According to IRS estimates, one-third of organizations make at least one payroll error a year. The consequence isn’t just fixing mistakes (although you should do that, too). Payroll errors also lead to fines – $7 billion in 2021, to be exact.

It’s no wonder 40% of small business owners believe managing payroll and taxes is the worst part of owning their business.

Whether you’re a company of 10 or 10,000 employees, getting payroll right every time is critical. That means adhering to payroll best practices, such as developing a solid compensation plan, maintaining compliance, and paying people equitably.

Below are ten payroll tips to know so you can plan and manage payroll confidently.

10 Tips to Manage Payroll for Small Businesses

1. Put a Payroll Policy in Place

Want to avoid disorganized and inefficient processes? Start by putting a payroll policy in place. In short, a payroll policy serves as a single source of truth that payroll administrators can follow. Moreover, it provides preferred guidelines so your team can accomplish payroll tasks accurately and efficiently.

That last part – efficiency – is a game-changer when managing payroll. According to Score, a mentoring service for businesses, 63% of small business owners underestimate the time payroll takes. As a result, leaders must shift priorities and potentially miss other deadlines to file payroll on time. It’s no wonder 50% of owners think this process is frustrating.

Thus, when constructing your payroll policy, assess the process, time, and resources needed to draft your plan and pay your people each month.

Consider including the following:

- An outline of the payroll process

- Employee classification specifications

- Determining factors for salaries and wages

- Reporting obligations for employees

- Instructions and procedures for resolving payroll mistakes

- Levels of earnable vacation time

- Guidelines on how to calculate wages and promotions

2. Set a Payroll Budget

Payroll expenses shouldn’t be a surprise. Plan salaries, bonuses, and other payroll expenses accordingly so you have the proper financial runway needed to compensate employees.

Employers are also legally responsible for certain employment taxes, such as Social Security and Medicare. For example, employers must match the Social Security and Medicare deductions from an employee’s compensation, which amounts to 7.65% of gross pay and the employee’s salary or hourly wage. Payroll taxes vary by state, so it’s critical to consider this information when budgeting.

To ensure that the spending won’t harm the company’s finances, budget by calculating overall payroll costs as a proportion of revenue.

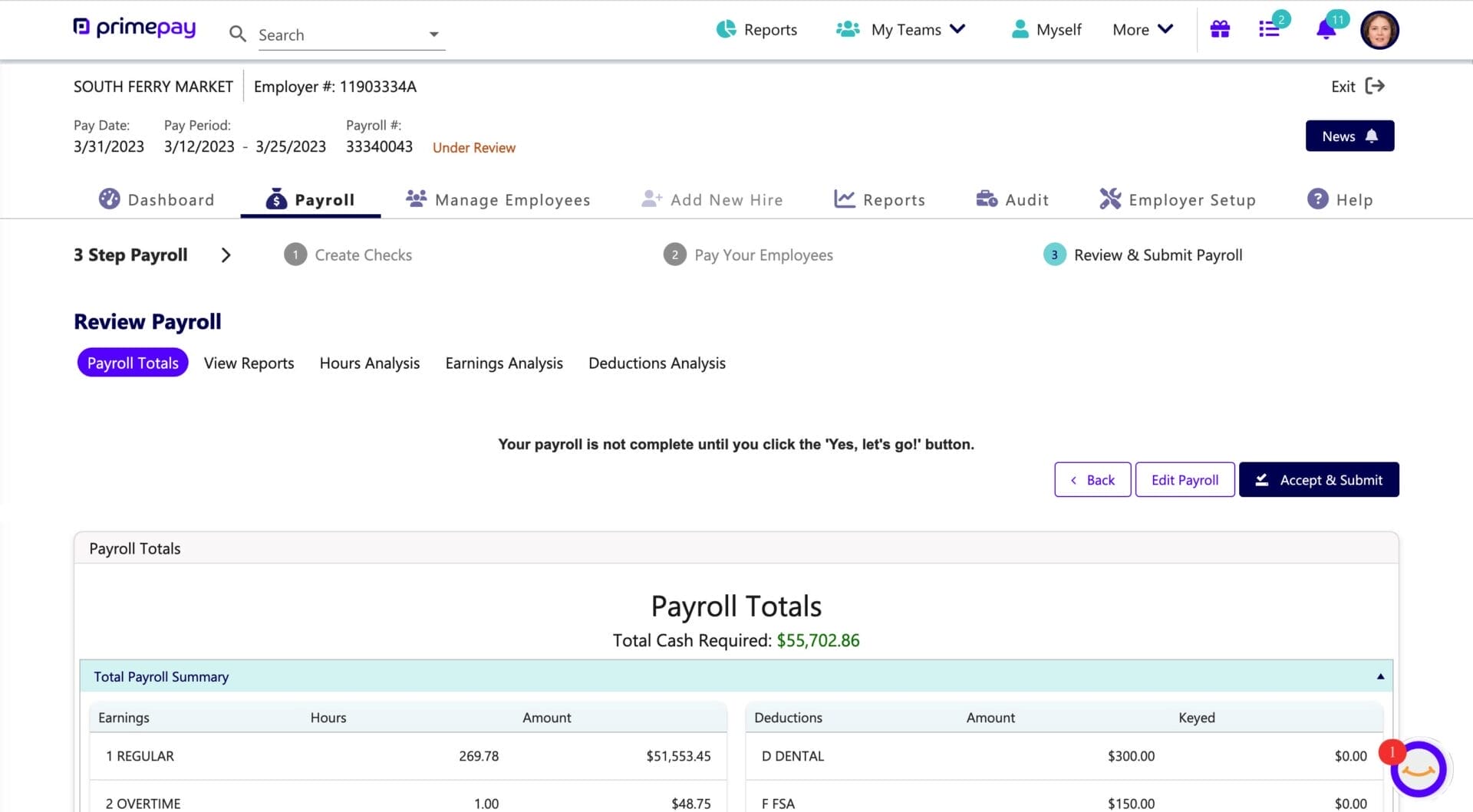

No more crunching numbers or using rough estimates – payroll software takes the guesswork out of payroll totals and deductions.

3. Accurately Categorize Employees

One crucial piece of payroll advice is to cross your t’s and dot your i’s. More specifically, you want to double (or triple) check everything, including accurately classifying your people.

Misclassifying people as employees or independent contractors is more common than you think. The Economic Policy Institute estimates that 10-20% of employers misclassify at least one employee.

Proper classifications are important since state and federal agencies use tax revenue (income, Social Security, Medicare, and unemployment taxes) to provide public services and benefits.

Once you’ve accurately classified workers as employees, you should further categorize them by hourly or salaried employment. From a legal standpoint, you’ll need to know that:

- Hourly employees are entitled to protection under the Fair Labor Standards Act (FLSA) and must receive overtime pay if they work more than 40 hours per week.

- Salaried employees may not be subject to FLSA overtime regulations.

4. Develop a Payroll Calendar

Establishing a consistent payroll schedule ensures timely payments and provides predictability for finance teams and employees. Creating and maintaining a payroll calendar will help finance teams better handle unforeseen events, minimize errors, and enhance employee satisfaction with the service provided.

One payroll tip (that may sound old-school) is to keep a visual calendar. Visual calendars help you better anticipate the ongoing monthly payroll process stages and encourage you to identify upcoming federal holidays for an altered holiday pay schedule.

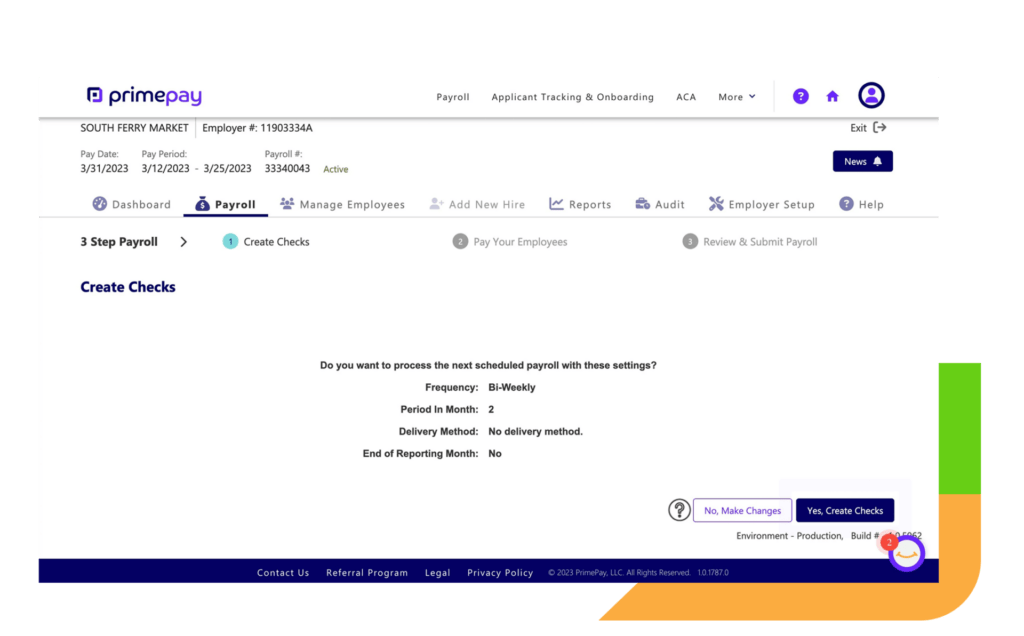

Payroll software with scheduling functionalities lets you channel your best late-night infomercial impression – just set it and forget it.

5. Educate Employees on Payroll Procedures

Another payroll best practice is to train and educate employees on payroll procedures. Finance teams should understand responsibilities and deadlines thoroughly and provide continuous training on the latest regulations, software updates, and payroll best practices.

Additionally, employees should know how to submit timesheets and update personal information. To mitigate frequent questions, make your payroll policy and supporting documents easily accessible. Consider:

- Discussing payroll procedures in All-Hands or Town Hall meetings so everyone receives the same information and message.

- Uploading documents to the company intranet or self-service portal for easy access at any time.

6. Maintain Proper Compliance

Payroll and compliance go hand in hand. Therefore, you must abide by all federal, state, and local laws regarding employee compensation.

Keep the agencies that regulate payroll laws – the Internal Revenue Service (IRS) and the Department of Labor (DOL) – top of mind and understand payroll laws and regulations.

Some payroll laws to consider are:

- Fair Labor Standards Act (FLSA)

- Federal Insurance Contributions Act (FICA)

- Federal Unemployment Tax Act (FUTA)

- Equal Pay Act (EPA)

- Workers’ Compensation

7. Conduct Regular Audits

When was the last time you audited your compensation strategy and payroll process? If it’s been more than 12 months, add it to your to-do list. Regular audits of employee classifications, tax withholdings, and benefit calculations help finance teams identify and rectify errors promptly.

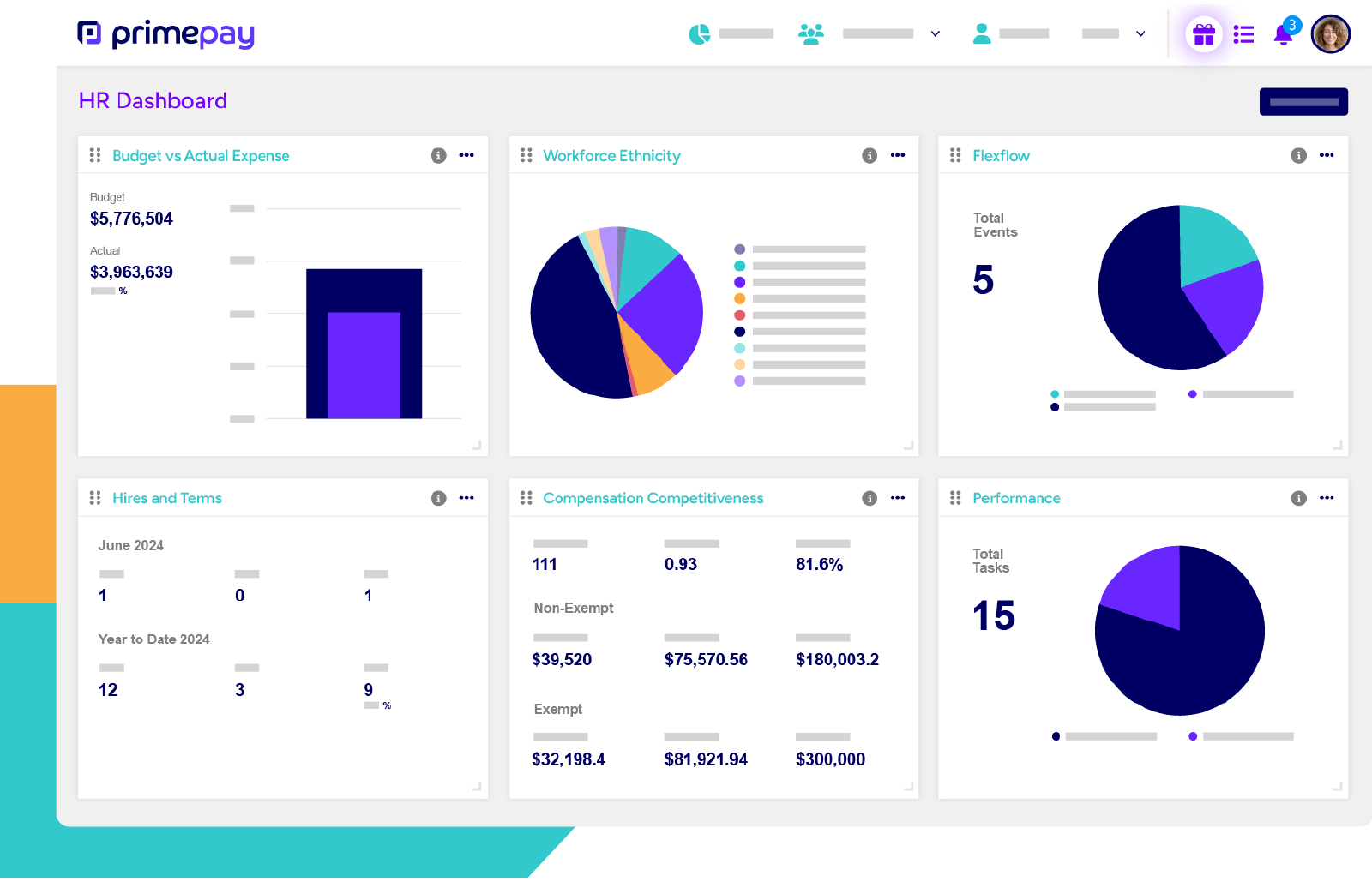

But in addition to auditing for accuracy, it’s essential to analyze your current compensation strategy. Run reports to spot any trends or opportunities for improvement. Are specific demographics receiving more promotions than others? Are new hires earning more than seasoned employees?

This payroll advice contributes to not only the company’s financial health but also its organizational health. Regular auditing practices help ensure fair and equitable compensation across teams, foster employee trust, and promote transparency.

8. Equip Employees With a Self-Service Portal

We’re all guilty of sending the “where does that information live, again?” email. And it makes sense, as the average company has 15-35 different tools in their HR tech stack.

One solution to the constant back-and-forth is to equip your people with an employee self-service portal. With one login, employees can access pay stubs, tax documents, PTO, time sheets, and other personal information.

With the right software, employees can access company resources, complete tax forms, enroll in direct deposit, and elect benefits, all in one place.

9. Prepare for Year-End Reporting

Plan for year-end reporting requirements, including W-2 and 1099 forms, to avoid last-minute hassles and prevent potential issues with tax authorities.

Besides adhering to government requirements, there’s another reason to prepare your year-end reports: sound decision-making. When you have a clear and precise financial picture of the business, you can accurately plan for headcount, bonuses, and other financial decisions that align with your strategic goals.

10. Invest in Reliable Payroll Software

You could spend five hours a month managing payroll, checking state and federal updates, chasing down missing information on time cards, and double-checking every data entry. But the better way is to invest in reliable software for payroll that handles payroll complexities so you don’t have to.

Payroll software automates calculating and distributing employee salaries, taxes, and other compensation-related activities. It also ensures accurate and timely employee payment while managing deductions, benefits, and tax compliance. These benefits aren’t just helpful for finance teams; they’re also critical for employees. Because 58% of people live paycheck-to-paycheck, they can’t afford to wait on fixed payroll errors.

If you’re in the market, consider payroll software that includes employee time management and HR capabilities. Why? Having connected time will remove the need for manual timesheet entry, which is prone to errors, and HR software centralizes all your data in one place so you can make the best decisions for your business and people.

Manage Payroll Like a Pro

The payroll best practices above aren’t just steps – they’re a roadmap to transform payroll processes from status quo to exemplary.

Embrace scalable solutions, empower employees with self-service portals, and stay proactive with regular audits and staff training.

By doing so, you’re not just managing payroll; you’re setting the stage for growth, fostering employee satisfaction, and ensuring your organization thrives in the long run.