You’re creating a benefits plan for your small business. It must resonate with top talent, provide well-rounded options, and signal to current and future employees that you care about their well-being. The catch? It also needs to be sustainable and within budget.

Building benefits packages can be complex, so it’s essential to follow straightforward, actionable steps to determine which benefits matter most and how to offer them effectively.

The advice below focuses on how to build a benefits plan to enhance employee satisfaction and drive retention, all without compromising your company’s financial well-being.

Understanding Small Business Employee Benefits

Did you know that nearly half of your team might be eyeing the exit if they’re unhappy with company benefits? This fact may sound surprising, but it’s one to recognize as you build out benefits for your small business.

That’s because, as a small business owner, your team is one of your most valuable assets. You don’t want your top talent (and their experience, knowledge, and skills) to walk out the door, especially over something in your control. Therefore, your benefits plan and other policies should acknowledge your employees’ needs, well-being, and financial future.

Note: While a study by SHRM found that health care was the most important benefit to employees, it’s important to examine retirement, leave, additional disability coverage options, and mental health as well. In fact, business spending for mental health coverage has risen 53% since March 2020, which signals that more and more companies are recognizing the importance of mental wellness in the workplace.

The Role of Health Insurance in Benefit Packages

Most people immediately jump to group health insurance when they think of benefits, and for good reason. Health insurance provides a safety net for employees by covering qualified medical expenses and promoting regular healthcare access (BTW: have you scheduled your yearly physical yet?).

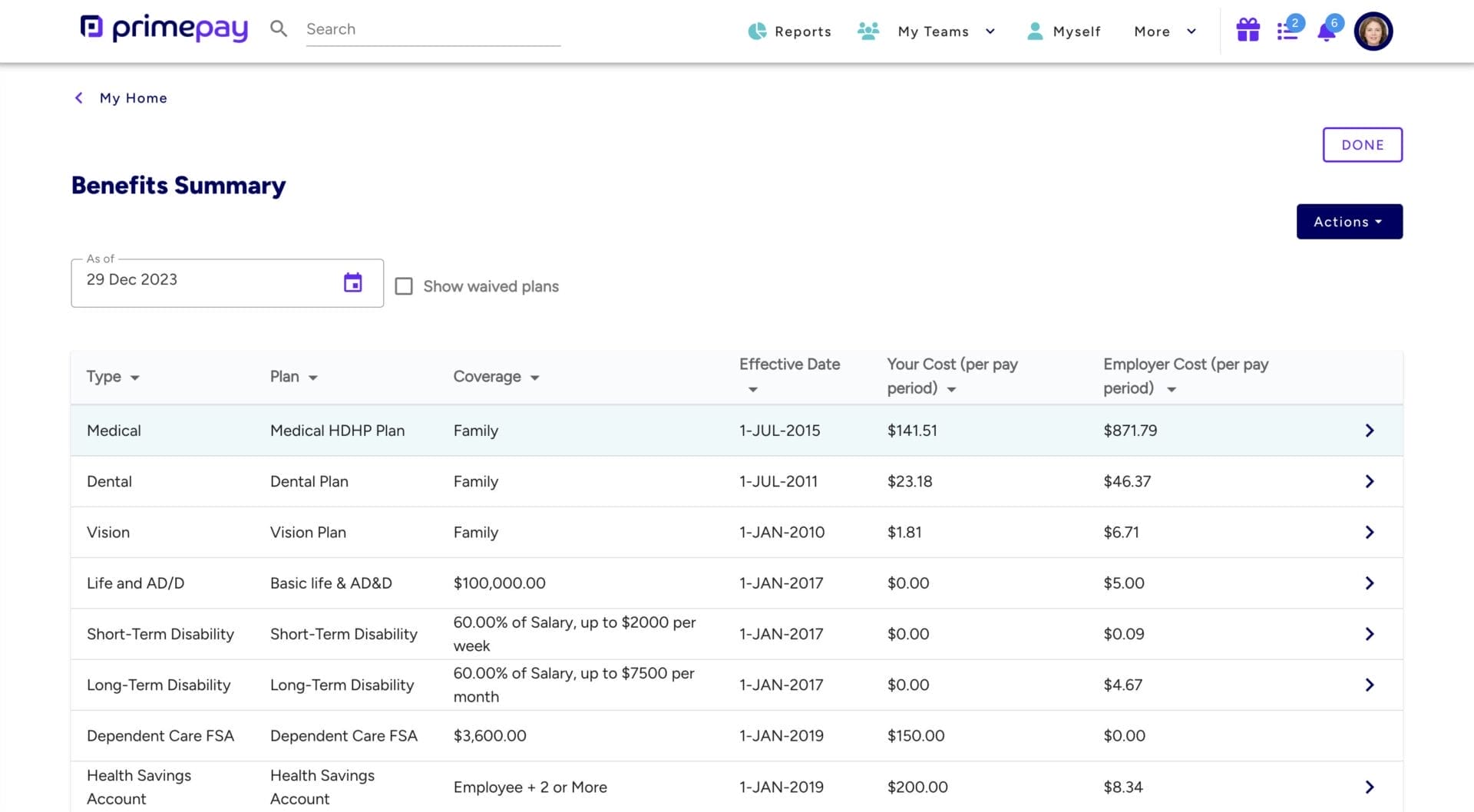

Selecting an appropriate health insurance plan for a small business entails weighing factors such as whether to offer a single plan or various health insurance plans for employees. Options include:

- Preferred Provider Organization (PPO) plans

- Health Maintenance Organization (HMO) plans

- Health Savings Account (HSA)-qualified plans

- Flexible Spending Account (FSA)-qualified plans

- Indemnity (AKA fee-for-service) plans

Retirement Savings Plans: A Key Employee Perk

Want to really step up your small business benefits package? Include a retirement savings plan. By doing so, your benefit offerings will help support employees’ present well-being and allow them to establish financial security for the future.

Options for retirement savings plans among small businesses can include:

- SIMPLE IRA

- SEP IRA

- Traditional or Roth IRA

- Solo 401(k)

However, when selecting benefits for your small business, matching or contributing to retirement plans may not be in your current budget. If that’s the case, build out your other offerings, but put retirement benefits on your roadmap.

Besides caring about your people’s financial well-being, including retirement benefits can:

- Give you the competitive edge. Only 22% of small and medium-sized businesses offer retirement benefits. Adding this option to your small business benefits package will make you stand out to candidates.

- Help attract top talent. If you want to tip the scale in your favor and secure top candidates, a retirement plan will help. A study by Businesswire found that 62% of candidates consider the availability of a retirement plan when deciding whether to accept a job.

- Increase retention rates. Regarding retention rates, many HR leaders focus on findings from the employee lifecycle. But financial planning has emerged as another contender to consider – 76% of employees are likely to be attracted to another company that cares more about their financial well-being.

Additional Coverage: Disability and Life Insurance

Beyond health insurance and retirement plans, employees appreciate additional coverage options like disability and life insurance as part of their benefits package. Disability insurance, for instance, provides a safety net for employees with work incapacity, enabling them to meet financial responsibilities and provide for their families.

The associated costs for disability insurance for small businesses typically range from 1% to 3% of their income. This investment is invaluable in ensuring employees’ financial security and peace of mind, making it a key component of a competitive benefits package.

4 Steps To Creating and Rolling Out an Employee Benefits Program

Crafting a benefits package for small businesses is an intricate process. Below are four steps to set you in the right direction as you design and communicate your employee benefits plan.

1. Design Your Small Business Benefits Program

The first – and arguably, the most complex – step is designing your benefits package. To develop a comprehensive package, execute the following four tasks:

- Strategic planning

- Careful budgeting

- Selection of suitable benefits plans

- Determining fair and competitive employer contributions

Yes, there are four steps within the first step… but these action items ensure that your benefits package is financially sustainable for the business and valuable and appealing to the employees.

Note: Your business size and financial runway are pivotal in the benefits you can afford to provide. Small and medium-sized companies should recognize which employee benefits attract and retain talent and tailor their benefits program to reflect their findings.

Set Your Benefits Budget

Consider the average cost of health insurance premiums when establishing your benefits budget. These costs can range from $703 to $8,435 per year for single coverage and from $1,997 to $23,968 per year for family coverage. While expenses fluctuate based on your business’s size and the range of benefits provided, it’s recommended to allocate 15-30% of your revenue to pay your employees (this percentage includes both salaries and benefits).

Determine Employer Contributions

To determine employer contributions to benefits plans, carefully assess the business’s financial resources alongside the needs and priorities of the employees. This process involves considering various benefits options – like medical insurance, retirement plans, and student loan repayment programs – while ensuring that the benefits align with employees’ expectations and provide meaningful value.

For health insurance, employers typically cover approximately 80% of premiums for single coverage and around 70% for family coverage. For retirement savings plans, the standard practice for employer contribution typically ranges from 3% to 6%. These contributions can significantly impact employee satisfaction by demonstrating the employer’s commitment to their well-being and future.

Note: As mentioned, tighter budgets may not allow for high employer coverage or retirement contributions. Until your budget increases, consider offering alternatives – such as free financial planning workshops – to demonstrate your prioritization of employee wellness.

2. Implement Employee Feedback in Benefits Selection

What good is offering pet insurance if none of your employees own an animal? Needless to say, it’s crucial to incorporate employee feedback as you begin planning your benefit offerings.

In short, by conducting employee surveys and customizing benefits options based on insights, small businesses can ensure their benefits package meets the diverse needs of their people.

Conduct Employee Surveys for Benefit Preferences

Administering employee surveys is an active way to grasp benefit preferences. This approach empowers employees to vocalize their needs in a constructive way and ensure the benefits package remains relevant and appealing.

To gather valuable insights into what employees value most, select a suitable methodology, craft well-designed questions, and prioritize confidentiality. High employee participation is important, so it’s crucial to not only email out a link but also announce the timeline during an All Hands meeting and have department and team leads encourage direct reports to complete the survey.

Customize Benefits Options

You’ll want to brush up on your tightrope skills, as selecting suitable benefits plans is a balancing act between the business’s spending capacity and employees’ preferences. The key is to offer various benefits that employees value so they can choose the options that best suit their needs.

Customizing benefits options allow employees to select the coverage that aligns with their unique needs. While executing multiple options requires extra time, resources, and communication, the rewards are worth the effort– research shows that 40% of employees increase their loyalty to their employer if benefit options are customized to meet their needs.

Luckily, HR software can facilitate the customization process. Benefit Administration functionalities during open enrollment can provide employees with a personalized experience, enabling them to explore and understand their benefits options at their own pace.

HR software with benefit administration features, like Enrollment Wizards, makes choosing the right benefits a breeze and takes the lift off HR teams.

3. Communicate the New Benefits Package

You’ve spent months budgeting, researching, consolidating data, and finalizing your plan. Now comes step three, perhaps the most vital step of all: announcing the offerings to employees.

To ensure your communication efforts go smoothly and equip people with the right information for open enrollment, craft a clear message, select multiple channels for notifications, and involve key stakeholders.

Whether through email, video conferencing, or in-person meetings, communication should be straightforward, concise, and accessible to all employees. In this strategy, everyone receives the same message, understands the benefits, and learns how to maximize them.

Note: Transparency is important here. For example, let’s say 63% of employees desire commuter benefits but it’s not feasible for your budget. Communicate your reasons for not including it in your small business benefits package (and potentially offer other ways to offset commuter costs) so employees feel heard and respected.

Create Clear Communication Materials

Insurance and benefits explanations are usually as clear as mud. It’s therefore important to use simple language and avoid technical jargon so employees understand their options for the year.

Visual aids such as infographics and charts can further enhance comprehension, making the information more relatable and easily understood. Online tools and personalized benefits counseling can also contribute to a better understanding of the benefits and encourage employees to engage with their benefits actively.

Host Informative Sessions

Hosted informative sessions allow employees to ask questions and better understand their benefits package. These sessions can be organized as Q&A sessions, lunch and learn sessions, or virtual meetings to provide employees with easy access to information.

Make sure your sessions cover many topics, including health insurance coverage, retirement benefits, and employee assistance programs. They should also be well-organized, with speakers prepared to deliver concise and relevant responses to employee inquiries.

4. Monitor and Adjust Your Benefits Offering Annually

You’ve designed your benefits plan. You’ve rolled it out company-wide. The process is over, right? Not so fast.

You’ll want to regularly monitor and adjust the benefits you offer to continue meeting the needs of your people.

Adapting to Employee Needs

You’ve most likely heard the quote, “The only thing constant is change,” which fortunately (or unfortunately) is incredibly applicable in the business world. Changes in work arrangements, economic fluctuations, and increased emphasis on work-life balance are some factors that can lead to shifting employee benefit offerings.

Some key indicators signaling the need for adjustment include a low benefits enrollment rate, frequent questions and complaints about benefits, and low employee morale.

Regularly Review Benefits Utilization

You should also review benefits utilization within your comprehensive annual review. This process includes:

- Soliciting feedback from employees on their experiences with current benefits

- Reassessing plans to ensure ongoing value

- Adjusting the benefits package in response to usage data and market dynamics

By conducting employee surveys, tracking changes in benefits preferences, and disseminating updates through multiple communication channels, you can better adapt your small business benefits package to meet these evolving needs and continue to offer value.

Critical signs of successful benefits usage include:

- High utilization rate

- Low emergency department use

- Minimal prescription drug utilization

- High employee capacity

- Low staff turnover rates

- High benefits utilization rate

Designing a People-First Small Business Benefits Package

A well-rounded benefits package is vital for small businesses to attract and retain top talent and enhance employee satisfaction and productivity. To create a people-first benefits plan for your small business, set your budget, allow employee input, communicate your offerings, and adjust accordingly.

By staying responsive to employee needs and preferences, small businesses can ensure their benefits package remains competitive, valuable, and fiscally responsible, contributing to the success of both their employees and the business.