There are many considerations when it comes to choosing the right payroll service for your business. You most likely want a process that isn’t time-consuming, is accurate, and helps you maintain compliance with federal, state, and local laws.

You also want to keep your company and employee information safe. However, according to a study by MoorePay, there’s been a 67% increase in a return to outdated payroll service solutions that use paper, telephone, or email input.

The issue?

These manual services make organizations susceptible to payroll scams, which are still on the rise (the FTC received roughly half a million reports of business and government scams in 2023, costing companies $1.1 billion).

That’s why choosing a solution is incredibly important—it needs to align with your budget and organizational needs and be safe and secure, as it involves highly sensitive information.

Because there’s much to consider when adopting a new service, we’ve broken down the different types and recommendations according to business size.

Types of Payroll Services

Businesses have several types of payroll service options. Which one is best will depend on their size, resources, and complexity. But we’ll be honest – there’s not a perfect payroll solution. Instead, each selection has benefits and drawbacks, and it’s up to you and your team to determine which is most appropriate for your business.

Let’s take a look at the most common types of payroll service solutions available today:

Manual In-House Payroll

This method involves handling payroll manually, often through spreadsheets or handwritten records. Employers are responsible for calculating wages, taxes, and deductions, ensuring they file everything correctly and on time.

The Rose: Manual in-house payroll can be cost-effective, especially for very small businesses with just a few employees. You maintain full control of the process, and there’s no need to invest in third-party software or services.

The Thorn: As your business grows, manual payroll becomes time-consuming and error-prone. You’ll need to keep up with tax law changes, which can be challenging if you’re not constantly reading up on the newest rules. As you likely know, tax filings or compliance mistakes can lead to costly penalties and fines.

Bookkeepers

Some small to medium-sized businesses outsource their payroll duties to a bookkeeper. Bookkeepers handle day-to-day financial tasks (including payroll), saving business owners precious time and reducing the risk of errors.

The Rose: Bookkeepers offer more expertise than manual in-house payroll, especially when it comes to organizing records, calculating payroll, and ensuring taxes are filed on time. It’s a relatively affordable option for small businesses and provides some peace of mind.

The Thorn: Bookkeepers may not have the deep payroll-specific knowledge needed for complex tax issues, benefits management, or compliance with multi-state regulations. As your business grows, you might find that a dedicated payroll service is more suited to your needs.

CPAs

Certified Public Accountants (CPAs) are often hired to manage payroll, particularly for businesses that combine payroll services with accounting and tax planning. CPAs are well-versed in tax regulations and can offer guidance on how payroll impacts overall financial strategy.

The Rose: CPAs bring a high level of expertise and can ensure compliance with tax laws. They’re particularly helpful for businesses with complex payroll needs, like multi-state operations or special tax requirements. Their ability to handle accounting and payroll as a unified service adds value.

The Thorn: Their services tend to come with a higher price tag, which might be a barrier for smaller businesses. CPAs are best suited for larger organizations or those with more complex financial needs that justify the cost.

PEO (Professional Employer Organization)

A PEO offers a more comprehensive solution, co-employing your staff and taking over the management of payroll, HR, benefits, and compliance. Essentially, the PEO becomes the employer of record while you focus on running your business.

The Rose: PEOs are ideal for businesses looking to outsource a wide range of HR functions, not just payroll. They handle everything from benefits management to compliance with employment laws, providing a one-stop solution that can save time and reduce risk.

The Thorn: When partnering with a PEO, you’re giving up a certain level of control. While they manage many day-to-day HR functions, businesses may have less flexibility in choosing vendors or implementing specific policies, which might not suit every company’s culture or operational style.

Payroll Software Providers

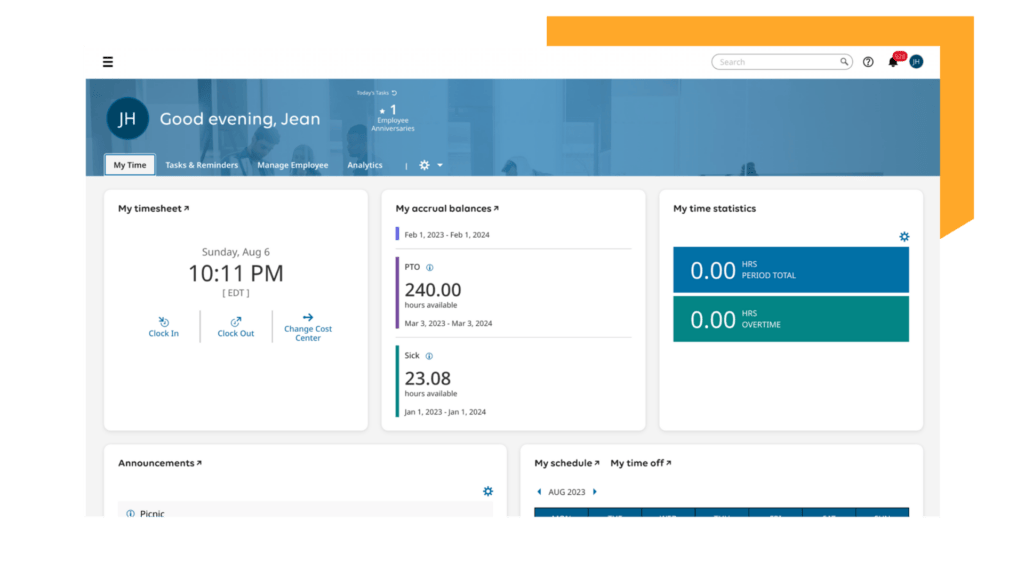

Payroll software providers offer a great balance for businesses wanting to streamline payroll while maintaining control. These platforms automate payroll calculations, tax filings, and direct deposits, reducing the risk of human error and ensuring compliance. Most payroll software is scalable, making them suitable for businesses of various sizes.

The Rose: Payroll software automates many time-consuming tasks, reducing the risk of errors while ensuring taxes and deductions are calculated accurately. These platforms often integrate with other HR tools like time tracking and benefits management. They also provide flexibility, offering control while automating routine tasks.

The Thorn: While payroll software providers are cost-effective, they still require some level of management. You’ll need your company’s personnel to oversee the process, input data, and ensure accuracy. Additionally, mistakes can still occur without expert oversight if the software isn’t set up or used correctly.

Payroll Companies

Payroll companies provide fully outsourced payroll solutions, managing everything from calculating wages and taxes to issuing payments and filing returns. This option takes payroll management completely off your plate, which can be a relief for business owners focused on growth.

The Rose: Payroll companies offer a hassle-free solution for managing payroll, ensuring everything is done accurately and on time. They handle tax filings and direct deposits and confirm compliance with federal, state, and local regulations. Outsourcing payroll to a company provides peace of mind for businesses looking to focus on their core operations.

The Thorn: A full payroll service comes with a higher cost, which may not be suitable for startups. Additionally, if the payroll company makes a mistake, it can reflect poorly on your business, even if you weren’t directly responsible.

How to Choose a Payroll Solution

According to a study by MoorePay, UK businesses reported 73% more frustrations with their payroll process in 2023 than in previous years, yet many are reluctant to switch providers due to the economic climate. Unfortunately, clunky or error-prone payroll processing can set finance teams up for failure, especially as the business grows and payroll needs become more complex.

Therefore, whether you manage a small team or oversee multiple locations, finding the right fit can save you time, reduce costly errors, and ensure compliance with tax regulations.

Here’s a breakdown of which payroll options might work best for small businesses, medium-sized companies, large organizations, and franchises.

Small Businesses

For small businesses, cost and simplicity are usually top priorities. Manual in-house payroll might be an option if you’re running a very small team, especially if your payroll needs are straightforward. However, errors and compliance issues can become more frequent as your business grows.

A better option for small businesses is a bookkeeper or payroll software provider. Bookkeepers can manage payroll alongside other financial tasks, while payroll software automates the process, offering affordability and convenience.

Medium-Sized Businesses

As businesses grow, so do their payroll needs. Medium-sized businesses usually need more robust solutions that ensure compliance with tax laws and reduce the administrative burden. CPAs can be a good fit for handling payroll while offering accounting and tax expertise.

Alternatively, payroll software providers are a scalable option for medium businesses. Software solutions can handle the increasing complexity of a larger workforce and multiple tax jurisdictions. Many payroll software platforms also integrate with HR and benefits systems, making managing payroll and employee needs easier in one place.

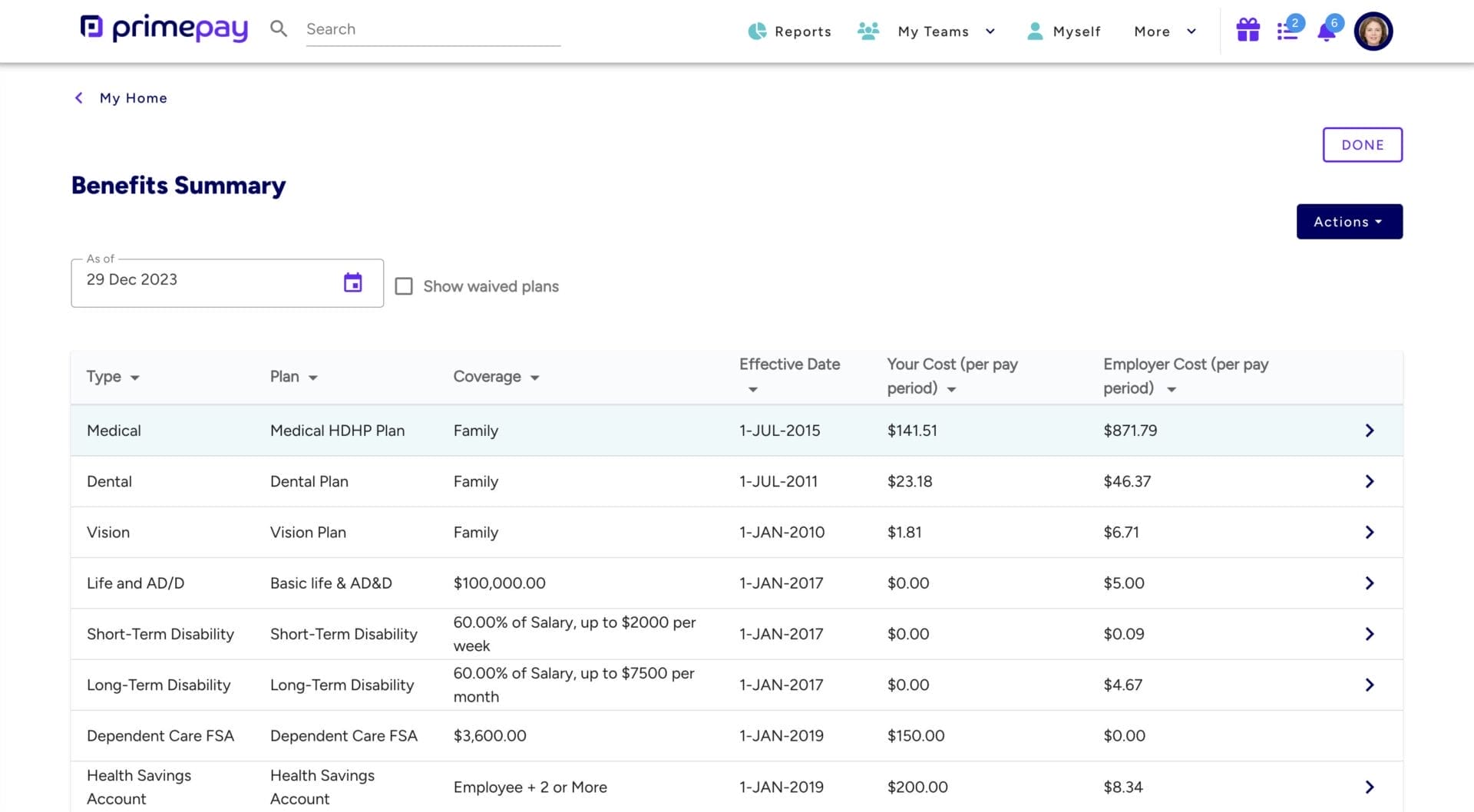

A system that integrates with benefits management increases enrollment accuracy and helps employees make changes easily, without assistance from HR teams.

Large Organizations

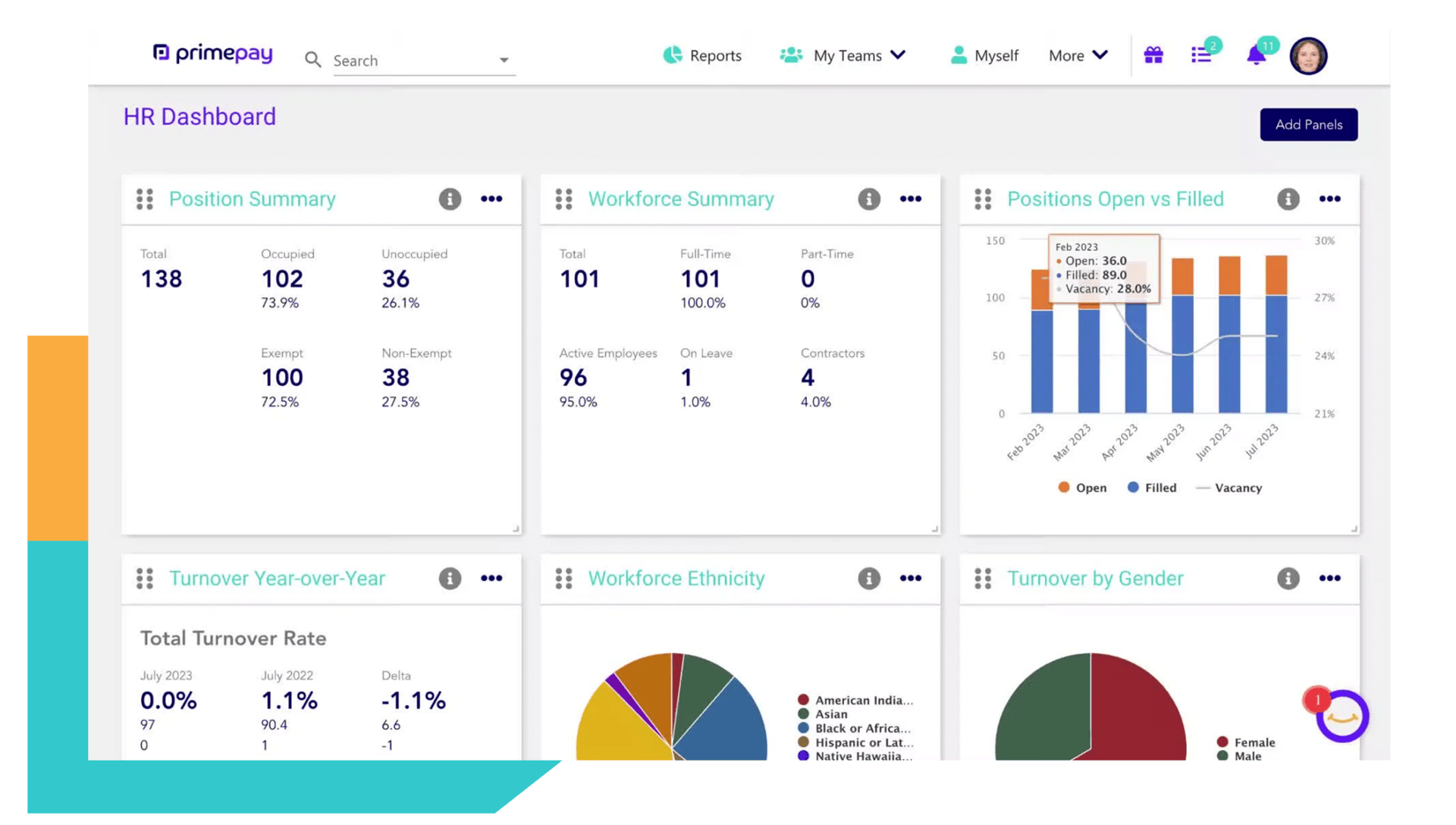

Larger businesses often face complex payroll needs, including multi-state tax filings, detailed reporting, and benefits administration. Payroll companies offer fully outsourced solutions, taking care of every aspect of payroll, from tax compliance to issuing payments. This allows larger organizations to focus on their core operations while ensuring payroll is handled smoothly.

Large organizations might opt for a PEO for even more comprehensive HR support. By partnering with a PEO, businesses gain access to a full suite of HR, payroll, and benefits management services, helping them streamline operations and stay compliant with employment laws.

When your payroll and HR software integrate seamlessly, your data is centralized, and you gain deeper insights into your workforce.

Franchises

Franchises have unique needs, especially when it comes to managing payroll across multiple locations. PEOs are often a great choice for franchises, as they can provide consistent payroll and HR services across the entire organization – confirming that all franchise locations remain compliant with payroll and tax laws, regardless of location.

Another option for franchises is payroll companies, which can handle multi-location payroll, offer detailed reporting, and ensure compliance with local and federal regulations. These complete payroll solutions for franchisors are perfect for those that want to centralize payroll while allowing franchisees to focus on business operations.

Chose the Right Solution for Your Current and Future Needs

While it’s not hard to switch your payroll provider, it’s also not a walk in the park, meaning you don’t want to do it every year as your business grows. Instead, forecast your budget, headcount, and overall expansion to ensure the payroll service you choose now will also be compatible with your needs down the road.

Your best bet is to adopt a solution that grows with your needs and integrates payroll, HR, and compliance so checks and taxes are right, HR processes are fast and simple, and employees and candidates feel connected.