As a business owner or operator, It is hard to keep so many different types of tax forms straight. When running a small business, it is important to know which form is used when – along with the compliance concerns to watch out for.

The most common forms you will use in business (and during tax time) are Forms W-4, W-2, W-9, and 1099-NEC.

Let’s dig into each form type to provide a clear distinction, helping your business run most effectively.

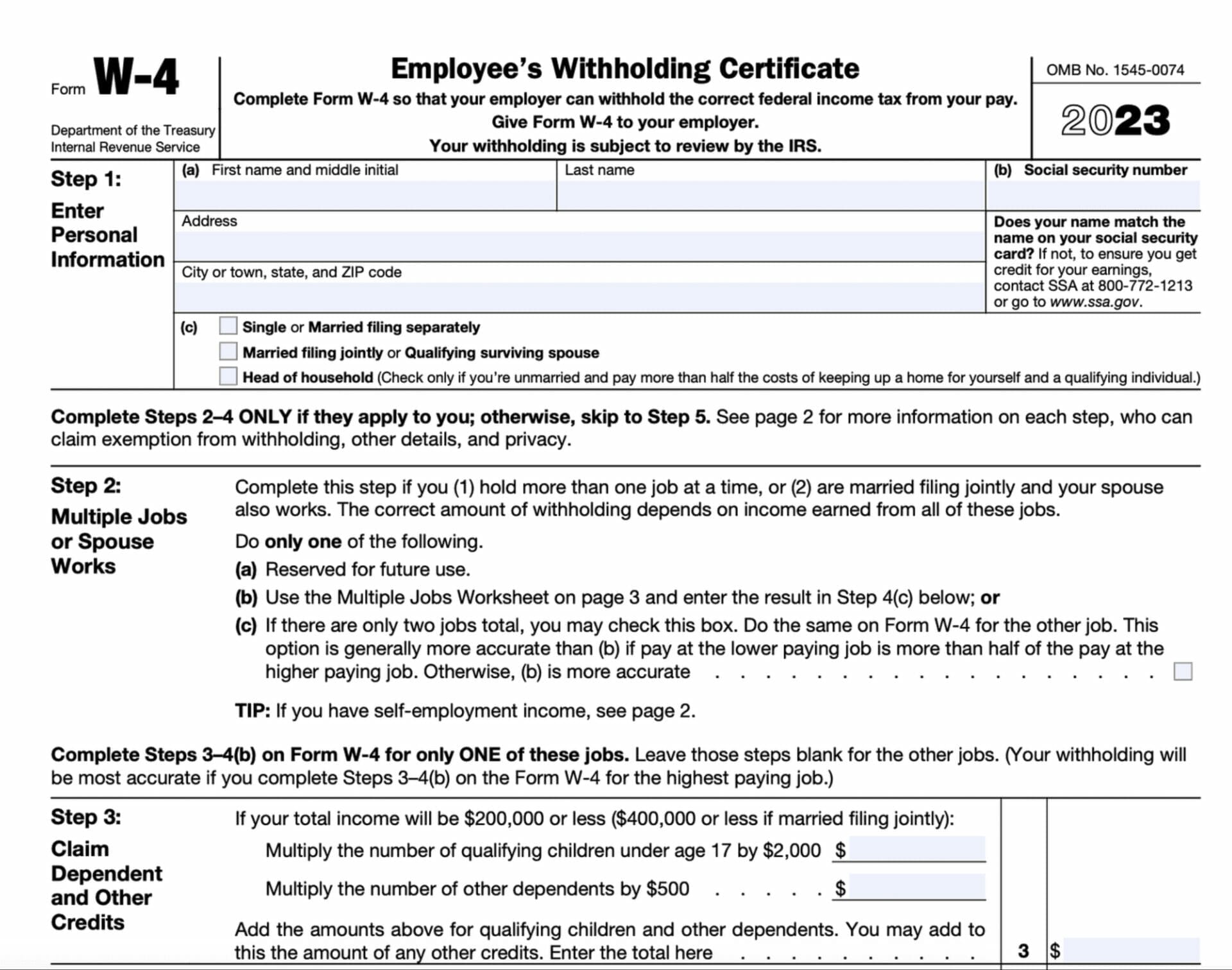

W-4 Form: Paying Employees

A W-4 Form, also known as the Employee’s Withholding Allowance Certificate, is filled out by an employee. It is how the employer knows how much to tax to withhold throughout the year. The amount withheld will be based on the allowances claimed – the more allowances, the lower amount of federal taxes withheld from each paycheck.

The personal allowances worksheet that is provided with a Form W-4 helps employees calculate how many ‘allowances’ to claim on the form. PrimePay has a Form W-4 assistance calculator to provide to your employees when they’re filling out a Form W-4, ensuring they claim the right number of allowances.

Some employees may want to update their withholding allowances throughout the year. The time to do this, other than hire date, would be when there is a life event like marriage, birth of a child, etc.

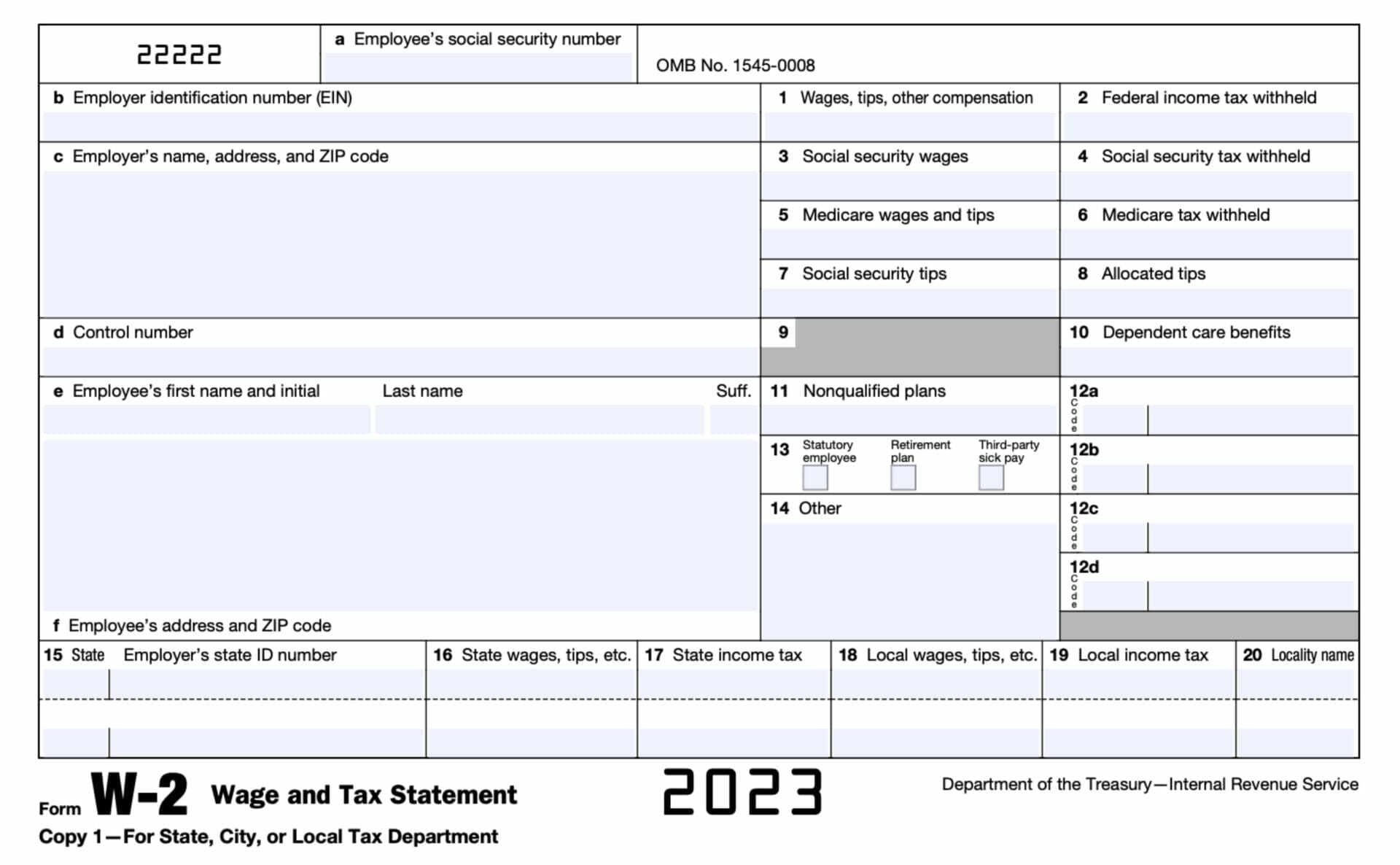

W-2 Form: Summary of Wages & Withholdings

A W-2 Form, Wage and Tax Statement, shows the income and taxes withheld from an employee’s pay for the year and is necessary to file your taxes. Employment taxes (like Social Security taxes and Medicare taxes) amount to 15.3% of a worker’s gross wages. Employers pay half of this (7.65%) and withhold the other half from W-2 employee paychecks.

While a W-4 Form instructs employers what to take out while collecting employee personal data, the W-2 Form is a summary of the wages paid and what was withheld throughout the year (thanks to the W-4).

While a W-4 Form is completed by the employee, W-2 Forms are completed by employers. The IRS requires employers to provide employees copies of their W-2 Forms by no later than January 31.

If you’re a W-2 employee and do not receive your W-2 Form on time, there are steps you should take to make sure you do not get penalized.

W-9 Form: Gathering the Info of Non-employee Payees

If you have any other individuals (or companies) that are doing work for your business, but they are not a W-2 employee, have them complete a W-9 Form prior to doing work for you. A common example of who will fill this form out for you is an independent contractor or freelancer.

A quick note about Independent Contractors. It’s important to pay careful attention to what constitutes an independent contractor versus a full-time employee, especially for a business. Why? Misclassifying an employee as an independent contractor may lead to hefty financial penalties. With penalties that can include:

- A fine of up to $1,000 may be imposed for misconduct.

- A fee of $50 will be charged for every incorrectly classified W-2 form.

- Penalties amounting to 1.5% of the withheld income taxes will be imposed.

- The employee’s FICA taxes, which include Social Security and Medicare, were not withheld at a rate of 40%.

- The tax calculation is impacted by the classification of employees, affecting both the employer and the workers. Employers must withhold income taxes and pay taxes for wages paid to W-2 employees. Payments made to 1099 contractors are typically not subject to tax withholding or payment.

When deciding if an individual providing services is an employee or independent contractor, it is necessary to evaluate all evidence that demonstrates the level of control and independence. The IRS has guidelines to determine whether the individuals providing services are Employees or Independent Contractors. At a high level, a business must assess the facts of the engagement that provide evidence of the degree of control and independence. This assessment falls into three categories:

- Behavioral: Does the company control or have the right to control what the worker does and how the worker does his or her job?

- Financial: Are the business aspects of the worker’s job controlled by the payer? (these include things like how the worker is paid, whether expenses are reimbursed, who provides tools/supplies, etc.)

- Type of Relationship: Are there written contracts or employee-type benefits (i.e. pension plan, insurance, vacation pay, etc.)? Will the relationship continue and is the work performed a key aspect of the business?

A W-9, a Request for Taxpayer Identification Number and Certification, does it exactly what it sounds like. It captures the information of the person, or company, doing work for your business. From here, you can record their wages.

It differs from a W-4 Form in the sense that it does not have any kind of withholding or allowance information. Its main purpose is to gather the information of the payee so you can accurately complete a 1099 Form.

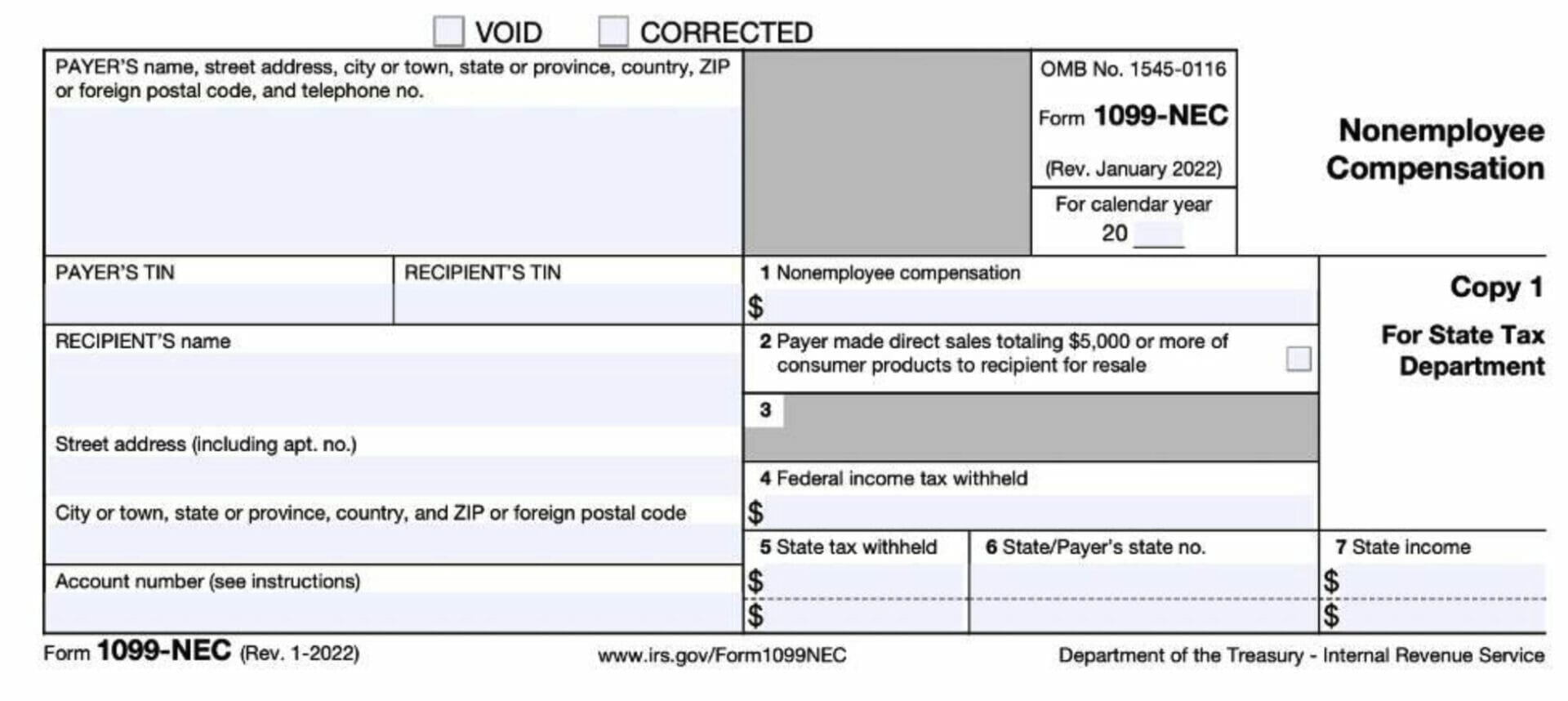

A 1099-NEC or 1099 Form: Summary of Payments

A 1099 Form is to a W-9 Form like a W-2 Form is to a W-4 Form. Except withholdings are not recorded and Employment taxes (like Social Security taxes and Medicare taxes) that amount to 15.3% of a worker’s gross wages, are paid in full by the independent contractor.

Like a W-2 Form, a 1099 Form must be filled out by the employer and provided to the individual or entity by January 31. This form will report what is paid to the individual or entity and their reporting details (like name, address, SSN or TIN), but all of the tax payments are up to the payee of this form.

When in Doubt, Let PrimePay Help

PrimePay’s All-Inclusive Payroll bundle comes complete with federal and state tax filing for your business, and it could also handle the distribution of your W-2 Form!

Please read our disclaimer here.