File W-2c and W-3c forms. Amend employee tax returns. Phone legal counsel. Investigate tax evasion and identity theft.

These are just some of the steps you must take when employees use fake social security numbers (SNNs).

While none of those actions sound pleasant, the kicker is that they also happen at a very busy time of year: when you’re running year-end payroll.

It’s therefore crucial to verify your employees’ SSNs during the hiring process (or throughout the year) to ensure you’re not adding extra stress and work to your plate.

How Social Security Numbers are Issued

The Social Security Administration (SSA) began assigning the nine-digit SSN in 1936 to track worker earnings over their lifetimes and pay benefits.

The SSN has always comprised of a three-digit number followed by a two-digit number and ending with a four-digit number. An example of a social security number is 123-45-6789.

SSN randomization is the method that the SSA implemented in 2011 that prevents them from running out of SSNs and helps protect against identity theft. On a W-2, the SSA uses the SSN, plus the first seven characters of an employee’s last name to post Social Security wages and Social Security tips to his/her earnings record.

As of 2011, the SSA:

- No longer issues SSNs based on geography.

- Issues SSNs beginning with the number 8 which had never been done before.

- Includes all possible SSNs with the number ‘7’ in position 1, rather than reserving SSNs starting with ‘t’ for certain states and groups.

Even with SSN randomization, some aspects of SSN assignment won’t change. A few examples include:

How to Identify a Fake SSN

An invalid or fake SSN is one that the SSA never assigned. Below are examples of number combinations you will never see in a valid social security number.

- The SSN number 123-45-6789.

- SSNs having 000 or 666 as the first three digits.

- Social security numbers will never begin with the number 9.

- SSNs equal to or greater than 773 as the first three digits.

- SSNs having 00 as the fourth and fifth digits.

- SSNs having 0000 as the last four digits.

How to Verify a Social Security Number is Valid

For some background, businesses must send Copy A of Form W-2 to the SSA. The SSA then matches the employee’s name and SSN against its database. Once matched, the earnings information from the W-2 is recorded with the employee’s earnings history.

If the names and numbers don’t match …well, you can just imagine the headache for the employer and employee. Below are three tips to catch any errors or unauthorized numbers to help ensure a seamless filing process.

1. Verify Names

You’d think verifying names would be simple, but you’d be surprised how many misspellings, nicknames, and unnecessary titles end up on W-2 filings. If you’re manually filling out forms, enter the name on the W-2 as shown precisely on the employee’s Social Security card.

If you want to reduce the HR lift, mandate that employees verify their names and SSNs before you close out your books to prepare W-2s.

Note: If an employee changes their name mid-year, continue to use their old name and have them contact SSA to update their card. Using the new name before the employee updates his or her records may prevent the SSA from posting earnings to the employee’s earnings history.

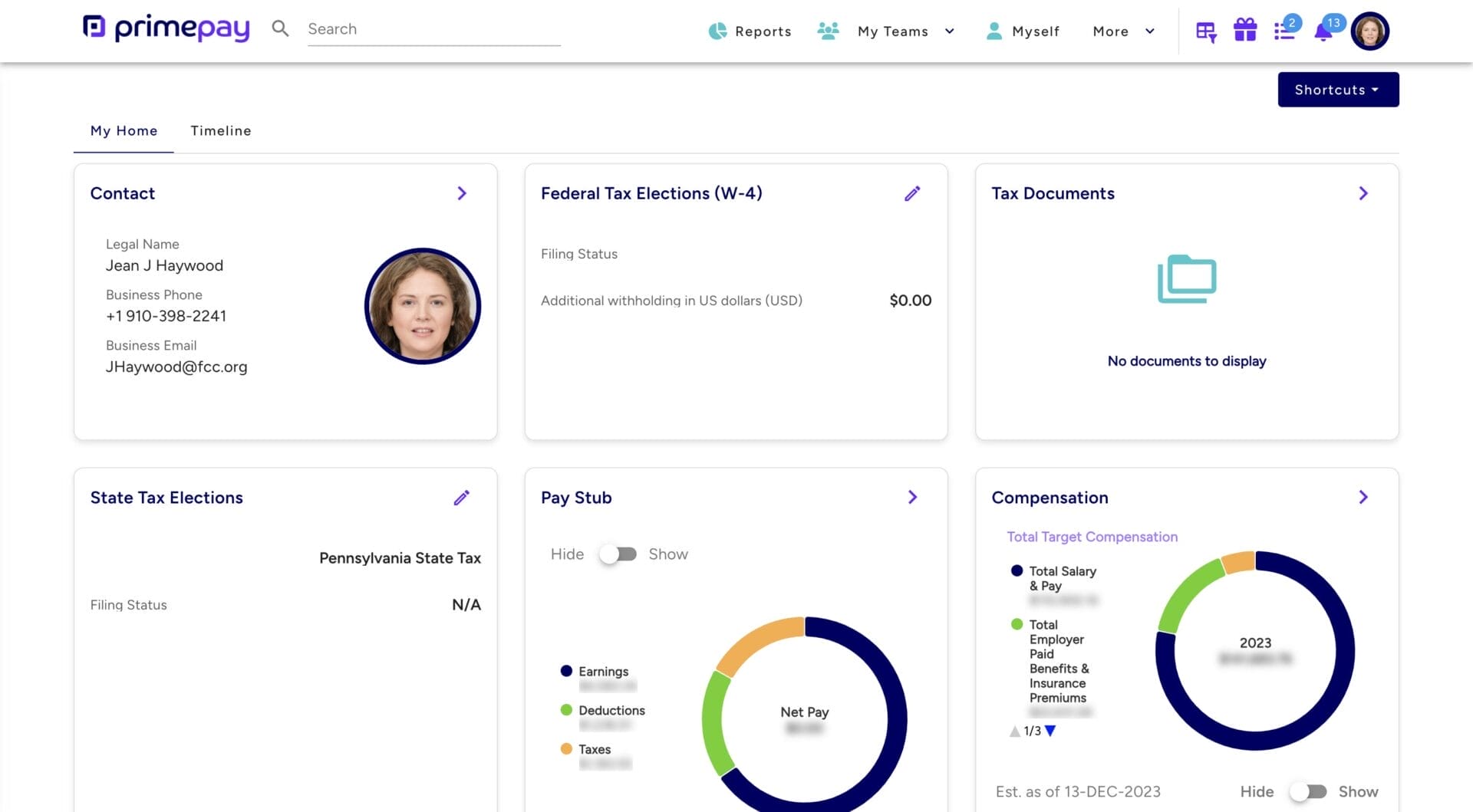

Employees can verify their own tax information through a self-service portal, which will improve the efficiency of tax preparation and filing.

2. Use Free Online Resources

There are a few options to verify Social Security numbers for wage reporting purposes.

- The Social Security Number Verification Service is a free online service that allows registered users to verify that the names and SSNs of hired employees match Social Security’s records.

- The Consent-Based Social Security Number Verification Service is available to enrolled private companies and state and local agencies for a fee and provides instant automated verification. It can also handle large volume requests.

- E-Verify is a free online system operated by the Department of Homeland Security in partnership with the SSA. It allows employers to electronically verify that their new hires are authorized to work in the U.S. by comparing details on Form I-9 with Federal government databases. (Unlike the first two, this process validates that your new hire is legally eligible to work in the U.S.)

3. Look to Your Payroll Software

Your payroll software provider may automatically verify employee SSNs – either during onboarding, before filing season, or both. By cross-referencing employee information with official databases, payroll software helps organizations maintain compliance with regulations, reduce errors in payroll processing, and prevent fraudulent activity … all without the employer lifting a finger.

Ensure You Are Reporting correct SSNs

The IRS suggests the following tips to ensure you’re reporting correct SSNs.

- Ask each employer to show you his/her Social Security card during the hiring process. However, don’t require the card when the employee complete Form I-9.

- Maintain a copy of the Form W-4 your employees provide. Document any subsequent solicitations for a new form if you receive notification from the SSA or IRS that there is a problem with a form.

- Maintain accurate records of all SSNs and employee names in all payroll records.

- Remind employees to report any name changes due to marriage, divorce, etc. to the SSA first and then to you (the employer). These changes can be made using Form SS-5 or other electronic SSN card application).

- Validate the SSN on the Form W-4 using the SSA’s SSN Verification Service. Referred to as the *SSNVS, this free digital system allows an employer to easily identify potential discrepancies to avoid penalties. Visit the SSNVS by clicking here. When you use this resource, you’ll be asked to provide the following information about yourself and your company: name, SSN, date of birth, type of employer EIN, company name, company address, company phone number, email address.

- Have your employees verify the accuracy of their names and SSNs when they receive their Forms W-2. Review it for typos or other possible glitches that could’ve occurred in the system.

What to do if a Social Security number is wrong on a W-2

Mistakes do happen. We can all understand that. Luckily, you can correct a W-2 before it’s too late.

If you reported an employee’s name or SSN correctly on a previous form, but the name or SSN is incorrect this year, complete Form W-2c through box ‘i’. Form W-2c cannot be used to add information if the error is a missing employee name or SSN. In that case, you must contact the SSA directly.

If you sent the incorrect Form W-2 to the employee (but you haven’t sent to the SSA), simply check Void on Copy A. Make a new Form W-2 with the correct information and write CORRECTED on the employee copies. The version you send to the SSA should not have CORRECTED written on it, however.

You’ll want to check out the IRS’ Publication 15 (Circular E, Employer’s Tax Guide) for thorough instructions for recording employees’ names and SSNs.

Penalties for incorrect filing

According to the IRS, if you fail to file a correct Form W-2 by the due date and cannot show reasonable cause – you may be subject to a penalty.

Here’s when the penalty would apply to you:

- Failure to file timely.

- Failure to include all information required on a Form W-2.

- Including incorrect information on Form W-2.

- Filing on paper forms when required to e-file.

- Reporting an incorrect TIN (taxpayer identification number, which would include an SSN).

- Failure to report a TIN.

- Failure to file paper Forms W-2 that are machine readable.

As a final note, it’s crucial to remember that accurate SSNs are important not only for year-end processes but also for maintaining compliance and safeguarding sensitive information within your organization.

Conduct regular audits and thorough documentation practices to reinforce compliance efforts and promptly identify and address any issues related to invalid or fraudulent SSNs. Ultimately, doing so will protect your organization against potential liabilities and uphold the integrity of its data management practices.

Now on to some fun facts about social security numbers.

Who created Social Security numbers?

The Social Security Board did not have field offices in late 1936, so it contracted with the U.S. Postal Service to distribute and assign the first batch of SSNs. Of the 45,000 local post offices around the country, 1,074 of them were also designated ‘typing centers’ where the cards were prepared.

According to the SSA, the procedure for issuing the first SSNs worked like this: The post offices were to distribute SS-4 application forms to employers. The forms would have employers indicate how many employees they had on staff.

Then, using that data, the post offices supplied a SS-5 form to each employee (which the assignment of an SSN was based). Once the forms were complete, they were returned to the post office where an SSN would be assigned. The SSA’s records indicate that the first SSN was issued mid-November of 1936.

Who received the first official Social Security number?

Master records were created in Baltimore in December of 1936. The first block of 1,000 records were assembled into a large stack. When the man in charge of accounting was ready to process this stack, he pulled off the top record and declared it to be the first official Social Security record. So, it’s not exactly the first SSN, as it’s impossible to identify the first card actually typed in those typing centers, but still a cool fact nonetheless.

That first record? It belonged to John D. Sweeney, Jr. – age 23 at the time – of New Rochelle, New York. Turns out, he was the son of a wealthy factory owner and was working as a shipping clerk for his father when he filled out his application for a Social Security card. The SSA even has his photograph posted online!

Who designed the Social Security Card?

That little piece of paper that we’ve all come to recognize was designed by Fred Happel of Albany, NY back in 1936. Happel famously designed the ‘Flying Tigers’ logo used by General Chennault’s forces during World War II. He was paid just $60 for his work on the Social Security card.

The SSA has loads of interesting stories regarding SSNs right here on their history page.