Succession planning is important for every business. Why wouldn’t you want to ensure business continuity, reduce risk, promote talent development, and improve investor confidence?

It’s therefore astounding that 36% of HR leaders say their organization doesn’t have a succession plan in place nor has plans to develop one in the future.

Maybe the process seems overwhelming, or they think it’s something they’ll get to eventually…and we all know how that goes.

Below is a list of five succession planning best practices to help you get started (or continue) your planning process and mitigate any hesitations you may have.

1. Start Succession Planning Early

Many companies wait until a leadership vacancy arises to think about succession planning. By then, it’s often too late to find the right hire in a short time frame. According to research, “the longer it takes a company to name a new CEO during a succession crisis, the worse it subsequently performs relative to its peers.”

That’s why early succession planning is crucial, as it ensures your business stays stable, even when key leaders leave. Long story short, identifying and developing future leaders well before transitions occur can prevent disruptions and create a seamless shift in responsibilities.

Why It Matters: According to a Deloitte survey, 86% of leaders believe succession planning is an urgent priority, yet only 14% feel confident in their succession plans. Without early preparation, companies risk losing institutional knowledge and facing leadership gaps that could slow down operations.

How to Identify and Develop Future Leaders

- Assess leadership potential: Use holistic performance reviews, leadership assessments, and employee feedback to pinpoint high-potential employees.

- Invest in leadership development: Offer mentorship programs, executive training, and stretch assignments to groom future leaders.

- Create career growth pathways: Give employees clear steps for advancement to increase engagement and retention. A CEO of a large financial services company noted in a Deloitte study: “Succession management is often done in too passive a way. Most companies just ask, ‘Is that person ready?’ as opposed to, ‘How do we get them ready?’”

- Promote a knowledge-sharing culture: Encourage senior leaders to document processes and mentor potential successors.

Real-World Example

Forbes reports that over 75% of Gen Z employees believe they should receive a promotion within the first year of a role. Ladders, Inc., a job search firm, decided to create a promotions program that included performance hurdles, title increases, and pay bumps to encourage retention and progression toward expertise. CEO Marc Cenedella says, “We learned that more frequent career feedback, with better chances for getting ahead, and some self-direction were actually very effective tools for building morale and contributing to the success of our company.”

Key Takeaway: Be proactive in identifying the right people for your succession planning needs. It’s never too early, but it can be too late.

2. Align Succession Planning with Business Strategy

If you think succession planning is just about replacing leaders, think again. It’s more about ensuring leadership transitions align with your company’s long-term goals.

Why? The right successors should be able to drive business strategy forward, not just fill an empty seat.

Why It Matters: According to McKinsey & Company, companies that align succession planning with their strategic objectives are 2.2 times more likely to outperform their competitors. When leadership changes aren’t guided by business priorities, companies risk losing momentum, damaging their culture, or failing to adapt to evolving market conditions.

How to Ensure Succession Planning Supports Business Growth

- Define future leadership needs: Conduct a skills gap analysis to identify the skills and experience leaders will need based on where your company is headed, not just where it is today.

- Integrate leadership development with business strategy: Build leadership programs that develop the competencies required to achieve long-term company goals.

- Engage leadership in the process: CEOs, CFOs, and HR leaders should collaborate to ensure succession planning reflects both operational and financial objectives.

- Establish a communication plan: Outline how leadership changes will be communicated to employees, stakeholders, and customers. Employees deserve to know major personnel and business changes, and should hear the message from you and not through a game of telephone.

Real-World Example

Family-owner supermarket Foy’s SuperValu recognized the importance of proactive succession planning to maintain business continuity. John Foy and his daughter, Kelly (who has worked full-time in the family business for over a decade), collaborated for years to develop a comprehensive succession plan that included open communication, legal and tax planning, and clear agreements to prevent future disputes. John believes the extensive preparation was critical not only for managerial purposes but also for the staff and shoppers. He says, “It’s important the foundations are there to protect the employees and make sure that the community is served too.”

Key Takeaway: Successful succession planning is about preparing leaders who can execute the company’s future strategy.

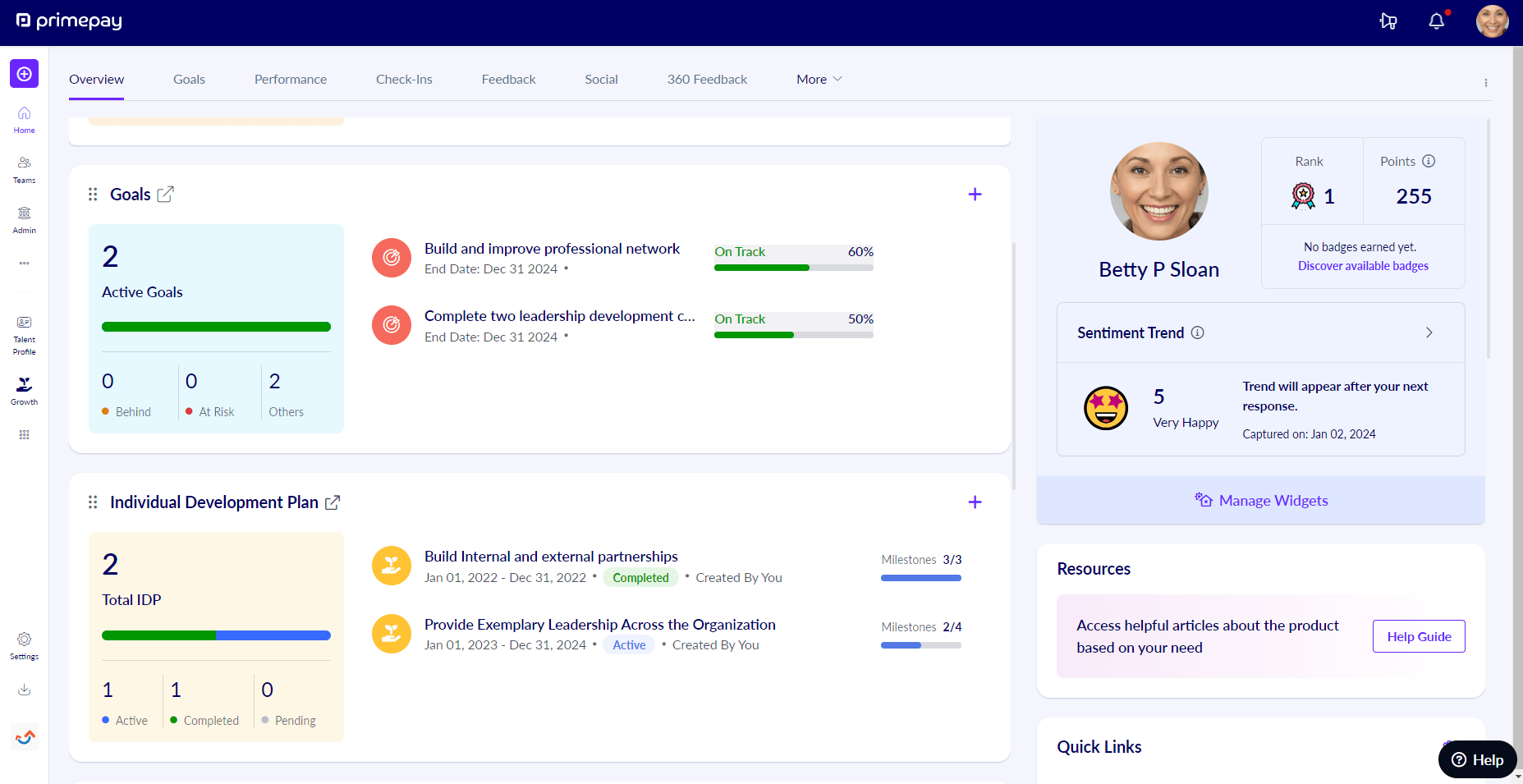

A drag-and-drop org chart lets you see how your succession plans impact various teams and reporting structures to reflect workforce planning and future company goals.

3. Plan for the Future of Your Budget

Leadership transitions can have major financial implications. According to SHRM, replacing an employee can be three to four times the positions salary – and that number only grows when financials and hiring plans aren’t solidified beforehand.

Therefore, without a clear budget strategy, companies risk costly hiring mistakes, training inefficiencies, and operational disruptions.

Why It Matters: Without a financial plan in place, companies may struggle to fund leadership transitions while maintaining business stability. Ankit Shah of Columbus State Community College explains, “When all of these professionals are meeting with potential candidates, screening applications, scheduling a few rounds of interviews, and making final decisions, it takes away time from accomplishing organizational goals/outcomes, which then certainly ties to ROI.”

How to Budget for Succession Planning

- Estimate transition costs: Consider expenses such as executive search firms, leadership training, onboarding, and temporary coverage.

- Invest in leadership development: Allocating funds for mentorship programs and professional development can reduce reliance on external hires. While the debate and nuance of internal vs. external hires will always be present, HBR shares some dramatic data: “in only 7.2% of instances will an outside CEO hire have a 60% chance of outperforming an insider, and in a mere 2.8% of cases will he or she have a 90% chance of outperforming an insider.”

- Leverage HCM technology for cost efficiency: An integrated Human Capital Management (HCM) system can unify workforce and financial data and help HR and Finance teams make strategic, budget-conscious decisions.

- Plan for compensation changes: Leadership changes often come with salary adjustments, incentives, and retention bonuses. Budgeting for these ensures smooth transitions.

Real-World Example

PrimePay uses its own HCM platform to reflect on past budgets and workforce needs to help plan for future scenarios. Suzanne Fohl, CFO, says: “By using our own platform daily, we benefit from its advanced integration capabilities, unifying people and financial data in a single system. This technology enables our HR and Finance teams to collaborate effectively, leveraging real-time insights to drive data-informed, strategic decisions that enhance organizational performance.”

Key Takeaway: Budgeting for leadership transitions is a financial necessity and strategic move that protects business continuity and long-term success.

4. Foster a Culture of Continuous Learning

Hiring top talent is critical, but you should also create internal programs that prioritize professional growth and skill-building. As a result, you’ll create a strong leadership pipeline and build a culture of continuous learning. With these assets in place, organizations can upskill and reskill employees to make leadership transitions smoother and more strategic.

It’s also important to remember that even the best-laid succession plans can be disrupted by sudden departures. A culture of continuous learning helps you better build an emergency succession strategy, which ensures your business can quickly adapt when key leaders leave unexpectedly.

Why It Matters: A LinkedIn Workplace Learning Report found that 94% of employees would stay at a company longer if it invested in their learning and development. Additionally, businesses that focus on upskilling and reskilling reduce hiring costs and improve retention rates, making leadership succession more seamless and cost-effective.

How to Build a Learning-Focused Culture

- Encourage upskilling and reskilling: Provide opportunities for employees to develop leadership skills, learn new technologies, and adapt to evolving organizational needs.

- Make the process transparent and inclusive: Communicate the company’s succession plans to employees, ensuring they understand growth opportunities and how to qualify for leadership roles. An added bonus? Your people will better understand how their job relates to the bigger picture, giving them a stronger sense of purpose.

- Plan with diversity in mind: Most leadership teams are still composed of white men, which can actually be a disservice to companies. Travis Osborne, VP of information technology at Apache Corporation, suggests organizations view succession planning as “an opportunity to find a new set of perspectives in leadership, not just a carbon copy of the person who held the position before.” He reasons that companies need to “freshen the perspective periodically” and hire people with other skill sets and views the leadership team doesn’t have.

- Cross-train employees: Ensure multiple people are familiar with critical job functions so no single departure cripples the company. Because you’re losing institutional knowledge as well as an employee, you don’t want everything they know walking out the door with them without additional documentation in place.

Real-World Example

Talent management firm CCI Consulting worked with a privately-held family of companies in the residential real estate sector to prepare the next generation of leaders. Recognizing the need for leadership development, CCI designed a High-Potential Leadership Development Program. The initiative led to a robust internal leadership pipeline, reduced the need for external hires, and strengthened the company’s culture.

Key Takeaway: Although professional development programs are an employee benefit, they’re also a strategic investment in the future of your company. Businesses that prioritize professional development retain top talent and build stronger leadership teams.

5. Test and Refine Succession Plans

Even the most well-thought-out succession plans need real-world testing. Conducting trial runs, temporary role transitions, or job rotations helps businesses assess leadership readiness and refine their strategy before a critical leadership change occurs.

But that familiarity goes both ways, says Laura Miller, CIO at Macy’s. She believes the leadership team also needs working relationships with potential successors to help build confidence in future transitions. She furthers, “When you’re trying to groom successors for your role, it’s not just about their growth and development. It’s also about giving them that exposure.”

Why It Matters: Actively testing your succession plans more likely ensures a successful leadership transition. Without testing, companies risk placing underprepared employees into key roles, leading to instability and performance declines.

How to Evaluate Leadership Preparedness

- Conduct trial leadership assignments: Allow high-potential employees to take on leadership responsibilities temporarily to gauge their readiness.

- Use job rotations to expand experience: Moving employees across departments broadens their skills and prepares them for leadership roles. Miller does this with her own team by inviting high-potential talent to observe and participate in decision-making. She explains: “It’s important to say, ‘I’ve got a couple of successors here, and I’d like to rotate them through so that they can understand what the job looks like. If you have a successor that you’re grooming, you’ve got to create those moments.”

- Implement acting or interim roles: When possible, appoint interim leaders before a permanent transition to assess fit and performance.

- Gather feedback and adjust: Regularly review succession test results and refine leadership development programs accordingly. It’s also smart to have different versions of your succession strategy to account for turnover and business shifts.

Real-World Example

Microsoft’s leadership transition from Steve Ballmer to Satya Nadella in 2014 was a prime example of succession planning best practices in action. Nadella had been with the company for over two decades, working in various leadership roles before being named CEO. His deep understanding of Microsoft’s vision and culture allowed for a smooth transition and an eventual company turnaround.

Key Takeaway: A succession plan is only as strong as its execution. Testing leadership readiness through trial runs and temporary assignments helps businesses identify gaps and refine their approach before making a permanent transition.

Preparing for the Future

Preparing for your organization’s future is hard, and it’s not just because it takes time and resources. “The end of an era” is often a difficult pill for current leaders to swallow. However, it’s clear that companies need plans to set them up for success.

These plans can (and should) be rolled out through intentional programming and succession planning tools to ensure clear communication and alignment with business strategy and finances. In short, by using the succession planning best practices above, you’ll be well on your way to carving a proactive and data-driven path for your company’s future.