Seventy percent of companies admit they’re “mediocre or below” regarding pay equity. That’s an issue, especially for organizations that say they’re prioritizing people-focused initiatives, transparency, and DEIB.

The good news is that leaders from the same study acknowledged these shortcomings and plan to build a more equitable environment for their employees.

But before committing to a pay equity analysis or remediation, leaders must first understand the ins and outs of pay equity laws and compliance.

That’s because fair pay isn’t just a moral initiative (although treating people equally and with respect should be engrained in company culture). It’s also a legal one: pay equity laws ensure you’re not accidentally (or intentionally) discriminating against specific groups.

Once that foundational knowledge is in place, HR and Finance leaders can work together to audit pay practices and make any necessary changes to create an inclusive and fair workplace.

What is Pay Equity?

Pay equity means ensuring everyone gets fair pay for similar work, regardless of gender, race, or background. It’s not just the right thing to do; it’s a must-do to prevent discrimination and build a welcoming workplace. Alternatively, ignoring pay equity laws can lead to dire consequences that range from decreased employee trust to discrimination lawsuits.

While there are many protected classes, gender and race are two main areas organizations should focus on when it comes to rectifying unequal pay.

The Gender Pay Gap

We’ve all heard of the gender pay gap, where women earn less than men. Unfortunately, this concept isn’t an idea of the past. In 2021, white women earned 82% of what men earned, and this figure is even lower for women of color. And because these losses compound, women make anywhere from $400K to $1+M less than men in their 40-year career.

Let those numbers sink in.

One way to combat the gender pay gap is to grant salaries based on skills and experience. Additionally, to truly lean into building an equitable environment, organizations should also examine programs, such as parental leave, to combat social biases and pressures, and other initiatives, such as female representation in leadership positions.

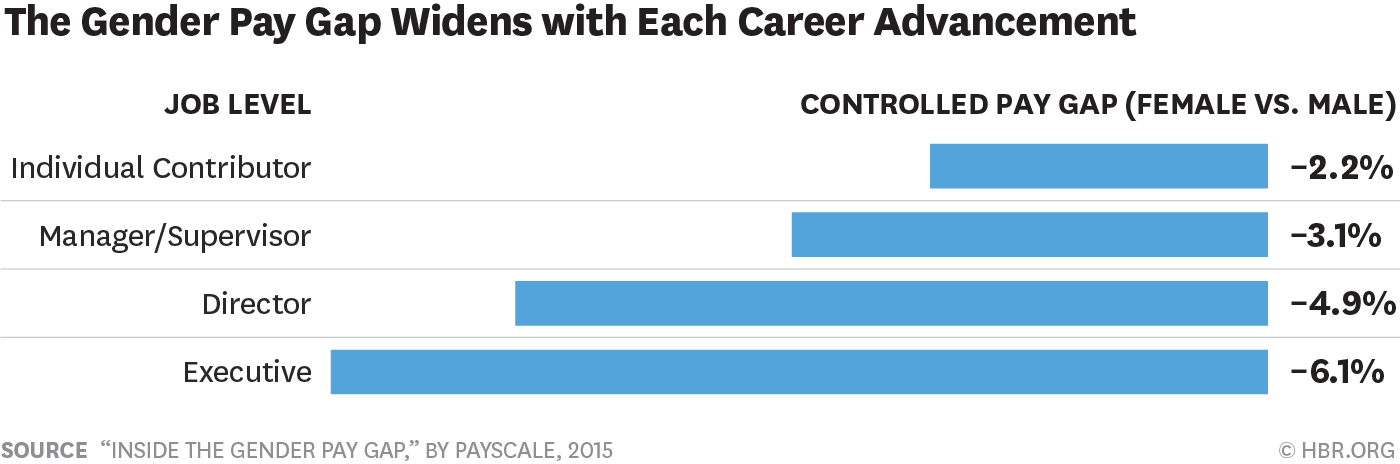

As HBR notes, the pay gap widens for certain female employees, including executives, women with children, and women with higher degrees.

Pay Equity for People of Color

There’s no way to sugar-coat it. Unfortunately, people of color face striking wage disparities. For example:

- Hispanic women earn 57 cents for every dollar earned by white, non-Hispanic men

- Black women earn 64 cents for every dollar earned by white, non-Hispanic men

- Some Asian subpopulations earn below 60 cents for every dollar earned by white, non-Hispanic men, while others exceed one dollar in this comparison.

These wage gaps, which result in significant financial losses over time, are influenced by factors such as occupational segregation, biases against part-time work due to caregiving, and direct and indirect discrimination in hiring and industry selection.

To dispel these implicit biases, organizations should identify and address wage disparities by actively promoting pay equity, documenting strategies, adjusting recruitment tactics, and conducting pay equity analyses for data-driven decisions.

Why is Pay Equity Important?

Pay equity is critical for fostering fairness and driving organizational success. When employees trust that they’re being compensated equitably, it boosts morale, productivity, and loyalty. On the other hand, pay disparities can lead to dissatisfaction, turnover, and even legal risks.

From a business perspective, companies prioritizing pay equity have a competitive edge. A report by McKinsey found that diverse and inclusive organizations, which often include equitable pay practices, were 35% more likely to outperform their competitors financially.

For employees, pay equity reinforces the message that their contributions are valued. It helps build trust and a sense of belonging, which are key to a positive employee experience. Moreover, addressing pay gaps can improve retention rates, saving organizations significant costs for recruiting and onboarding new talent.

Beyond internal benefits, pay equity also positively impacts a company’s external reputation. Today’s workforce—and customers—are paying close attention to how organizations handle issues like diversity, equity, and inclusion (DEI). Companies with transparent and fair pay practices often attract top talent and loyal customers who align with their values.

Josh Bersin, a leading HR industry analyst, explains, “Organizations that embrace pay equity not only align with societal expectations but also set themselves up for long-term success by fostering a culture of trust and fairness.”

By prioritizing pay equity, businesses can build a stronger, more inclusive future that benefits everyone—employees, employers, and communities alike.

Pay Equity Laws and Regulations

Luckily, there are pay equity laws that combat pay discrimination: the Equal Pay Act of 1963 and Title VII of the Civil Rights Act of 1964. You must also know your state and local laws to ensure pay equity compliance.

The Equal Pay Act of 1963

The Federal Equal Pay Act of 1963 mandates that employers must pay equal wages for work requiring substantially equal skill, effort, and responsibility when performed under similar working conditions, regardless of gender.

It’s enforced by the Equal Employment Opportunity Commission and mandates that employers maintain records concerning wages, hours, and other employment practices. The statute of limitations for filing a claim is set at two years for non-willful violations and three years for willful violations, providing a robust framework for ensuring pay equity.

Title VII of the Civil Rights Act of 1964

The scope of pay equity is broadened by Title VII of the Civil Rights Act of 1964, which prohibits employment practices that discriminate based on race, color, religion, sex, and national origin.

Applicable to organizations with fifteen or more employees, Title VII:

- Defines the role of the Equal Employment Opportunity Commission (EEOC) in enforcing its provisions.

- Protects against discrimination in training or apprenticeship programs based on protected characteristics.

- Allows for the recovery of compensatory and punitive damages in cases of intentional discrimination.

State and Local Pay Equity Laws

State and local pay equity laws add another layer of complexity to pay equity compliance. These laws vary; some address wage discrimination based on sex, while others include race. However, all focus on comparable work with skill, effort, responsibility, and similar conditions.

Certain regions even mandate pay scale disclosure requirements (shoutout to Colorado for passing the first pay transparency law). Although only two-fifths of companies include salary ranges in their job postings, it’s in your best interest to do so, especially if you’re hiring remote employees from around the country.

An added bonus: Including salary ranges promotes fair compensation practices within your organization, helps attract top talent, and speeds up the hiring process.

Pay Equity Compliance

While enforcing pay equity is the ethical thing to do, it also helps companies avoid compliance risks. In recent years, pay equity has been in the spotlight, with high-profile pushes for new regulations and stronger enforcement of state and federal equality statutes.

Those pushes have been rivaled by equally high-profile legal battles and lawsuits that have resulted in multimillion-dollar settlements (looking at you, Uber) and public embarrassment for previously well-respected brands.

Staying compliant means regularly reviewing compensation practices, documenting pay decisions, and ensuring transparency to avoid potential legal and financial risks.

If you violate pay equity laws, there are a variety of penalties, including:

- Monetary payment, including back pay and interest.

- Donations to relevant charities.

- Hiring outside counsel to monitor company policies and procedures.

- Developing initiatives to ensure equal access to hiring and promotions.

- Reputational risks that lead to bad publicity and damage to brand name.

Running a Pay Equity Analysis

Don’t think you’re compliant or that you’re offering equal pay. Know it. A pay equity analysis isn’t just good practice; it’s a clear signal that you value fairness and transparency.

The best way to ensure you’re paying employees fairly (and not facing compliance risk) is by conducting a pay equity analysis. By doing so, you’ll signal that you’re taking pay equity seriously and practicing what you preach. That’s important, as a study found that although most companies say they prioritize pay equity, only 22% performed a salary audit between 2016 and 2020.

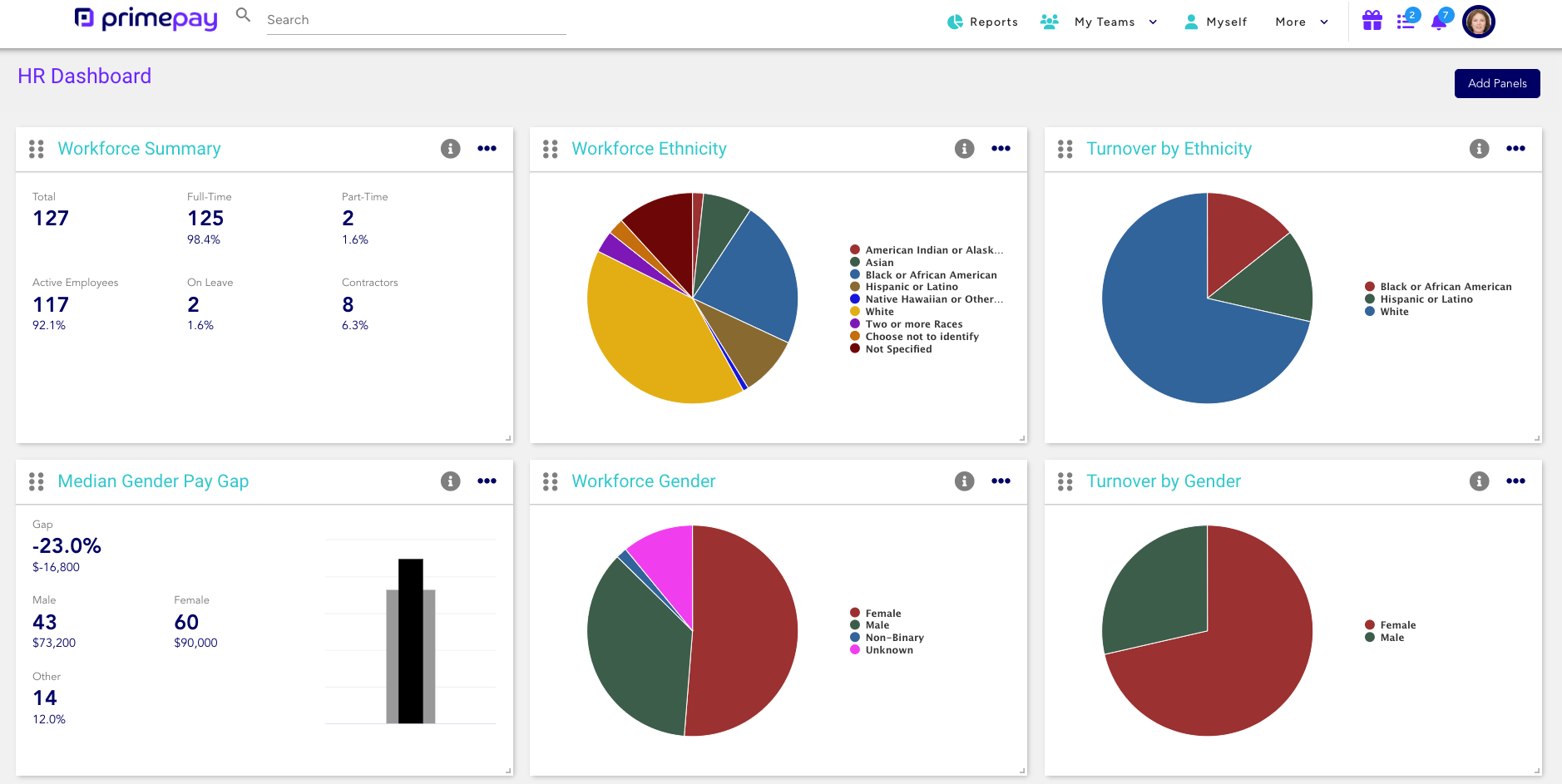

We’re not going to lie – auditing your pay practices is a large job. Depending on the size of your organization, the process can range from a few months to over a year. However, using an HCM with DEIB reporting features streamlines your data-wrangling process so you can spend your time making decisions instead of interpreting spreadsheets.

Workforce data isn’t actionable if it sits in a spreadsheet. Visualize your people data with modern HR software to pinpoint steps to building an equitable workplace.

To manage pay equity within your organization, make sure you:

- Provide leaders with the data they need. Make it easy for all stakeholders to review real-time pay comparisons. Using HR software helps people visualize internal data to pinpoint areas of opportunity quickly. You’ll also want to conduct an external market analysis to see if your salaries are competitive in your industry.

- Track and enforce pay ranges. An HCM provides you with the tools to track and implement pay ranges and guidelines based on job classifications. When you can automate and streamline the pay process (such as hiring, promotions, and incentives), it’s less likely that inequitable practices will arise.

- Create and communicate transparent pay programs. To engage employees and raise awareness, create compensation and pay programs based on objective metrics and data. Communicate those programs so employees know where they stand and have visibility to your fair practices.

Prioritize Pay Equity for a Better Future

Like other discriminatory practices, pay equity is a vital issue to resolve in an organization. But unlike more blatant forms of race or gender-based discrimination, unfair pay usually slides under the rug – especially when discussing salaries within your organization is taboo.

To prioritize pay equity, you must understand compliance laws, audit your current pay practices, and make necessary changes. Doing so will mitigate compliance risks and signal that you’re serious about DEIB and fair pay, boosting your recruitment and retention efforts.

Frequently Asked Questions

What is the meaning of pay equity?

Pay equity means equally compensating employees with similar job functions, regardless of gender, race, or other status. It ensures that employees performing jobs of equal value receive equal pay.

What is another word for pay equity?

Another word for pay equity is pay parity, which refers to the practice of paying people equitably.

What are the key laws governing pay equity in the United States?

The key laws governing pay equity in the United States are the Equal Pay Act of 1963 and Title VII of the Civil Rights Act of 1964. These laws aim to ensure equal pay for equal work.