Even if you create the safest workplace environment and go above and beyond for safety training, the hard truth is that employees will get hurt on the job. Almost three million private industry employees reported nonfatal workplace injuries and illnesses in 2022. Even worse, 5,486 fatal work injuries were reported that year.

To maintain compliance (and pay injured employees the proper amount), you need to know how to calculate workers’ comp for any scenario. As a reminder, workers’ compensation is mandated by the government and covers medical treatment, disability payments, and death benefits for employees injured at work.

Since calculating workers’ comp can be complicated, we’ve listed ten common questions (and their answers) to equip you with the correct information for success.

1. What is the Cost Employees Pay for Workers’ Compensation?

Workers’ compensation is an important form of insurance protection for employers and employees. It provides necessary financial assistance to those who experience work-related injuries or illnesses while keeping employers from potential legal liability. The employer pays 100% of workers’ compensation premiums, with no exceptions in any U.S. state. This policy ensures that businesses cannot pass on any costs to their employees or deduct wages for coverage.

However, employees contribute to the cost of workers’ compensation by maintaining a safe workplace and seeking proactive care when possible. By following safety protocols, reducing risks, and pursuing appropriate medical treatment right away after an accident, employees can work toward minimizing premiums for their company’s insurance plan. Encourage injured employees to keep accurate records regarding money awarded through workers’ compensation claims (in some cases, it may be taxable). Keeping up with all information related to safety procedures and filing notices or paperwork as needed will help reduce costs associated with premium payments and keep your workforce safe and secure.

2. What is the Process for Calculating Workers’ Compensation for Full and Part-Time Employees?

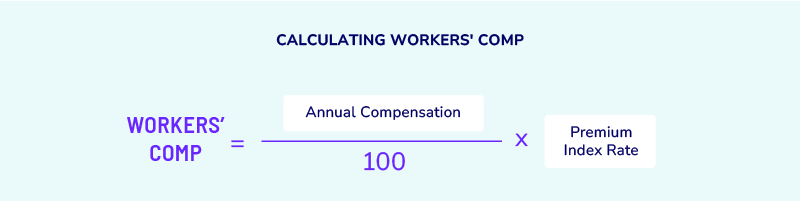

The basics involve taking an employee’s annual compensation, dividing it by 100, and multiplying this number by the premium index rate for their particular role.

To ensure an accurate and efficient process, make sure you:

- Collect any necessary data from the employee, such as wage information or proof of insurance documentation.

- Consider your state’s worker’s compensation laws, as different states implement various regulations.

- Speak with an experienced broker regarding additional details associated with coverage rates according to your state standards. Brokers can usually provide accurate estimates and guidance in finalizing paperwork for setting up a workers’ comp insurance plan.

The process remains the same for full-time employees when calculating workers’ comp for part-time employees. Though the formula remains consistent, a part-time employee will have a lower average workers’ comp cost due to their reduced hours compared to full-time employees. Note that you won’t pay less relative to standard premium costs; these costs are adjusted accordingly based on the amount of time worked.

3. How are Workers’ Compensation Premiums Calculated?

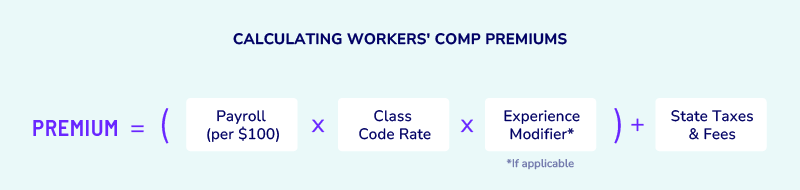

Workers’ comp insurance premiums are calculated according to employee classification and the rate assigned to each employee classification.

The premium rate is expressed as dollars and cents per $100 of payroll for each class code. The National Council on Compensation Insurance (NCCI) determines most states’ classification rate and experience modification factor (MOD).

Factors of Workers’ Comp Premiums:

- Employee job classifications

- Company’s claims experience

4. How Does Employer Classification Affect Insurance Rates?

The classification system identifies which type of work presents more risk to the employees performing these tasks. For each employee classification, the business owner must pay a certain amount for workers’ comp insurance based on every $100 of payroll.

5. How Does the Experience Modification Factor Affect Your Premium?

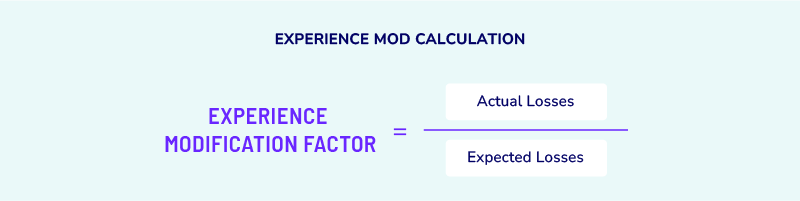

Your experience modifier, typically referred to as your MOD, is a numeric representation of your company’s claim experience. MODs are based on how your business compares to others in your industry with similarly classified employees. An average MOD is set at 1.00. Employers with fewer and less severe accidents than average have a MOD of less than 1.00.

6. Does Workers’ Compensation Depend on Gross Wages?

The amount workers’ comp pays out is based on an employee’s gross wages, which can affect the employer’s rates when it comes time to renew their policy. This means that any deductions taken from a worker’s salary before taxes are irrelevant when calculating premiums — the amount is calculated on what they’re being paid without those deductions.

7. How Does Running Payroll Affect Workers’ Comp Rates?

Your payroll is the basis for an employer’s workers’ comp insurance premium. For each $100 of your payroll, there is a specific rate, which is determined by the classification codes of your employees.

You can spread your premium payment out over the year for better cash flow management instead of paying one lump sum. Just be sure to choose a payroll provider that allows you to have your workers’ comp premium deducted each payroll period. This is called a ‘pay as you go’ program.

8. Do Salary Raises Affect Workers’ Comp Premiums?

Yes, compensation increases will most likely affect workers’ compensation insurance costs. That’s because premiums consider gross wages (remember, gross wages include overtime pay, bonuses, regular wages, and salaries) rather than net earnings. As such, plan and factor this into your headcount and compensation plans for the future.

9. What is the Cost of Workers’ Compensation Insurance for One Employee?

Workers’ compensation insurance is mandatory for most businesses, regardless of the number of employees. Sufficient coverage helps protect both the business owner and their employee should an injury or illness be sustained while on the job. Depending on the role and amount of compensation for an individual employee, you could not need workers’ comp insurance if you have only one employee.

This decision will depend significantly on the laws in your state across different industries and professions. For instance, most states mandate that all employers must provide workers’ comp when they have at least four employees, although this may vary if specific industries are exempt from this stipulation. You may also not be required to carry workers’ comp when the employee is classified as an independent contractor instead of a full-time worker. It’s essential to research your state’s specific regulations and consult with a business lawyer before deciding whether or not it is necessary for your situation.

10. How Can Employers Reduce the Cost of Workers’ Compensation Coverage?

Incorrect worker’s compensation calculations can greatly affect an employer’s cash flow. In short, overpaying for a policy is undesirable and takes away money that could have been invested into the business.

Alternatively, underpaying can result in an unexpected bill at year’s end. To ensure you’re paying the right amount for workers’ comp premiums, it’s recommended to regularly:

- Review insurance premiums. Insurance premiums are indicators that a premium may be incorrectly set. Keep an eye on certain indicators, such as changes in payroll (including new hires or departures), significant and unexplained changes in premium bills, and improper charges for subcontractors with their own coverage.

- Review job classifications. You want to ensure your people are correctly classified. Common misclassifications are employees who assume other business roles temporarily, seasonal hires classified as permanent employees, and people who transition from full-time to part-time.

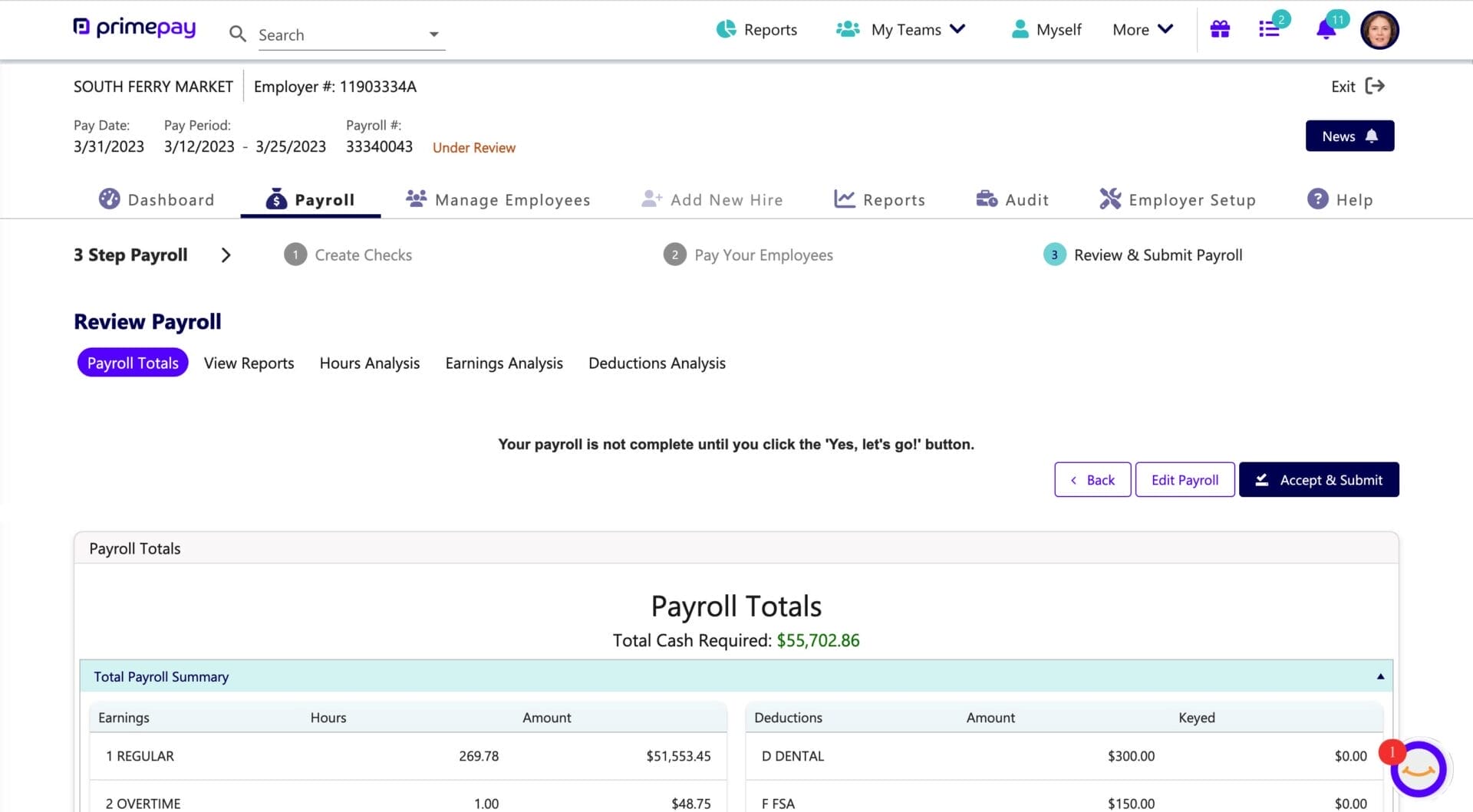

- Double-check payroll. Payroll errors can impact workers’ compensation premiums and your year-end tasks. It’s therefore important to regularly review payroll reports to ensure that data is input and processed correctly.

Modern payroll software makes for easy auditing. View payroll totals, reports, and other analyses to ensure accurate payroll, coverage, and more.

Tackle Workers’ Compensation with PrimePay

As an employer, it’s your job to establish and maintain a safe working environment. It’s also your responsibility to compensate for medical costs when someone gets hurt on the job. Managing these aspects can feel overwhelming, which is why PrimePay partners with thousands of companies to reduce and manage health, wealth, and HR needs.