Hiring the right employees is crucial for any small business. Why? A single bad hire can lead to financial losses, decreased productivity, or even legal troubles. (Hopefully you haven’t learned this lesson from experience.)

Many small business owners therefore turn to employer background checks to ensure they make informed hiring decisions. The key, though, is running a background check properly while staying compliant with employment laws.

Below, we dive into the importance of background checks, compliance laws you must follow, and best practices.

Download our free Hiring Red Flags guide to help spot issues and verify that you’re hiring the best people for the job.

Why Small Business Background Checks Matter

As a small business owner, you may not have the luxury of an extensive HR department to handle hiring risks. Hiring risks aren’t new but are, unfortunately, a growing issue.

One risk – employee theft – often takes the top spot of concerns. As of 2025, 75% of workers admit to stealing from their employer at least once, costing businesses roughly $50 billion annually. If that’s not sobering enough, experts believe businesses lose $0.20 of every dollar to employee theft.

These losses, combined with hiring and training costs, are money most small businesses can’t afford. Luckily, conducting a thorough employer background check can help you:

- Verify a candidate’s work history and qualifications.

- Ensure workplace safety by screening for criminal history.

- Avoid negligent hiring claims.

- Protect company assets and customer trust.

However, background checks must be conducted legally and ethically. Before implementing them, it’s essential to understand compliance requirements and best practices.

Compliance with Background Check Laws

Background screening is governed by the Fair Credit Reporting Act (FCRA) and various state regulations. To stay compliant, make sure you:

- Notify applicants in writing that a background check will be conducted.

- Obtain written consent from the applicant before running the check.

- Use a reputable background check provider and certify compliance with FCRA.

- Provide pre-adverse action notices if you decide not to hire based on the background check results.

- Allow candidates to dispute any inaccuracies in the report.

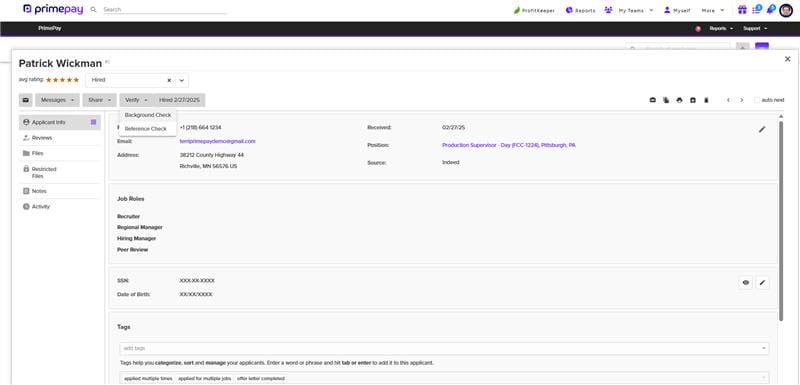

If you use an applicant tracking system (ATS) to run background checks, you’re already one step ahead of competitors. That’s because you can integrate your recruitment, candidate profiles, pre-employment screening, and background checks in one place. The result? An organized, streamlined process for you and your candidates.

“Data-driven decisions separate thriving businesses from those struggling with turnover. An ATS that integrates background checks ensures small businesses aren’t making hiring choices based on instinct alone but on verified information that safeguards their workforce and bottom line.” — Joshua Siler, CEO of HiringThing

Best Practices for Running a Background Check

Although background checks may seem straightforward, making errors (compliance or otherwise) can cause headaches and financial penalties. We’ve therefore gathered seven strategies to ensure you save time and make informed hiring decisions to set your small business up for success.

1. Conduct Background Checks Post-Job Offer

The best time to run a background check is after you’ve extended a conditional job offer. This timing helps prevent potential discrimination claims and ensures that all candidates are evaluated fairly.

Note that candidates should be aware employer background checks are a part of the hiring and preboarding process. Don’t be like one Cincinnati-based home healthcare small business, where, after rounds of interviews, their chosen candidate failed a drug test (and had a history of doing so!). The candidate’s response? “If I would’ve known that was a requirement, I wouldn’t have wasted time interviewing.”

2. Understand Legal Restrictions

Many states have laws limiting how employers can use credit reports and criminal records in hiring decisions. Additionally, the “Ban the Box” movement restricts asking about criminal history early in the hiring process to help former inmates secure work. Be sure to research your state’s specific laws before proceeding.

3. Know What Information You Can Access

When conducting a small business background check, here are some key areas you may review:

- Criminal records (state and federal laws apply)

- Driving records (essential for roles requiring transportation)

- Employment verification (confirming past job roles and tenure)

- Education verification (validating degrees and certifications)

- Credit reports (only when relevant to the job role)

- Drug testing records (if permitted in your state)

4. Communicate with the Candidate

If your hiring program is transparent (and it should be), candidates should be in-the-know about their onboarding steps and, specifically, their background check process and results.

If the returned results of the background check influence your decision-making on the particular candidate, here are some quick steps of the proper way to let them know:

- Notify the applicant.

- Provide them with a copy of the report.

- Give them reasonable time to review it and explain any negative information.

- Provide the candidate with a copy of their rights under the FCRA.

5. Retain Background Check Records

Properly storing background check records ensures compliance with federal and state laws. For applicants not hired, retain records for one to two years (depending on your business size and any applicable affirmative action laws).

For hired employees, keep background check records for six years after termination to protect against potential legal claims.

Make sure you store these records separately from employee personnel files to maintain confidentiality.

Making the Right Hiring Decision

A well-executed small business background check can provide peace of mind when hiring new employees. However, following legal guidelines and ensuring fairness in your hiring process are essential. If you’re unsure about compliance, consider consulting with an HR professional or your ATS provider’s support team to streamline the process.

By taking these steps, you can build a trustworthy workforce while protecting your business from potential risks.