Most business owners don’t look forward to setting up payroll. Although necessary, setting up payroll accounts is often cumbersome, a little daunting, and frankly, quite time-consuming.

Despite these negatives, understanding how to manage payroll can save time and help you maintain compliance with legal and tax obligations. Again, it’s not an optional task if you have employees, so we’ve simplified the process for you below so you can feel confident in your decisions.

Below are the actions you must take to set up, process, and run payroll. Happy planning!

How to Set Up Payroll

Setting up a payroll account is straightforward once you understand the steps involved. While some are more basic than others, all are important to ensure you comply with state and federal regulations.

Here’s how to get started:

1. Obtain an EIN

The first step in setting up payroll is obtaining an Employer Identification Number (EIN) from the IRS. This number identifies your business for tax purposes and must report taxes and employee information.

2. Understand State and Federal Requirements

Payroll is regulated at both the state and federal levels. Make sure you’re aware of federal laws like the Fair Labor Standards Act (FLSA), which governs minimum wage, overtime, and record-keeping. Additionally, check your state’s specific requirements for tax withholdings, unemployment insurance, and workers’ compensation.

3. Draft a Payroll Policy

A payroll policy helps outline how payroll is managed within your company. This document should include details like how employees are paid, what deductions will be taken, and the payroll frequency. A clear policy ensures consistency and helps prevent misunderstandings.

4. Classify Your Employees

It’s crucial to classify your employees correctly. Are they full-time, part-time, or contractors? Misclassifying employees can lead to fines and legal issues.

5. Complete Employee Paperwork

Before you can pay your employees, you’ll need to gather some paperwork. This includes W-4 forms for tax withholdings and I-9 forms to verify their eligibility to work in the U.S. Depending on your state, you may also need additional forms for state tax withholdings.

6. Decide on a Pay Schedule

How often will you pay your employees—weekly, bi-weekly, or monthly? This is one of the most important decisions when setting up payroll. You’ll need to balance employee expectations with your business’s cash flow. Once you decide, communicate the pay schedule clearly to your team.

7. Document Compensation Terms

When hiring employees, be clear about their compensation. This includes their base salary or hourly rate, any bonuses, and benefits they’ll receive. All compensation terms should be documented and shared with both the employee and payroll administrator.

8. Select a Payroll Administrator

Finally, decide who will be responsible for managing payroll. Whether it’s an in-house team member or an outsourced payroll provider, you’ll need someone to set up your payroll account and ensure accuracy and compliance with all relevant laws and regulations.

How to Process and Run Payroll

Once you’ve set up payroll, it’s time to process and run it. Running payroll for the first time – especially after switching providers – can be extremely nerve-wracking.

Follow these steps each pay period to ensure everything runs smoothly:

1. Calculate Hours Worked

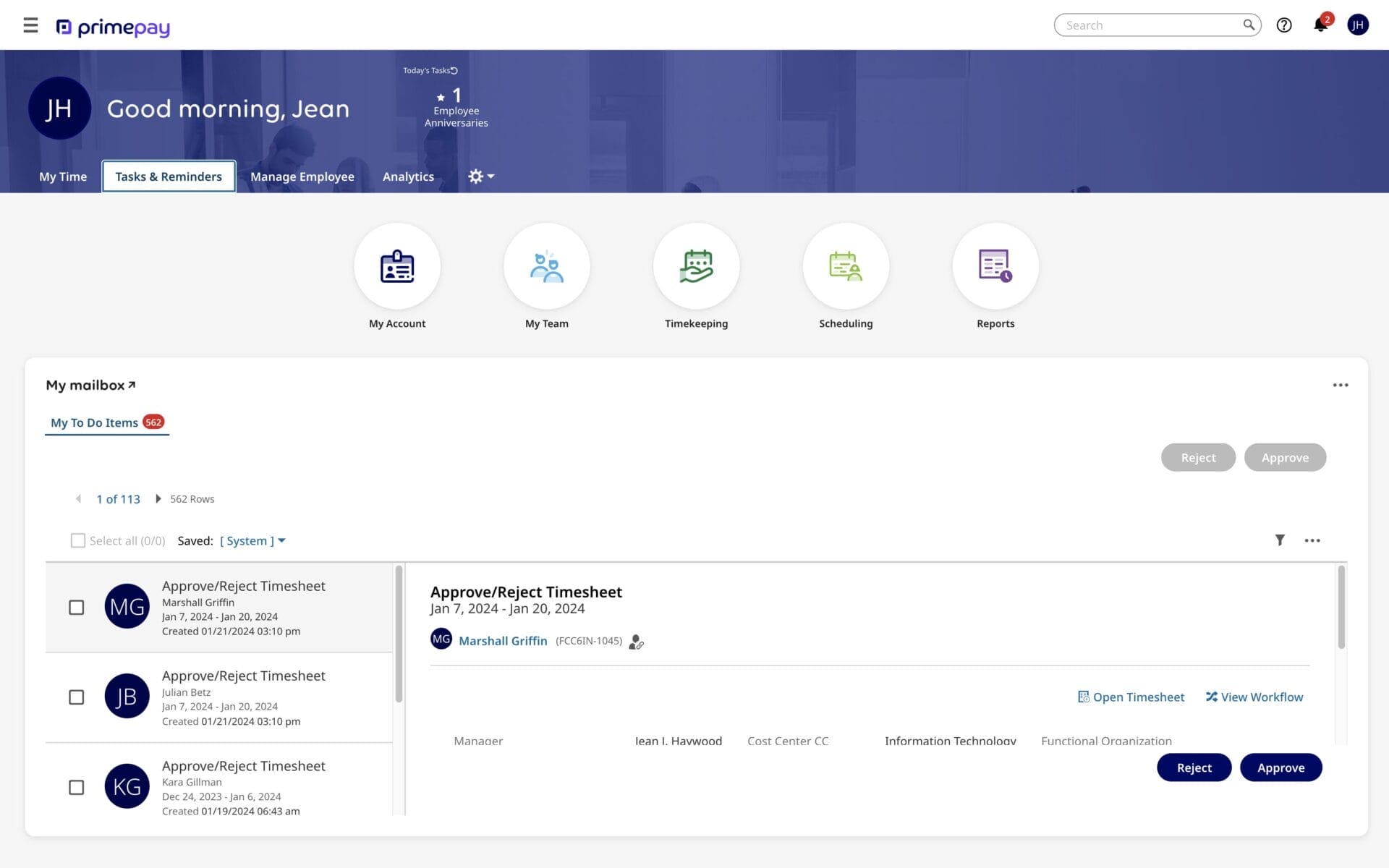

Start by calculating the total hours worked by each employee during the pay period. This includes regular hours, overtime, and any paid time off. Make sure your time-tracking system is accurate and up to date, as even small errors can lead to payroll issues.

Choose a time and attendance system that’s integrated with your payroll software and requires minimal lift to approve timesheets and analyze reports.

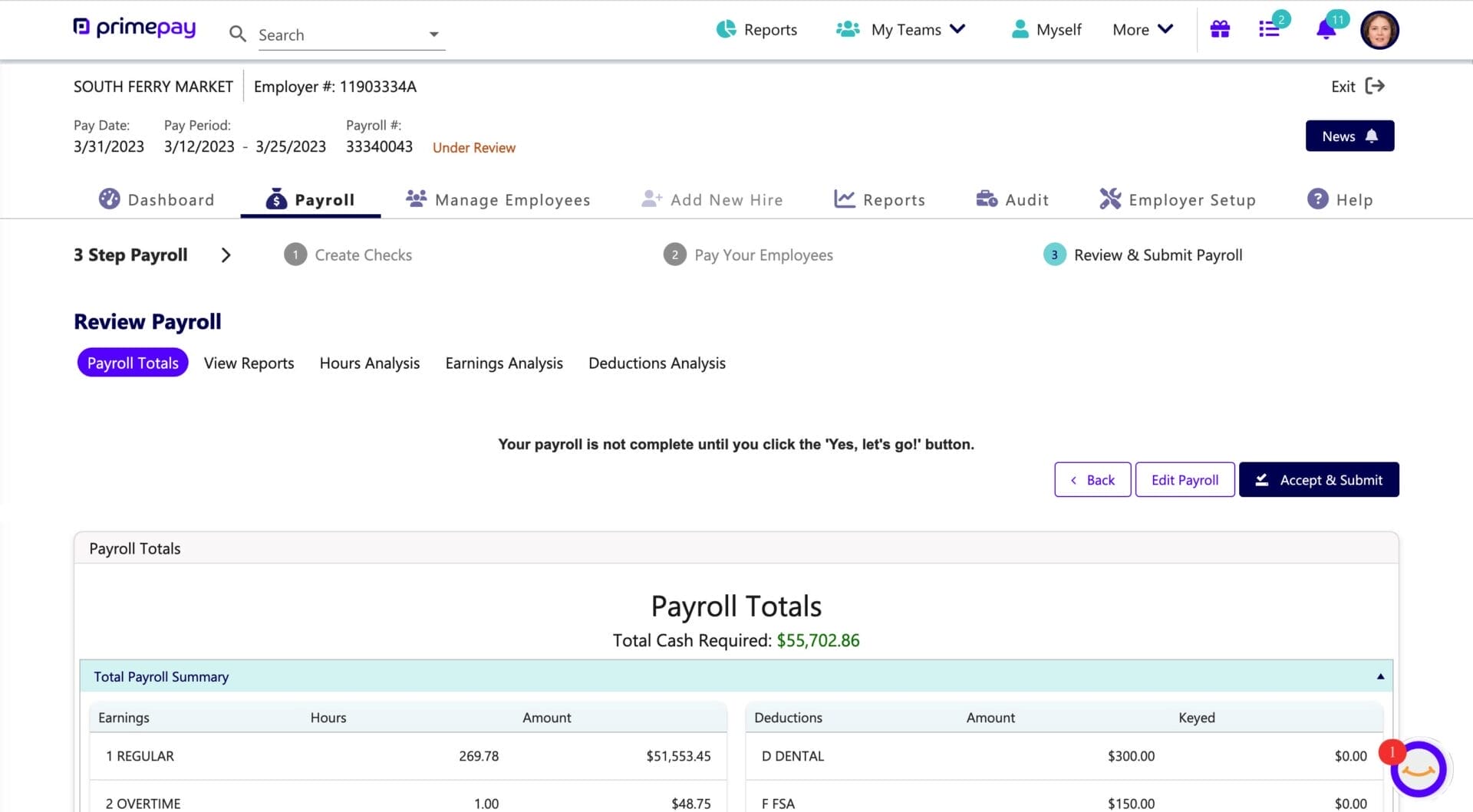

2. Apply Payroll Deductions

After calculating gross pay, you’ll need to apply the necessary deductions. These include federal and state income taxes, Social Security, Medicare, and any benefits contributions like health insurance or retirement plans. Be sure to stay compliant with tax regulations, as withholding errors can result in penalties.

3. Calculate Net Pay

Once you’ve deducted taxes and other withholdings, you’re left with the employee’s net pay, or the amount they’ll actually take home. You’ll issue this final figure to your employees via direct deposit, check, or other method.

4. File Taxes

Filing payroll taxes on time is critical to comply with federal and state laws. This step includes depositing federal income tax, Social Security, and Medicare with the IRS, as well as state income taxes where applicable. You’ll also need to file tax forms like the IRS Form 941 every quarter.

5. Properly Store Payroll Records

Payroll records must be stored properly and securely. Federal law requires you to keep payroll records for at least three years, but some states have longer retention requirements. Records should include details like hours worked, pay rates, tax withholdings, and benefits deductions.

6. Report New Hires

Most states require employers to report new hires to the state’s directory within a certain timeframe (usually within 20 days of hiring). This rule helps the state enforce child support orders and manage other government programs. Be sure to stay on top of this requirement to avoid penalties.

An Easier Way to Run Payroll

Of course, you could (and should) follow the above steps if you want to run payroll manually. However, there’s an easier way: using payroll software.

Payroll software handles your payroll deductions, calculations, and taxes, helping you reduce manual errors and save time. Plus, your onboarding team will help ensure all employee information is safe and accurate before running your first payroll to avoid any mistakes and messiness down the road. At the end of the day, the decision comes down to how your time is best spent as a leader in the business.