries: While similar to accrued wages, accrued salaries specifically refer to fixed payments made to salaried employees. If the end of the month falls on a weekend or holiday, and payment is delayed until the next business day, the salaries for that period would be accrued.

- Accrued bonuses and commissions: Bonuses and commissions are often paid out after the period they are earned. For instance, sales commissions are typically accrued throughout the month and paid later once all sales data has been finalized.

- Accrued vacation pay and sick leave: This accrual type involves PTO employees have earned but have not used. Companies accrue these expenses regularly, even if the employee hasn’t taken the vacation or sick leave yet.

- Accrued payroll taxes: Payroll taxes include Social Security, Medicare, and any applicable state or local taxes the employer must pay. Like wages, these taxes are considered accrued until the funds are transferred to the appropriate authorities.

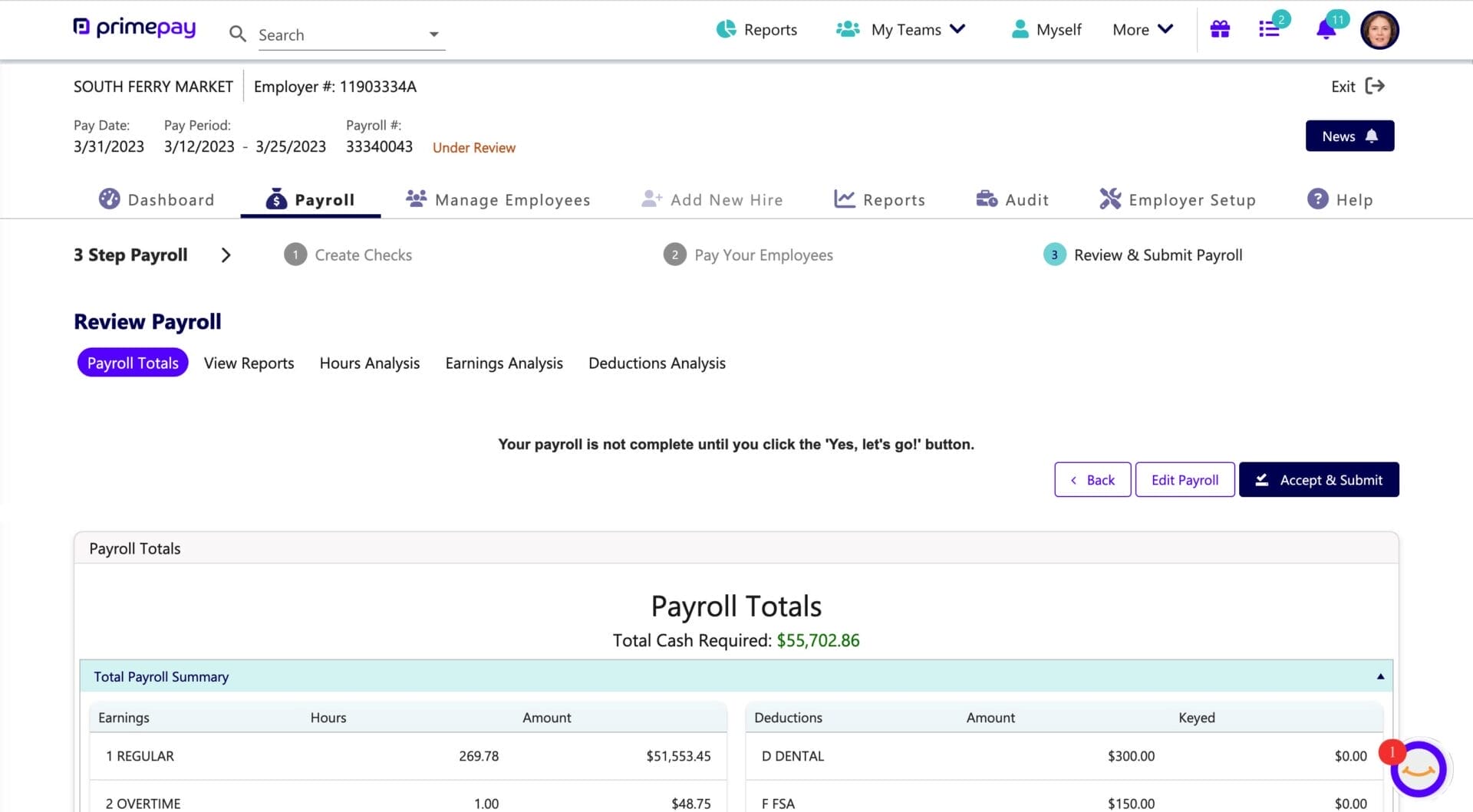

As you can see above, the pay period ended on 3/25 but the pay date isn’t until 3/31 – meaning the payment is accrued.

How to Calculate Accrued Payroll

Accurately calculating accrued payroll is essential for maintaining precise financial records and ensuring employees are paid correctly for the work they’ve completed.

Luckily, there’s no need to bust out your old calculus book for these calculations. It just takes seven simple steps, multiplication and addition only!

1. Identify All Accrued Payroll Elements

List all the components of accrued payroll, such as regular wages, overtime, bonuses, commissions, vacation pay, sick leave, and payroll taxes. Each element needs to be accounted for individually.

2. Determine the Accrued Time Period

Identify the period for which the wages and expenses have been incurred but not paid. This is typically the gap between the end of the payroll period and the actual payment date.

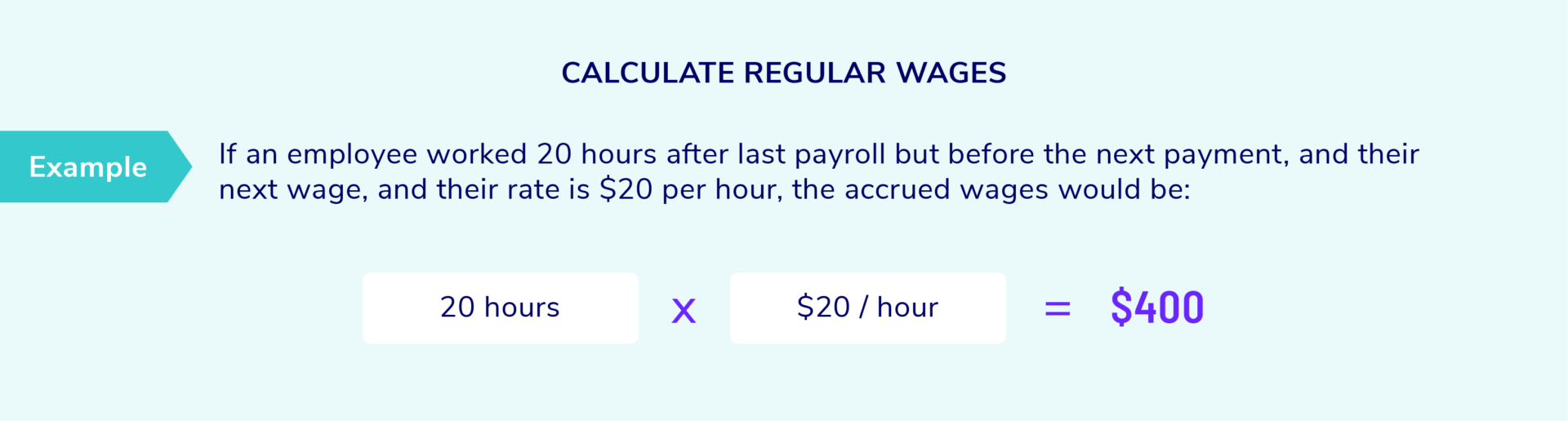

3. Calculate Regular Wages

Multiply the number of hours worked during the unpaid period by the hourly wage rate. For salaried employees, divide their annual salary by the number of pay periods in the year, then multiply by the fraction of the period that remains unpaid.

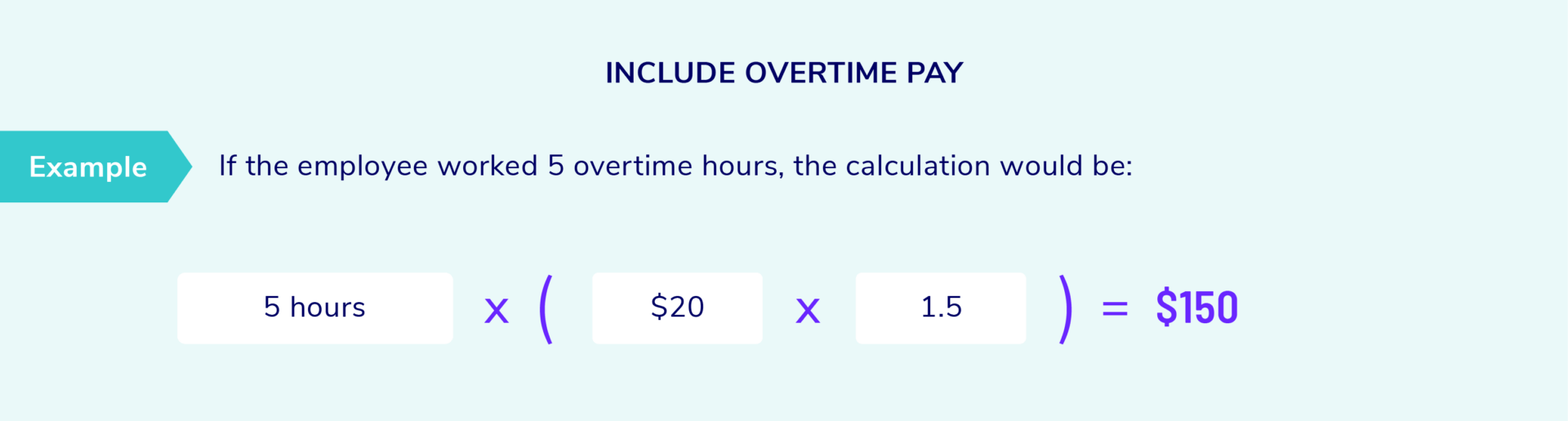

4. Include Overtime Pay

If employees worked overtime during the unpaid period, calculate overtime pay by multiplying the overtime hours by the overtime rate (usually 1.5 times the regular rate).

5. Factor in Additional Pay Elements

Add any accrued bonuses, commissions, vacation pay, or other compensation earned during the period. For commissions, use estimates based on sales data for the unpaid period.

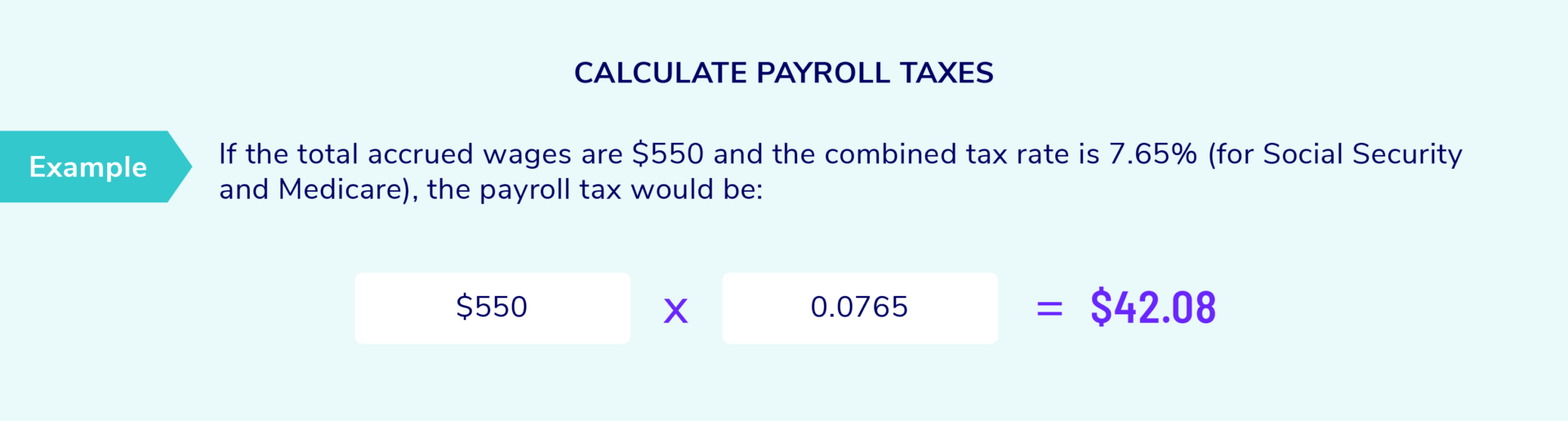

6. Calculate Payroll Taxes

Accrued payroll includes employer payroll taxes, such as Social Security, Medicare, and state taxes. To calculate these, apply the relevant tax rates to the total accrued wages.

7. Add All Components

Add up all the calculated amounts for wages, overtime, additional pay elements, and payroll taxes to get the total accrued payroll.

And that’s it!

Of course, there’s an easier way to ensure your accounting books are accurate and you maintain compliance with accounting standards.

You guessed it: payroll software. Payroll software is automated, integrates with your HR and timesheet data, and simplifies payroll tax filing – all of which mitigate human errors and ensure payroll accuracy.

Even better, you’ll save ample time so you can focus on other top priorities. Just take it from Jeff Berliner, Chief Information Officer at the Institute for Advanced Study, who reflects on his organization’s switch to payroll software, “The solution’s automation functionality means that activities like payroll processing and validation that used to take us 15 or 20 hours per week can now be done in a matter of minutes.”

Benefits of Accrued Payroll

As mentioned, payroll accrual offers several advantages that help businesses maintain accurate financial records and improve cash flow management.

Some key benefits are:

- Improved financial accuracy: Payroll accrual ensures that expenses are recorded in the correct accounting period, aligning with the accrual accounting method. This process leads to more accurate financial statements, which are essential for stakeholders who rely on these documents to make informed decisions.

- Better cash flow management: By recognizing expenses when they are incurred rather than when they are paid, your business can better anticipate cash needs and manage its cash flow more effectively.

- Compliance with accounting standards: Accruing payroll helps businesses comply with Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS), which require expenses to be recorded in the period they occur. Watch out – non-compliance can lead to legal and financial repercussions.

- Enhanced budgeting and forecasting: Accurate accrual of payroll expenses supports better budgeting and forecasting by providing a more precise picture of future financial obligations.

- Streamlined financial audits: Accrued payroll simplifies the audit process by ensuring that financial records are complete and up-to-date. This reduces the likelihood of discrepancies and the time spent reconciling accounts during audits.

Ensure Financial Accuracy

By now, you should hopefully see that payroll accrual is a strategic tool that helps enhance your company’s overall financial management. Knowing the exact numbers—what’s coming in, going out, and when—contributes to improved economic health and operational efficiency for your organization.

With this information top-of-mind, accrued wages, taxes, and PTO become second nature in your financial analysis, improving accuracy as you plan budgets, headcount, and other positive changes for the future.