Running a small business is exciting, but it’s also risky.

If you’re a business owner, it may not surprise you to hear that one of the biggest challenges is cash flow. In fact, 38% of small businesses fail because they run out of money. That’s more than any other reason, including lack of market, competition, or a poor business model.

The bottom-line: Without a budget, your business is flying blind, and you’re putting your company, yourself, and your employees at risk for an unstable future.

The good news is that you can mitigate various issues by knowing your numbers (and sticking to them).

Below is a simple, step-by-step guide to creating a small business budget that keeps your finances steady and sets you up for long-term growth.

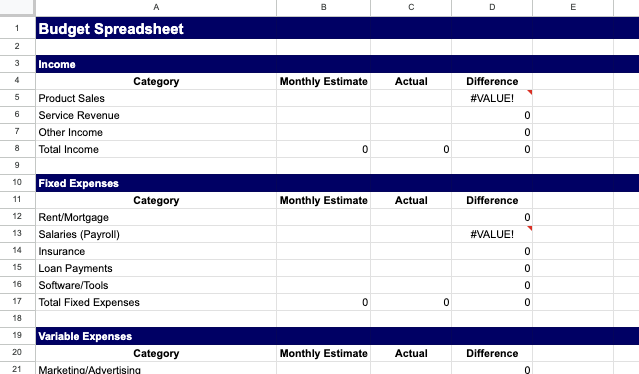

Looking to create a personalized budget for your small business? Download our editable spreadsheet here.

Why Create a Budget for Your Small Business?

Creating a budget for your small business is a smart financial move with long-term benefits. It helps you see where your money is going, prepare for surprises, and make smarter decisions.

Here’s what the right budget does for you:

Better Financial Planning and Cash Flow Management

A solid budget tracks your revenue and expenses so you know whether you have enough to cover everyday operations.

For example, payroll is usually your biggest expense. Best practice says salaries shouldn’t exceed 15–30% of your gross revenue. With a budget, you can make informed decisions—like whether you can afford a new hire or need to adjust benefits—before problems crop up.

Tools like payroll software can help by providing accurate labor cost data, tracking overtime, and automating compliance. When your payroll numbers are reliable, your budget is too.

Reduces Risk

When you know your numbers, you’re less likely to take risks you can’t afford. A budget helps you prepare for downturns, supply disruptions, or other “what-ifs” by giving you a clear picture of your financial health. Doing so helps leaders minimize financial stress by developing contingency plans to ensure consistent cash flow and avoid overleveraging.

Supports Long-Term Sustainability

Budgets track profitability and ROI, helping you see which initiatives are worth scaling and which are draining resources. They also guide big decisions, like whether you’re ready to expand your team or enter a new market.

Having reliable payroll reporting at your fingertips makes it easier to model these scenarios. You can see how adding headcount or adjusting compensation will affect your bottom line before making a move.

Improves Your Chances to Scale

Scaling takes money, whether from profits or outside investments. Even if you’ve completed a total addressable market analysis, worked out a fantastic go-to-market plan, or created a great product prototype, you’ll struggle to scale or secure funding without a structured budget (and, therefore, without a realistic business plan).

A well-structured budget proves to investors that you know your numbers and can manage growth responsibly. Moreover, it validates your business model and shows discipline, both of which increase your odds of securing capital.

5 Factors to Consider When Creating a Budget

There’s no one-size-fits-all approach to budgeting. Some companies set budgets based on revenue, while others use goal-oriented or zero-based budgeting (where every dollar must be justified). For small businesses, goal-oriented and zero-based approaches often work best because they tie spending directly to growth.

No matter your method, these five factors will keep your budget realistic and useful.

1. Your Current Financials

Start with the facts, not guesses. Review financial documents like income statements, cash flow statements, and balance sheets.

From there:

- Add up all income to see how much your business generates.

- List expenses to understand where money goes.

- Find your break-even point (how much you need to cover costs).

- Note income/spending fluctuations to prepare for slow months.

- Review assets and liquidity to check your short-term stability.

Collect data for several months, preferably a year (to account for seasonality and trends), and use these numbers to inform your small business budget.

Unfortunately, many startups don’t have historical financial statements to build realistic budgets. If that’s you, research relevant benchmarks in your industry. These provide reliable estimates for developing a more accurate budget. You can find some helpful financial reports on platforms like IBISworld and Statista.

Why It Matters: This exercise gives you a clear baseline so you can set realistic goals and spot cash flow issues before they become crises.

2. Your Business Goals

Budgets should always reflect your goals. Make your goals SMART (specific, measurable, attainable, relevant, time-bound).

For instance: “Create an employee recognition program to reduce turnover by 25% within seven months, measured through exit surveys and retention rates.”

Break them down into short-term and long-term objectives.

- Short-term goals (urgent, specific): Example—boosting website traffic by 20% in six months through digital ads. Your budget should set aside funds for campaigns like paid ads, influencer partnerships, or SEO.

- Long-term goals (strategic, sustained): Example—expanding into two new markets in the next 24 months. These require bigger investments over time, such as technology upgrades or infrastructure improvements.

Why It Matters: Understanding both long and short-term goals allows you to correctly allocate your financial resources.

3. Your Fixed and Variable Costs

Once you’ve listed expenses, separate them into:

- Fixed costs: Rent, salaries, loan payments, insurance. These don’t change much.

- Variable costs: Marketing, hourly wages, commissions, inventory, utilities, training. These flex with business activity.

Review each expense and ask: Is this essential? Is there a smarter way to handle it?

For example, could you outsource payroll instead of hiring an in-house specialist? Or negotiate better payment processing fees to reduce transaction costs?

Adjust variable spending based on performance. If business is growing, increase your marketing budget; if it’s slowing, redirect funds toward retention efforts.

Why It Matters: Separating fixed and variable costs makes it easier to see where you have flexibility to adjust spending and where you don’t, helping you stay agile as conditions change.

4. Your Compensation Plan

Compensation is often your largest expense. It also helps business owners stay compliant, says Katelyn Lopez, VP of Customer Success at Comprehensive.

She explains: “Regulatory bodies are cracking down on pay disparities. Failure to comply can lead to legal consequences, reputational damage, and financial penalties – all things you can avoid by running compensation audits and adjusting your practices accordingly.”

Build a clear compensation plan that covers:

- Salaries and raises

- Benefits (healthcare, PTO, retirement)

- Performance incentives (bonuses, commissions)

Luckily, payroll tools can simplify this process by automatically tracking wages, benefits, and taxes, giving you visibility into how labor costs align with your small business budget.

Why It Matters: A well-structured compensation plan ensures you’re investing in people while keeping labor costs sustainable within your budget.

5. Contingencies

Unexpected events like equipment breakdowns, supply chain issues, or losing a key employee can derail even the best budget.

Protect yourself with:

- A contingency fund (5–15% of your budget, depending on your industry).

- The right insurance (general liability, professional liability, product liability).

- A plan for common disruptions, such as payroll fraud or service interruptions.

Why It Matters: Building contingencies into your budget safeguards your business from shocks, ensuring you can recover quickly and keep operations running smoothly.

Confidently Plan for Your Company’s Future

Budgeting gives your business the freedom to grow without financial panic. A well-planned budget shows you where your money is going, helps you make smarter choices, and builds confidence with investors.

Most importantly, it should evolve as your business evolves. Review your budget regularly, adjust when needed, and keep it flexible enough to handle both surprises and opportunities.