Imagine you’re a small business owner, and one of your top employees knocks on your office door. Looking distraught, they tell you their parent, child, or spouse was just admitted to Hospice and they’ll need to take time off. The problem is you’ve never granted anyone extended leave, and to be honest, don’t know too much about the Family and Medical Leave Act (FMLA) and your responsibilities as an employer.

Business owners need to move fast to support their team members, but must also remain compliant with federal regulations they’re not familiar with. Yikes. While they can’t build a time machine to prevent this frantic feeling, you can learn from their mistakes and prepare yourself for the future.

Below is an overview of FMLA. We cover your responsibilities as an employer, and helpful steps to create an FMLA policy to maintain compliance and support your people.

What is FMLA?

The Family and Medical Leave Act (FMLA), is a federal law under which eligible employees are entitled to up to 12 work weeks of unpaid, job-protected leave within a 12-month period for specific family and medical reasons.

An employee can take their available FMLA leave consecutively or schedule intermittent leave to help balance their work and family responsibilities.

By providing this unpaid job-protected leave, the FMLA supports employees in managing significant life events while maintaining their employment status.

One of the FMLA’s cornerstone provisions is the guarantee of job restoration. When an employee returns from FMLA leave, you must reinstate them to the same position they held before the leave or to an equivalent position with the same wage, benefits (like health insurance coverage), and other terms of employment. This rule ensures that if FMLA leave is taken it does not disadvantage the employee in their career progression.

FMLA violations by employers include interfering with, restraining, or denying the exercise of these rights and any form of retaliation.

Does FMLA Apply to Small Businesses?

FMLA applies to private-sector employers with an average of 50 or more employees for 20+ weeks in the current or prior calendar year.

It also applies to all public and local educational agencies, regardless of their number of workers.

State Paid Family Leave Laws

Just because you, as the employer, may not qualify for FMLA doesn’t mean your company can ignore state paid family medical leave laws.

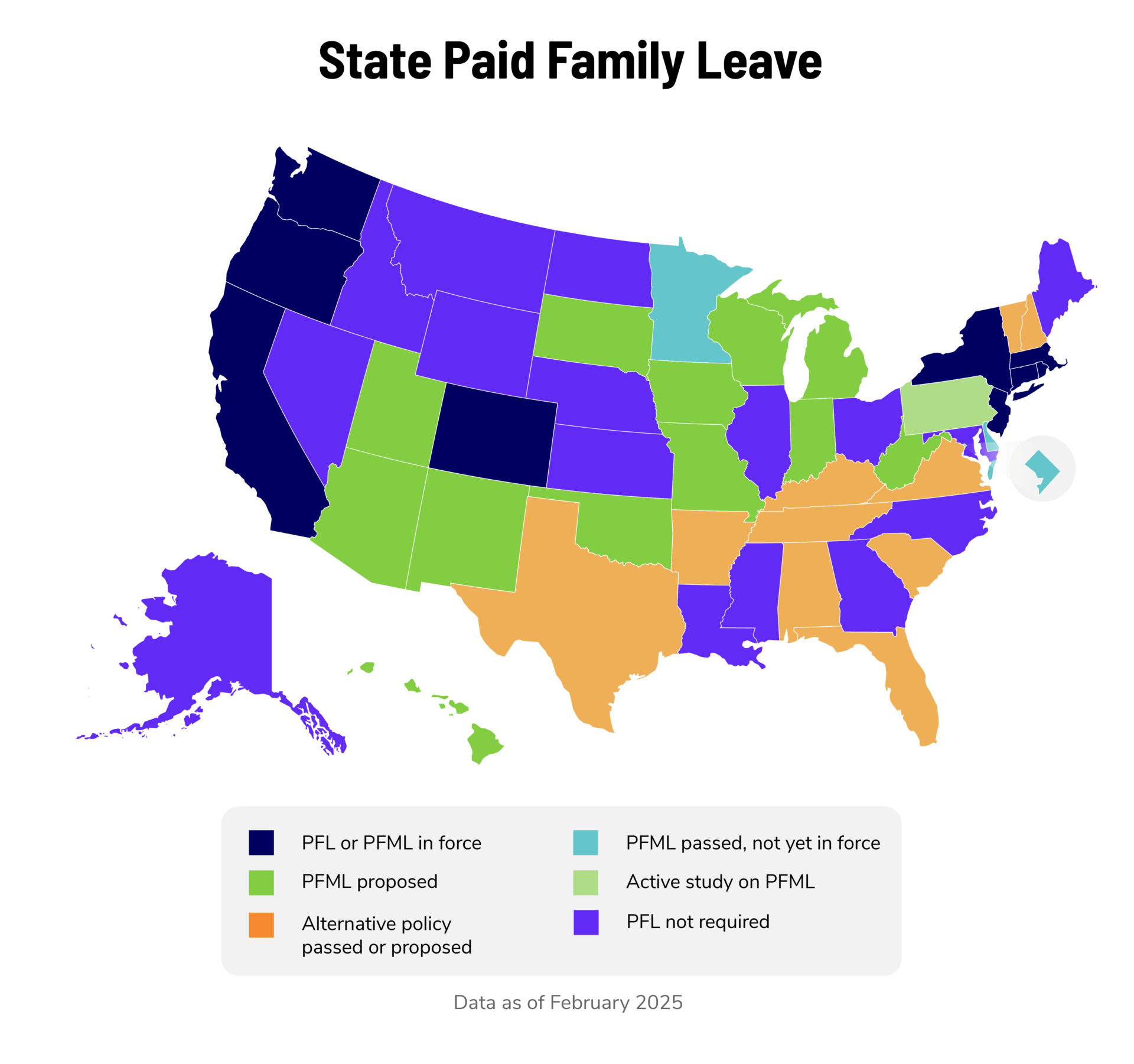

Thirteen states, as well as Washington D.C., have mandatory paid family leave systems.

Nine other states have voluntary systems that provide paid leave through private insurance. Because laws and benefits regularly change, it’s important to stay up-to-date on your state’s requirements.

How to Calculate Employees

Below are a few tips to ensure your calculations are accurate and that you maintain compliance with FMLA requirements.

- To determine the number of workers employed each week of the year, employers must include all employees listed on the payroll who worked any part of each working day, even if they weren’t paid during that time. This includes full-time, part-time, seasonal, and variable-hour employees.

- Each employee is counted as a single employee towards the 50-person threshold. This means that part-time workers are not counted as fractional employees as they are for COBRA and ACA purposes.

- Related employers, sometimes called integrated employers, must aggregate their total employees to determine FMLA applicability. If, as a group, they have more than 50 employees for at least 20 weeks in the current or previous year, they all have to follow FMLA requirements.

FMLA Qualifications

To be eligible for FMLA leave, an individual must be considered a qualified employee. This means that, before their protected leave starts, they have worked for a covered employer for at least 12 months cumulatively, for at least 1,250 hours.

In addition, their employer must employ at least 50 employees within 75 miles of the workplace at which the employee works.

How Employees Can Use FMLA

Only certain situations make an employee eligible for FMLA leave.

- The birth and care of a newborn child;

- Placement of a child for adoption or foster care;

- To care for a family member with a serious medical concern;

- To care for oneself when the employee has a serious health condition;

- Due to a ‘qualifying exigency’ due to a family member’s active duty status in the Armed Forces

- To care for a ‘covered service member’ with a serious injury or illness.

The Department of Labor (DOL) has defined a ‘serious health condition’ as an illness, injury, impairment, or physical or mental issue that involves either:

- Inpatient care in a hospital, hospice, or residential medical care facility; or

- Continuing treatment by a healthcare provider

Employee Notice Requirements

Because FMLA is a federal law, it comes as no surprise that there are strict guidelines for requesting FMLA leave. When you create your organization’s FMLA policy, make sure the notice requirement is clear to prevent any miscommunication and missed opportunities for your employees.

- Employees must: notify their employer when requesting leave and provide certification of the need for FMLA leave within 15 calendar days of the employer’s request. Note that the certification must be completed by a healthcare professional and must include the dates of treatment, the nature of the condition, and the expected duration of the treatment. Employees may be required to provide additional information or documentation to support their request for FMLA leave.

- Employers must: respond to the leave request within five days.

Can FMLA Requests Be Denied?

Yes, requests for FMLA (Family and Medical Leave Act) can be denied, but only under specific circumstances.

Some common reasons for denial are:

- Ineligibility: If the employee hasn’t worked for the company for at least 12 months, hasn’t worked 1,250 hours in the past 12 months, or if the company has fewer than 50 employees within a 75-mile radius, the employee is not eligible for FMLA leave.

- Insufficient notice: Employees must generally give 30 days’ notice for foreseeable leave. If they fail to do so without a good reason, the employer may deny the request.

- Lack of medical certification: If the employee doesn’t provide the necessary medical certification to support their leave request, the employer can deny it until the certification is provided.

- Exhausted leave: FMLA allows up to 12 weeks of unpaid leave in a 12-month period. The employer can deny additional requests if the employee has already used up their FMLA leave for the allowed period.

How to Create an FMLA Policy

Developing a well-structured FMLA policy is a critical step for HR leaders to ensure both legal compliance and smooth administration of employee leave. Including this guideline in your employee handbook sets clear expectations, fosters transparency, and minimizes the risk of misunderstandings or legal issues down the line.

Below are eight steps to help you form your organization’s policy if your company meets the requirements.

1. Establish Your 12-Month Measurement Period

FMLA allows for up to 12 weeks of unpaid leave. Employers can choose how to measure their 12-month FMLA period. The four common methods include:

- Calendar year

- Any fixed 12-month period (e.g., anniversary date)

- The 12-month period starting from the first day an employee takes FMLA leave

- A rolling 12-month period measured backward from the date of leave

Decide which option works best for your organization and ensure it is consistently applied across the board.

2. Determine Your Leave Request Method

Clearly define the process for requesting FMLA leave to ensure effective communication. Outline how employees should notify HR or management (e.g., written requests, specific forms). Specify deadlines for notice, especially for foreseeable leave, and set expectations for what information employees need to provide when requesting FMLA.

3. Include Qualifying Reasons for FMLA Leave

You should list the conditions that qualify an employee for FMLA leave. These conditions generally include:

- Serious health issues affecting the employee or a close family member

- Childbirth, adoption, or foster care placement

- Certain military-related absences

Provide examples and details to minimize any confusion about eligibility.

4. Display the Notice of FMLA Rights

Ensure compliance by posting the required Notice of FMLA Rights in a visible area, like a breakroom or common area. Doing so fulfills a legal requirement and informs employees of their rights under the law.

5. Outline How Benefits Premiums Will Be Collected

Employees on FMLA leave are entitled to maintain their health benefits. You should explain how benefit premiums will be paid during leave (whether through payroll deductions before leave or another method. Additionally, address what happens if an employee fails to return from leave and how long benefits will continue to be offered.

6. Designate Paid vs. Unpaid Leave Options

FMLA is typically unpaid, but your plan can specify conditions under which employees can substitute paid leave (e.g., sick leave, vacation time) for part or all of the FMLA leave period. Be clear about how accrued paid time off (PTO) or other benefits can be used to supplement unpaid leave.

7. Implement HIPAA-Compliant Procedures for Handling PHI

When processing FMLA requests, it’s likely you’ll receive Protected Health Information (PHI) through doctor’s certifications or other medical documentation. To protect this sensitive information, include a HIPAA Authorization form in your plan. This form ensures that your company can lawfully obtain, use, and store health information related to an employee’s FMLA leave while respecting privacy regulations.

Make sure your plan covers the following:

- Collection of HIPAA authorization: Require employees to sign a HIPAA Authorization form if they submit medical documentation for FMLA purposes. Explain that this document allows you to handle health information strictly for the FMLA process.

- Secure storage and access: Describe the protocols for securely storing PHI, whether in physical or digital formats, and outline which team members have authorized access to this information.

- Guidelines for sharing information: Clearly state that PHI will only be shared as necessary and in compliance with HIPAA. For example, FMLA information might only be accessible to HR and specific managers involved in the leave process.

Implementing these HIPAA-compliant steps in your FMLA policy helps protect employee privacy and keeps your company compliant with both FMLA and HIPAA regulations.

8. Establish Communication Guidelines for Employees on Leave

Maintaining open lines of communication with employees on FMLA leave is crucial. Outline expectations regarding periodic updates on their continuous or intermittent leave status and their return-to-work date. Make sure employees know how often they need to check in, if applicable, and if they need to provide additional medical certifications during extended leave.

9. Create a Return-to-Work Process

Your should also address how employees will be reintegrated once they return from FMLA leave. In most cases, employees are entitled to be reinstated to the same or an equivalent position. Outline any necessary steps, such as fitness-for-duty certifications or missed training, and ensure that employees understand what will happen when they return—whether they will resume their previous role or be reassigned to an equivalent one.

Maintain Compliance and Support Your Employees

While there are numerous rules and regulations for FMLA, navigating it as an employer or employee doesn’t need to be (and shouldn’t be!) confusing. By understanding the ins and outs of FMLA, as well as creating a clear organizational policy, you’ll feel more comfortable making decisions and supporting employees, all while maintaining compliance.