Some employer obligations are apparent, such as providing mandated benefits and following anti-discrimination practices. However, when it comes to compliance documents, things can get confusing quickly (and, not to mention, costly if you miss those deadlines).

One such compliance rule is filing Form 5500. Below is a quick run-down of the ins and outs of the form – including Form 5500 filing requirements, due dates, and versions – to help you remain compliant this year.

What is Form 5500?

The Form 5500 Series ensures that employers administer and manage employee benefit plans in compliance with certain established standards. Form 5500 also ensures that employers supply or give participants, beneficiaries, and regulators access to adequate information to protect their rights and benefits under employee benefit plans.

Thanks to a collaboration between the DOL, the IRS, and the Pension Benefit Guaranty Corporation, employee benefit plans can use the Form 5500 Series forms to meet annual reporting requirements under Title I and Title IV of the Employee Retirement Income Security Act of 1974 (ERISA) and the Internal Revenue Code.

Who Files Form 5500?

Every plan covered by ERISA (including health and welfare plans) must file Form 5500.

As outlined by the DOL, these benefit plans generally include:

- medical, surgical, or hospital benefits

- some employee assistance programs

- sickness or accident benefits

- disability benefits

- death benefits

- supplemental unemployment or vacation benefits

- apprenticeship, or other training programs

- daycare centers

- scholarship funds

- prepaid legal services

- severance pay

- Life

- prescription drug

- Vision

It’s important to note that even small businesses can file under ERISA just like any other employer and must adhere to the same Form 5500 filing requirements.

Form 5500 Filing Exceptions

There are exceptions based on the plan’s size, funding arrangement, and sector, including:

- Governmental and church plans.

- Unfunded, fully insured, or a mix of insured and unfunded welfare plans with fewer than 100 participants at the start of the plan year (also called “small” plans).

- Welfare programs administered outside of the United States that primarily benefit non-resident aliens.

- Plans where only a few management or highly compensated employees are covered by unfunded or insured welfare programs.

- Plans are only kept to comply with workers’ compensation, unemployment compensation, and disability insurance requirements.

- Participating welfare benefit plans in a group insurance arrangement that submits Form 5500 for the participating plans.

- Apprenticeship or training plans that satisfy specific criteria.

- Specific unfunded welfare benefit plans financed by dues.

- Only the owner and/or spouse of a completely owned trade or firm, or the partners and/or spouses of partners in a partnership, have access to welfare benefit programs.

Note: Please refer to the DOL’s Health and Welfare Form 5500 Requirements Report for additional information.

Which Version of Form 5500 Should I File?

Your organization’s size and your retirement plan’s structure determine which version of Form 5500 you must complete.

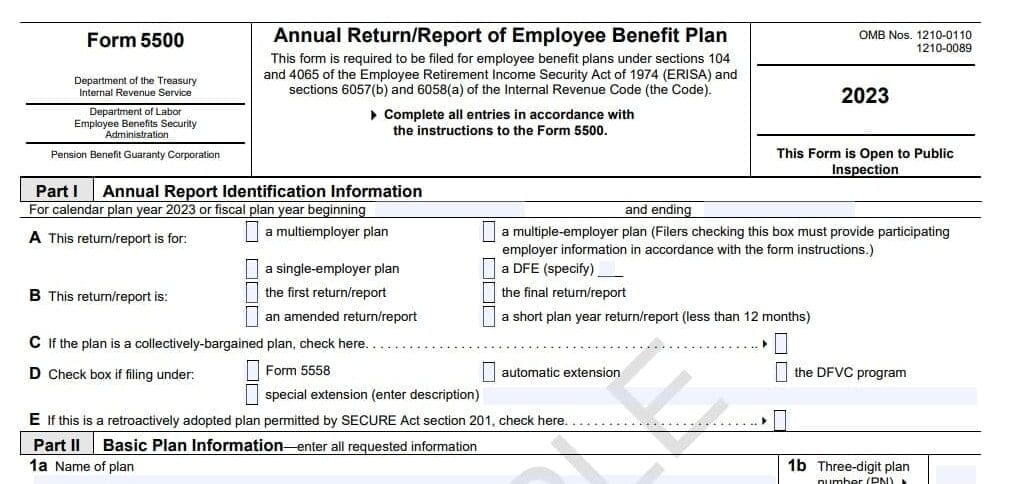

1. Form 5500

Most organizations that have a plan with 100 or more participants use Form 5500, Annual Return/Report of Employee Benefit Plan.

Form 5500 reports information about a plan’s qualification, financial condition, investments, and activities.

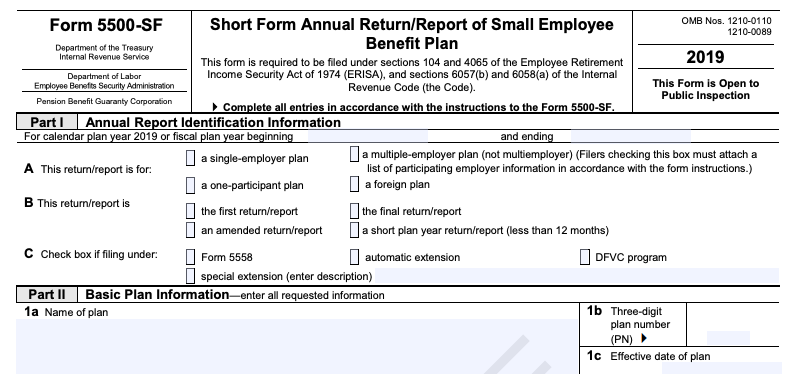

2. Form 5500-SF

Most organizations that have a plan with fewer than 100 participants requiring a submission use Form 5500-SF, Short Form Annual Return/Report of Small Employee Benefit Plan.

Form 5500-SF also reports information about a plan’s qualification, financial condition, investments, and activities.

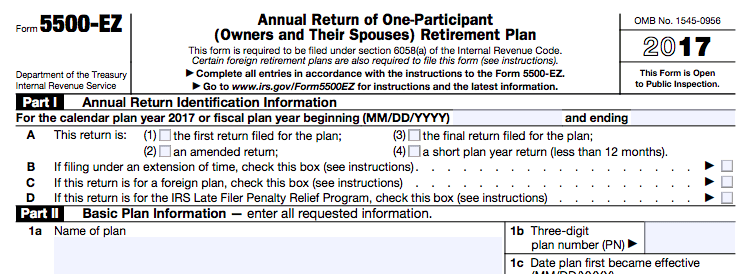

3. Form 5500-EZ

Most organizations with a “one-participant” plan and/or a foreign plan use Form 5500-EZ, Annual Return of A One-Participant (Owners/Partners and Their Spouses) Retirement Plan or A Foreign Plan.

Note: Prior to 2021, one-participant plans could use Form 5500-SF. Employers of such now must use Form 5500-EZ.

What is the Form 5500 Due Date?

The due date for Forms 5500, 5500-SF, and 5500-EZ is “the last day of the seventh month after the plan year ends.” In other words, if your plan is scheduled for the calendar year, your Form 5500 deadline is July 31.

Need more time? You can file for an extension using Form 5558.

For additional information, refer to the IRS Form 5500 Corner.