Payroll Software for Restaurants

Built for Restaurants, Designed to Support Busy Teams

Streamline payroll and time tracking to spend more time delivering exceptional dining experiences.

In restaurants, payroll never slows down, and keeping up can feel like a full-time job. Managing accurate pay across hourly and salaried staff—plus split shifts, overtime, and shift differentials—takes hours you don’t have, and complex labor laws and tip regulations only add more pressure. All of this comes on top of supporting your team and ensuring your guests enjoy their dining experience.

82%

82% of restauranteurs reported being short-staffed at least one position.

67%

67% of restaurant operators spend more than 100 hours per year processing payroll manually.

100%

As of 2025, the turnover rate for full-service restaurants can be as high as 100%, with quick service restaurants exceeding 130%.

Focus on your guests, let us take payroll and compliance off your plate.

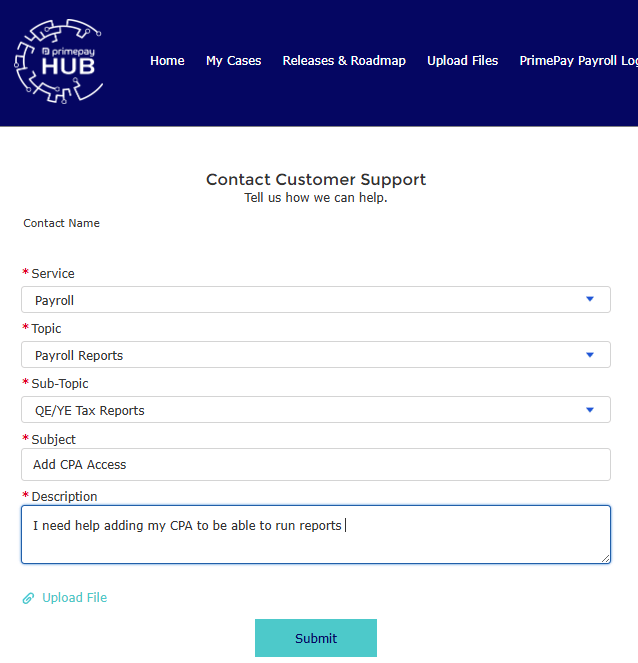

Support You Can Trust

From onboarding to ongoing support, get fast, reliable service from specialists who understand the unique payroll and compliance demands of restaurants.

- Partner with a team that understands the complexities of restaurant payroll, while benefitting form U.S.-based service.

- Simplify compliance with wage and hour laws, paid leave requirements, multi-state reporting, and shifting labor regulations with expert guidance every step of the way.

- Deliver attorney-reviewed training (e.g., OSHA, workplace safety) through your LMS to stay compliant and safeguard your organization.

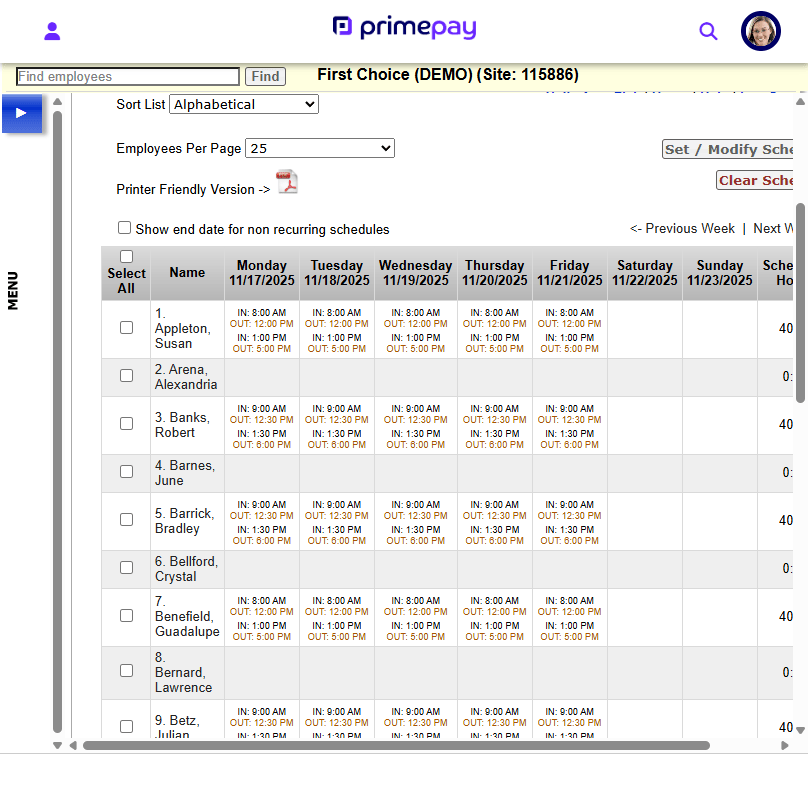

Managing restaurant schedules just got easier.

Restaurant Scheduling Made Easy

Manage restaurant schedules, track employee hours, and ensure accurate payroll across your restaurant.

- Optimize staffing across roles with advanced scheduling tools designed for restaurant operators.

- Maintain verifiable, audit-ready time tracking with geofencing, ensuring employees clock in and out only from approved locations.

- Guarantee pay accuracy by syncing hours and rates directly between Tray POS, time & attendance, and payroll, pulling real-time punches for precise smoother shift management.

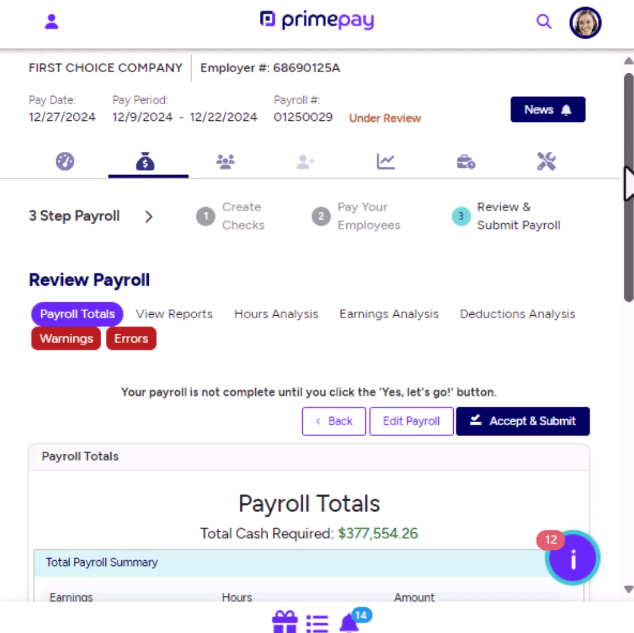

Accurate payroll, every shift.

Effortless Restaurant Payroll

Run payroll in minutes, even with tips and multiple roles.

- Streamline payroll for hourly and salaried restaurant employees with built-in error detection and compliance safeguards.

- Accurately calculate overtime, split shifts, and automate tip to minimum calculations.

- Automate tax filing to adhere to state/local tax regulations and tip credits.

All a Restaurant Needs in One Place

Payroll

Automated, compliant payroll that streamlines tax filing, worker’s comp, and built in error alerts.

Learn About Our Payroll SoftwareTime & Attendance

Payroll-connected tracking that manages time off, holidays, accruals, absences, and scheduling.

See Our Time Functionality in ActionCompliance

Integrated add-on services that automate record-keeping & reporting and makes HR legally compliant.

Applicant Tracking

Intuitive online recruiting that simplifies job postings, and manages applicants & hiring of employees.

Learn More About Applicant TrackingHR & Onboarding

HR Services that you need and expect like Performance Management, Learning Management, and HR Legal Advice.

Learn More About Our HR SoftwareBenefits Services

Comprehensive employee programs, refined for modern workforce needs, delivering confidence and compliance.

See Our Benefits Admin Capabilities

Frequently Asked Questions

How can payroll software help restaurants manage labor costs?

Payroll software helps restaurants manage labor costs by automating time capture, overtime calculations, tip credits, shift differentials, and multi-location or multi-concept pay structures. With real-time payroll data, operators can instantly see labor spending by store, role, or daypart—helping prevent overstaffing during slow periods and avoiding costly labor overruns during peak shifts. When payroll connects directly with time and attendance, restaurants gain accurate labor cost reporting that supports scheduling decisions, budgeting, and labor-to-sales optimization.

How does payroll software streamline wage calculations and compliance in restaurants?

Payroll software automates complex wage calculations, including overtime, blended rates, tip credit adjustments, dual-rate pay, service charge allocations, and shift premiums. It helps restaurants stay compliant with FLSA, state and local labor laws, tip regulations, and industry-specific rules by applying the correct pay rates and tip credit practices to each shift and role. Automated tax filing, error detection, and compliance alerts reduce administrative workload and help restaurants avoid penalties tied to wage violations or incorrect tip handling.

What payroll challenges do restaurants face most often?

Restaurants face unique payroll challenges such as high turnover, constantly changing schedules, staff working multiple roles in a single shift, and complex rules around tips and tip pooling. Operators must also manage overtime spikes, last-minute shift changes, pay differentials, and labor laws that vary across cities and states. These factors increase the risk of wage inaccuracies—making automated payroll essential for accuracy and compliance.

Do restaurant organizations typically have dedicated payroll teams?

Many restaurants—especially multi-unit groups—have dedicated payroll staff or shared HR/payroll roles because of the complexity of tipped wages, multi-role pay, compliance requirements, and frequent staffing changes. Focused payroll oversight is critical to preventing payroll errors that impact retention, labor budgets, and guest service.

How does payroll software improve efficiency in restaurant operations?

Payroll software reduces administrative workload by automating calculations for overtime, dual-rate pay, tip credits, tip pooling, and tax updates. With accurate time data flowing directly from scheduling and time tracking systems, restaurants eliminate manual entry, reduce rework, and accelerate payroll processing—ensuring employees are paid accurately and on time across all locations.

How does payroll software help restaurants attract and retain staff?

Accurate, consistent pay is essential in restaurants, where competition for talent is high and turnover is constant. Payroll software supports retention by eliminating paycheck errors, providing self-service access to pay stubs and hours, and managing pay rules tied to roles, tipped positions, and seniority. When employees trust their pay—especially with tips involved—they’re more likely to stay and deliver better guest experiences.