If you heard there was a way to streamline operations and avoid costly payroll mistakes, you’d do it, right? It’s actually easier than you think, and it all comes down to running payroll reports.

Payroll reporting benefits businesses of all sizes, as these insights help you stay organized and compliant. Moreover, running reports doesn’t require formatting spreadsheets or crunching numbers. Instead, many payroll providers offer customizable reporting options that pull your payroll and employee data to ensure you’re making accurate and informed decisions for your teams.

What are Payroll Reports?

Payroll reports are essential documents that detail a company’s payroll data over a specific period. They provide a snapshot of employee compensation, tax withholdings, benefits deductions, and other financial information related to payroll. These reports help businesses stay compliant with tax regulations, maintain accurate financial records, and make informed decisions about staffing and budgeting.

Whether you’re tracking year-end payroll summaries or regular pay period reports, these documents offer insight into how much is being spent on wages, taxes, and benefits.

Types of Payroll Reports

There are several types of payroll reports that businesses should be familiar with. Each serves a unique purpose and provides insights into different aspects of payroll management.

The most common types are:

Company Payroll Reports

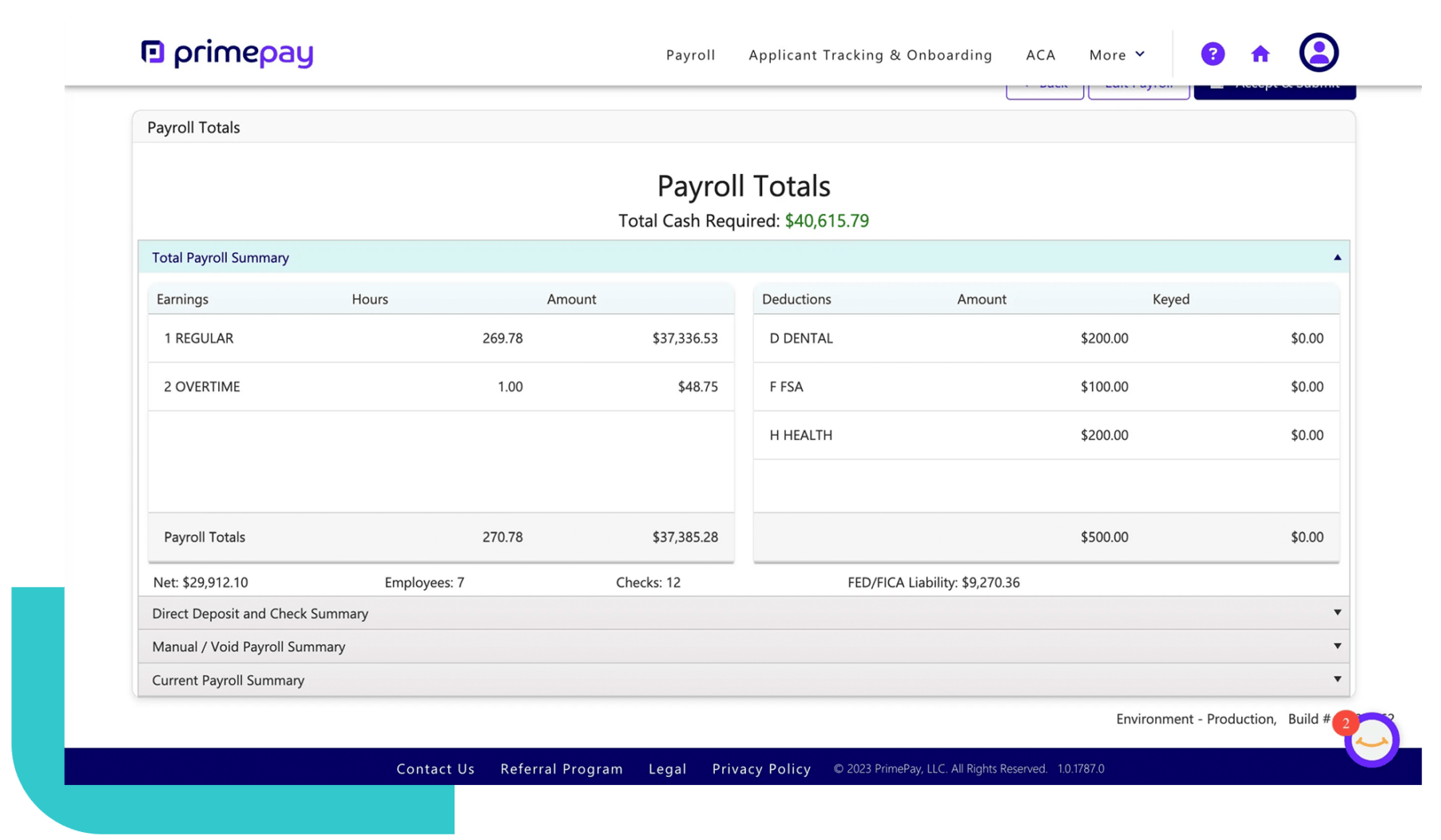

Company payroll reports offer a big-picture view of payroll expenses across the entire organization. A payroll summary report, for example, outlines total wages paid, taxes withheld, and any deductions applied during a specific period. This report is useful for budgeting, financial planning, and auditing purposes.

Example: A company reviews a monthly payroll summary report showing $250,000 in gross wages, $50,000 in taxes withheld, and $30,000 in benefits deductions. By comparing this report month-over-month, the company can identify trends, forecast future payroll costs, and plan for seasonal changes in labor needs.

Employee Payroll Reports

These reports focus on individual employee earnings and deductions. They detail each worker’s gross pay, taxes withheld, net pay, and contributions to benefits like health insurance or retirement accounts. Employee payroll reports help businesses ensure payment accuracy and maintain employee transparency.

Example: Imagine a retail business needs to verify that its top sales associate, John, earned $5,000 in gross pay last month, with $500 in taxes withheld and $200 in 401(k) contributions. The employee earnings report ensures John’s paycheck is accurate and that deductions for benefits are properly applied, minimizing payroll errors.

Tax Payroll Reports

Tax payroll reports ensure that your business complies with federal, state, and local tax laws. These reports typically track income tax withholdings, Social Security, Medicare, and unemployment taxes. One subset of this type is certified payroll reporting, which is often required for businesses working on government contracts to confirm wage compliance with prevailing wage laws.

Example: A clean energy company uses this report to confirm that all workers on a government project are paid prevailing wages. For example, the certified payroll report might show that a welder earned $30 per hour for 40 hours of work, complying with local wage requirements. These reports ensure businesses meet regulatory standards and avoid penalties.

Time Tracking Reports

Time tracking reports document the total hours worked and are especially useful for hourly employees. These reports are key for verifying accurate pay based on hours worked, overtime calculations, and monitoring attendance patterns.

Example: A manufacturing plant uses a time tracking report to see that overtime hours spiked by 15% last month, with employees clocking an additional 500 hours. This insight helps managers adjust schedules to reduce overtime costs, ensuring more efficient labor management.

Retirement Contribution Reports

These reports track employee contributions and any matching employer contributions, such as 401Ks. They help ensure compliance with IRS contribution limits and keep both employees and the company on track for retirement planning.

Example: Let’s say an employee, Sarah, contributes 5% of her $4,000 monthly salary to her 401(k), with the company matching 3%. The report would show Sarah’s $200 contribution and the company’s $120 match. This reporting helps HR verify that contributions are processed correctly and meet IRS guidelines for retirement plans.

Federal, State, and Local Payroll Reports

These reports help businesses comply with tax regulations at various levels. Federal payroll reports might include IRS forms like Form 941 (quarterly tax returns) or Form W-2. Depending on your location, state and local reports may track regional income taxes or other mandatory contributions.

Example: A construction company sees that for the first quarter, they owe $75,000 in payroll taxes, with $40,000 going to federal taxes and $35,000 split between state and local taxes. Having this detailed breakdown helps businesses stay on top of tax payments and avoid penalties for late filings.

Take advantage of PrimePay’s numerous built-in reporting features to ensure you make the best decisions for your organization.

Payroll Reporting Benefits

It’s clear that payroll reporting provides critical insights into your business’s financial health and operations. But there are other significant benefits too – such as improved compliance, enhanced insights, and streamlined processes – that enhance your decision-making.

Improved Compliance

One of the biggest challenges for businesses is keeping up with complex payroll tax laws and regulations. Payroll reports ensure that you accurately track and file federal, state, and local tax obligations. With proper reporting, you can minimize the risk of penalties, audits, or compliance issues.

Specifically, certified payroll reporting is often a legal requirement for businesses working on government contracts to demonstrate compliance with prevailing wage laws, making accurate reporting a must-have.

Enhanced Financial Insights

Payroll reports give you a granular view of your labor costs. Analyzing reports (such as the payroll summary) shows how wages, taxes, and benefits affect your business’s cash flow. This level of visibility helps forecast future payroll expenses and make informed decisions on staffing, budgeting, or compensation adjustments.

With PrimePay’s Budget vs. Actual tile, you’re able to see how your current spending shores up to your planned budget.

Streamlined Payroll Processes

By automating and regularly reviewing payroll reports, businesses can significantly reduce the time and effort spent on manual payroll tasks. A well-structured payroll reporting system can help eliminate errors, ensure accurate employee payments, and provide a clear audit trail.

For example, time-tracking reports and retirement contribution reports help keep employee records up to date, ensuring that both employers and employees are on the same page regarding hours worked or benefits accrued.

Tips for Better Payroll Reporting

Accurate and efficient payroll reporting is essential for maintaining compliance and making informed business decisions.

Here are some practical tips to help improve your payroll reporting processes:

- Regularly audit your data: Conducting routine audits of your payroll reports can catch discrepancies early. Auditing includes reviewing employee information, verifying wage calculations, and ensuring accurate tax withholdings. A small error in one payroll cycle can snowball into a larger issue down the line, so it’s important to stay proactive in spotting inconsistencies.

- Stay updated on compliance requirements: Tax laws and payroll regulations constantly evolve. Staying informed about federal, state, and local changes is key to avoiding compliance issues. Consider subscribing to payroll compliance newsletters or partnering with a trusted payroll provider that keeps up with regulatory changes to help you remain compliant.

- Use detailed reports to your advantage: Don’t just rely on basic reports – dig deeper with more specific reports like time tracking, retirement contributions, and certified payroll reporting. This data can give you greater insights into workforce management and help you fine-tune your payroll processes. For example, time tracking reports can help you monitor overtime patterns and reduce unnecessary labor costs.

- Centralize payroll documentation: Ensure all payroll reports are properly stored and easily accessible for audits or compliance checks. Centralizing your payroll documentation in one system helps improve efficiency and creates a clear audit trail, which is especially helpful if you’re managing multiple locations or remote teams.

- Automate where possible: Automation can save time, reduce errors, and ensure consistency in your payroll reporting. Many payroll software solutions offer customizable reports, allowing you to generate payroll summaries, tax reports, and time-tracking data with just a few clicks. Automation also helps ensure that reports are generated on schedule, which is especially important for quarterly or year-end tax filings.

Use payroll software that integrates with your time and attendance and HR systems to ensure accurate data and reporting.