Quick Summary

Payroll outsourcing helps businesses manage one of their most time-consuming and risk-prone functions more effectively. As payroll complexity increases, especially for growing and multi-state employers, outsourcing provides structure, expertise, and peace of mind.

- At a high level, payroll outsourcing helps businesses:

- Reduce administrative time and repetitive manual work

- Improve payroll accuracy and pay employees on time

- Stay compliant with evolving tax and labor regulations

- Access modern payroll technology and expert support

- Scale payroll operations as the business grows

By combining technology with payroll expertise, partners like PrimePay help employers turn payroll into a reliable, well-managed process rather than a recurring headache.

The Power of Outsourcing Payroll

Payroll is one of those business functions that seems straightforward…until it isn’t. As companies grow, regulations change, and workforces become more complex, payroll quickly turns into a time-consuming, high-risk responsibility.

That’s why payroll outsourcing has become an increasingly common choice for employers of all sizes. In fact, a 2024 report from Deloitte shows that nearly three-quarters (73%) of organizations outsource at least part of their payroll operations.

The reason is that by outsourcing payroll, businesses can:

- Save time and reduce administrative burden

- Ensure payroll compliance and mitigate payroll-related risks

- Improve payroll accuracy and reduce errors

- Gain cost savings even beyond the obvious

- Access both advanced payroll technology and payroll expertise

- Enhance security and protect against fraud

- Scale with growth

- Boost employee satisfaction, trust, and experience

This guide explores how payroll outsourcing works and when it makes sense for your business.

What is Payroll Outsourcing?

Payroll outsourcing is the practice of hiring a third-party provider to manage some or all payroll responsibilities on your behalf. This typically includes employee wage calculations, tax withholdings, direct deposits, and ongoing compliance with federal, state, and local regulations. Instead of running payroll in-house, where HR or finance teams must stay current on filing deadlines, rule changes, and payroll processing details, businesses transfer that work to specialists whose core focus is payroll.

Payroll outsourcing is not one-size-fits-all. Some providers offer basic processing support, while others deliver full-service payroll solutions that integrate tax filing, benefits administration, and compliance monitoring. Understanding your current payroll complexity and future needs is key to choosing the right level of support and unlocking the optimal combination of outsourcing benefits.

Why Do Businesses Outsource Payroll?

For many employers, payroll outsourcing starts as a response to growing complexity. What once felt manageable can quickly become overwhelming as a business adds employees, expands into new states, or navigates overlapping federal, state, and local requirements. Multi-state payroll alone introduces layers of tax rules, filing schedules, and reporting obligations that are difficult to manage without specialized expertise. For small business payroll teams already stretched thin, the risk of missed deadlines or costly errors rises fast.

In fact, as payroll grows in scope and complexity, cost is only one factor among many in the decision to outsource. “Organizations don’t [just] outsource to lower cost,” Deloitte found in its 2024 report. “It’s typically to decrease risk, avoid building the capability in-house because it’s hard to manage, or because of technology limitations.”

Top Benefits of Outsourcing Payroll

There are many benefits to hiring outside experts to handle your payroll. Below is a brief overview of seven benefits.

1. Time Savings and Reduced Administrative Burden

Payroll has a way of quietly consuming far more time than most organizations expect. On the surface, it appears to be a recurring task that happens once or twice a month. In reality, it pulls HR, finance, and business owners into a steady cycle of preparation, verification, corrections, and follow-up.

Research from Deloitte shows that payroll teams spend more than 25% of their time running payroll. And that figure does not include time spent answering employee questions, correcting errors, or re-entering data across systems. Manually entering payroll inputs alone is the single most time-consuming part of payroll processing, followed closely by entering adjustments and reconciling inputs.

Outsourcing payroll removes much of this repetitive, manual work from internal teams. Instead of sifting through spreadsheets, timecards, and exception reports, organizations can rely on established processes designed specifically for payroll accuracy and efficiency. The result is not just time saved, but mental bandwidth reclaimed. HR and finance leaders can redirect their attention toward workforce planning, financial strategy, and business execution, rather than spending payroll cycles managing data entry and rework.

2. Payroll Compliance and Risk Mitigation

It’s no secret that navigating the complexities of tax laws and regulations is challenging. In fact, NFIB Research Center reports that “four of the top ten most burdensome issues for small business owners are tax-related.”

That’s why many companies benefit from outsourcing their payroll. They’re hiring payroll talent with expertise in these laws, so they don’t need to know the ins and outs. Additionally, professional payroll providers stay updated on federal and state regulations to ensure accurate calculations and timely filings. The result? Fewer errors and penalties to worry about.

3. Improved Payroll Accuracy and Fewer Errors

Surveys show that between 32% and 44% of employees have noticed paycheck errors (and worse, nearly half of those who have noticed an error say those mistakes are frequent). Each and every error then compounds the time spent on payroll. One survey found that nearly half (41%) of payroll teams end up spending an extra four to ten hours every payroll cycle just correcting hours.

The operational cost of those mistakes adds up quickly, too. Employers make an average of 15 payroll corrections per pay period, and according to accountancy firm EY, incorrect or missing time punches alone can cost nearly $78,700 per 1,000 employees each year. Beyond direct costs, corrections create downstream issues such as amended filings, manual adjustments, and strained employee relations.

Outsourcing payroll improves accuracy by standardizing processes and layering automation with experienced review. Instead of relying on ad hoc spreadsheets and fragmented systems, payroll providers apply consistent calculation logic, validation checks, and controls across every pay cycle. Outsourcing helps break that cycle by getting payroll right the first time.

4. Cost Savings and Opportunities Beyond the Obvious

Outsourcing payroll can save money across the top (according to advisory group PwC, employers save 18% on average by outsourcing payroll). But while outsourcing can reduce administrative labor, eliminate the need for specialized in-house payroll systems, and lower the risk of fines or penalties, its financial impact extends beyond simple line-item comparisons.

Payroll also generates indirect costs such as time spent on corrections, compliance monitoring, or technology maintenance. There are also opportunity costs when HR and finance leaders are pulled away from higher-value work to deal with payroll problems or handle transactional duties that could be automated, streamlined, or outsourced.

Consequently, it’s just as important to consider what outsourcing enables. By removing repetitive payroll work, businesses free internal resources to focus on growth initiatives, customer experience, and strategic planning. In that sense, payroll outsourcing supports cost control not just by reducing expenses, but by improving how time and talent are deployed across the organization.

5. Access to Advanced Technology and Payroll Expertise

According to Deloitte’s 2024 payroll survey, “Technology limitations are the most pressing service delivery issues which respondents face [in payroll].”

Outsourcing helps close that gap by pairing modern systems with payroll specialists who know how to use them effectively. In turn, employers gain access to sophisticated payroll technology without requiring large upfront investments. Cloud-based platforms allow secure, real-time access to payroll data from anywhere, supporting remote work and faster decision-making. Advanced providers also offer AI-driven analytics that help employers understand labor costs, identify trends, and plan more effectively.

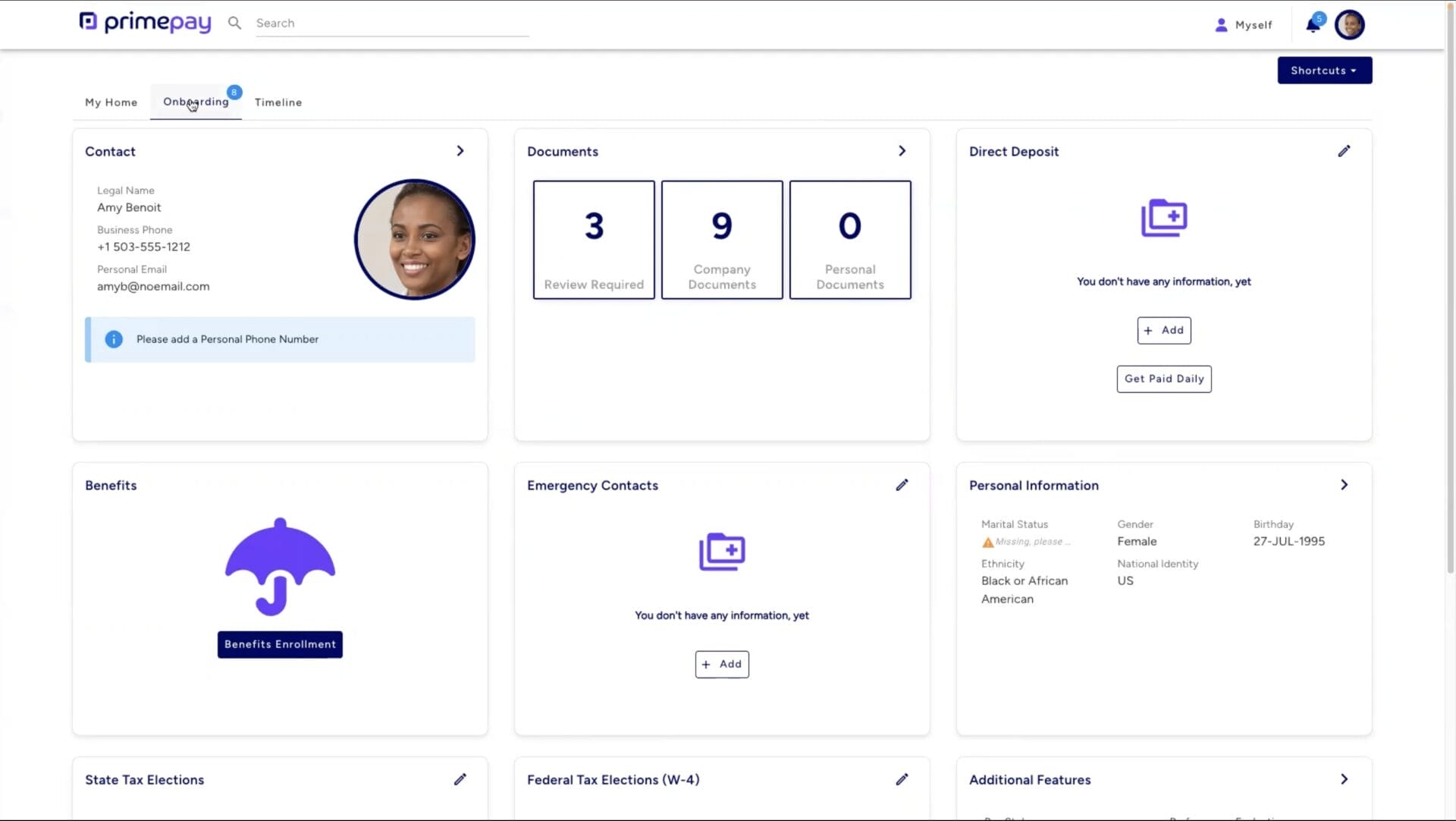

Integration is another major advantage. Payroll systems that connect seamlessly with HR, time and attendance, and benefits platforms reduce duplicate data entry and improve consistency across records. Self-service portals further enhance transparency by allowing employees to access pay stubs, tax forms, and personal information without HR intervention.

6. Enhanced Security and Fraud Protection

We don’t need to tell you that protecting sensitive employee information is paramount. Unfortunately, many companies that run their payroll in-house aren’t set up to fight fraud and scam attempts. In fact, these types of intrusion campaigns (AKA fraud and scam attempts) have increased 35% the past year, meaning your payroll security should be a top priority for your business.

Many third-party providers implement robust encryption and security protocols to safeguard information. Additionally, professional payroll services have checks and balances in place to detect and prevent internal and external fraudulent activities.

In addition to external threats, outsourcing introduces checks and balances that reduce the risk of internal fraud. Segregation of duties, approval workflows, and anomaly detection are far easier to enforce within a dedicated payroll environment than in small internal teams where responsibilities often overlap. For many employers, these protections alone justify the move to a third-party provider.

7. Scalability for Growing Businesses

Growth is often what pushes payroll systems past their breaking point. Hiring accelerates, pay structures diversify, and geographic expansion introduces new regulatory obligations. What worked for a ten-person team quickly becomes unmanageable at fifty or one hundred employees.

Payroll outsourcing supports growth without forcing organizations to rebuild processes every time they expand. Providers are designed to handle workforce changes, new locations, and evolving compensation models without adding internal headcount or complexity. Whether a business is adding contractors, opening offices in new states, or navigating seasonal workforce fluctuations, outsourced payroll scales with far less disruption.

This flexibility allows leaders to focus on growth opportunities rather than worrying about whether payroll infrastructure can keep up.

8. Improved Employee Satisfaction and Trust

Here’s a chilling fact: “Payroll issues have damaged trust for 21% of employees, and more than half say repeated mistakes would push them to consider leaving.”

For many workers, pay is tied directly to their sense of worth, and it is definitely connected to how valued they feel at their organization, and even small issues can carry outsized emotional weight. “At the beginning of my career, payroll was considered better not seen or heard unless something went wrong,” Tiffany Paquette, director of people technology and operations at Puma North America, told HR Executive. “Now, payroll teams are intricately woven into the employee experience, helping employees understand how and what they are being paid.”

Repeated payroll issues damage trust. Recent surveys show that payroll problems have eroded trust for more than one in five employees, and more than half say ongoing mistakes would cause them to consider leaving. Reliable, transparent payroll, supported by self-service access and clear communication, reinforces credibility and strengthens employee relationships.

Every organization claims to value its people. Payroll is where those claims are tested. Outsourcing payroll helps ensure that pay is accurate, on time, and easy to understand, aligning everyday operations with the values employers want to project.

Who Should Consider Outsourcing Payroll?

Payroll outsourcing is not limited to companies of a certain size or industry. It is most valuable for organizations where payroll complexity, limited internal resources, or growth pressures make in-house processing increasingly difficult to manage. The following types of businesses tend to benefit the most.

Small Businesses

Many small businesses operate with lean teams, where payroll responsibilities fall to owners, office managers, or already-stretched HR and finance staff. In these environments, payroll can quickly become a distraction from core business priorities.

Unfortunately, most employers (63%) underestimate the time required to process payroll, often leading to last-minute scrambles, increased stress, and a higher risk of errors or delays. The result? Frustrated and spread-thin finance teams, not to mention possible delays and increased risk of errors.

Outsourcing payroll gives small businesses access to dedicated payroll support without having to hire or train in-house specialists. Instead of spending hours each pay cycle managing calculations, filings, and corrections, small teams can focus on growth, customer relationships, and day-to-day operations, while still maintaining confidence that payroll is accurate and compliant.

Growing and Multi-State Businesses

Growth introduces payroll complexity at a rapid pace. Adding employees, expanding into new states, or shifting workforce structures can strain systems that were never designed to scale. Multi-state employers face dramatically higher compliance demands, with different tax rules, labor laws, and filing schedules in each jurisdiction.

Studies show that employers with multi-state workforces experience significantly higher payroll complexity and spend substantially more on payroll administration than single-state employers. Errors in these environments carry real financial consequences, with penalties, corrections, and remediation costs adding up quickly. For growing businesses, outsourcing payroll helps treat expansion as a planned launch rather than a reactive cleanup, ensuring systems and compliance frameworks are in place before problems arise.

Large or Complex Organizations

Larger organizations often manage high payroll volumes, multiple pay structures, and specialized requirements such as bonuses, commissions, or union agreements. Consistency and risk management become critical at this scale. Outsourcing payroll allows these organizations to standardize processes, reduce variability, and apply controls that are difficult to maintain internally across large teams and locations.

Industries That Benefit the Most

Some industries face payroll challenges that make outsourcing especially attractive:

- Restaurants and Hospitality: High turnover, tipped wages, overtime rules, and multi-unit operations create constant payroll complexity. Outsourcing ensures accurate calculations and compliance across locations.

- Healthcare: Shift differentials, contract workers, and state-specific regulations make healthcare payroll uniquely demanding. A payroll provider helps manage these nuances efficiently.

- Construction and Manufacturing: Job-based pay, union requirements, and certified payroll reporting introduce specialized compliance needs best handled by experts.

- Retail: Seasonal hiring and fluctuating hours require payroll systems that can scale quickly during peak periods.

- Technology and Startups: Fast-growing teams often prefer to stay lean. Payroll outsourcing removes administrative burdens so leaders can focus on innovation and growth.

For businesses in these categories, outsourcing payroll is less about convenience and more about maintaining accuracy, compliance, and operational stability as demands increase.

Common Myths About Outsourcing Payroll

Despite the clear benefits, some businesses hesitate to outsource payroll due to common misconceptions. Let’s debunk a few of them.

Myth 1: Outsourcing Payroll Means Losing Control

One of the most common concerns about payroll outsourcing is the fear of losing control. In practice, the opposite is usually true.

Outsourcing strengthens control by reducing errors, supporting compliance, and giving employers real-time visibility into payroll data through secure, cloud-based platforms. The decision-making authority stays with the business, while execution becomes more reliable.

It’s less like handing over the wheel and more like upgrading from a paper map to GPS. You still choose the destination, but you have better tools to avoid wrong turns along the way.

TIP: If you still want to run your own payroll and get the above control enhancements, research using payroll software with self-service capabilities. Choose a system that is easy to use and integrates with your time-tracking and HR technologies.

Myth 2: Payroll Outsourcing Is Only for Large Companies

Here too, the opposite is often true. Large organizations can foot the bill for expansive internal payroll teams. It’s smaller organizations where payroll obligations typically exceed capacity and capability. Running payroll in-house demands time, specialized knowledge, and constant attention to regulatory changes.

For smaller teams, those demands compete directly with strategic priorities. Outsourcing shifts that burden away, while also providing access to payroll technology and expertise that would otherwise be difficult or expensive to maintain internally, especially as the business grows.

Myth 3: Outsourcing Payroll Is Too Expensive

Many employers assume payroll outsourcing is cost-prohibitive, yet that view often overlooks the hidden costs of managing payroll in-house. Software licenses, ongoing training, compliance monitoring, and the time required to fix mistakes all add up.

Errors and missed deadlines can be particularly expensive. For example, the IRS charges penalties for late or incorrect payroll filings, which can result in significant fines. For example, the “failure to deposit penalty” is a percentage of the taxes not deposited on time, in the right amount, or in the right way. When viewed holistically, outsourcing payroll can help control costs by reducing risk, rework, and administrative overhead.

Choosing the Right Payroll Outsourcing Partner

Choosing the right payroll outsourcing partner is about more than processing paychecks. It’s about finding a provider that understands your business, anticipates compliance risks, and supports you as complexity grows. PrimePay combines modern payroll technology with experienced payroll professionals and ongoing support to help businesses operate with confidence.

By reducing avoidable payroll costs, improving accuracy, and managing regulatory requirements proactively, PrimePay helps employers turn payroll from a recurring headache into a reliable, well-managed function. The result is greater efficiency, lower risk, and more time to focus on what matters most: running and growing your business.

Payroll Outsourcing FAQs

What does payroll outsourcing typically include?

Payroll outsourcing usually covers core payroll processing tasks such as calculating wages, managing tax withholdings, issuing direct deposits, and filing payroll taxes. Depending on the provider, services may also include year-end reporting, compliance monitoring, wage garnishment administration, and employee self-service access to pay records.

Some payroll outsourcing partners go further by integrating payroll with time and attendance, benefits administration, and HR systems. The level of support varies, so it’s important to understand whether you need basic processing or a more comprehensive payroll solution.

Do I still have control over payroll if I outsource it?

Yes. Outsourcing payroll does not mean giving up control over pay decisions, schedules, or approvals. Employers remain responsible for determining wages, compensation policies, and payroll timing. What changes is who handles execution.

With payroll outsourcing, businesses gain greater visibility through dashboards, reporting tools, and real-time access to payroll data. Instead of manually managing calculations and filings, leaders can review, approve, and oversee payroll with more confidence and fewer operational distractions.

Is payroll outsourcing secure?

Reputable payroll outsourcing providers invest heavily in data security and fraud prevention. This includes encryption, role-based access controls, secure data storage, and monitoring systems designed to protect sensitive employee and financial information.

For many small and midsize businesses, outsourcing actually improves security compared to in-house payroll, where controls may be limited and responsibilities overlap. Payroll providers also implement internal checks and balances that reduce the risk of both external threats and internal payroll fraud.

How do I know if my business is ready to outsource payroll?

Businesses often consider payroll outsourcing when payroll starts consuming too much internal time, errors become more frequent, or compliance concerns increase. Growth is another common trigger. Expanding headcount, adding new locations, or operating in multiple states introduces complexity that can overwhelm in-house processes.

If payroll is pulling owners, HR leaders, or finance teams away from strategic work, or if staying compliant feels increasingly risky, it may be time to explore outsourcing options.

How do I choose the right payroll outsourcing provider?

The right payroll outsourcing partner should offer more than software. Look for a provider that combines technology with experienced payroll professionals, proactive compliance support, and responsive service. Industry experience, scalability, and integration with existing systems all matter.

A partner like PrimePay focuses on helping businesses reduce avoidable payroll costs, improve accuracy, and manage compliance risk through a blend of modern tools and ongoing expert support. The goal is not just to run payroll, but to make it easier, safer, and more reliable over time.