A well-designed compensation strategy helps align pay with business goals, attract top talent, and ensure long-term retention.

Yet, many companies struggle to create a structured, data-driven approach to compensation that meets both employee expectations and organizational needs. Why? Besides that it takes detailed planning and execution, compensation management isn’t a copy-and-paste program from one business to the next. Instead, each organization’s compensation strategy is unique to its budget, headcount, values, and goals.

If your company’s pay strategy feels inconsistent or outdated, it’s time to rethink your approach. Here’s how to build a smarter, more effective compensation strategy that drives business success.

Why Compensation Strategy Matters More Than Ever

Compensation is one of the biggest factors influencing recruitment, retention, and overall workforce satisfaction.

A strong compensation strategy helps businesses:

Stay Competitive

In today’s tight labor market, competitive pay is a must to attract and retain top talent. Simply put, companies that fail to offer competitive compensation risk losing out on top-tier candidates.

That’s because job seekers now have access to salary data through platforms like Glassdoor and LinkedIn, which makes it easier than ever to compare offers. Some online communities have even started creating Google Docs and spreadsheets (documenting roles, pay, bonus structures, and benefits) to raise awareness and help others demand better compensation.

TIP: If you presently can’t offer competitive pay, you should have a concrete plan in place (AKA, not “someday”) for increasing salaries. Until then, make sure your benefits are top-notch – like including mental health resources, paid family leave plans, and retirement plan contributions – to take care of your people and attract candidates.

Drive Employee Engagement

Employees who feel undervalued or uncertain about their pay structures are more likely to seek opportunities elsewhere.

The problem is that U.S. companies aren’t budgeting salary increases according to inflation rates, so many offers aren’t as competitive as they were five years ago. The result? Employees not only feel stuck in their current roles but are also less engaged. In fact, 33% of full-time employees admit that money worries negatively impact their productivity at work.

In-tune leaders understand that fair, transparent pay fosters trust and reduces turnover. According to research by Affirmity, over 60% of organizations are focusing on pay equity and 68% of companies plan to increase salaries for underpaid employees to retain the right talent.

TIP: A well-communicated compensation strategy – even if it’s not yet finalized – reassures employees and enhances job satisfaction. OnSecurity’s Head of People, Alan Wilson, explains: “People often respond better to transparency than expected. It builds trust…and it’s super important that they hear it from you. It’s not effective if they hear it second-hand.”

Ensure Compliance

Wage laws, pay equity regulations, and industry standards consistently evolve, especially since the “explosion of new equal-pay laws adopted by state legislatures” in 2020, says Lynne Anderson, an attorney with Faegre Drinker in Florham Park, N.J.

Your pay strategy should keep up.

Compliance-wise, regulatory bodies are cracking down on pay disparities. Failure to comply can lead to legal consequences, reputational damage, and financial penalties – all things you can avoid by running compensation audits and adjusting your practices accordingly.

Optimize Costs

A balanced strategy ensures that payroll budgets align with company performance while maintaining employee satisfaction.

However, many organizations struggle to align and work with accurate employee data. Jennifer Manuel, a pay equity researcher and diversity consultant, shares that a recent client of hers “had 16 data sources to integrate.” Without clean and up-to-date data, businesses may overspend on compensation or fail to allocate resources effectively.

Many leaders turn to their HCM platform to ensure that all decisions—present and future—are made with accurate data. That way, they’re confident their budget aligns with the company’s runway and can support compensation and other employee initiatives.

Key Components of an Effective Compensation Strategy

A high-impact compensation strategy should be structured, data-driven, and scalable. Below are four components HR and Finance leaders should focus on to build (or improve) their compensation management strategy.

1. Pay Structures and Benchmarking

Your compensation framework should be based on market data and internal alignment. Salary benchmarking against industry standards is the most popular method for organizations – 71% of leaders say they do so – to ensure that pay is competitive.

However, only 56% of leaders conduct an internal review, which may raise concerns regarding pay disparity and, ultimately, your employee experience.

Consider this very real scenario: It’s a tight job market, and you want to hire the best candidate by improving your compensation package. The issue is that existing employees with the same or similar roles aren’t granted the same pay bump or benefits, leading to inequity and potentially internal turmoil.

Therefore, to develop an effective pay structure, you should:

- Conduct salary benchmarking using industry-specific data sources.

- Define pay bands for different roles, considering experience levels and geographic cost-of-living differences.

- Align salary ranges with internal job architecture to ensure fair and consistent pay.

- Set limits for salaries offered at the hiring stage to prevent unintended disparities.

2. Establishing Clear Promotion and Merit Increase Criteria

Before rolling out your compensation strategy, companies must first define structured, data-driven criteria for promotions and merit-based salary increases. A lack of clarity in these areas can lead to inconsistencies, pay inequities, and employee frustration.

Tim Lobanov, Employee Benefits Lead at Alter Domus, says that “surprisingly, so many [companies] are just not there yet, since [pay transparency] was never a priority in the past.”

To build a solid foundation for your compensation strategy, you should:

- Define promotion criteria: Outline the skills, performance metrics, and experience levels required for advancement. Consider implementing career progression frameworks that clearly map out growth opportunities within the company.

- Standardize merit increases: Establish objective guidelines for salary raises based on performance, tenure, and market benchmarks. This process will prevent pay disparities and ensure fair compensation adjustments.

- Ensure manager alignment: Train managers to evaluate employee performance consistently and communicate promotion opportunities effectively. Misalignment in expectations can lead to employee dissatisfaction.

3. Transparency

Employees shouldn’t be left in the dark about their salaries, pay structures, raises, and bonuses. In fact, people have a right to know why they earn what they do and how their pay will evolve over time.

Therefore, you’ll need to develop clear, written compensation policies that leaders and employees can easily access and roll out to the company via All Hands meetings, email, and intranet announcements.

Rameez Kaleem, Found and CEO at 3R Strategy, encourages HR to consider the following when communicating about pay:

- Explain your pay philosophy so employees understand your “why.”

- Share the salary ranges for all positions within job levels.

- Discuss how pay will progress as employees move up in their roles.

- Review your strategy for reviewing and adjusting salary ranges.

TIP: Communicate your benefits more than once a year during open enrollment. People need reminders, and you want to make sure they’re making the most of your offerings. When it comes to more complex rewards, like bonuses or equity, consider holding quarterly informational sessions so new and existing employees can completely understand expectations and results.

4. Flexibility and Scalability

Your compensation strategy should evolve with the world around it. That means considering not only the economy but also company and headcount growth. It’s therefore crucial to implement scalable solutions that allow adjustments based on business needs and market conditions.

C-suite coach and CEO Emii Bernard-Bahn reminds leaders: “It’s natural for compensation programs to need a regular tune up — pay gaps start to re-emerge as organizations experience employee turnover, reorganizations, changes in job duties, and subjective bias. It’s a best practice to conduct “spot checks” annually, with a deep dive every few years.”

Being flexible looks like:

- Regularly revisiting compensation structures as the business expands.

- Adjusting pay bands for inflation, cost-of-living changes, and competitive shifts.

- Creating adaptable bonus structures that reflect company revenue growth and profitability.

Common Pitfalls to Avoid

Even well-intentioned compensation strategies can fall short. Avoid these common mistakes:

- Relying on outdated market data: Compensation trends shift rapidly, and using old benchmarks can lead to pay gaps. Ensure salary surveys and benchmarking data are refreshed regularly.

- Lack of pay equity analysis: Inconsistent pay structures can result in legal risks and employee dissatisfaction. Conduct ongoing pay audits to catch and correct disparities before they become issues.

- Ignoring total rewards: Competitive salaries alone aren’t enough; employees value benefits, flexibility, and growth opportunities. Companies that overlook these factors may struggle with engagement and retention.

- Failing to communicate pay policies: Employees should understand how their compensation is determined and what factors impact raises and bonuses. A lack of transparency can lead to confusion, dissatisfaction, and increased turnover.

How to Build a Smarter Compensation Strategy

- Conduct a compensation audit: Assess your current pay structures, compare them with market benchmarks, and identify gaps. Review pay across departments, roles, and levels to ensure fairness and competitiveness.

- Establish clear pay bands: Define salary ranges for each role based on experience, location, and industry standards. Implement formalized salary bands that leave room for growth and performance-based increases.

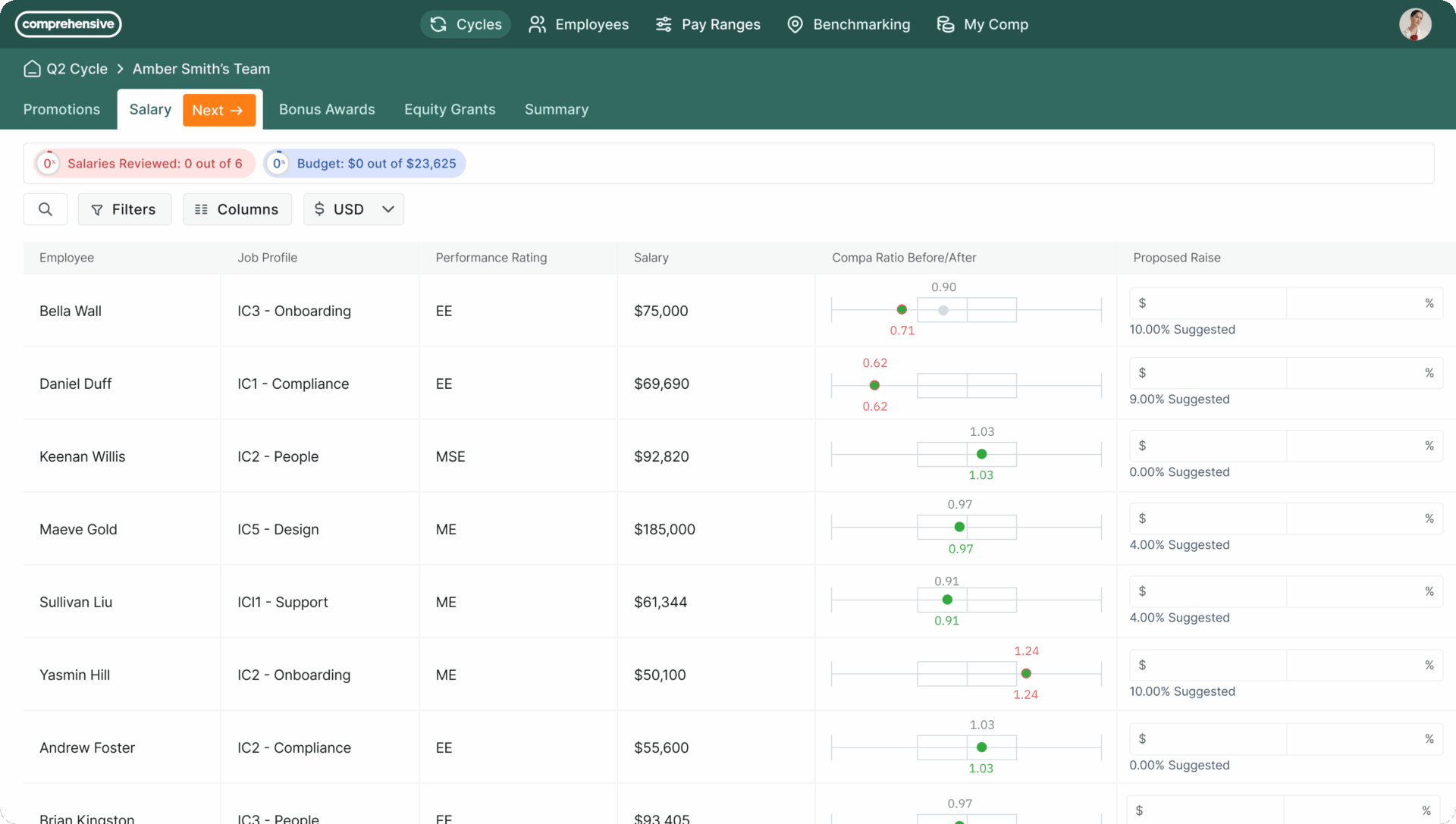

- Plan and manage merit cycles: Merit cycles are key opportunities to reward performance and retain top talent. Create a structured, repeatable process for reviewing employee performance, allocating salary increases, and tracking budget impact.

- Implement a total rewards framework: Include bonuses, incentives, benefits, and career growth opportunities. A well-rounded approach ensures that employees see long-term value beyond their base salary.

- Ensure pay equity: Regularly analyze pay data to identify and correct disparities. Develop a structured, objective approach to promotions and raises that minimizes bias.

- Use technology for data insights: Compensation management tools can streamline analysis and decision-making. All-in-one platforms can help HR leaders make more informed salary decisions.

- Communicate transparently: Provide employees with clear insights into how pay decisions are made. A well-communicated compensation strategy strengthens employer branding and boosts employee satisfaction.

The Future of Compensation Strategy

Companies must stay agile in their compensation planning with constantly shifting workforce expectations, remote work trends, and increasing regulatory requirements. Forward-thinking HR and Finance leaders know this and embrace data-driven and transparent compensation strategies.

The result? Their detailed compensation plans not only help leaders better understand and adhere to a budget, but the company also gains a competitive edge in attracting and retaining top talent. Ultimately, by investing in a smart, structured approach to compensation, your organization can build a stronger workforce, optimize costs, and drive long-term success.