The Affordable Care Act (ACA) raises compliance questions for many organizations. One common question is regarding IRS Forms 1094 and 1095.

Companies file both Form 1094 and 1095 to record the employer-provided health insurance coverage.

As a reminder, the ACA requires applicable large employers (ALEs) – companies with 50+ full-time employees or full-time equivalents – to offer employees health care coverage.

Providing health care isn’t mandated if you’re a smaller company, but remember that offering it is a huge perk that helps recruit and retain employees. In fact, 64% of people say benefits is their number one priority when searching for a job.

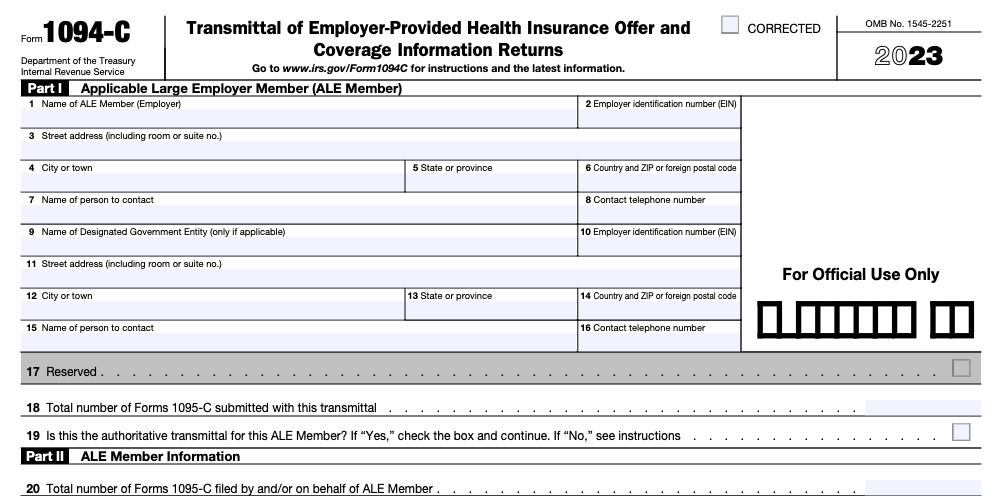

Form 1094

Purpose: This reporting form informs the IRS about the employer’s health insurance coverage.

Deadline: Per the IRS, you must file the paper version of Form 1094-C by February 28 and March 31 if filing electronically. As with all tax documents, you’ll file information about the previous calendar year (so in 2025, you’ll file the information for the year 2024).

1094-B vs. 1094-C: Filing Form 1094-C is a requirement for ALEs. There’s also another 1094 Form (confusing, we know) called 1094-B. This form is submitted no matter your company size if you provide fully insured health coverage, but it’s completed and submitted by your provider.

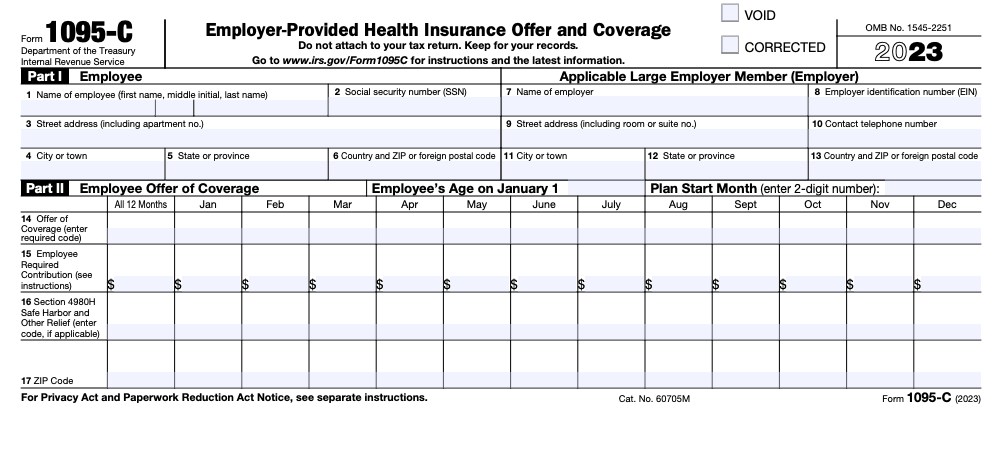

Form 1095

Purpose: Form 1095 informs the IRS and covered employees about employee eligibility for tax credits.

Deadline: Similar to Form 1094, ALEs must file Form 1095 on or before February 28 if filing on paper and March 31 if filing electronically.

1095-B vs. 1095-C: If you provide fully insured health coverage to your employees, no matter the size of your business, your insurance carrier will complete 1095-B. ALEs are required to file Form 1095-C. If you’re an ALE, your enrolled employees will receive Forms 1095-B and 1095-C.

Additional Resources

Interested in learning more about the Affordable Care Act (ACA)?

More information is available at IRS.gov. See below links to the IRS reporting instructions for forms filed in 2024 reporting coverage provided in calendar year 2023:

How PrimePay Helps Ensure Compliance

Employer mandate compliance is confusing. Luckily, PrimePay helps simplify it. Our ACA Compliance Navigator solution helps with variable-hour employees, filing and providing IRS Forms 1094/1095, and giving penalty exposure warnings, checklists, and more. And because the ACA Compliance Navigator is synced with your payroll, there’s no chance of manual errors and missed deadlines.