Human resource compliance doesn’t have to be overwhelming.

In this guide, you’ll learn what HR compliance is, why it matters, and how to stay aligned with key labor laws and regulations. Plus, get a practical checklist to help you evaluate your current compliance status and reduce risk.

What is HR Compliance?

HR compliance is the ongoing process of ensuring your company’s policies, procedures, and practices align with federal, state, and local labor laws.

From wage and hour regulations to workplace safety and anti-discrimination rules, staying compliant is essential to operating legally and fostering a fair, accountable work environment.

Now, let’s focus on the next step: building a proactive HR compliance strategy that protects your business and supports your team. Implementing a strategy and understanding the laws will minimize the risk of penalties for non-compliance.

Types of HR Compliance

There are several compliance areas you should understand to ensure you are adhering to a variety of rules. Below are a few areas of HR compliance that you should be aware of.

- Statutory adherence: Observing the employment laws that set the baseline for your workplace—things like minimum-wage rules, payroll-tax obligations at both state and federal levels, equal-opportunity mandates, required insurance coverages, and other legislative directives.

- Regulatory alignment: Meeting the standards and guidelines issued by government bodies and oversight agencies (e.g., the Department of Labor or the Federal Trade Commission).

- Contractual obligations: Honoring the terms laid out in any legally binding agreements with employees, independent contractors, vendors, or clients. If you have union-represented staff or work under a collective bargaining agreement, you must also comply with its provisions on pay, nondiscrimination, benefits, and worker protections.

HR Compliance Laws and Regulations

Understanding HR compliance laws and regulations is essential for building a fair, legally sound workplace.

The following table outlines the critical employment laws that guide employee rights, employer responsibilities, and workplace protections in 2025 and beyond.

| Law / Regulation | Focus Area | Enforcement Body |

|---|---|---|

| Fair Labor Standards Act (FLSA) | Minimum wage, overtime, recordkeeping, child labor | U.S. Department of Labor (DOL) |

| Occupational Safety and Health Act (OSHA) | Workplace health and safety standards | Occupational Safety and Health Administration (OSHA) |

| Family and Medical Leave Act (FMLA) | Unpaid, job-protected leave for family and medical reasons | U.S. Department of Labor (DOL) |

| Americans with Disabilities Act (ADA) | Prohibits discrimination against individuals with disabilities | Equal Employment Opportunity Commission (EEOC) |

| Title VII of the Civil Rights Act | Prohibits employment discrimination based on race, color, religion, sex, national origin | Equal Employment Opportunity Commission (EEOC) |

| Equal Pay Act (EPA) | Prohibits wage discrimination based on gender | Equal Employment Opportunity Commission (EEOC) |

| Genetic Information Nondiscrimination Act (GINA) | Prohibits genetic information discrimination in employment | Equal Employment Opportunity Commission (EEOC) |

| Employee Retirement Income Security Act (ERISA) | Regulates employee benefit plans and pensions | U.S. Department of Labor (DOL) |

| Age Discrimination in Employment Act (ADEA) | Protects workers aged 40 and older from discrimination | Equal Employment Opportunity Commission (EEOC) |

| National Labor Relations Act (NLRA) | Protects employees’ rights to unionize and collective bargaining | National Labor Relations Board (NLRB) |

| Immigration Reform and Control Act (IRCA) | Prohibits employment discrimination based on citizenship or immigration status | U.S. Department of Justice (DOJ) |

| Uniformed Services Employment and Reemployment Rights Act (USERRA) | Protects employment rights of individuals returning from military service | U.S. Department of Labor (DOL) |

| Health Insurance Portability and Accountability Act (HIPAA) | Protects medical information privacy | U.S. Department of Health and Human Services (HHS) |

| Consolidated Omnibus Budget Reconciliation Act (COBRA) | Provides continuation of health coverage after job loss | U.S. Department of Labor (DOL) |

| California Consumer Privacy Act (CCPA) | Protects personal data of California residents | California Attorney General’s Office |

| General Data Protection Regulation (GDPR) | Protects personal data of individuals in the EU | European Commission |

Common HR Compliance Issues

Whether you’re just starting out as a small business owner, a seasoned entrepreneur or an HR leader, it’s critical to be aware of common compliance issues. Making sure an employer complies with regulations is critical to being proactive in avoiding penalties and lawsuits.

1. Discrimination and Harassment

Title VII of the Civil Rights Act bans discrimination in all phases of employment by employers based on race, religion, color, sex, national origin, or age discrimination. (This applies to employers with 15 or more employees.) Title VII also prohibits employment decisions based on stereotypes and assumptions about abilities, traits, or the performance of individuals of certain racial groups.

Title VII prohibits harassment of employees. As an employer, you are required to take appropriate steps to prevent this and your employees should know the proper procedures for reporting such issues.

Bottom line: Your company should provide adequate training and strong written communication regarding these practices.

2. Wage and Hourly Compliance

The U.S. Department of Labor’s (DOL) wage and hour division establishes protections for workers as it relates to the rate of pay, minimum wage, overtime, breaks, and more under the Fair Labor Standards Act (FLSA). And it may be easier than you think to violate this. The simple mistake of misclassifying employees violates the FLSA and could end up pretty costly. Other common FLSA ‘no-no’s’ include not providing compensation for all employee hours worked, which includes short breaks, on-call time, and time spent working off the clock.

Aside from minimum wage, overtime, and hours worked, the FLSA outlines regulations around recordkeeping and child labor.

In short, your business must accurately classify employees, display an official poster outlining the requirements of the FLSA, focus on the health and well-being of youth workers, and more.

3. Employee Classification

It is pertinent that you know the difference between independent contractors, full-time and part-time employees. Familiarize yourself with the classifications and stay in accordance with the U.S. Department of Labor’s guidelines as well as the IRS.

As mentioned above, misclassifying employees can be a costly mistake. When workers are misclassified, they can be denied important services and protections like minimum wage, sick leave, and unemployment insurance. This not only hurts the employee but also results in less tax revenue for the government and less money for employee programs.

Reclassifying workers and paying their taxes can help avoid penalties and protect both workers and the economy. Save a copy of this IRS fact sheet on understanding employee versus contractor designation to help avoid this mistake.

By enforcing these clear job definitions, you will not only be in compliance with the law, but each employee should better understand what they are accountable for.

4. Workplace Safety

Providing employees with a safe work environment is critical. The Occupational Safety and Health Act (OSH Act), enforced by the Occupational Safety and Health Administration (OSHA), requires businesses to provide employers with a work environment free from recognized hazards.

The top 10 OSHA-cited standards include the following:

- Fall Protection, construction

- Respiratory Protection, general industry

- Ladders, construction

- Hazard Communication, general industry

- Scaffolding, construction

- Fall Protection Training, construction

- Control of Hazardous Energy (lockout/tagout), general industry

- Eye and Face Protection, construction

- Powered Industrial Trucks, general industry

- Machinery and Machine Guarding, general industry

Employers in specified low-risk industries are exempt, however, it’s best to verify the risk level of your industry as outlined by OSHA.

5. Employee Leave

Employees are entitled to certain types of leave, such as sick leave, vacation time, and parental leave. Employers must comply with federal and state laws, such as The Family and Medical Leave Act (FMLA), regarding leave and provide appropriate time off to employees who qualify. The FMLA also allows eligible employees to take up to 12 weeks of unpaid leave for certain reasons.

Examples of FMLA violations include:

- Refusing to authorize FMLA leave for an eligible employee,

- Discouraging an employee from using FMLA leave,

- Manipulating an employee’s work hours to avoid responsibilities under the FMLA,

- Using an employee’s request for or use of FMLA leave as a negative factor in employment actions, such as hiring, promotions, or disciplinary actions, or,

- Counting FMLA leave under “no-fault” attendance policies.

6. Equal Pay and Pay Equity

The Equal Pay Act (EPA) amended the FLSA to prohibit wage discrimination between workers doing the same job with the same qualifications and experience who should receive the same pay, regardless of their gender, race, or other characteristics.

Pay equity is about ensuring that pay differences are based on legitimate factors such as job responsibilities and experience, as opposed to based on sex, race, religion, etc. Employers must comply with laws regarding equal pay and pay equity to avoid legal consequences.

7. DEI

In order to properly align with Diversity, Equity, and Inclusion (DEI), employers must strive to create a workplace that is diverse and inclusive, where employees feel valued and respected regardless of their race, ethnicity, gender, religion, or other characteristics. This can be achieved through policies and practices that promote diversity and equity, such as inclusive hiring practices, training programs, and employee resource groups.

Many companies make the following mistakes:

- Not focusing on the right data. Look past the number, and get into all the insights!

- Focusing on one aspect. People are complex!

- Failing to lead from the top down. DEI is a company-wide effort!

- Recognizing DEI through brand, not actions. Ever hear ‘actions speak louder than words’?

All in all, ask the right questions to your employees to understand their honest feedback on how to improve your company’s DEI efforts.

8. Data Privacy

The Equal Employment Opportunity Commission’s privacy program establishes practices for employers who must take measures to protect their employees’ personal information and ensure that it is collected and stored securely. This includes information such as social security numbers, bank account information, and healthcare medical records. Employers must also comply with laws such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) to avoid legal consequences.

Installing software that shields against cyber attacks, implementing training, and additional security measures can help your business avoid a data breach.

How to Manage HR Compliance

Now that we’ve covered what HR compliance is, and what the top HR compliance issues are, it’s time to get into the fun part – managing HR compliance.

Below are a few ways you can navigate through HR compliance challenges with confidence.

Develop A Compliance Program

A compliance program lays out all the necessary steps, policies, and procedures within your business to adhere to federal, state, and local laws, rules, and regulations. The program should include a code of ethics and conduct, a process for reporting and investigating violations, and guidelines for managing risks.

Provide Training And Education

Getting your employees on board and educated on HR compliance can make managing compliance much easier. When employees understand their legal responsibilities and know what the legal requirements are, it’s easier to adhere to them. You should consider providing training on topics such as workplace safety, anti-discrimination laws, harassment, and data privacy. More topics may be necessary according to your unique business case or industry.

Create Clear Policies And Procedures

Clear policies and procedures can help prevent violations and ensure that employees understand what is expected of them. You should consider creating policies on topics such as equal pay, employee leave, and harassment. More policies and procedures may be necessary according to your unique business case or industry. And of course, what good are policies and procedures if they’re difficult to access? Make sure your policies and procedures are outlined in a place that’s easily accessible by your organization, like an employee handbook.

Update Policies As Laws Change

Let’s face it, laws change. And they can change pretty frequently. You should consider regularly reviewing policies and updating them as laws change. It’s important to stay up-to-date with changes in federal laws, state, and even local regulations to ensure compliance. Here are a few ways to make keeping up with law changes easier:

- Use technology and tools for compliance management: There are plenty of HR software systems on the market to help manage employee data, track compliance training, and ensure that policies are being followed.

- Conduct Audits: Regular compliance audits can help identify areas of non-compliance and prevent violations. Audits should be conducted by a qualified HR professional or outside consultant.

Resolving HR Compliance Issues

Despite your best efforts, compliance issues may still arise. Here are some ways to address and resolve compliance issues:

- Document Issues – Ensure all documentation related to compliance issues is accurate and complete.

- Communicate With Parties – Establish clear communication with all parties involved in compliance issues, including the complainant, accused, and witnesses.

- Maintain Confidentiality – Maintain confidentiality throughout the compliance process to protect the privacy of those involved.

- When To Bring in Legal Counsel – Consider consulting with legal counsel if you are unsure about how to proceed with a compliance issue or if a violation may result in legal action.

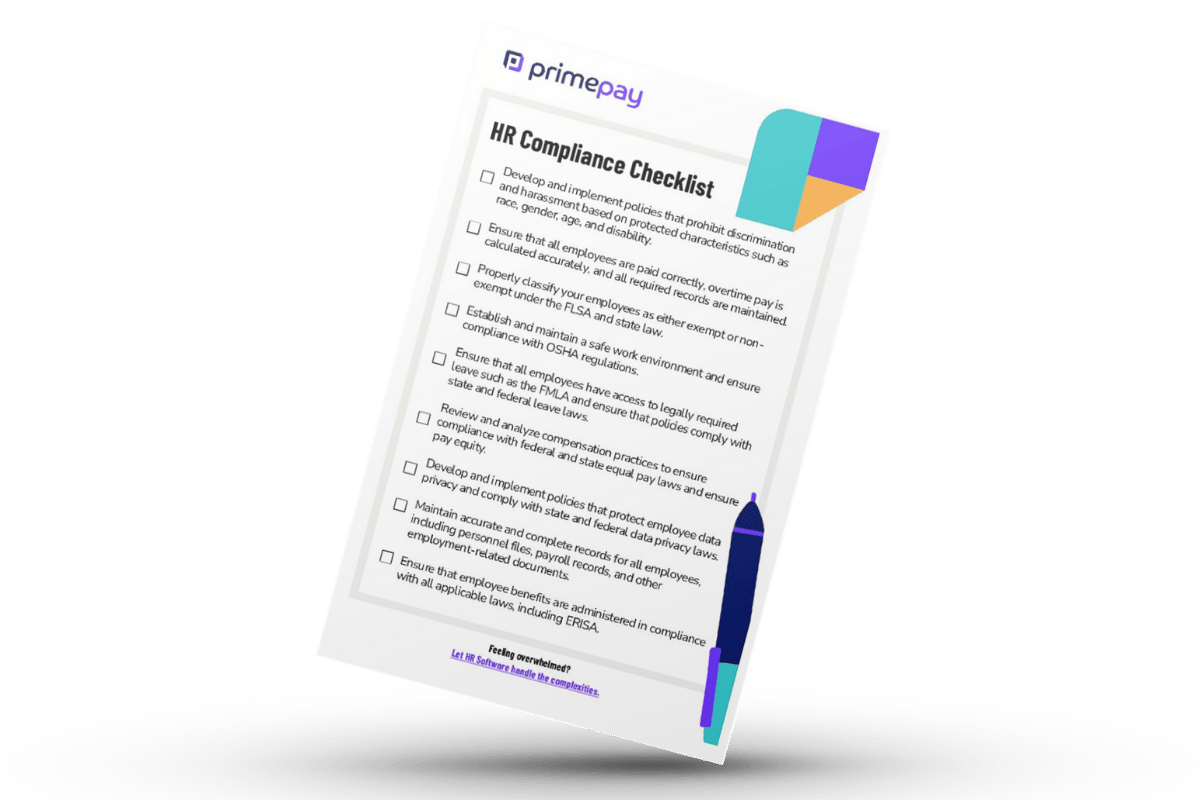

HR Compliance Checklist: Assessing Your Risk and Readiness

Make sure you are on track with your human resource and bonus performance review compliance with our free PDF checklist.

- Anti-discrimination and harassment policies: Develop and implement policies that prohibit discrimination and harassment based on protected characteristics such as race, gender, age, and disability.

- Wage and hour compliance: Become an expert in the minimum wage and ensure that all employees are paid correctly, overtime pay is calculated accurately, and all required records are maintained.

- Employee classification: Make sure to properly classify your employees as either exempt or non-exempt under the Fair Labor Standards Act (FLSA) and state law.

- Workplace safety: Establish and maintain a safe work environment and ensure compliance with Occupational Safety and Health Administration (OSHA) regulations.

- Employee leave policies: Ensure that all employees have access to legally required leave such as the Family and Medical Leave Act (FMLA) and ensure that policies comply with state and federal leave laws.

- Equal pay and pay equity: Review and analyze compensation practices to ensure compliance with federal and state equal pay laws and ensure pay equity.

- Data privacy: Develop and implement policies that protect employee data privacy and comply with state and federal data privacy laws.

- Recordkeeping: Maintain accurate and complete records for all employees, including personnel files, payroll records, and other employment-related documents.

- Benefits administration compliance: Ensure that employee benefits are administered in compliance with all applicable laws, including the Employee Retirement Income Security Act (ERISA).

- Legal Counsel: Gain access to resources to help you avoid fines and lawsuits while managing the evolving HR and employment requirements.

Bonus Checklist: HR Compliance During Employee Performance Reviews

Performance reviews are an important aspect of employee development and growth in any organization. They provide an opportunity for employees to receive feedback on their work and set goals for the future. However, without proper preparation, performance reviews can become an unproductive and frustrating experience for both employees and managers.

The following quick checklist of best practices will keep you compliant when conducting performance reviews:

- Establish a cadence: Ensure performance reviews are conducted for all employees on a regular basis.

- Communication is key: Clearly communicate job expectations and responsibilities to all employees including the measured performance standards.

- Create a system: Put systems into place for measuring performance based on job-related functions and criteria that were illustrated in the employee’s job description.

- Review and refresh: Review and update job descriptions at least once a year.

- Document: Keep an accurate log and detail the records regarding performance to support personnel decisions.

- Be clear: Make certain that performance reviews are based on specific job-related criteria.

- Be honest: Provide honest, factual, and complete notes.

- Focus on OKRs: Compare performance against job descriptions and goals.

- Offer ongoing feedback: Don’t save feedback for review time, give feedback regularly!

- Be fair: Ensure the review process for measuring performance is equal amongst all employees.