Applicant Tracking Software (ATS) to Streamline Hiring

Accelerate hiring ROI with an all-in-one platform that attracts top talent, streamlines recruiting, and simplifies onboarding. Post jobs, manage candidates, and automate workflows to save time and reduce costs—delivering a faster, smarter hiring process that drives stronger business results.

Hiring managers drown in resume overload, compliance paperwork, and scattered conversations that push every requisition off schedule. Hiring managers juggle disjointed calendars, inconsistent interview notes, and endless email threads that stall decisions and frustrate candidates. Talent leaders operate in the dark without real‑time funnel data, forcing them to guess at recruiting ROI while top prospects slip away.

$14,000

Organizations lose $14,000 per hire that leave in the first year.

50%

The cost of an employee that has turned over is roughly 50% or more of their salary.

20%

20% of worker turnover happens in the first 45 days of employment.

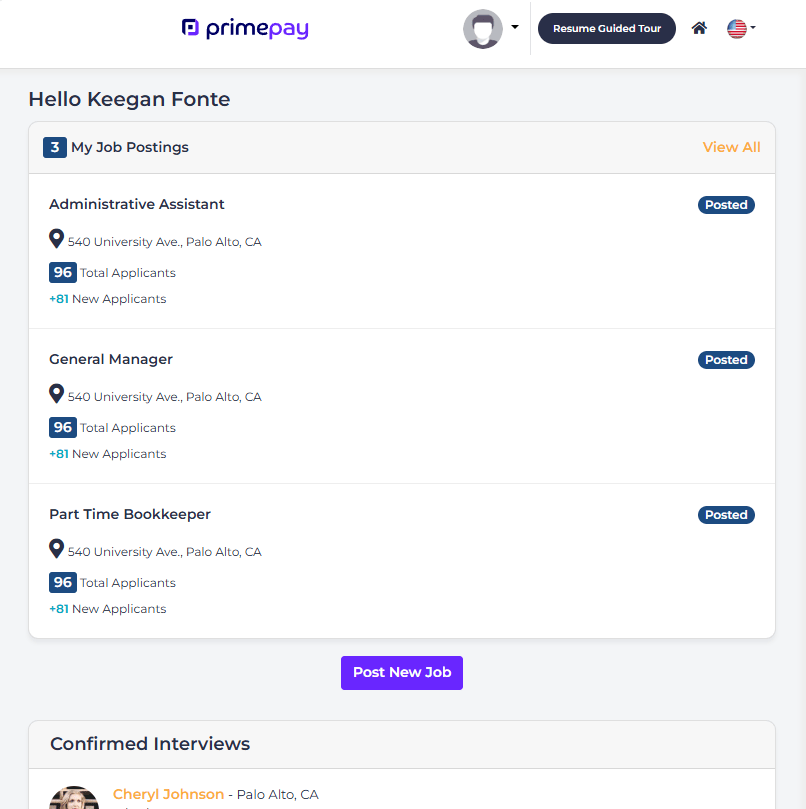

Streamline hiring with powerful applicant tracking

Attract Top Talent

Get StartedEasily create and share job postings across top job boards and social media with our applicant tracking system.

- Post openings to leading job boards and social media with a single click.

- Add customizable pre-screening questions to filter top candidates.

- Capture video or audio responses to get a deeper view of applicants.

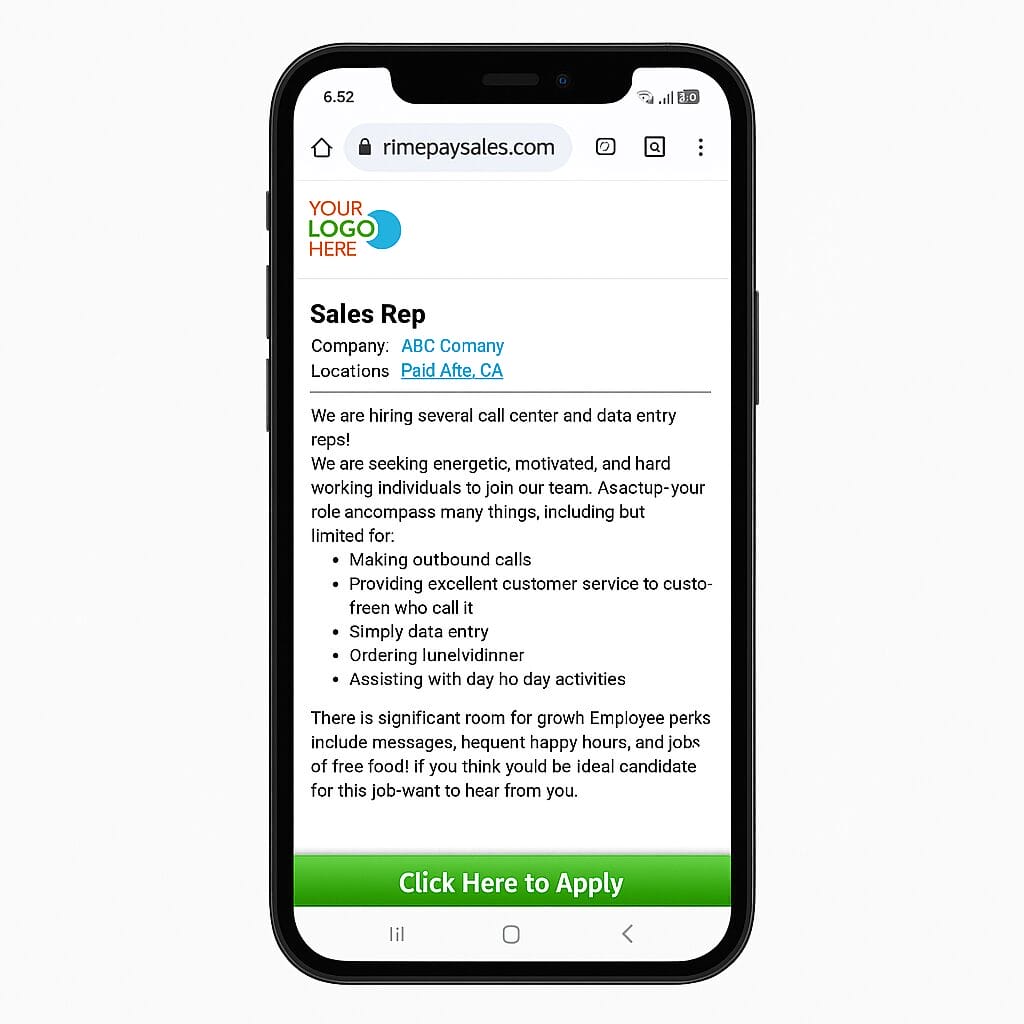

Boost applications with mobile-optimized postings

Evaluate Faster with Intelligence

Get StartedEnsure every job posting is automatically optimized for mobile to attract more qualified candidates.

- Format postings automatically for a seamless mobile experience.

- Reach over half of job seekers who apply from their phones or tablets.

- Deliver a professional, mobile-first application process that boosts engagement.

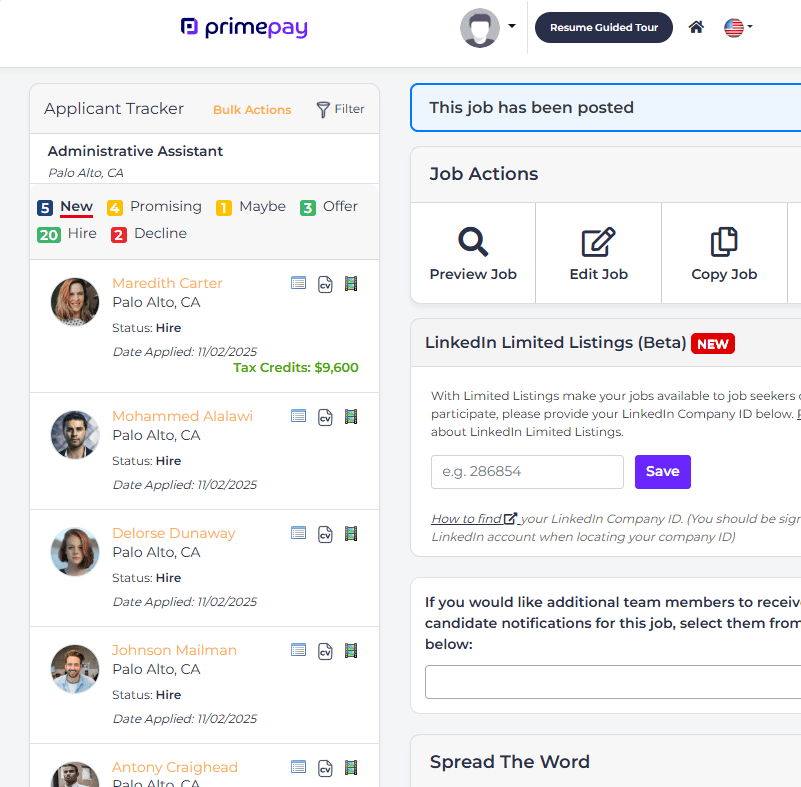

Simplify recruiting with smart hiring software

Seal the Deal and Onboard Seamlessly

Get StartedManage every step of the hiring process seamlessly within our applicant tracking system.

- Organize candidates, schedule interviews, and collaborate effortlessly with your team.

- Customize workflows, requisitions, and rating templates to fit your hiring needs.

- Send electronic offer letters and run background checks—all in one place.

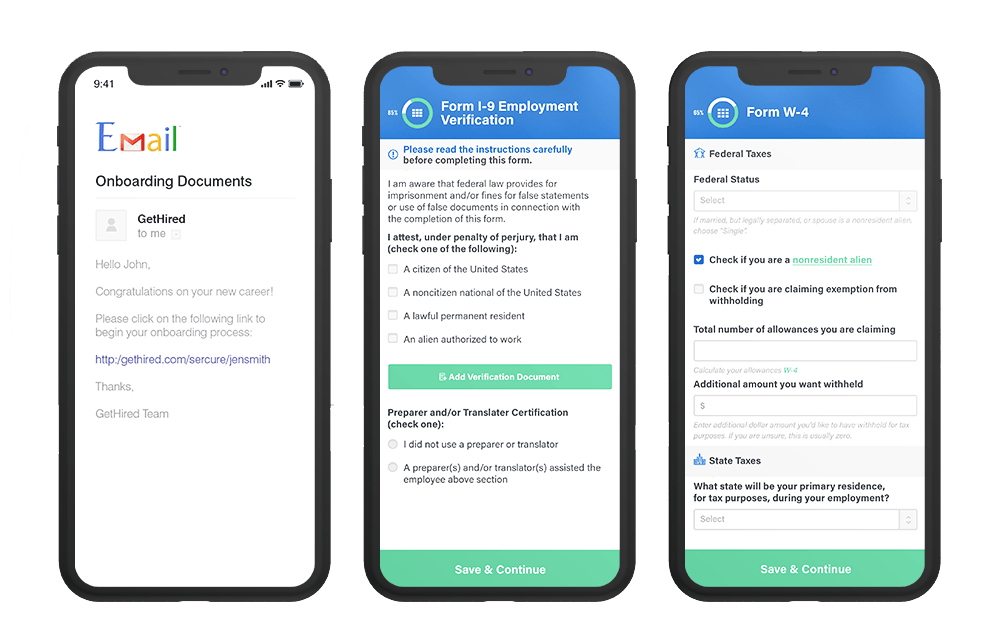

Enhance new hire onboarding experience online

Optimize Results and Safeguard Compliance

Get StartedStreamline onboarding with our mobile-first platform that lets new employees complete all documents from anywhere.

- Enable new hires to review and sign forms like I-9s, W-4s, and payroll documents online.

- Include additional materials such as employee handbooks or policy acknowledgments.

- Customize onboarding documents to fit your company’s unique requirements.

Frequently Asked Questions

What is the difference between HRIS and applicant tracking systems?

HRIS is used to manage employee data and ATS is used to compile applicant data, with the role of ATS ending after hiring is made and HRIS coming into play.

What are the key benefits of using an ATS?

An ATS can provide key benefits such as improved efficiencies, cost savings, and better talent acquisition, making it an invaluable tool for any HR department.

How can I customize my ATS for optimal results?

Optimize your ATS by implementing sourcing strategies, reducing bias, and streamlining interviews and assessments for the best hiring results.

How can integrating my ATS with other HR tools benefit my organization?

Integrating your ATS with other HR tools can benefit your organization by creating a comprehensive HR tech ecosystem, increasing efficiency and optimizing costs.