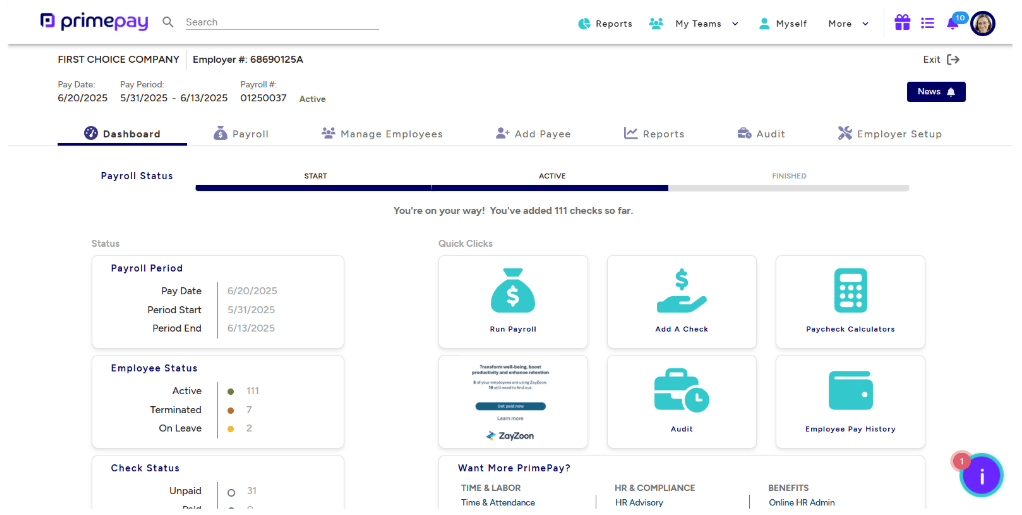

On Demand Pay

Boost Retention with Pay Flexibility

Today’s employees want more control over how and when they get paid. With PrimePay’s On-Demand Pay feature, they can access earned wages anytime—no more waiting for payday. It’s a simple, no-cost way to boost retention, attract talent, and reduce payroll friction.

HR teams are constantly fielding last-minute pay advance requests, handling paper check logistics, and calming employees stressed about their finances. Each exception adds more manual work, more questions, and more pressure to an already overloaded payroll cycle. Even small disruptions—like one missed check or timing issue—can ripple across the team and stall your day.

79%

Of workers are willing to switch to an employer that offers On-Demand Pay.

29%

Employers offering On-Demand Pay report a 29% reduction in turnover.

$4-$20

Each paper check costs a business between $4 and $20 on average.

Flexible Access to Earned Wages

Give employees the ability to access a portion of their earned wages when they need it most.

- Access up to 50% of earned wages before payday

- Send funds to a bank account, Venmo, or prepaid Visa® card

- Choose from multiple free or low‑cost payout options 24/7

Hero Heading: Employee-Friendly Payout Options

Offer a range of convenient and value-added methods for employees to receive their pay.

- Redeem instant gift cards with bonus spending power

- Earn a 5% bonus on withdrawn wages with the ZayZoon Gas Card

- Provide unbanked employees with a reloadable Visa® Prepaid Card

Built-In Support Tools for Daily Life

Help employees stretch their paychecks and reduce financial stress with everyday tools.

- Obtain a free CleverRX prescription discount card for medications

- Find lower rates using the Auto Insurance Shopping Tool

- Use the service without credit checks or paperwork

What Our Clients Say About Us

We looked at other systems but the flexibility PrimePay offered — and the user-friendliness — made it the obvious choice,...

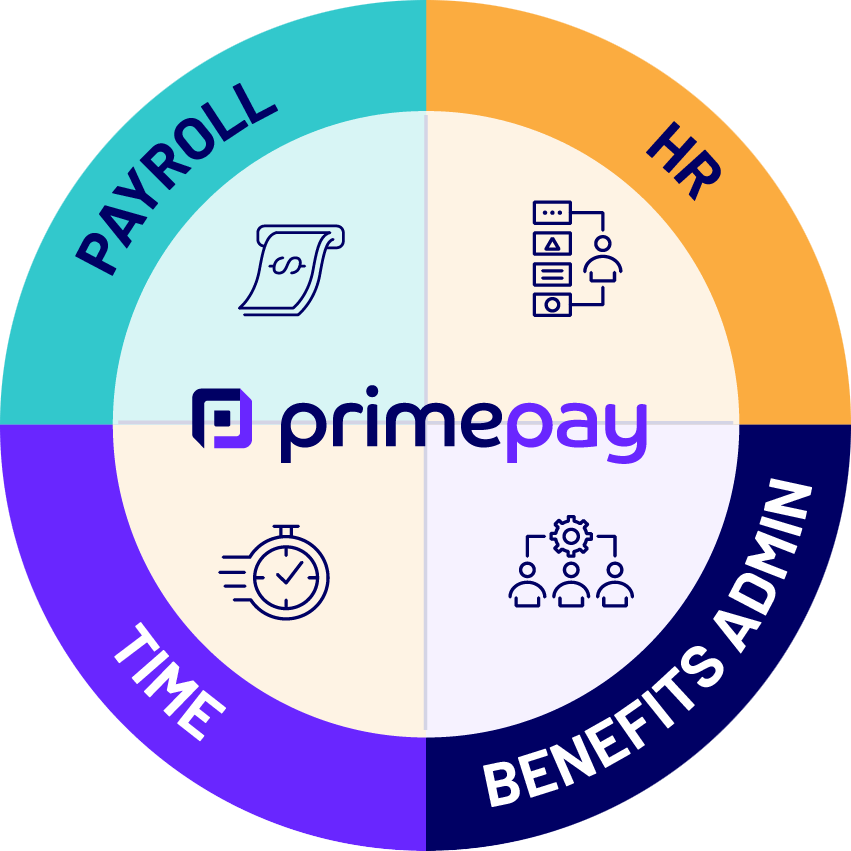

Payroll

Automated, compliant payroll that streamlines tax filing, worker’s comp, and employee self-service.

Learn About Our Payroll SoftwareHR & Onboarding

Patented, position-based system that modernizes processes & data, self-service, and workforce planning.

Learn More About Our HR SoftwareTime & Attendance

Payroll-connected tracking that manages time off, holidays, accruals, absences, and scheduling.

See Our Time Functionality in ActionBenefits Administration

Self-guided benefits enrollment that connects all major carriers and adapts to life events and EOI standards.

See Our Benefits Admin CapabilitiesApplicant Tracking

Intuitive online recruiting that simplifies job postings, and manages applicants & hiring of employees.

Learn More About Applicant TrackingCompliance

Integrated add-on services that automate record-keeping & reporting and makes HR legally compliant.

Frequently Asked Questions

How does repayment work?

Process payroll as usual. On-Demand pay deducts advanced wages when the paycheck hits the employee’s spending account.

How does On-Demand pay impact payroll?

Just like any other bank account, employees need to update their direct deposit in Payroll.

What about hour adjustments?

Our On-Demand pay partner takes the risk and will deduct the outstanding amount from the next pay cycle.

How about taxes and deductions?

Our On-Demand pay partner allows employees to advance up to 60% of their gross wages to ensure that so they don’t over-advance.

What if an employee quits?

Our On-Demand pay partner takes all repayment risk and never passes it on to employers.