Managing payroll is a crucial aspect of running a small business. To do so well, you must understand the actual costs associated with your payroll process, including the cost of payroll.

Why? Payroll costs significantly impact a company’s bottom line.

Whether you’re a small business owner looking to reduce the cost of payroll or want to explore your payroll options, understanding payroll costs can help you improve your financial health.

What are Payroll Costs?

Payroll costs include all expenses associated with compensating employees for their work. Payroll service costs include factors such as the size of the business, payroll frequency, and compliance complexity. These costs go beyond just the salaries or hourly wages paid to employees; they include various mandatory and optional expenses such as employee benefits, state payroll taxes, and payroll processing fees.

Estimates of Payroll Costs for Small Businesses

According to the U.S. Small Business Administration (SBA), the total payroll cost of employees typically ranges from 1.25 to 1.4 times the salary, depending on certain variables. Payroll service costs vary based on the provider, specific services required, and company size.

For example, if an employee’s salary is $75,000, the total payroll costs could range from $93,750 to $105,000.

What Factors Impact Payroll Costs?

Several factors influence payroll costs, so businesses need to understand these variables to manage their expenses effectively.

- Number of employees: The more employees a business has, the higher its payroll costs will be. This cost includes not just wages but also associated taxes and benefits.

- Employee benefits: Offering comprehensive benefits like health insurance, retirement plans, and paid time off can significantly increase payroll costs.

- Location and local laws: Payroll costs vary by location due to differences in minimum wage laws, state taxes, and other local regulations. For instance, businesses in states with higher minimum wages will face higher payroll expenses. Additionally, states with more stringent labor laws may require more administrative work, adding to the overall cost.

- Overtime and bonus payments: Paying employees for overtime or offering bonuses can also increase payroll costs.

- Pay period: The frequency of pay periods can impact payroll costs. More frequent pay periods can lead to higher administrative costs and increase the likelihood of payroll errors, resulting in additional expenses for corrections and compliance issues.

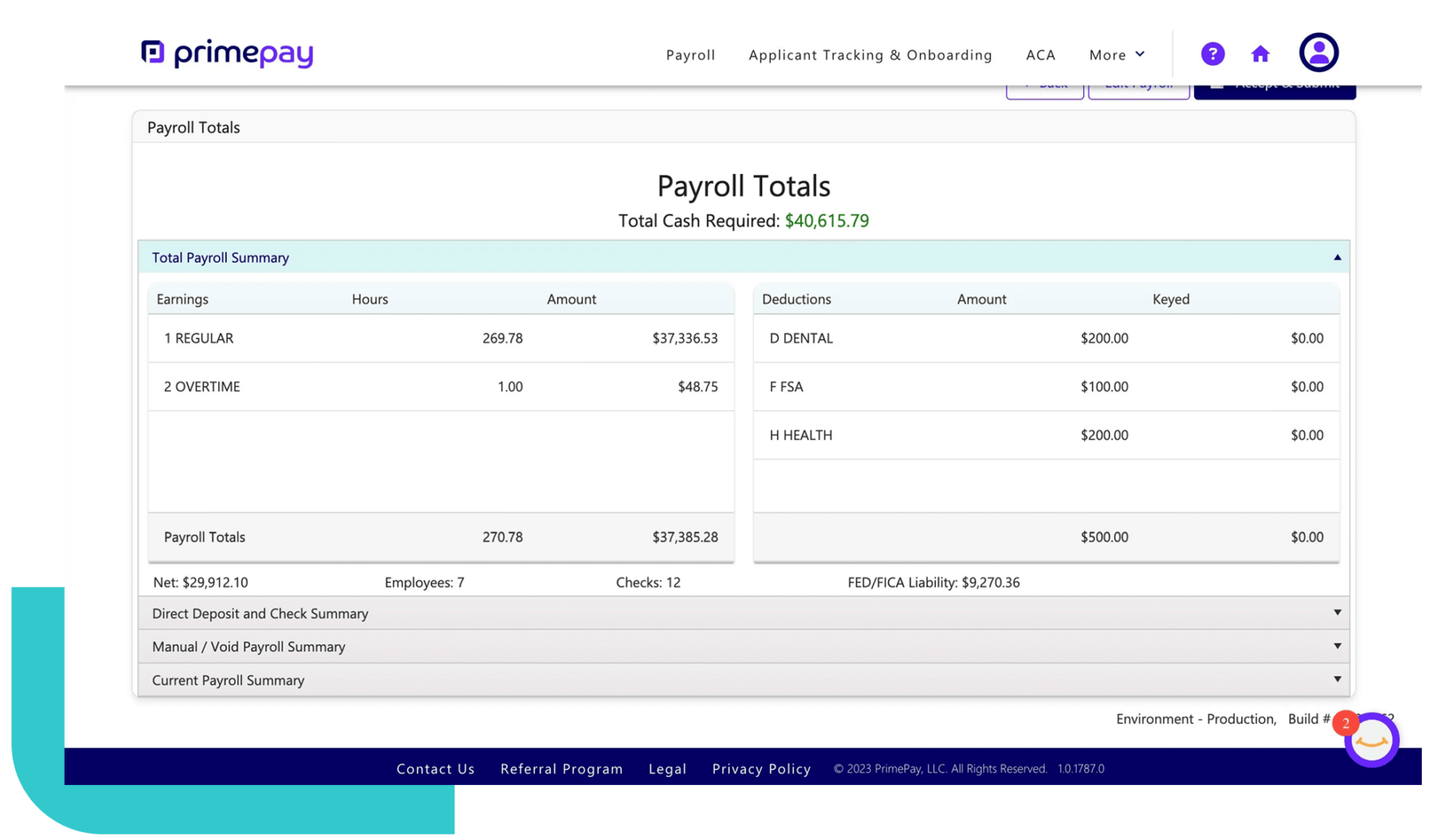

Options for Processing Your Payroll

There are several options to help your company process payroll including service providers, in-house, or payroll software. Below we break down each option to help you decide which is the payroll solution for your company.

In-House Payroll

In-house payroll refers to managing payroll processes by a company’s internal team rather than outsourcing to an external service provider. This approach gives companies complete control over payroll data, allowing for greater customization and quicker responses to payroll issues.

To manage payroll in-house, companies must navigate the complexities and costs involved, including substantial investments in payroll software and ongoing compliance with ever-changing regulations. According to the American Payroll Association, over 58% of U.S. companies handle payroll in-house. In-house payroll management is particularly appealing to businesses prioritizing data security and maintaining control over sensitive employee information.

While it offers advantages like reduced costs and enhanced flexibility, it also comes with challenges. For example, businesses must keep up with complex tax laws and labor regulations to avoid payroll errors. And for small businesses, managing payroll in-house can be resource-intensive.

The solution we’ve witnessed is companies shifting towards human capital management systems, indicating that many companies prefer to keep payroll processing in-house while integrating it with broader HR functionalities.

Payroll Service Providers

Payroll service providers offer businesses an external solution to manage their payroll processes. An outsourced payroll solution will handle tasks such as basic payroll services, wage calculations, tax withholdings, and compliance with federal and state regulations. Payroll services costs can vary based on company size, required features, and support levels, making it essential to consult multiple providers for accurate quotes. By outsourcing payroll, companies can save time and reduce the risk of errors, especially as regulations continue to evolve.

According to a report by Deloitte, nearly 73% of businesses outsource some aspect of payroll. While payroll providers can be cost-effective, they also present some risks, such as data security concerns and the potential for service interruptions. To mitigate these risks, businesses must vet potential providers carefully, ensuring they offer robust security measures and have a strong track record of reliability.

Payroll Software

Payroll software revolutionizes managing employee payments, tax filings, and compliance with labor laws. It’s instrumental in maintaining precise payroll records to prevent the headaches associated with incorrect tax filings and the resulting fines. Payroll software expedites and enhances payroll management, minimizing the risk of costly errors and seamlessly integrating with other HR responsibilities, providing a comprehensive solution for effectively managing employees.

The benefits of payroll software extend beyond just accuracy and efficiency. Many solutions offer additional features such as employee self-service portals, automated tax filing, and integration with time and attendance systems. These capabilities can significantly reduce the administrative burden on HR departments (a Deloitte study found that using payroll software reduces payroll processing time by 30%), making these cloud-based payroll solutions especially appealing to small and medium-sized businesses looking to save time and resources.

Choose a payroll system that integrates with your time and attendance software, as well as HR modules, to make the most out of your tech stack.

FAQ

What are some tips for reducing payroll costs?

Several ways to reduce payroll costs include outsourcing specific tasks, automating processes, and using technology to streamline operations. But here’s a longer list of ways you can reduce payroll costs:

- Evaluate your staffing needs: Review your current workforce and assess whether you have the correct number of employees for the workload. Avoid unnecessary hiring and ensure that you have an efficient team structure.

- Review employee classification: Properly classify employees as exempt or non-exempt according to labor laws. Misclassification can lead to unnecessary overtime costs or potential legal issues.

- Optimize employee scheduling: Create efficient employee schedules that align with business needs. Avoid overstaffing during slow periods and utilize part-time or seasonal workers when necessary to control labor costs.

- Stay compliant with labor laws: Stay up-to-date with labor regulations and compliance requirements to avoid costly penalties or legal issues related to payroll practices.

- Conduct regular expense reviews: Regularly review your business expenses, including payroll-related costs, to identify areas for reducing unnecessary spending or finding cost-saving opportunities.

Can you do payroll yourself?

Small business owners often ask if they can do payroll themselves. The answer is yes, but there are many things you need to know and do, including:

- Educate yourself on payroll processes: Understand the fundamentals of payroll, including tax obligations, employee classification, deductions, pay periods, and record-keeping requirements. Familiarize yourself with relevant federal, state, and local regulations to ensure compliance.

- Stay updated on tax laws: Payroll tax laws can change regularly, so stay informed about any updates or modifications to ensure accurate withholding and filing. Consider consulting with a tax professional or utilizing online resources tax authorities provide for guidance.

- Maintain accurate records: Keep organized records of employee information, timesheets, pay stubs, tax forms, and other relevant payroll documents. Accurate records help tracking employee compensation, deductions, and tax obligations. Accurate record-keeping is crucial for audits and ensuring compliance.

- Calculate payroll accurately: Double-check calculations for gross wages, tax withholdings, deductions, and net pay to avoid errors and ensure employees are paid correctly. Consider any additional factors such as overtime, bonuses, or commission.

- File and remit payroll taxes on time: Be aware of your tax filing deadlines and ensure timely submission of payroll tax forms to the appropriate tax agencies. Remember to pay federal taxes (e.g., Form 941), state taxes, and local or municipal taxes.

- Stay informed about payroll best practices: Stay updated on industry trends and best practices related to payroll management. Attend webinars and seminars or join professional networks to gain insights from experts and exchange knowledge with peers.

What if I don’t want to do payroll myself?

Luckily, several payroll companies are happy and ready to handle the payroll burden. Learn more about the payroll processing solutions from PrimePay and all of the options to customize it for your needs.