The two-week notice: Dread it or celebrate it, it’s the universal symbol that an employee is about to begin another venture in life.

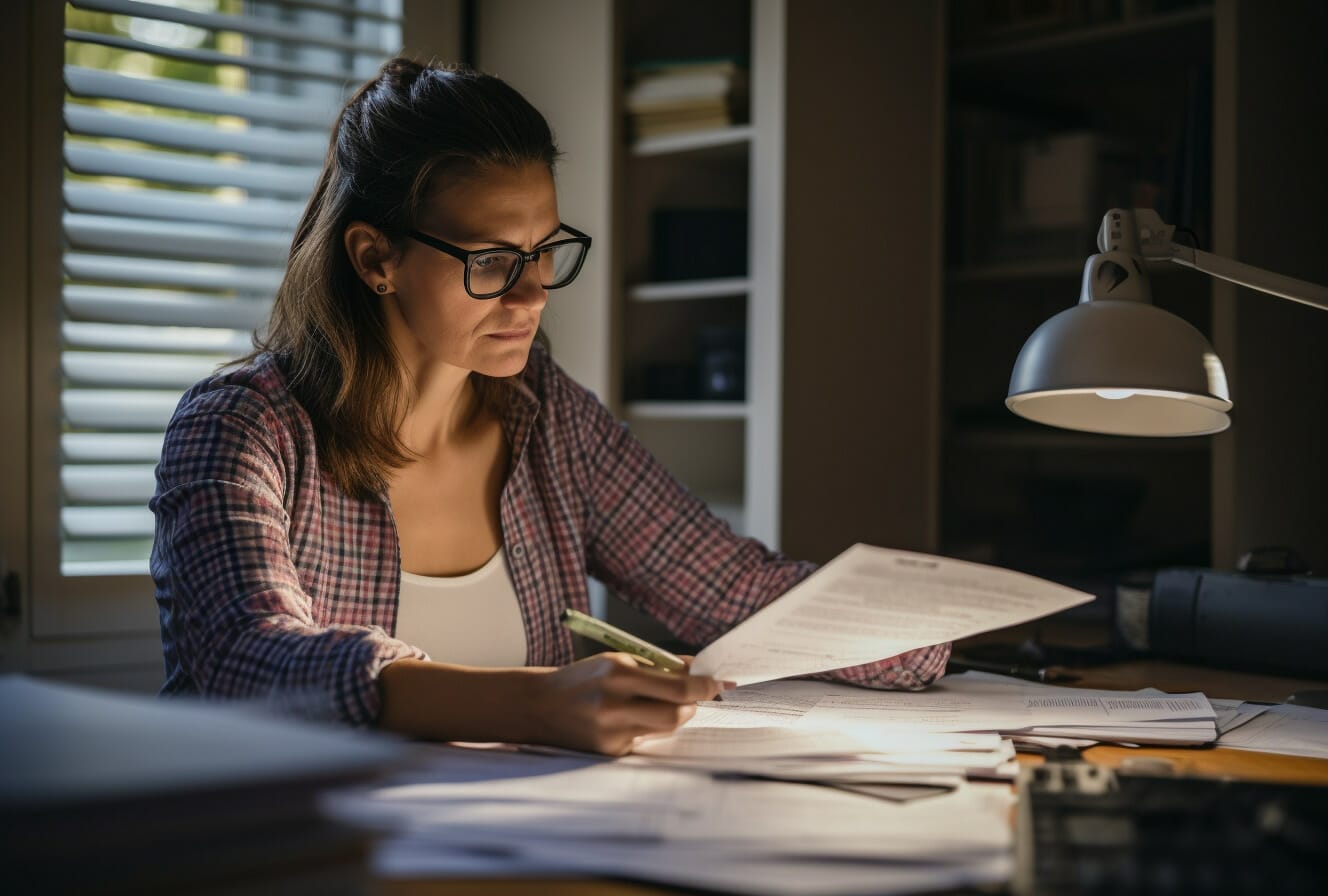

As a business owner or human resources manager, saying goodbye and making a deal to stay in touch isn’t the last of your responsibilities with this employee. The duty at hand now becomes calculating their final paycheck. The same goes for a terminated employee-they still need to be compensated for the final hours clocked at your company.

According to the DOL, employers are not required by federal law to give employees their last paycheck immediately. However, state regulations differ for things like accrued paid time off and sick leave, so checking your specific location’s law is the best place to start. For instance, in California, an employer must include all elements of pay owed, including commissions.

As you can surmise, it’s not so cut and dry when it comes to determining the right way to handle a final paycheck.

What if an employee only worked five days of their last 15-day pay period? The following is a best practice:

Under the Fair Labor Standards Act, a company may make deductions from an exempt employee’s salary for the employee’s initial or terminal week of employment if that employee doesn’t work the full week.

To determine the amount of the daily salary to be deducted for full-day absences or more, the calculation must be based on the usual number of workdays scheduled to be worked by the exempt employee in a workweek. That number is then divided into the pro rata monthly salary attributable to a week.

To break it down:

- The pre-determined monthly salary is multiplied by 12 to find the yearly salary.

- The product of that multiplication is divided by 52 (the number of weeks in a year) to find the weekly salary.

- The usual number of days (regardless of the number of hours usually worked in any workday the employee is scheduled to work in a workweek is divided into the weekly salary.

According to SHRM, under federal regulations, an employee’s last paycheck should include compensation for all time worked. Nonexempt employees must be paid at least minimum wage for all regular hours. Exempt employees’ final paychecks shouldn’t reflect extra deductions for discipline or property violations.

As you part ways with your former colleague, your work is not quite done. Evaluating their final paycheck so that it complies with the law should be one of the last things on your employment cycle to-do list. Look into your specific state’s regulations first and determine the best course of action from there.

Hand it Over to a Payroll Provider

PrimePay can partner with you to offer support throughout the entire employee lifecycle. Learn more about how PrimePay can help you streamline Payroll & Human Resources processes.

Please read our disclaimer here.