Payroll processing is one of the most important responsibilities for small business owners. And it makes sense, since paying employees accurately and on time keeps your workforce happy and ensures compliance with federal, state, and local tax laws.

But for many business owners, calculating payroll can feel overwhelming. There are tax withholdings, deductions, and compliance requirements to consider, as well as allocating the time to do so. Business owners often underestimate how long it takes to run payroll; Deloitte reports that a typical payroll employee works 25 hours of overtime per month to get the job done.

The good news? Once you understand the key components and follow a structured payroll process, it becomes much easier.

This guide will explain how to calculate payroll step by step so you can confidently manage employee paychecks and tax obligations.

TIP: Bookmark the links below so you’ll always have the calculators handy!

Step-by-Step Payroll Calculation Process

Calculating payroll isn’t as simple as issuing paychecks. Instead, it involves multiple steps like gathering employee information, calculating gross pay, withholding the correct taxes, and ensuring compliance with payroll tax laws.

Whether you have a single employee or a growing team, following a structured process helps prevent costly payroll errors.

Below, we break down the essential steps to run payroll accurately and efficiently for your small business.

1. Gather Employee Information

Before processing payroll, you must collect essential information from each employee. This ensures accurate tax withholdings and helps you comply with federal and state employment laws.

New employees must complete the following forms before their first payday:

- Form W-4: Determines how much federal income tax should be withheld.

- State W-4 (if applicable): Some states require a separate withholding form.

- Form I-9: Verifies employment eligibility and legal work status.

- Direct Deposit Authorization: Required if you’re paying employees via direct deposit.

Ensure this paperwork is complete before an employee’s first paycheck to avoid payroll delays and tax compliance issues.

2. Determine Gross Pay

Gross pay is the total amount an employee earns before deductions. The calculation method depends on whether the employee is hourly or salaried.

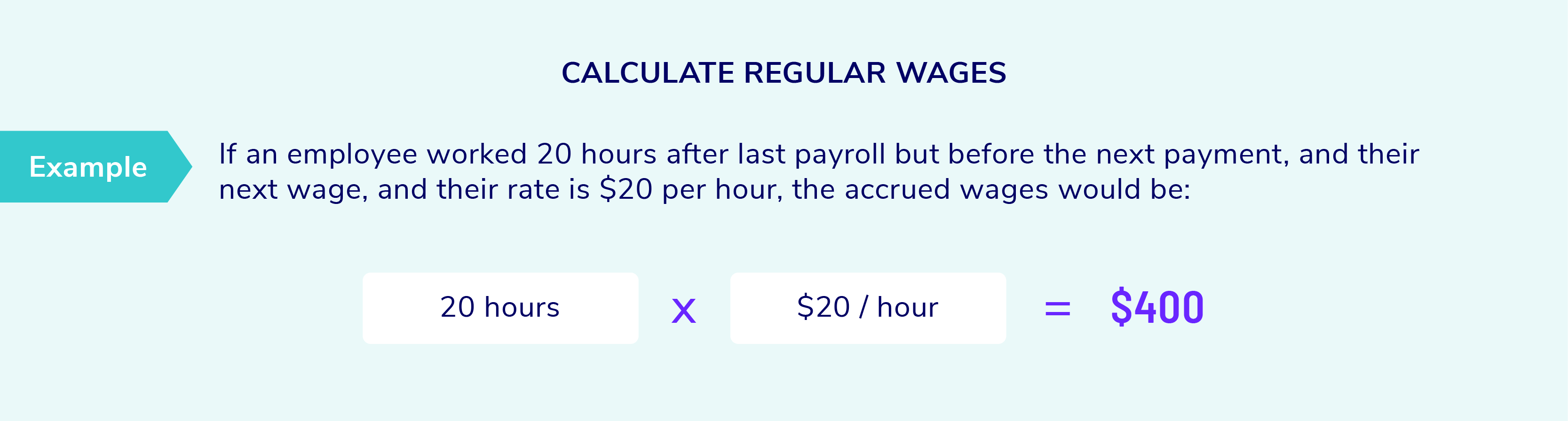

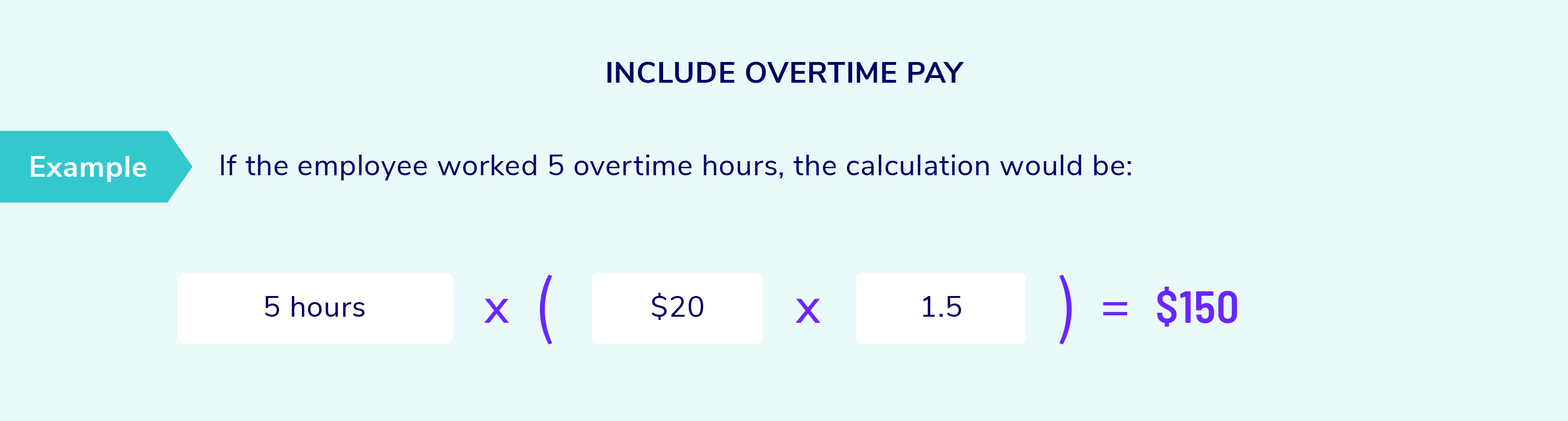

For hourly employees: Multiply total hours worked by their hourly wage. If they worked overtime, apply the correct overtime pay rate.

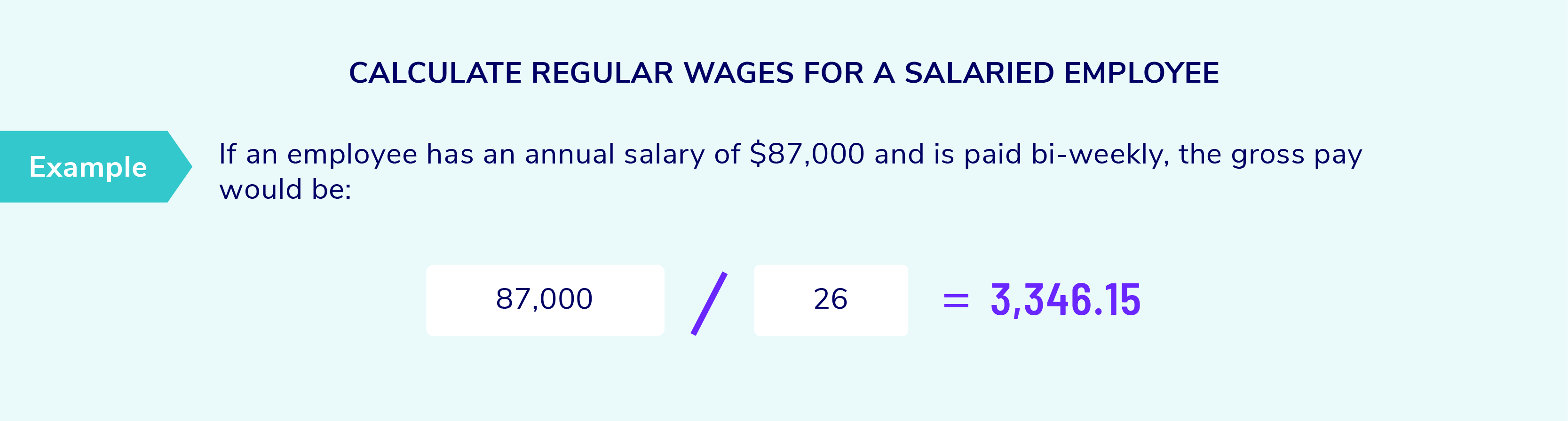

For salaried employees: Divide their annual salary by the number of pay periods in a year (e.g., 26 for biweekly, 52 for weekly).

Accurately calculating gross pay ensures employees are properly compensated and that tax withholdings are based on the correct earnings. Make sure you take into account any additional earnings needed, such as commission, tips, bonuses, etc.

3. Apply Pre-Tax Deductions

Pre-tax deductions are amounts taken from an employee’s paycheck before taxes are calculated. These deductions reduce taxable income, helping employees save on taxes while contributing to important benefits.

Common pre-tax deductions include:

- Health insurance premiums (medical, dental, vision)

- Retirement contributions (401(k), SIMPLE IRA)

- Health savings accounts (HSAs) and flexible spending accounts (FSAs)

Not all deductions qualify as pre-tax, so review IRS guidelines to ensure compliance.

TIP: If you’re not offering retirement plans in your benefits package, you should consider it. HRDive reports that 81% of people say retirement benefits are a “must-have” in a job offer. By including 401(k)s (and potentially company matches), you’ll increase loyalty and boost employee satisfaction.

4. Calculate Tax Withholdings

After applying pre-tax deductions, employers must withhold payroll taxes from employee paychecks. These taxes include:

- Federal income tax: Based on IRS tax brackets and W-4 elections.

- State and local income tax: Varies by state and locality.

- FICA taxes: Social Security (6.2%) and Medicare (1.45%).

Employers are responsible for withholding the correct amount of payroll taxes and submitting them to the appropriate agencies by required deadlines.

NOTE: Pre-tax deductions will reduce the taxable wages for applicable tax types, since the tax withholdings would be based on these taxable wages.

5. Apply Post-Tax Deductions

Post-tax deductions are amounts taken out after taxes have been withheld. These deductions do not reduce taxable income but may be necessary for legal or voluntary reasons.

Common post-tax deductions include:

- Wage garnishments: Court-ordered deductions for unpaid debts.

- Union dues: If the employee is part of a union.

- Roth 401(k) contributions: Unlike traditional 401(k) plans, Roth contributions are made after taxes.

Employers must accurately apply these deductions and ensure compliance with federal and state wage laws.

6. Calculate Net Pay

Net pay, or take-home pay, is the amount an employee receives after all deductions. It’s deposited into their bank account or printed on a paycheck.

The formula for net pay:

Accurate payroll processing ensures that employees receive the correct net pay and prevents payroll disputes.

7. Account for Employer Tax Contributions

Beyond employee withholdings, employers have their own payroll tax responsibilities. These taxes include:

- FICA taxes: Employers must match the 6.2% Social Security and 1.45% Medicare tax.

- FUTA (Federal Unemployment Tax): Typically 6% on the first $7,000 of wages per employee.

- SUTA (State Unemployment Tax): Varies by state.

- State-specific employer liabilities such as PFML

Failure to pay employer taxes can result in IRS penalties and fines, so staying compliant is essential.

8. Issue Paychecks

Once payroll is calculated, it’s time to pay employees. Businesses can issue pay through:

- Direct deposit: The most efficient and secure option.

- Paper checks: May be necessary for employees without bank accounts.

- Payroll cards: A reloadable card option for employees who prefer not to use traditional banks.

Timely paycheck distribution is critical for employee satisfaction and compliance with wage payment laws.

TIP: Offer direct deposit and on-demand pay to retain employees. Direct deposit is a given these days (88% of W2 employees use direct deposit), and 25% of on-demand pay users stay at their jobs longer.

Payroll Recordkeeping and Compliance

As you know, payroll doesn’t stop once paychecks are issued. Businesses must maintain accurate payroll records to comply with federal and state laws and be prepared for tax audits. Proper record keeping also ensures transparency in case of employee disputes.

Maintain Accurate Records

Federal law requires employers to keep payroll records for at least three years, while tax-related records should be stored for up to seven years.

Key payroll documents include:

- Employee tax forms (W-4, I-9)

- Payroll registers and pay stubs

- Tax filings and deposit records

Compliance with Filing Requirements

Employers must meet federal, state, and local payroll tax filing deadlines to avoid penalties. Common payroll filings include:

- Quarterly tax reports (IRS Form 941 for federal withholdings)

- Annual employee tax forms (W-2 for employees, W-3 for the IRS)

- State unemployment filings

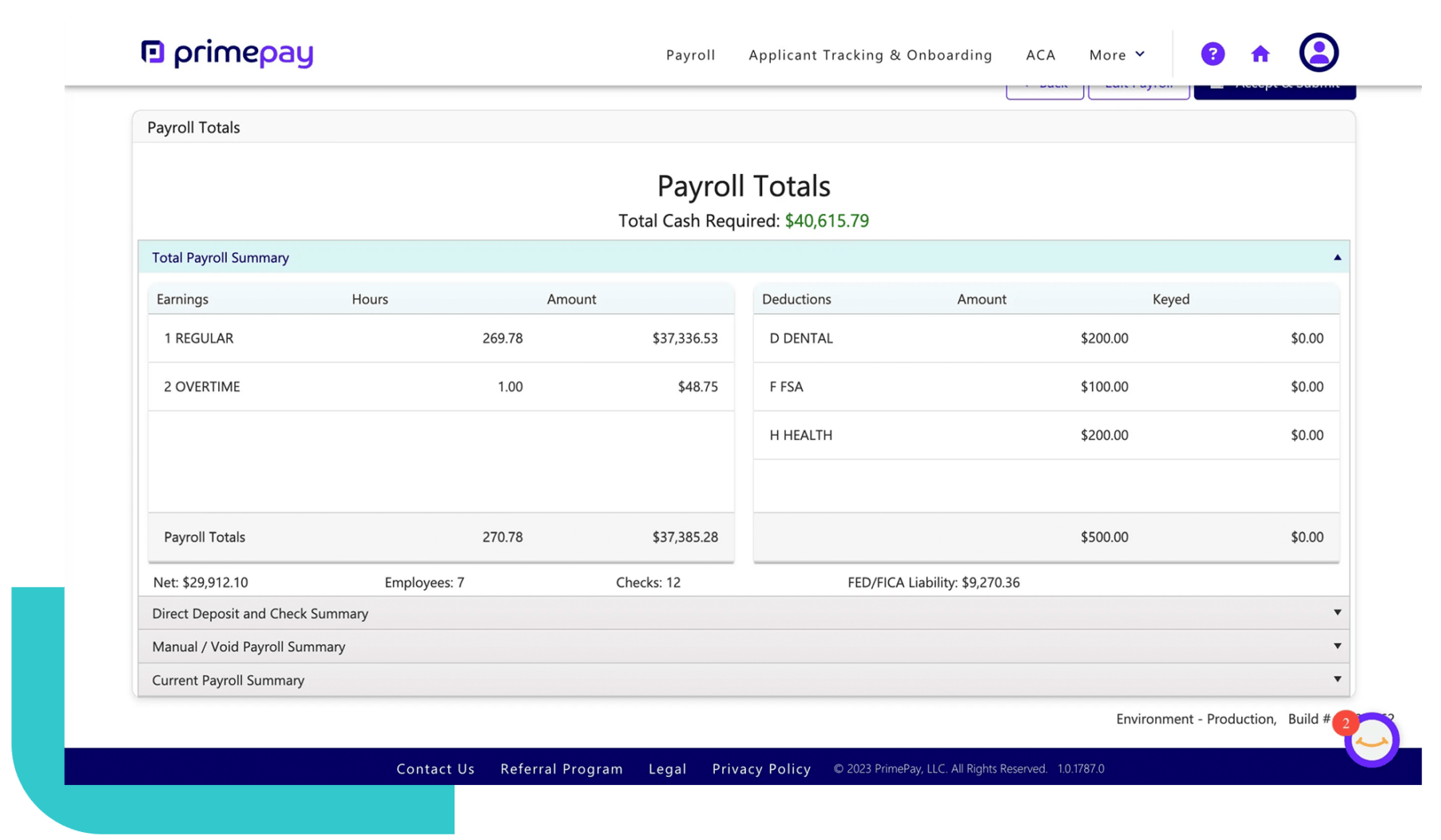

Using payroll software or a payroll provider can help ensure all filings are submitted on time and error-free.

Final Thoughts

Payroll processing is essential to running a business, and accuracy is key to staying compliant and keeping employees happy. By following these step-by-step payroll calculation guidelines, you can confidently manage payroll while minimizing errors.

If payroll feels like a time-consuming burden, PrimePay’s payroll solutions can simplify the process—handling payroll calculations, tax filings, and compliance for you.