It goes without saying that companies must keep costs in check to stay competitive and profitable. This includes taking steps to reduce payroll costs and other operating expenses. While this has always been important, events in recent years have emphasized the need for financial savviness and operational efficiency for organizations to survive and thrive.

In this article we will help you find strategic ways to lower payroll costs without sacrificing headcount.

Strategies to Reduce Payroll Costs

1. Hire the Right People

While you can’t build a time machine to undo hiring mistakes, you can focus on maintaining accurate headcount plans and hiring the right people for the future. Hiring the right people can improve productivity and reduce turnover which will help to reduce payroll spend.

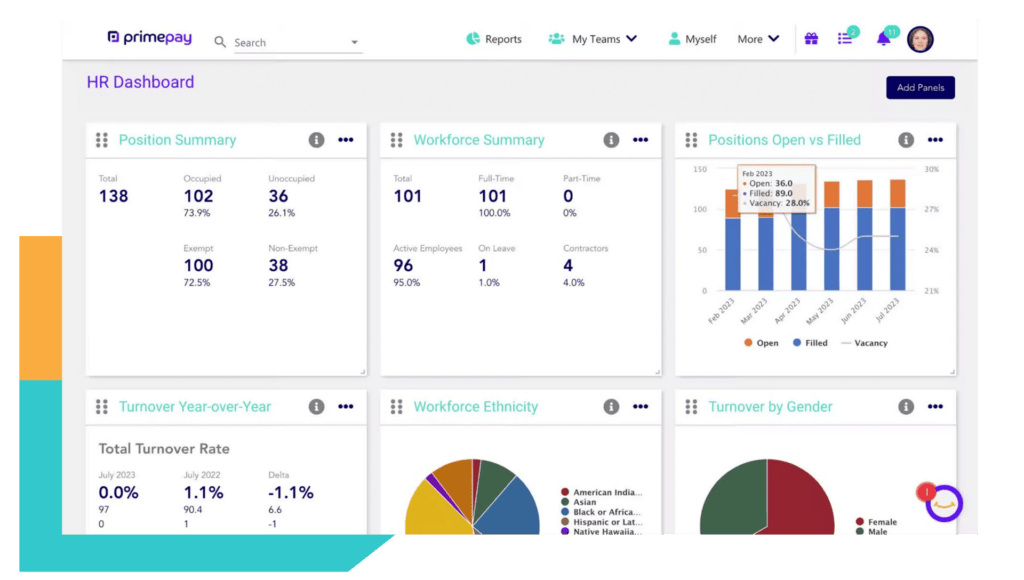

To improve your hiring process and promote efficient team structures, equip your recruitment team with an ATS that integrates with your tech stack and encourages strategic conversations between hiring and department managers.

An ATS that connects with your HR and payroll program simplifies hiring processes and enhances data accuracy for all involved.

2. Review Employee Classification

Are you part of the 10-20% of employers who misclassify employees? Hopefully not, as inaccurate classification can lead to back taxes and penalties, additional overtime pay, legal fees and court costs, federal and state fines, and exclusion from government contracts.

Therefore, it’s vital to ensure your employees are correctly classified as employees and independent contractors, as well as salaried and hourly employees.

3. Optimize Employee Scheduling to Avoid Overstaffing or Understaffing

Fiscally responsible leaders take note of schedules, business needs, and historical patterns and use them to gain a payroll cost savings. Creating a well optimized employee schedule can reduce overtime costs and reduce employee turnover.

Examples include:

- A restaurant near Lake Michigan hiring seasonal employees for summer seasons to avoid overstaffing during slower months.

- A technology call center increasing the number of agents scheduled in the days following a product release.

- A brewery scheduling fewer employees on game days after the local team lost in the playoffs.

- An automotive assembly plant aligning employee shifts with the production demands of the new year.

However, there’s a fine line between optimizing employee scheduling and consistently understaffing your organization. In short, not having enough employees results in many consequences, such as employee burnout, high turnover, and less-than-stellar customer service.

As Josh Bersin, president and founder of Bersin & Associates, explains that understaffing “is bad for everybody. For the customers. It’s bad for the employees. It’s bad for the company.”

4. Automate Payroll Processing with Payroll Software

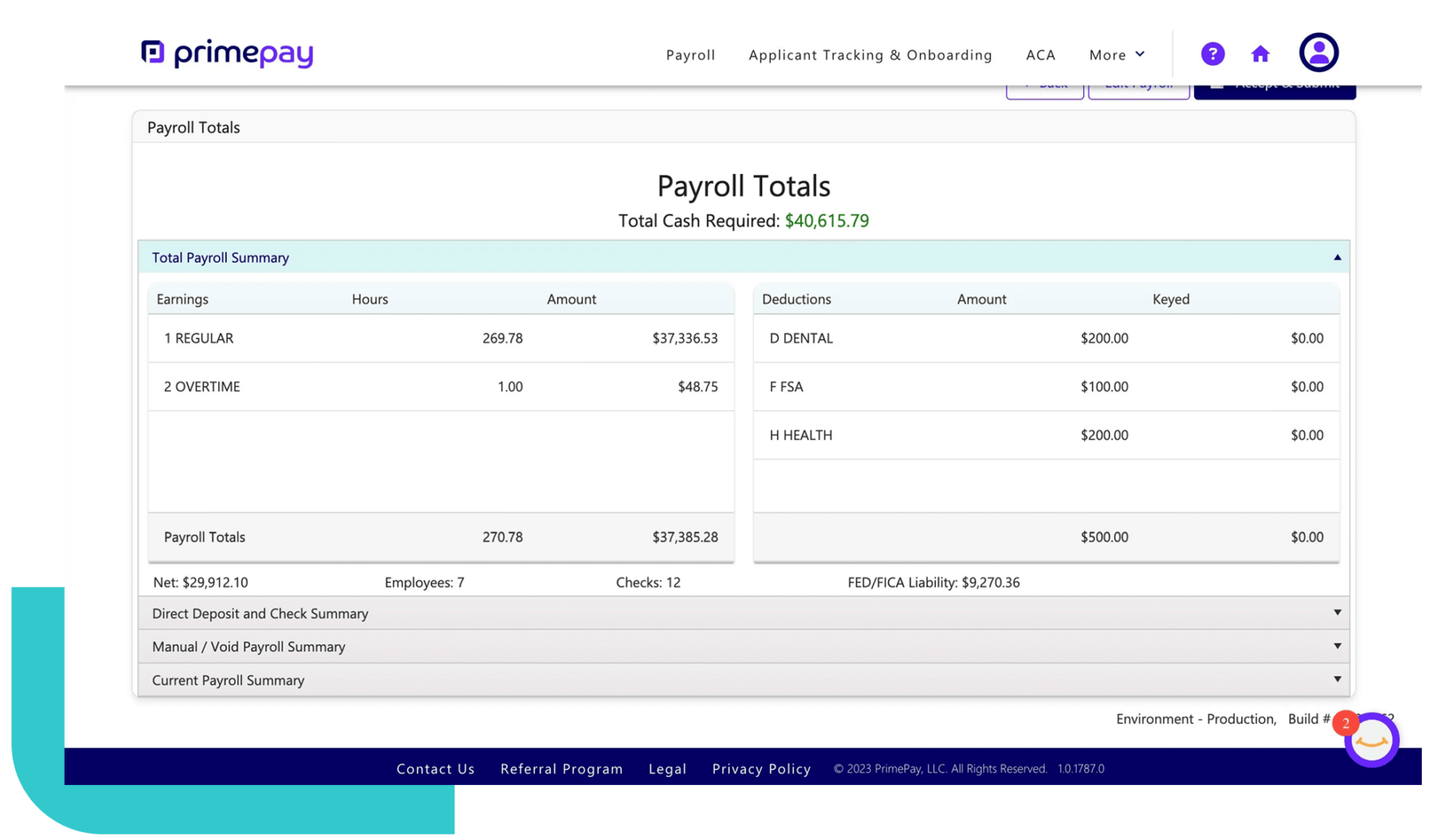

Outsourcing your payroll automates payroll and taxes. This results in no more manual data-entry errors, printing checks, and wasting time finding employee information. There are many other advantages to payroll outsourcing that should be considered too.

Instead, with an automated payroll system, you’ll sleep well knowing your information is accurate, secure, and centralized, with the additional benefit of saving thousands of dollars on in-house payroll.

Modern payroll solutions helps cut payroll costs with functionalities such as direct deposit, time tracking, tax payments, and robust analytics.

5. Review Benefit Plans

Another way to control payroll costs is to regularly evaluate benefit plans to ensure they’re cost-effective, match your budget, and align with employee needs. Consider negotiating better rates with insurance providers or exploring alternative benefits to get the best bang for your buck.

Jamie Press, SVP of HR at PrimePay, recommends gathering employee feedback in the spring and early summer to help determine the benefits to prioritize. She explains: “Employee feedback is crucial when we begin building our benefits package for the following year. We use their input as we gather bids from different companies to determine what’s best for our employees, company, and budget.”

6. Conduct Regular Expense Reviews

Many leaders have a ton of data at their fingertips. But here’s the thing – 86% of people say the volume of data actually makes decision-making more difficult.

That’s why it’s important to view your data with a goal in mind. Schedule meetings specifically for analyzing payroll-related costs or finding places to reduce unnecessary spending so you can make efficient decisions and stay focused on the task at hand.

Regularly reviewing your data helps you spot trends and opportunities and provides context and clarity when reducing labor costs.

It’s crucial to keep fiscal responsibility top of mind, and even more so in times of volatility. By employing the six strategies above, you’ll be better able to reduce labor costs without decreasing your headcount.

By controlling payroll costs, you can improve your company’s overall financial health, increase profitability, and potentially invest in other business areas.

Benefits of Optimizing Payroll Costs

There are four main benefits to optimizing payroll costs including cost reduction, profitability improvement, market competitiveness, and adaptation to economic challenges.

We dive into each of the benefits below:

- Cost Reduction: Labor costs often represent a significant portion of a company’s overall expenses (labor expenses can range from 15%-70%, depending on the industry).

- Profitability Improvement: Payroll cost savings can directly contribute to improved profit margins. When a company can operate more efficiently and allocate resources effectively, it’s better positioned to generate higher profits. This, in turn, can make the company more competitive in the market and attract potential investors.

- Market Competitiveness: Optimizing payroll costs allows companies to offer products or services at competitive prices without compromising quality. Doing so can be crucial in gaining market share and retaining customers in a price-sensitive market.

- Adaptation to Economic Challenges: Economic downturns or unforeseen challenges can lead to a decrease in revenue for many businesses. In these situations, companies should seek to decrease labor costs to realign their cost structure with reduced income. This adaptive measure can help companies make lemonade out of lemons by avoiding a reduction in force and remaining financially stable.

It’s important to note that reducing payroll costs doesn’t necessarily mean reducing your workforce. In fact, that option shouldn’t be your first (or fifth) step to save money. Instead, it’s best to explore ways to achieve fiscal resilience without compromising workplace culture or hindering long-term growth prospects.

While reducing payroll expenses can offer short-term financial benefits, you should carefully consider the potential impact on employee morale, productivity, and the long-term sustainability of their operations. Communication with employees, ethical considerations, and a balanced approach to cost-cutting are crucial for maintaining a positive culture.