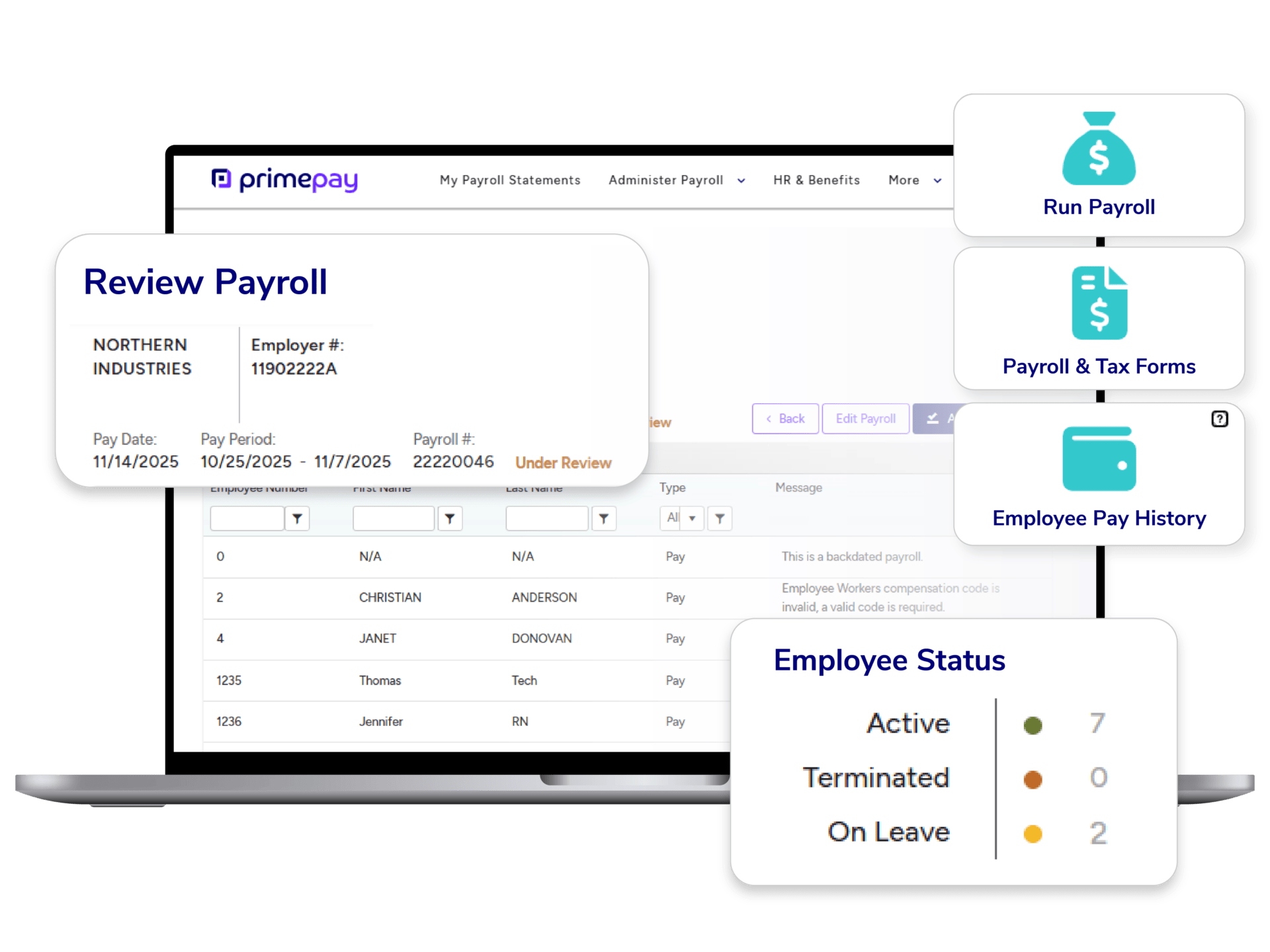

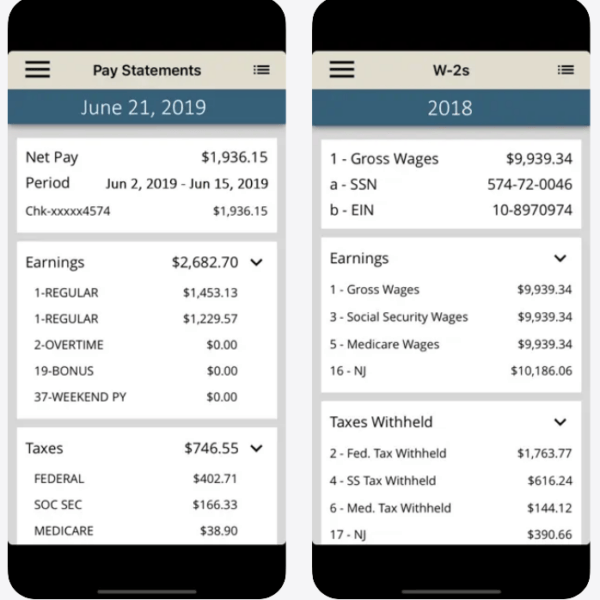

Managing your payroll doesn’t have to be a headache. With the right payroll management system, you can simplify the entire process payroll, from calculating wages to generating pay slips.

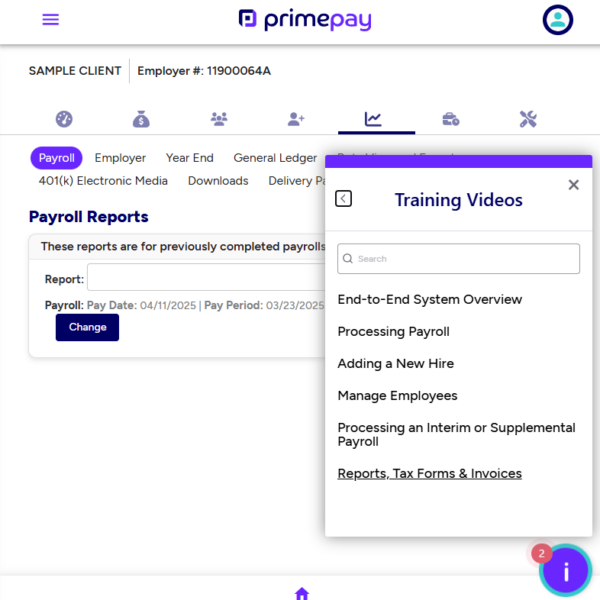

A simple payroll system can automate payroll tasks, allowing you to focus on growing your business.

Automated payroll systems offer several benefits, including:

- Minimizing human involvement

- Optimizing calculations

- Streamlining tasks

- Providing features such as compensation administration, time tracking integration, and expense management

Automated Payroll Systems

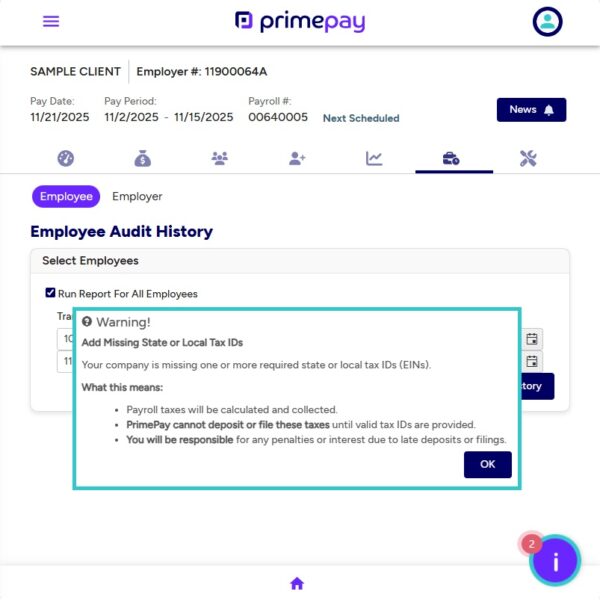

Businesses have transformed how they manage payroll via automated payroll systems offered by various payroll companies. By automating repetitive tasks and minimizing the risk of human error, these systems improve accuracy and productivity. These systems ensure high accuracy through:

- Meticulous maintenance of employee records

- Data verification

- Error checks

- Continuous updates to comply with regulatory changes.

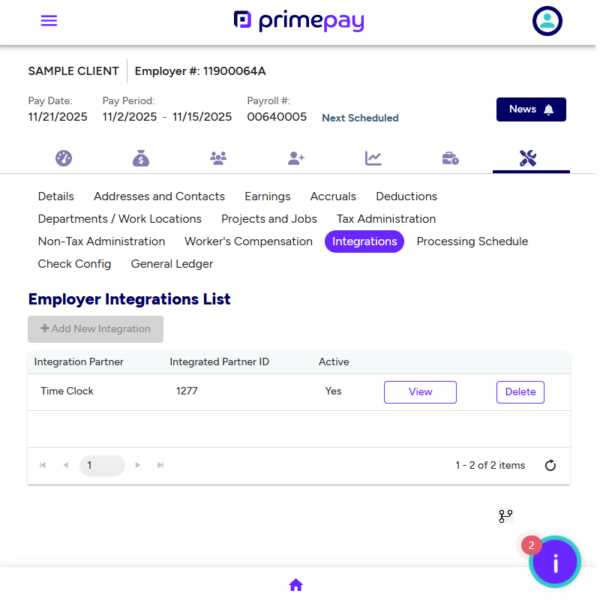

Key features to look out for include:

- Real-time data tracking

- Strong payroll automation capabilities

- Dedicated 24/7 customer support

- Seamless integration with accounting software

- Efficient time tracking

Direct Deposit Advantages

Another feature simplifying the payroll process significantly is direct deposit. It allows employers to deposit salaries directly into employees’ bank accounts, eliminating the need for physical checks.

Direct deposit offers several benefits:

- Enhances payroll efficiency by reducing costs and increasing employee satisfaction

- Utilizes resources more effectively

- A win-win situation for both employers and employees

Streamlined Payroll Tasks

Implementation of a payroll solution brings a key benefit: streamlining payroll tasks. By managing repetitive and manual activities such as data entry, form completion, and notification distribution, businesses can save substantial time and reduce errors.

Optimizing payroll tasks offers numerous advantages, including:

- Improved accuracy

- Compliance

- Cost and time savings

- Enhanced data security

- Overall efficiency

- Increased productivity

- Improved communication