The old adage goes, “People don’t leave jobs; they leave managers…and lack of benefits.” Okay, we added that last part, but that’s because employees are now (more than ever) considering company benefits when applying for and remaining in roles.

In fact, 80% of people value benefits over salary – a considerable shift from priorities a decade ago. While health insurance, flexible work, and PTO usually take precedence in employer plans, more and more leaders are focusing on employee retirement accounts.

While the benefits of individuals having retirement plans are evident, it’s also a strategic asset for companies to offer them.

A Brief Overview of Retirement Accounts

Retirement plans, such as defined contribution plans and savings incentive match plans, offer:

- Easy ways to save for retirement

- Automatic contributions

- Potential employer-matching contributions

- Pre-tax contributions

- Tax-free investment growth

Retirement plans come in various forms, each with unique features and benefits. For example, a 401(k) plan, a type of defined contribution plan, allows employees to save a portion of their paycheck before taxes are taken out. These plans often include employer-matching contributions, which can significantly enhance an employee’s savings.

Similarly, a savings incentive match plan for employees (SIMPLE) IRA is designed for small businesses and offers a more straightforward and less costly alternative to a traditional 401(k) plan.

Other types of retirement plans include defined benefit plans, also known as pension plans, which promise a specified monthly benefit at retirement.

Some plans may combine features of both defined benefit and defined contribution plans. These hybrid plans, such as cash balance plans, are becoming more popular as they provide both the employer and the employee with greater flexibility and predictability.

Lastly, individual retirement accounts (IRAs) allow individuals to save for retirement outside of employer-sponsored plans. Traditional IRAs and Roth IRAs are common types of IRAs, which differ primarily in their tax treatment.

Communication about your retirement plan is key since each type has its own set of rules regarding contributions, tax advantages, and withdrawals. Both employers and employees must understand the differences and select the right plan that aligns with their retirement goals and financial situation.

Benefits of Offering Company Retirement Plans

Offering retirement plans is not just a perk — it’s a strategic move. Below are four results you’ll likely see after implementing robust retirement plans for your employees.

1. Attract Top Talent

In a competitive job market, differentiating factors can tip the scales in favor of businesses. One such factor is well-structured retirement plans. In fact, 81% of people state that retirement benefits are a “must-have” when considering a job offer.

Alex Johnson, HR Director at InnoTech Solutions, explains: “A robust retirement plan can be the deciding factor for many candidates when they’re choosing between job offers. It’s not just about the paycheck; it’s about the future.”

By offering these benefits, employers signal that they’re invested in their employees’ long-term success and financial stability, which can be a powerful motivator for job seekers looking for a workplace that supports their life goals and has a culture of care.

Tip: Make sure your job descriptions indicate the base salary and total compensation. Without the latter, many candidates may forget to factor in the overall benefits that a company can offer beyond immediate salary, such as matching 401K contributions, paid business retreats, and additional time off during the holidays.

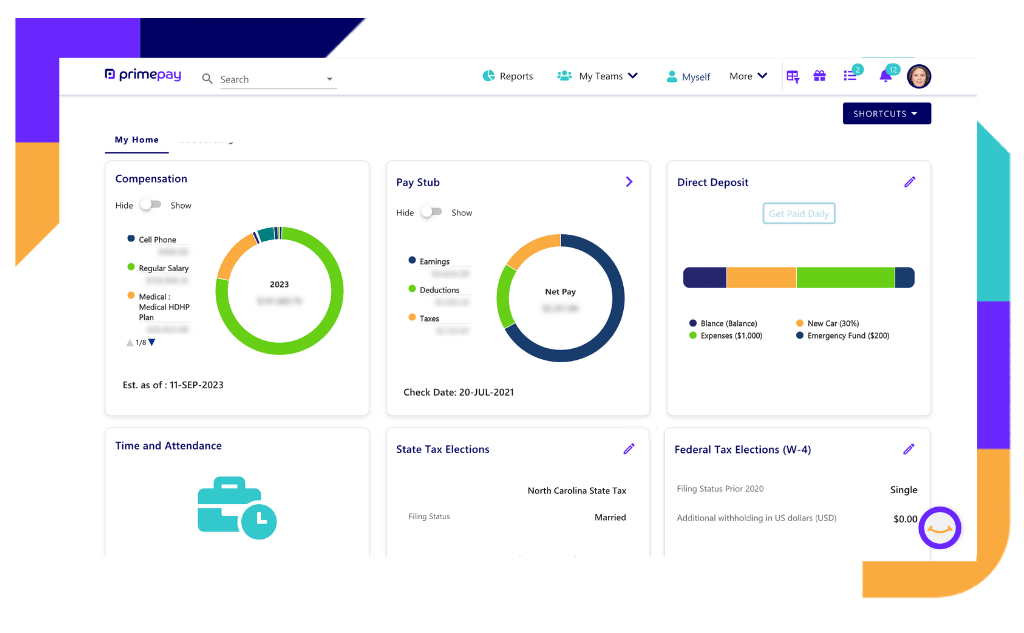

Equip your people with an employee self-service portal so they can track their total compensation, as well as PTO and other personal information.

2. Boost Job Satisfaction

If you think benefits packages are just a way to maintain compliance, it’s time to think bigger. You must intentionally design your benefits programs to create a stronger employee experience and foster a positive organizational culture.

Specifically, when you include financial benefits and retirement planning in your offerings, you help bolster employees’ sense of security about their future. Moreover, you’ll impact overall morale and workplace happiness; the National Institute on Retirement Security, 85% of people report that retirement benefits provide job satisfaction.

Emily Roberts, CFO at Dynamic Growth Enterprises, explains the profound impact that retirement planning can have on an organization’s culture and employees’ sense of value and commitment. She shares, “When our employees know that we care about their future, they care more about their present work.”

3. Increase Loyalty

Offering a well-structured retirement plan is an effective strategy for cultivating a culture of loyalty within your organization: a staggering 94% of employees say that a strong retirement plan is critical to their loyalty to the company, according to a report by the Employee Benefit Research Institute.

When employees see that their employer invests in their long-term financial security, they’re more likely to develop a strong sense of allegiance to the company.

This loyalty can manifest in various ways, such as:

- A higher retention rate

- A willingness to go above and beyond in their roles

- An overall positive attitude towards the company.

And if you’re really looking to increase employee loyalty, consider embedding financial planning programs into your professional development cadence. Recent studies show that 53% of employees report that financial planning programs are essential for increasing loyalty.

Unfortunately, only 28% of people (Extensis Group survey) confirm that their employer offers education regarding retirement plan investments—a huge area for improvement (or, if you’re an opportunist, a way to stand out) to help increase loyalty and attract top talent.

4. Build a Better Brand Image

Because offering retirement plans demonstrates a commitment to the long-term well-being of employees, organizations may witness an added benefit: employees becoming powerful advocates for their company.

Jane Smith, a project manager at Global Tech Solutions, explains, “Comprehensive benefits like retirement plans are more than perks—they’re a statement that the company cares about us long-term.” The result of such sentiment? Employees share their positive experiences and contribute to the organization’s reputation as an employer of choice.

Moreover, by showcasing a dedication to sustainable employee benefits, businesses can also project an image of stability and reliability to customers and partners, potentially leading to more business opportunities. For example, a strong brand image rooted in social responsibility can attract investors looking for companies with ethical business practices and a forward-thinking mindset.

Help Employees Feel Financially Secure

It’s clear that retirement planning is crucial for the financial security and welfare of employees and employers alike. Even if you already offer a competitive benefits package, there’s always room to grow.

Consider educating your workforce about the benefits and operation of these plans, including tax advantages and employer-matching contributions. Simplification and automatic enrollment can enhance participation, while open dialogue about retirement planning ensures employees fully leverage these crucial benefits.

Ultimately, by prioritizing retirement planning and offering comprehensive plans, businesses can establish a supportive and forward-thinking culture that benefits both the employees and the company’s long-term success.