Fifty thousand dollars. That’s the median loss for a company battling payroll fraud.

And while that’s a sum no organization wants to pay, the Association of Certified Fraud Examiners (ACFE) found that most perpetrators don’t limit themselves to one type of financial fraud, meaning that $50K can quickly turn into hundreds of thousands in loss.

It’s therefore important to understand payroll fraud – and how to combat it – so you and your team can monitor signs of fraudulent activity and act quickly.

What is Payroll Fraud?

Payroll fraud is a deceptive practice in which employees manipulate the payroll system to receive compensation they’re not entitled to. This type of fraud can take various forms, such as falsifying work hours or issuing payments to fictitious employees.

Internal payroll fraud is particularly concerning because it’s committed by individuals within the organization. These people take advantage of their familiarity with the company’s payroll processes and controls.

Of course, payroll fraud undermines a business’s financial health. It can lead to significant financial losses, erode employee morale, and damage the company’s reputation.

Despite these severe implications, payroll fraud is surprisingly common. According to ACFE’s 2024 report, payroll fraud schemes account for 10% of all asset misappropriation incidents and can go undetected for an average of 18 months.

Types of Payroll Fraud

Payroll fraud takes various forms and exploits different aspects of the payroll process. Understanding the common types of payroll fraud—workers’ compensation fraud, misclassification, timesheet fraud, and ghost payroll—is crucial for identifying and preventing them in your organization.

1. Workers’ Compensation Fraud

Workers’ compensation fraud occurs when an employee falsely claims an injury or illness to receive compensation benefits. This type of fraud can be particularly damaging, as it increases insurance premiums and disrupts workplace productivity.

Common signs of workers’ compensation fraud include:

- Inconsistent injury reports

- A lack of witnesses to the incident

- Delayed reporting of the injury

For example, an employee might exaggerate the severity of an injury to extend their time off or claim an injury that occurred outside of work as a workplace incident.

Mac Lillard, Sr. Manager of Risk and Advisory Services at GFR, encourages companies to review injury reports and conduct thorough investigations to mitigate fraud. He explains: “Regularly reviewing injury reports is essential for identifying patterns and inconsistencies that may indicate fraudulent claims. Consistent oversight ensures that all incidents are legitimate and helps prevent potential abuse of workers’ compensation systems.”

Employers can also implement a return-to-work program to facilitate the transition of injured employees to their roles, thereby reducing the potential for fraudulent claims.

2. Misclassification

Misclassification fraud involves incorrectly classifying employees as independent contractors to avoid paying certain benefits, taxes, and overtime wages. By doing so, organizations deprive employees of their rightful compensation and open themselves to legal risks and penalties.

It’s important to note that misclassification can be accidental or deliberate. Unfortunately, deliberate misclassification is a cost-cutting strategy some businesses use to reduce labor costs. However, it’s illegal and can result in significant fines.

To prevent accidental misclassification and comply with the Fair Labor Standards Act (FLSA) guidelines, conduct regular audits. While scheduled audits are helpful, ACFE reports that 42% of organizations use surprise audits as an effective anti-fraud method.

3. Timesheet Fraud

Timesheet fraud occurs when employees falsify their working hours to receive unearned wages. This type of fraud involves employees clocking in for each other, exaggerating hours worked, or recording time for periods when they weren’t actually working.

While this issue may not seem like that big of a deal, timesheet fraud can significantly inflate payroll costs.

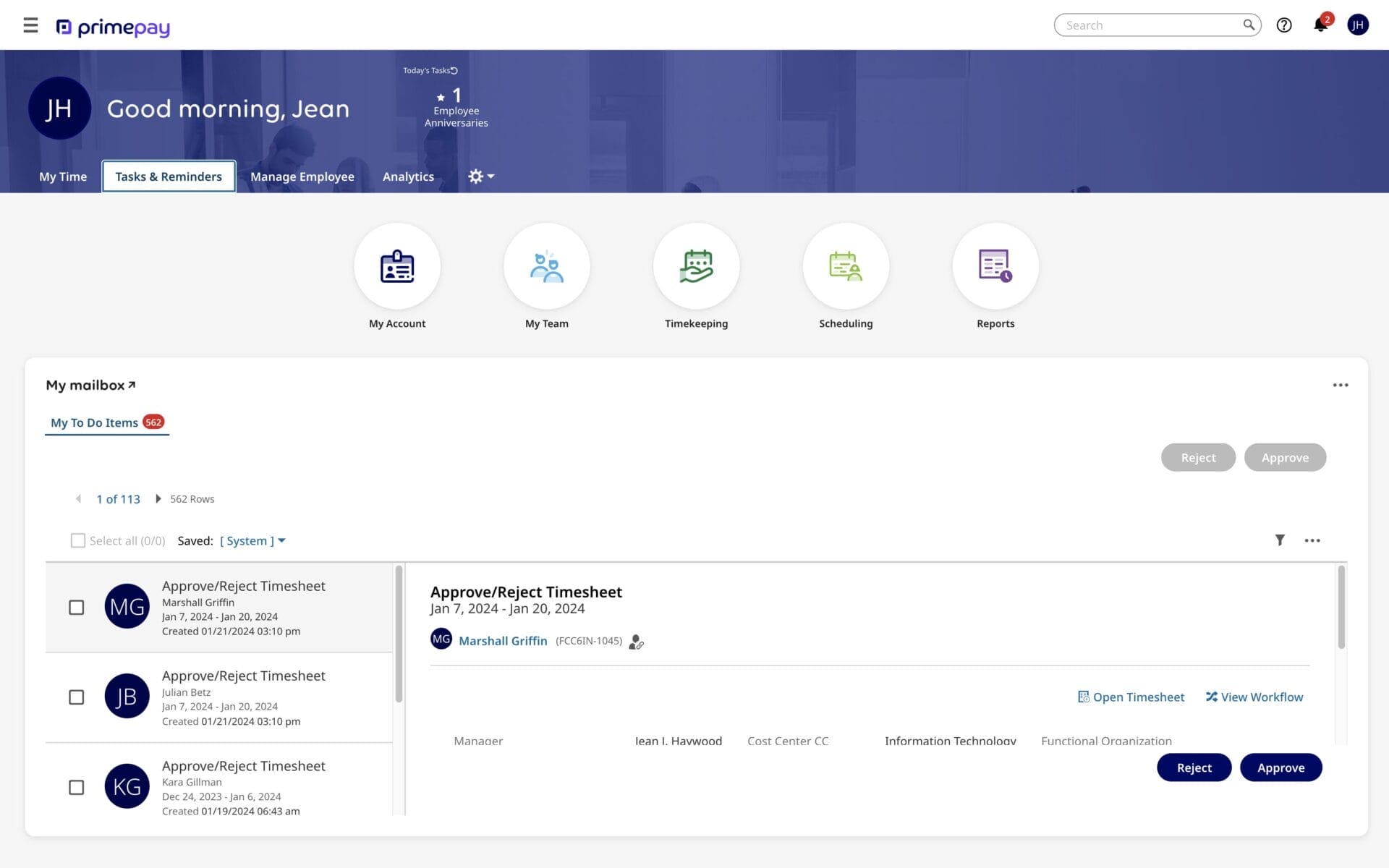

Because time fraud is often difficult to detect without diligent monitoring, it’s best to use an automated timekeeping system. (In fact, we have a helpful time and attendance calculator to help people determine their software’s ROI when it comes to preventing timesheet fraud!).

Time and attendance software prevents payroll fraud for both parties because it:

- Ensures that people are being accurately paid for their time worked

- Helps users stay on top of absences, tardiness, and PTO accruals

- Grants an organization-wide view with real-time reports and schedules

When looking for time and attendance features, choose a system that integrates with your payroll software to ensure accurate payroll.

4. Ghost Payroll

Ghost payroll schemes involve creating fake employees or retaining former employees on the payroll to divert their wages. Payroll administrators or employees with access to payroll systems often perpetrate this fraud.

For instance, a payroll manager might set up a fictitious employee and deposit the ghost employee’s salary into their account. Alternatively, they might keep a departed employee on the payroll and pocket their wages.

Regular audits of payroll records, cross-referencing employee lists with actual employees, and implementing strict access controls can help prevent ghost payroll fraud.

How to Detect Payroll Fraud

Unfortunately, no company is safe from payroll fraud. However, staying vigilant and catching issues earlier helps lessen the financial impact and may prevent further payroll scandals.

Here are several effective strategies to help you detect payroll fraud:

- Conducting regular audits and reconciliations: Internal and external audits can help identify discrepancies in payroll records (such as duplicate payments, unusual overtime claims, or mismatched employee details). Reconciliations involve comparing payroll records with bank statements, employee timesheets, and other relevant documents to ensure consistency.

- Monitoring overtime and absenteeism: Unusual patterns in overtime and absenteeism can indicate payroll fraud. For instance, an employee consistently reporting excessive overtime or frequently absent employees being marked as present could signal fraudulent behavior. Regularly reviewing and analyzing these patterns can help identify inconsistencies that warrant further investigation.

- Offering rewards for whistleblowers: While auditing and data analysis are more common approaches to detecting fraud, encouraging employees to share information is an effective strategy. Specifically, companies that offer rewards for whistleblowing see a 24% reduction in fraud and reduce the average fraud duration by three months.

Tips to Prevent Payroll Fraud

While it’s important to know how to detect fraud, it’s even more critical ideal to have policies in place to prevent it.

Here are some practical tips to help you prevent payroll fraud:

- Review payroll reports regularly: Running regular audits gives you the foundational knowledge of the organization’s finances, which therefore helps people spot any errors or inconsistencies quickly. Key reports to review include your payroll register, the employee master file changes, and exception reports.

- Implement segregation of duties: Segregation of duties helps prevent (and also detect!) fraud by dividing responsibilities among different employees. For example, the person responsible for processing payroll should be different from the person who approves it. This separation of tasks makes it more difficult for a single individual to commit and conceal fraudulent activities.

- Use payroll software with security features: Investing in a secure payroll management system that offers features like two-factor authentication, audit trails, and direct deposit verification is a priority.

- Educate and train employees: Educating employees about payroll fraud and its consequences helps create a culture of transparency and accountability. Provide regular training sessions on fraud awareness, detection, and reporting mechanisms.

- Establish a whistleblower policy: Create a confidential and anonymous whistleblower policy to encourage employees to report suspicious activities. In fact, more than half of fraud tips come from employees. Forming a reporting system, such as a hotline or online portal, allows employees to report concerns without fear of retaliation.

- Conduct background checks: Perform thorough background checks on new hires, especially those with access to payroll systems. Verify employment history, criminal records, and references to ensure you are hiring trustworthy individuals. Regularly update background checks for current employees in sensitive positions.

- Foster a positive work environment: According to criminologist Steve Albrecht, one reason people commit fraud is that they’ve rationalized the action. While creating a positive work environment is a long-term strategy for preventing fraud, it improves morale, promotes equitable pay, and encourages company values – all results that deter actions against the organization.

Prevent Employee Payroll Fraud

Payroll fraud is something you think will happen to another company…until it happens to yours.

Unfortunately, it affects organizations of every size and industry, which is why it’s important to understand it, know how to detect it, and employ strategies to prevent it.

By following the above advice and leveraging the knowledge from your internal team and external sources, you’re well on your way to securing your company’s finances and managing an accurate and safe payroll.