Below is a list of the 12 best payroll software solution providers to consider. Whether you’re a small startup or an established enterprise, these vendors offer a wide range of features and functionalities to fit your organization’s needs.

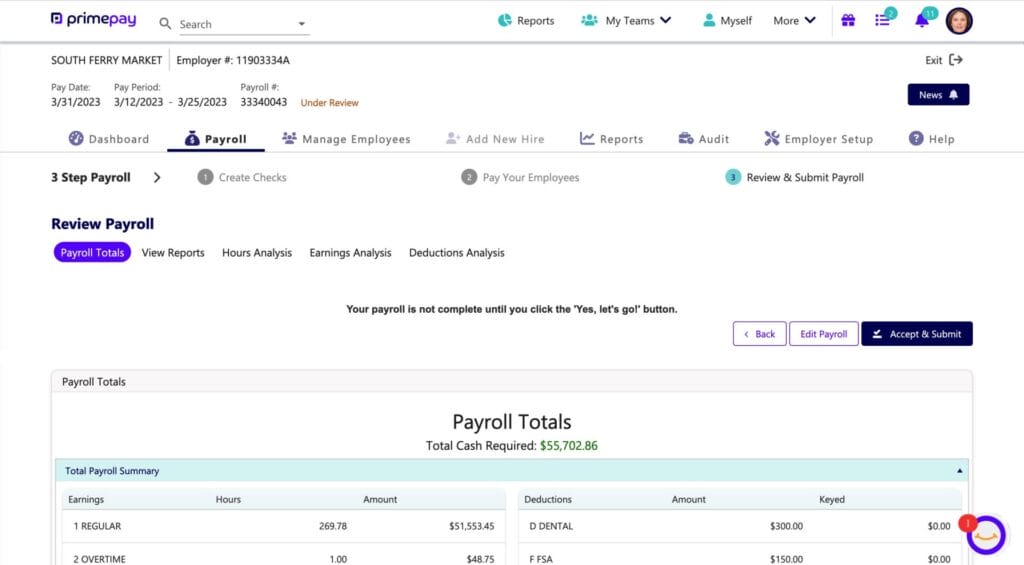

1. PrimePay: Best for Growing Companies

PrimePay’s payroll software is a robust and intuitive solution crafted to facilitate seamless payroll management for businesses of all sizes. The software features automated payroll processing, compliance management, and scalability to accommodate the evolving needs of expanding companies. PrimePay empowers organizations on their growth journey.

Key Features:

- Versatile Platform: PrimePay is designed as a ‘plug and play’ platform. Defined by options, it allows businesses to start with basic payroll or HR functions and add features as their needs evolve.

- Simplified Processes: The platform aims to streamline the payroll process, ensuring that checks are accurate, taxes are taken care of, and benefits are clearly outlined.

- Comprehensive Services: PrimePay handles a wide range of services, including payroll, HR, ATS, time tracking, and benefits management.

- Payroll Tax Filing: File federal, state, and local taxes automatically across 50 states.

Pros:

- Comprehensive Solution: PrimePay offers a range of features covering various payroll needs, appreciated by businesses of different sizes.

- Versatile and Scalable: Tailored solutions and bundles that grow with the needs of your business.

- HR-Add On: Ability to add and integrate HR software to your existing payroll provider.

- User-Friendly Interface: The platform is praised for its ease of use, making payroll and HR tasks more enjoyable.

Cons:

- Expensive: PrimePay’s monthly minimum makes the platform costly for smaller clients.

- Issues with Customer Service: Some users have noted inconsistencies in customer support, particularly with a need for dedicated representatives.

Pricing:

- Payroll Essentials: Starting at $99.00

- HR Essentials: Starting at $5.00

- HR Advantage: Starting at $8.00

- HCM Essentials: Starting at $10.00

Client Review:

“PrimePay is a relatively easy-to-use program that makes payroll and tax season easier. Payroll is a breeze with Primepay, and setting up new employees is quick and easy. Employees can easily access all their payroll information. Primepay makes tax season easier by sending out 1099s and creating tax packages containing all the necessary information. PrimePay support is very helpful.”