Time & Attendance Software

PrimePay’s time and attendance software automates time tracking and payroll, enabling better staffing decisions and safeguarding compliance with labor laws.

It’s dinnertime, but you’re still hunched over your desk. You’re triple-checking your employees’ hours worked and computing rate rules … something you do before every payday. You’d much rather be running the business instead of being swamped with manual tasks, especially in cases where one error can create a domino effect of issues.

$11 billion in unworked time.

Buddy punching leads to roughly $11 billion in unworked time across the United States.

Wage theft affects 17% of low-wage employees.

Causing many families to fall below the poverty line.

Only 35% of once-per-week time punches are accurate.

Even those who clocked in daily were accurate only 66% of the time.

Time Tracking & Workforce Scheduling Just Got Easier

Mobile Employee Time Tracking

Get StartedAllow employees to input their own hours worked from any machine or mobile device.

- Mobile access for Payroll and Time & Attendance

- Designate time entry locations with geolocation and geofencing capabilities.

- Capture all employee hours worked across multiple locations and varying pay rates.

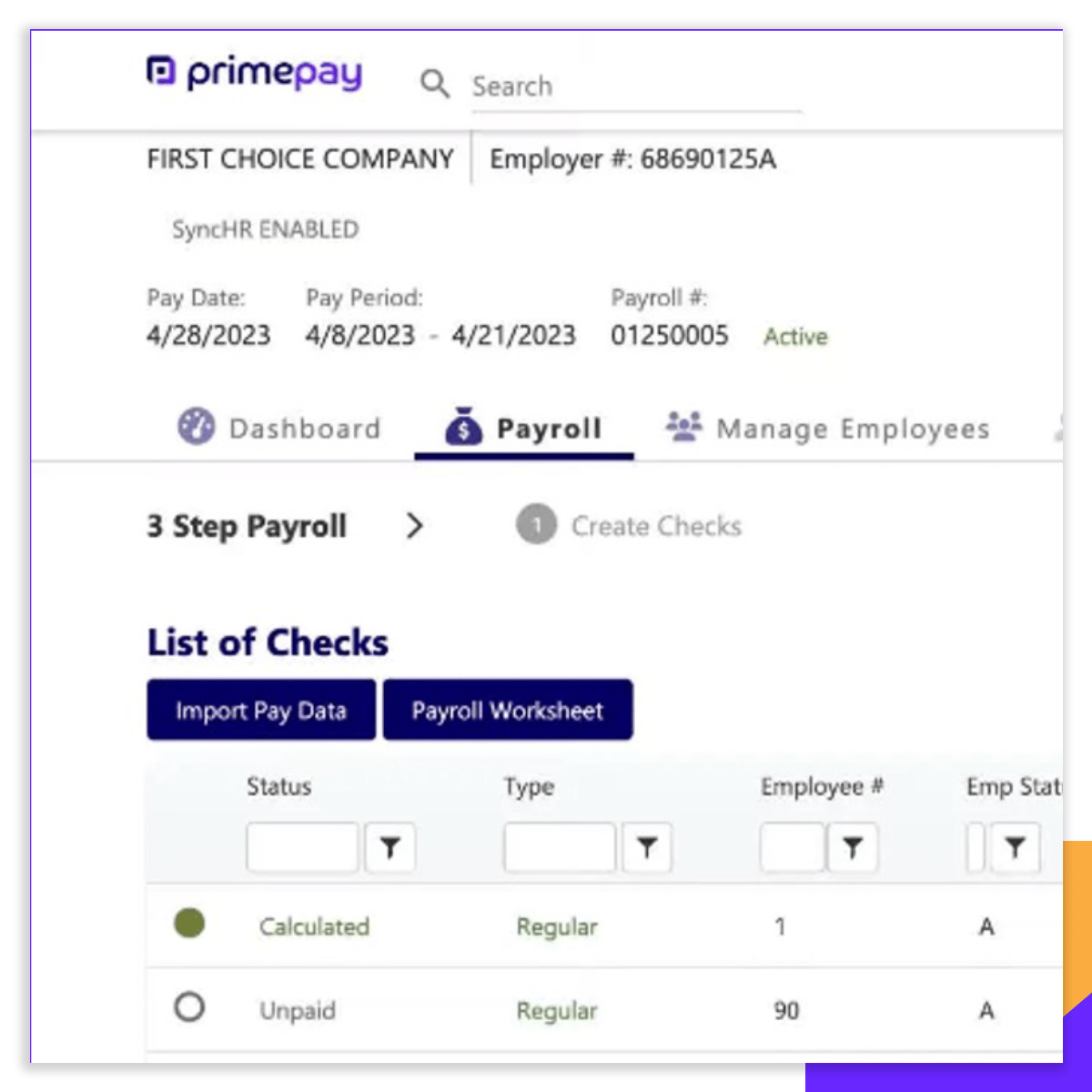

Optimize Payroll Efficiency with Automated Time Sync

Synchronized Payroll

Get StartedSync employee work hours directly with your payroll system. Integrate with payroll software to ensure accuracy, eliminate manual reconciliation, and reduce errors.

- Benefit from direct integration to PrimePay’s payroll software.

- Take action with notifications and automatic flags to exceptions that violate policies.

- Maintain compliance with employee classifications and overtime pay.

Real-Time Workforce Insights & Payroll Oversight

Manager Dashboard

Get StartedGain organization-wide visibility and insights for cost control and decision-making.

- Track and approve schedules and staffing.

- Monitor timecard statuses to prevent delays in payroll.

- Stay on top of absences, lateness, and accruals.

Dynamic PTO Management with Real-Time Adjustments

PTO Accrual Engine

Get StartedSet company PTO guidelines into motion with an engine that can easily create simple or complex calculations with the flexibility to make changes on the go.

- Configurable accruals based engine

- Balances & availability in real-time

- Supports unlimited Time-Off programs

Frequently Asked Questions

What is time and attendance software?

Time and attendance software is a digital solution that records employee hours, shifts, and leave, ensuring workforce compliance, payroll accuracy, and efficient labor management.

How does time and attendance software benefit businesses?

It minimizes errors, streamlines administrative tasks, and delivers in-depth reports to enhance team efficiency and productivity.

Can time and attendance software integrate with payroll systems?

Yes, our time and attendance software seamlessly connects with the PrimePay payroll system, simplifying wage calculations, minimizing errors, and ensuring on-time payments.