Oftentimes, business owners and HR managers alike might overlook the one basic business foundation that can get them into serious trouble if not done right—human resources (HR) compliance.

Even just the mere thought of HR compliance could be enough to overwhelm anyone and cause some to ignore it altogether.

Preparing yourself and educating yourself for these challenges proves to be essential in running a smooth business (and keeping money in your pocket). Making an investment into a good HR software program can help you be better prepared to tackle common compliance issues.

Consider the following to be a general business guide to human resources compliance and keeping track of HR laws and regulations.

What is HR Compliance?

HR compliance is often defined as the steps taken by businesses to ensure that their policies and actions follow the labor laws set by their country, state, or local government.

To stay compliant, companies must create and document their policies, and make sure to enforce them to ensure they are always following the laws. Making HR compliance a priority helps ensure that companies operate legally and fairly, promoting good workplace practices for everyone involved.

Now that we’ve covered what HR compliance is, and what the top HR compliance issues are, it’s time to get into the fun part – managing HR compliance.

Sensing some sarcasm in the ‘fun part’? Your instincts may be right, but we can try to make a daunting task a little less daunting (and maybe even a little fun) with the right guidance.

Below are a few ways you can navigate through HR compliance challenges with confidence.

Top HR Compliance Issues

Whether you’re just starting out as a small business owner, a seasoned entrepreneur, or an HR leader, it’s critical to gain awareness of some common HR compliance issues.

To highlight a few:

Discrimination and Harassment

Title VII of the Civil Rights Act bans discrimination in all phases of employment by employers based on race, religion, color, sex, national origin, or age discrimination. (This applies to employers with 15 or more employees.) Title VII also prohibits employment decisions based on stereotypes and assumptions about abilities, traits, or the performance of individuals of certain racial groups.

Title VII prohibits harassment of employees. As an employer, you are required to take appropriate steps to prevent this and your employees should know the proper procedures for reporting such issues.

Bottom line: Your company should provide adequate training and strong written communication regarding these practices.

Wage and Hourly Compliance

The U.S. Department of Labor’s (DOL) wage and hour division establishes protections for workers as it relates to the rate of pay, minimum wage, overtime, breaks, and more under the Fair Labor Standards Act (FLSA). And it may be easier than you think to violate this. The simple mistake of misclassifying employees violates the FLSA and could end up pretty costly. Other common FLSA ‘no-no’s’ include not providing compensation for all employee hours worked, which includes short breaks, on-call time, and time spent working off the clock.

Aside from minimum wage, overtime, and hours worked, the FLSA outlines regulations around recordkeeping and child labor.

In short, your business must accurately classify employees, display an official poster outlining the requirements of the FLSA, focus on the health and well-being of youth workers, and more.

Employee Classification

It is pertinent that you know the difference between independent contractors, full-time and part-time employees. Familiarize yourself with the classifications and stay in accordance with the U.S. Department of Labor’s guidelines as well as the IRS.

As mentioned above, misclassifying employees can be a costly mistake. When workers are misclassified, they can be denied important services and protections like minimum wage, sick leave, and unemployment insurance. This not only hurts the employee but also results in less tax revenue for the government and less money for employee programs.

Reclassifying workers and paying their taxes can help avoid penalties and protect both workers and the economy. Save a copy of this IRS fact sheet on understanding employee versus contractor designation to help avoid this mistake.

By enforcing these clear job definitions, you will not only be in compliance with the law, but each employee should better understand what they are accountable for.

Workplace Safety

Providing employees with a safe work environment is critical. The Occupational Safety and Health Act (OSH Act), enforced by the Occupational Safety and Health Administration (OSHA), requires businesses to provide employers with a work environment free from recognized hazards.

The top 10 OSHA-cited standards include the following:

- Fall Protection, construction

- Respiratory Protection, general industry

- Ladders, construction

- Hazard Communication, general industry

- Scaffolding, construction

- Fall Protection Training, construction

- Control of Hazardous Energy (lockout/tagout), general industry

- Eye and Face Protection, construction

- Powered Industrial Trucks, general industry

- Machinery and Machine Guarding, general industry

Employers in specified low-risk industries are exempt, however, it’s best to verify the risk level of your industry as outlined by OSHA.

Employee Leave

Employees are entitled to certain types of leave, such as sick leave, vacation time, and parental leave. Employers must comply with federal and state laws, such as The Family and Medical Leave Act (FMLA), regarding leave and provide appropriate time off to employees who qualify. The FMLA also allows eligible employees to take up to 12 weeks of unpaid leave for certain reasons.

Examples of FMLA violations include:

- Refusing to authorize FMLA leave for an eligible employee,

- Discouraging an employee from using FMLA leave,

- Manipulating an employee’s work hours to avoid responsibilities under the FMLA,

- Using an employee’s request for or use of FMLA leave as a negative factor in employment actions, such as hiring, promotions, or disciplinary actions, or,

- Counting FMLA leave under “no-fault” attendance policies.

Equal Pay and Pay Equity

The Equal Pay Act (EPA) amended the FLSA to prohibit wage discrimination between workers doing the same job with the same qualifications and experience who should receive the same pay, regardless of their gender, race, or other characteristics.

Pay equity is about ensuring that pay differences are based on legitimate factors such as job responsibilities and experience, as opposed to based on sex, race, religion, etc. Employers must comply with laws regarding equal pay and pay equity to avoid legal consequences.

DEI

In order to properly align with Diversity, Equity, and Inclusion (DEI), employers must strive to create a workplace that is diverse and inclusive, where employees feel valued and respected regardless of their race, ethnicity, gender, religion, or other characteristics. This can be achieved through policies and practices that promote diversity and equity, such as inclusive hiring practices, training programs, and employee resource groups.

Many companies make the following mistakes:

- Not focusing on the right data. Look past the number, and get into all the insights!

- Focusing on one aspect. People are complex!

- Failing to lead from the top down. DEI is a company-wide effort!

- Recognizing DEI through brand, not actions. Ever hear ‘actions speak louder than words’?

All in all, ask the right questions to your employees to understand their honest feedback on how to improve your company’s DEI efforts.

Data Privacy

The Equal Employment Opportunity Commission’s privacy program establishes practices for employers who must take measures to protect their employees’ personal information and ensure that it is collected and stored securely. This includes information such as social security numbers, bank account information, and healthcare medical records. Employers must also comply with laws such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) to avoid legal consequences.

Installing software that shields against cyber attacks, implementing training, and additional security measures can help your business avoid a data breach.

Managing HR Compliance

Now that we’ve covered what HR compliance is, and what the top HR compliance issues are, it’s time to get into the fun part – managing HR compliance.

Sensing some sarcasm in the ‘fun part’? Your instincts may be right, but we can try to make a daunting task a little less daunting (and maybe even a little fun) with the right guidance.

Below are a few ways you can navigate through HR compliance challenges with confidence.

Develop A Compliance Program

A compliance program lays out all the necessary steps, policies, and procedures within your business to adhere to federal, state, and local laws, rules, and regulations. The program should include a code of ethics and conduct, a process for reporting and investigating violations, and guidelines for managing risks.

Provide Training And Education

Getting your employees on board and educated on HR compliance can make managing compliance much easier. When employees understand their legal responsibilities and know what the legal requirements are, it’s easier to adhere to them. You should consider providing training on topics such as workplace safety, anti-discrimination laws, harassment, and data privacy. More topics may be necessary according to your unique business case or industry.

Create Clear Policies And Procedures

Clear policies and procedures can help prevent violations and ensure that employees understand what is expected of them. You should consider creating policies on topics such as equal pay, employee leave, and harassment. More policies and procedures may be necessary according to your unique business case or industry. And of course, what good are policies and procedures if they’re difficult to access? Make sure your policies and procedures are outlined in a place that’s easily accessible by your organization, like an employee handbook.

Update Policies As Laws Change

Let’s face it, laws change. And they can change pretty frequently. You should consider regularly reviewing policies and updating them as laws change. It’s important to stay up-to-date with changes in federal laws, state, and even local regulations to ensure compliance. Here are a few ways to make keeping up with law changes easier:

- Use technology and tools for compliance management: There are plenty of HR software systems on the market to help manage employee data, track compliance training, and ensure that policies are being followed.

- Conduct Audits: Regular compliance audits can help identify areas of non-compliance and prevent violations. Audits should be conducted by a qualified HR professional or outside consultant.

Addressing HR Compliance Issues

Despite your best efforts, compliance issues may still arise. Here are some ways to address and resolve compliance issues:

How To Address And Resolve Issues Or Complaints

As we mentioned above, compliance issues may arise, no matter how much you do to avoid them. Having a process in place for addressing and resolving compliance issues or complaints can help. This process could include a way for employees to report violations or concerns and a procedure for investigating and resolving complaints.

Documentation Issues

Like with many things in the work world, especially in the world of HR, documentation is key. As it relates to HR compliance, it’s critical to ensure that all documentation related to compliance issues is accurate and complete.

Communicating With Parties

It’s critical to establish clear communication and touch base with all parties involved in compliance issues, including the complainant, the accused, and any witnesses. And of course, communication should be respectful and professional.

Maintaining Confidentiality

This may go without saying, but it’s imperative that you maintain confidentiality throughout the compliance process to protect the privacy of those involved.

When To Bring Legal Counsel In

In some cases, it may be necessary to bring in legal counsel to address compliance issues. You may want to consider consulting with legal counsel if you are unsure about how to proceed with a compliance issue or if a violation may result in legal action.

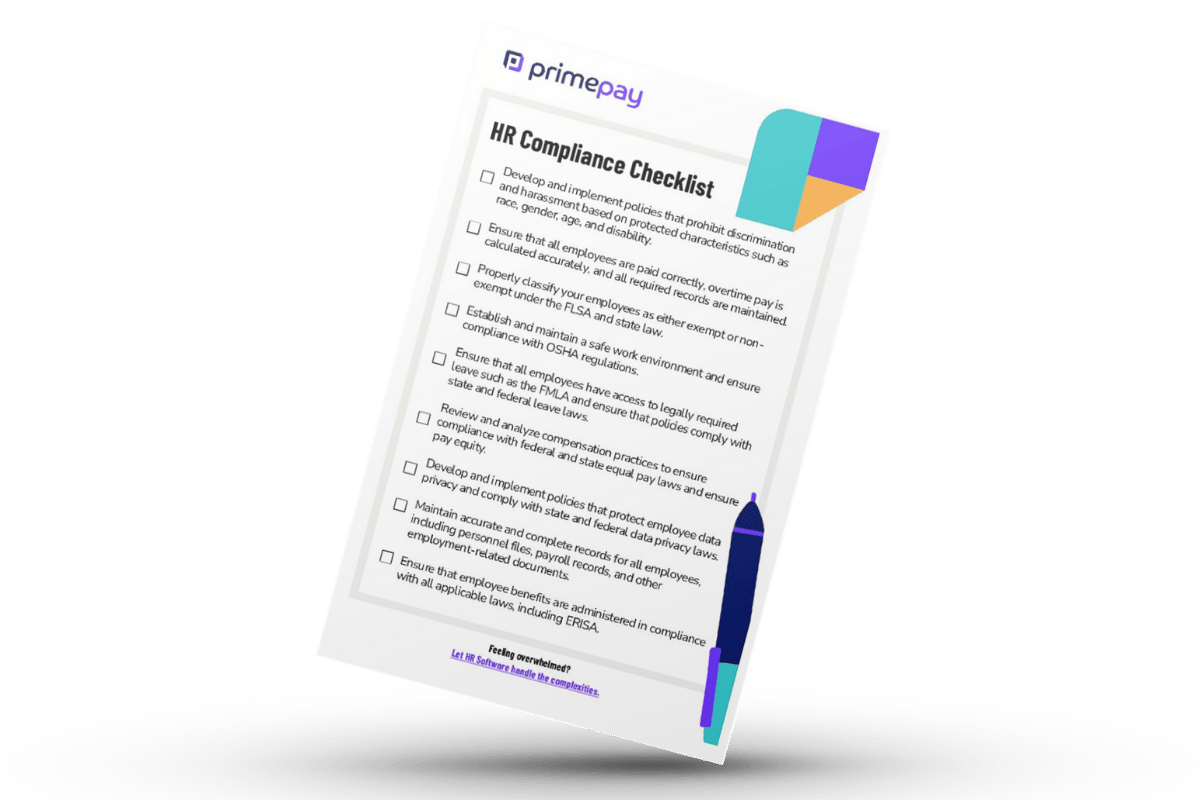

HR Compliance Checklist (+ Bonus Performance Review Compliance Checklist)

- Anti-discrimination and harassment policies: Develop and implement policies that prohibit discrimination and harassment based on protected characteristics such as race, gender, age, and disability.

- Wage and hour compliance: Become an expert in the minimum wage and ensure that all employees are paid correctly, overtime pay is calculated accurately, and all required records are maintained.

- Employee classification: Make sure to properly classify your employees as either exempt or non-exempt under the Fair Labor Standards Act (FLSA) and state law.

- Workplace safety: Establish and maintain a safe work environment and ensure compliance with Occupational Safety and Health Administration (OSHA) regulations.

- Employee leave policies: Ensure that all employees have access to legally required leave such as the Family and Medical Leave Act (FMLA) and ensure that policies comply with state and federal leave laws.

- Equal pay and pay equity: Review and analyze compensation practices to ensure compliance with federal and state equal pay laws and ensure pay equity.

- Data privacy: Develop and implement policies that protect employee data privacy and comply with state and federal data privacy laws.

- Recordkeeping: Maintain accurate and complete records for all employees, including personnel files, payroll records, and other employment-related documents.

- Benefits administration compliance: Ensure that employee benefits are administered in compliance with all applicable laws, including the Employee Retirement Income Security Act (ERISA).

- Legal Counsel: Gain access to resources to help you avoid fines and lawsuits while managing the evolving HR and employment requirements.

Bonus Checklist: Stay Compliant During Performance Reviews

Performance reviews are an important aspect of employee development and growth in any organization. They provide an opportunity for employees to receive feedback on their work and set goals for the future. However, without proper preparation, performance reviews can become an unproductive and frustrating experience for both employees and managers.

The following quick checklist of best practices will keep you compliant when conducting performance reviews:

- Establish a cadence: Ensure performance reviews are conducted for all employees on a regular basis.

- Communication is key: Clearly communicate job expectations and responsibilities to all employees including the measured performance standards.

- Create a system: Put systems into place for measuring performance based on job-related functions and criteria that were illustrated in the employee’s job description.

- Review and refresh: Review and update job descriptions at least once a year.

- Document: Keep an accurate log and detail the records regarding performance to support personnel decisions.

- Be clear: Make certain that performance reviews are based on specific job-related criteria.

- Be honest: Provide honest, factual, and complete notes.

- Focus on OKRs: Compare performance against job descriptions and goals.

- Offer ongoing feedback: Don’t save feedback for review time, give feedback regularly!

- Be fair: Ensure the review process for measuring performance is equal amongst all employees.