Good news for your employees with Flexible Spending Accounts (FSA): the contribution limit has increased.

The Internal Revenue Service (IRS) released the annual cost-of-living adjustments affecting the maximum contribution limits for several pre-tax benefits, including health FSAs, transit/parking accounts, and HSAs.

FSA Contributions Limits: 2025

The IRS confirmed that for plan years beginning on or after Jan. 1, 2025, the contribution limit for health FSAs will increase another $100 to $3,300. For those plans that allow a rollover of unused funds, the maximum rollover amount will increase to $660 for 2025.

Additionally, the monthly contribution and reimbursement limit for transit and parking FSAs will increase to $325 per account in 2025.

| 2025 Limits | 2024 Limits | |

| Health FSA | $3,300 Rollover – Up to $660 | $3,200 Rollover – Up to $640 |

| Transit/Parking FSA | $325/month | $315/month |

Employees must use FSA funds within a plan year. Remember that health FSAs have a “use-or-lose” rule, meaning that any funds left unused at the end of the year are forfeited to the employer.

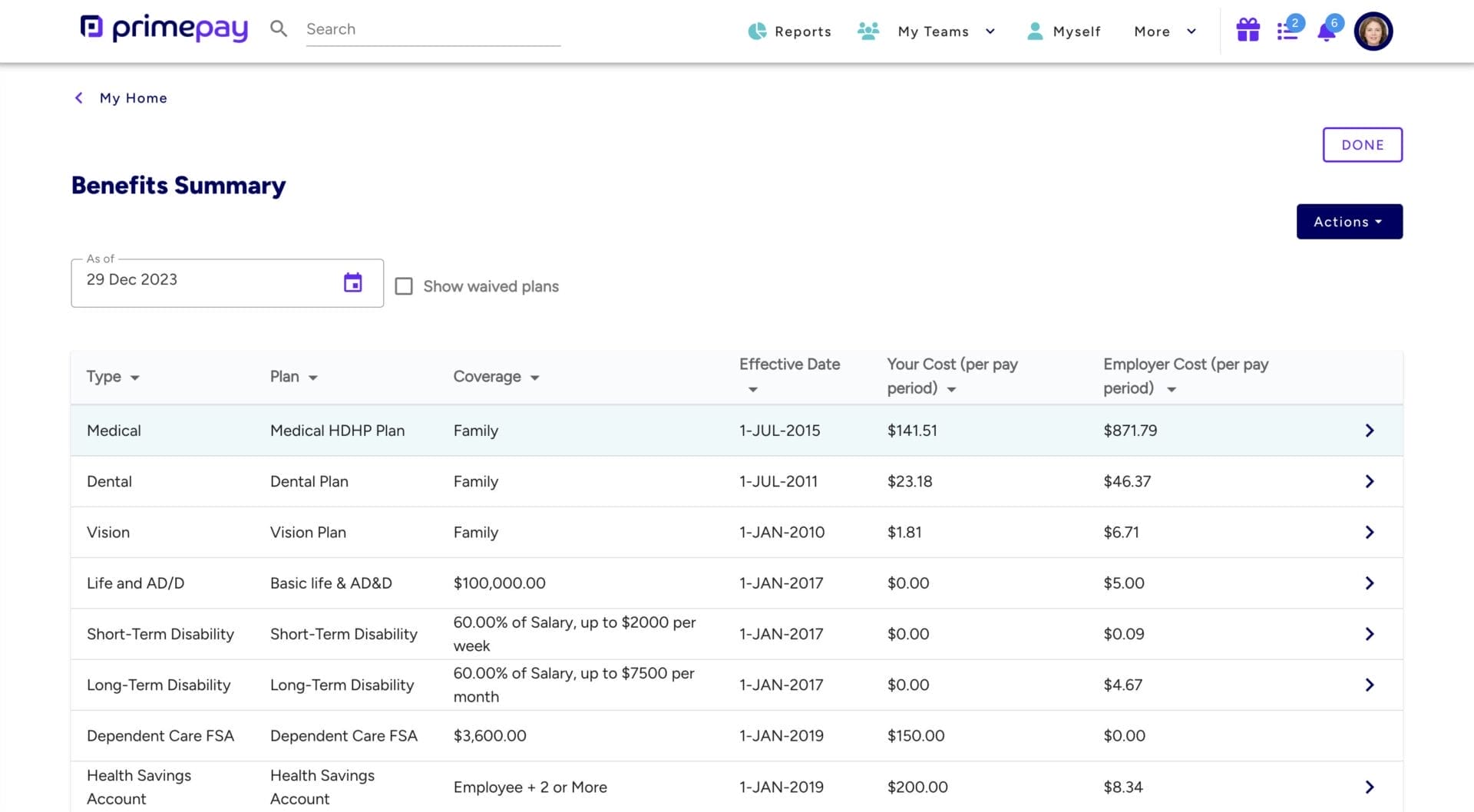

Employees should always know their contributions and benefits. When you equip your people with a self-service portal, they can easily access their specific benefit information without any back-and-forth with HR.

Two Exceptions to the FSA Rule

Two exceptions to the use-or-lose rule permitted by the IRS are rollover and grace period. HR teams must communicate company policies to employees well in advance so people can plan accordingly.

- Rollover: If funds are not used by the end of the year, up to $660 can be rolled over from the 2025 plan year into the next plan year.

- Grace Period: An employer can adopt a grace period for their health FSA. As explained by the IRS, “A grace period is a period of up to two months and 15 days immediately following the end of a plan year during which a participant may use amounts remaining from the previous plan year (including amounts remaining in a health FSA) to pay expenses incurred for certain qualified benefits during that two-month and 15-day period.”

A health FSA may incorporate either of these features; however, a plan may not have a rollover and grace period.

Plans may also include run-out periods that provide participants additional time to submit claims incurred during the plan year (typically 90 days). This can be in addition to either a rollover or grace period.

How Can PrimePay Help?

PrimePay provides pre-tax benefits administration of, including HRAs, HSAs, and FSAs. When you choose PrimePay’s pre-tax benefit plan administration, you receive a dedicated service team, access to our support portal, automated claims processing, and a PrimePay debit card and mobile app.

Please read our disclaimer here.