It’s clear that payroll delays significantly impact employee satisfaction and retention: nearly half of U.S. employees say they’d look for a new job after just two payroll errors.

But late payroll goes beyond decreased employee morale. It also can disrupt people’s financial stability, as 87 million Americans live paycheck to paycheck. Delayed or inaccurate payroll can lead to late mortgages and credit card payments, creating a negative domino effect that can take years to rectify.

For businesses, the effects of payroll delays—like interrupted cash flow and compliance issues—can be similarly severe.

Below we explore common reasons for payroll delays, provide actionable tips for running payroll more efficiently, and discuss how to measure payroll delays, so you can identify areas for improvement and ensure your payroll process remains smooth and reliable.

Common Reasons for Payroll Delays

Payroll delays can create serious stress for both employers and employees. Understanding the root causes of these delays is crucial for any business aiming to maintain a smooth payroll process.

Below are some common reasons for payroll delays:

- Data entry errors: Mistakes entering employee hours, incorrect tax information, or inaccuracies in benefit deductions can lead to processing delays. Even minor errors require time-consuming corrections and can push payroll timelines back.

- Last-minute changes: Adjustments like overtime, bonuses, or new hires processed too close to the payroll deadline can overwhelm payroll staff. These last-minute changes often require additional approvals or recalculations, leading to delays.

- Compliance issues: Ensuring payroll complies with federal, state, and local tax regulations can be complex, especially when laws change. Failure in compliance can result in delays as payroll teams work to correct potential errors or misunderstandings.

- System downtime: Technical issues such as system outages or glitches can halt payroll processing.

- Incomplete or missing documentation: Missing employee information, such as updated direct deposit details or tax withholding forms, can stall payroll.

- Inadequate payroll staffing: An understaffed payroll department can need help to keep up with processing demands, particularly during busy periods like year-end. Without sufficient personnel, even routine payroll tasks can become bottlenecks.

- Manual processes: Companies relying on manual payroll are more prone to delays. Manual calculations and paper-based systems are time-intensive and more likely to introduce errors, further delaying payroll completion.

How to Run Payroll More Efficiently

In an ideal world, your payroll would run smoothly every single time. No delays, no mistakes, no up-all-night-crunching-numbers scenarios.

Luckily, there are actions you can take to better ensure accurate and efficient payroll, including automating processes, auditing systems, and implementing an ESS.

Automate Payroll Processes

One of the best decisions you can make is automating your payroll processes. Shockingly, 34% of businesses still use paper for payroll, which is not only an inefficient system, but also opens companies up to human error and security issues.

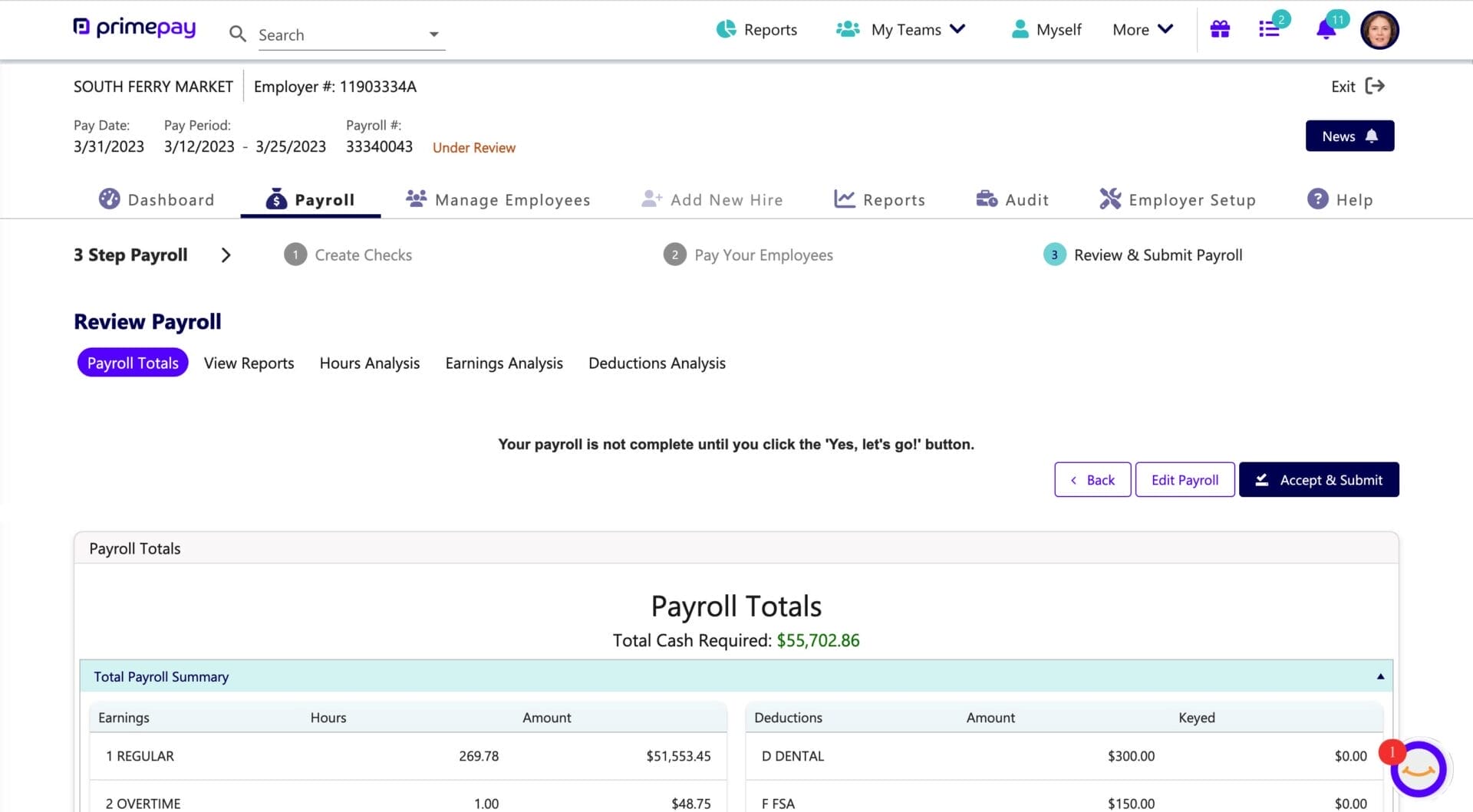

Alternatively, payroll software offers real-time access to payroll data and can handle everything from tax calculations to direct deposits. The right system allows you to update payroll information instantly, reducing the likelihood of delays caused by outdated or missing data. In fact, G2 reports that businesses using payroll software see 31% fewer errors, which is why this strategy earns top spot on our list.

If you’re looking for a payroll solution, we’d love for you to consider PrimePay (no shock there). But don’t just take the recommendation from us. Mia P. says: “Payroll is a breeze with PrimePay, and setting up new employees is quick and easy. Employees can easily access all their payroll information. PrimePay makes tax season easier by sending out 1099s and creating tax packages containing all the necessary information.”

Choose a payroll solution that integrates with your time clock and HR reporting to gain a holistic view of your company and people.

Regularly Audit Payroll Systems

Conducting regular audits of payroll processes is a critical step in maintaining the efficiency and accuracy of your payroll operations. These audits serve multiple purposes, including identifying inefficiencies, ensuring compliance with tax regulations, and uncovering areas for improvement.

Audits also help:

- Verify adherence to internal policies and procedures.

- Catch errors such as incorrect employee classifications, inaccurate tax withholdings, and unauthorized overtime payments.

- Provide an opportunity to assess the effectiveness of payroll software and systems.

- Enhance data security.

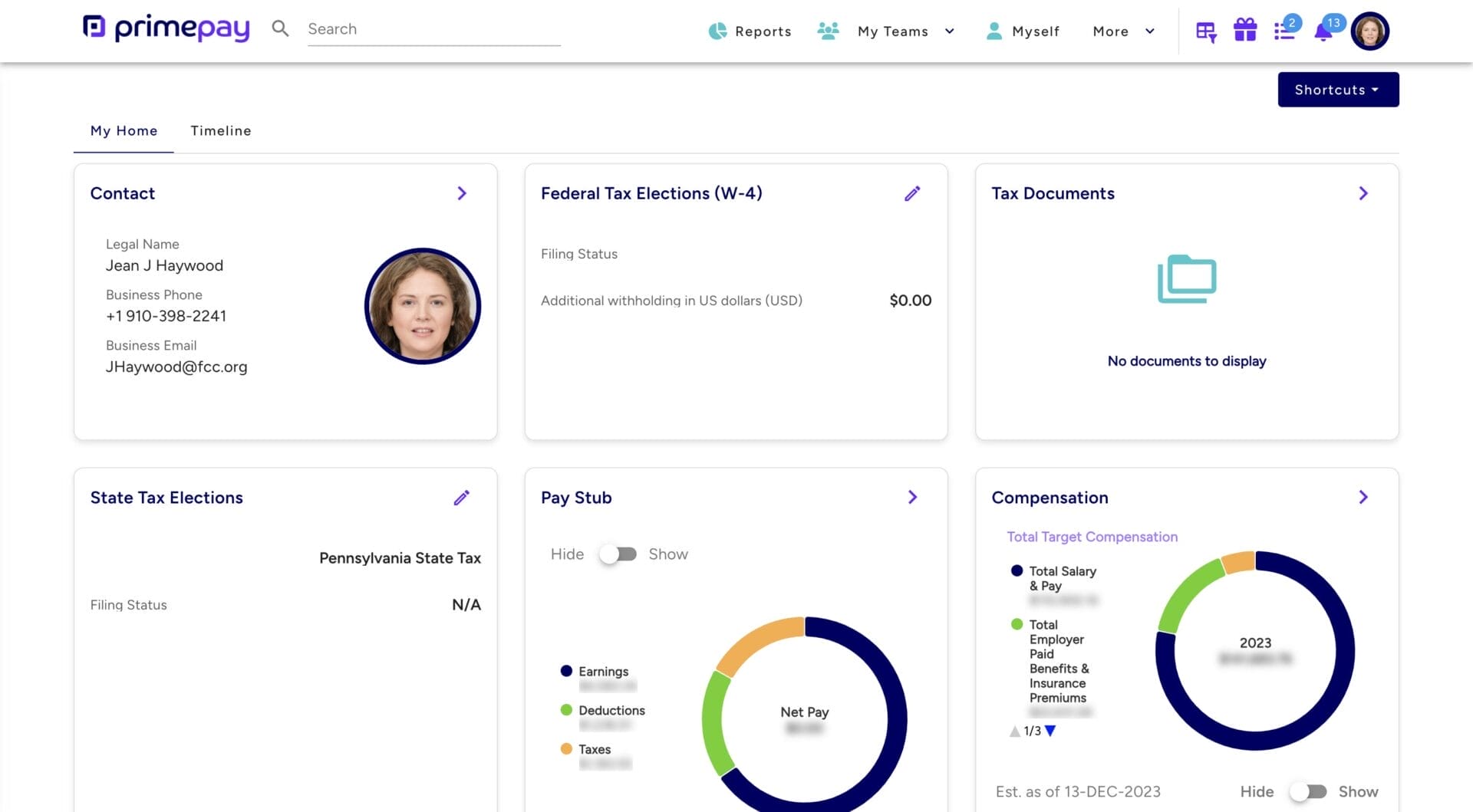

Encourage Employee Self-Service

Did you know that over one-third of businesses still don’t use employee self-service (ESS)? That means that employees must contact HR or Finance teams to update employee information, view pay stubs, and manage tax withholdings. Talk about inefficient.

If your company isn’t already using an ESS, it’s time to adopt one. Besides encouraging employees to manage their own information and elections, you can use an ESS as part of your onboarding process so new hires have a smooth transition into your organization and receive accurate pay their first paycheck.

Have them:

- Access company resources

- Complete tax forms

- Sign employee agreements

- Input tax withholding preference

- Enroll in benefits

Employees can use an ESS to manage their employee information, PTO, benefits selections, and more for increased payroll accuracy.

Measuring Payroll Efficiency

Understanding and measuring payroll delays is vital for identifying areas that need improvement. By tracking specific metrics and analyzing the root causes of delays, businesses can take actionable steps to enhance their payroll processes.

Here’s how to effectively measure payroll delays:

- Track payroll processing time: One of the most direct ways to measure payroll delays is by tracking the time it takes to process payroll from start to finish (including time required to gather employee data, calculate wages, and disburse payments). Comparing this time across pay periods can highlight trends and pinpoint bottlenecks.

- Analyze error rates: Errors in payroll processing, such as incorrect deductions or miscalculations, often lead to delays. Tracking the error rate can help identify recurring issues that must be addressed. Reducing errors not only minimizes delays but also enhances the accuracy and reliability of payroll.

- Survey employee satisfaction: Employee satisfaction with payroll processes can provide valuable insights into potential delays. Regularly surveying employees about their experience with payroll—whether they receive payments on time, if they encounter errors, and how easy it is to access payroll information—can help identify problems that might not be immediately apparent through metrics alone.

- Evaluate time to resolve payroll issues: A longer resolution time can indicate underlying problems in the payroll system or staffing issues. By tracking this metric, businesses can improve their response times and reduce the impact of delays on employees.

- Benchmark against industry standards: Comparing your payroll metrics against industry benchmarks can provide a clearer picture of where your processes stand. Industry benchmarks can vary, but companies should aim to meet or exceed these standards to ensure their payroll processes are competitive and efficient.

Create a Smooth Process

Payroll processing is integral to any business, but it doesn’t have to be a headache. By understanding the payroll processing process and the common reasons for delays, you can take steps to improve efficiency and reduce the likelihood of issues. Not only will you increase accuracy and optimize your processes, but you’ll foster a sense of security among employees that will help drive retention and productivity.