It’s common to feel overwhelmed by the intricacies surrounding employee wages, deposit requirements, and the associated deadlines.

As you know, staying on top of employment tax due dates is just as imperative as paying your employees on time. However, if you forget to pay your employees, they’ll be right there to remind you. The Internal Revenue Service (IRS) operates a bit differently.

Keep employment tax information and deposit due dates handy to stay ahead of the compliance curve. The information below helps remove complexities to better organize your payroll and tax calendars for 2026. Remember: Employment tax forms are filed on dates independent of tax deposit deadlines.

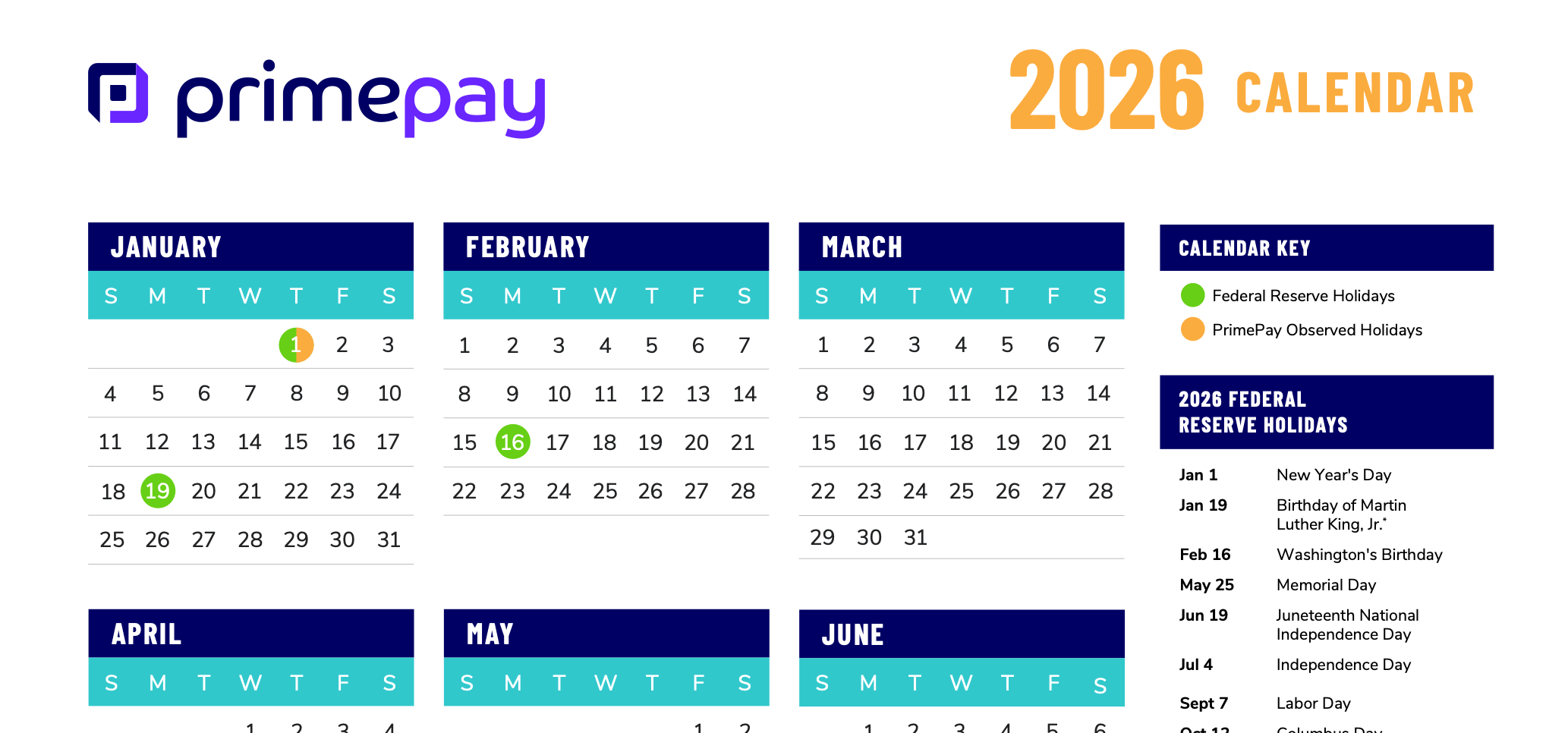

Bonus: Click below to keep a copy of our federal holiday payroll calendar so you don’t miss a payroll beat.

Download the full 2026 payroll calendar here.

Employment Tax Due Dates

The IRS requires employers to file particular employee tax return forms with specified due dates throughout the year. The documents are used to report taxable wages and employment taxes:

- Income tax withholding

- Tips

- Social Security Tax

- Federal Unemployment Tax Act (FUTA)

- Medicare tax

- And an additional Medicare tax (if applicable)

Employment tax return filings are due quarterly or annually, depending on the filed form. The form can be filed the next business day if the deadline falls on a Saturday, Sunday, or legal holiday.

The federal tax deposit is based on what’s reported on the tax return, and its due date may not correspond with the tax form’s deadline. To simplify, we’ll start with the quarterly form most employers must file.

Quarterly Forms

Form 941, Employer’s Quarterly Federal Tax Return, is the quarterly form employers use. It’s used to report the employment taxes withheld from employees’ paychecks and the amount the employer will pay for their portion of Social Security and Medicare taxes.

To comply with the regulations, employers must file Form 941 by the month’s conclusion following the quarter’s end. In other words, this form must be filed on the last day of the month, approaching the end of a quarter. The due dates fall on April 30, July 31, October 31, and February 2, 2027 for the fourth quarter of the previous calendar year.

If tax deposits were made before the deadline, the IRS allows an extra ten calendar days to file the return form. Please make sure to remember that it’s calendar days, not business days!

Annual Forms

There are two central employment tax due dates for annual forms, and which form you’re filing determines the deadline.

Forms due by February 2, 2026:

- W-2, Wage and Tax Statement, with Form W-3, Transmittal of Wage and Tax Statements

- Form 940, Employer’s Annual Federal Unemployment (FUTA) Tax Return

- Form 943, Employer’s Annual Federal Tax Return for Agricultural Employees

- Form 944, Employer’s Annual Federal Tax Return

Form due by March 2, 2026:

- Form 8027, Employer’s Annual Information Return of Tip Income and Allocated Tips, is the main form for employers due on this date. If filed electronically, this form has until March 31 to be filed.

Tax Deposit Due Dates

Even though the employment tax return is filed, the taxes must be deposited. Deposit due dates may sometimes align with deadlines for tax return filings. The tax deposit due dates are determined by the return used to report your employment taxes, past filing history, and other factors.

The Electronic Federal Tax Payment System (EFTPS) must be used to make all federal tax deposits. Making a deposit does not remove the responsibility of filing the appropriate tax return form; it’s still a requirement.

If the tax deposit due date lands on a Saturday, Sunday, or legal holiday, the deposits can be made via the EFTPS on the next business day.

Two deposit schedules for taxes are reported on Forms 941, 943, 944, or 945: monthly or semi-weekly.

- Monthly Depositor: For monthly depositors, employment taxes are due by the 15th day of the following month.

- Semi-Weekly Depositor: Deposit deadlines for semi-weekly depositors depend on the day employment wages are paid out. Wages paid on Wednesday, Thursday, or Friday employment taxes must be made by the following Wednesday.

Wages paid on Saturday, Sunday, Monday, or Tuesday are required to be deposited by the following Friday.

Next-Day Deposit Rule

The Next-Day Deposit Rule is an exception to the due dates above. If $100,000 or more is accumulated in taxes on any day during the monthly or semi-weekly deposit period, a deposit must be made by the next business day.

FUTA Deposits

FUTA deposits are based on the amount of your tax liability from quarter to quarter. FUTA tax liabilities of $500 or less can be carried over to the next quarter. FUTA taxes for the fourth quarter can be deposited or paid when Form 940 is filed by February 2, 2026.

The entire FUTA tax liability totaling $500 or more for that quarter has to be deposited by the last day of the first month following that quarter.

There are guidelines to help you understand how to calculate FUTA liabilities.

Having a clear idea of what’s expected of you as an employer is essential to complying with regulations of any kind. Knowing when to file which employment tax return and when to make a federal tax deposit makes your payroll schedule easier for your payroll department to stay within those guidelines.

These due dates are necessary to avoid costly penalties and high interest charges. Add these vital employment tax dates to your 2026 payroll calendar to keep track, stay organized, and ensure your business complies with IRS regulations.

All Wage and Tax Info, in One Place

Read our Quick Wage and Tax Resources today for federal wage and tax rates, FICA, federal minimum wage updates, and more.