Quick Summary

Many business owners don’t see the full cost of payroll. Gross wages are just one part of it. This guide shows how to calculate, categorize, and report payroll expenses. This helps leaders budget, price services, and hire confidently. Knowing total payroll costs helps avoid compliance errors and financial gaps.

- What payroll expenses include (gross wages, employer payroll taxes, benefits, insurance)

- The difference between salary expense and total payroll costs

- FICA, FUTA, SUTA, and employer tax obligations

- How to calculate and categorize payroll expenses accurately

- How proper reporting improves budgeting and compliance

Payroll Is More Than Just Wage Payments

Payroll is a major and steady expense for nearly all businesses. Payroll expenses are essential. Unlike other operating costs, you can’t skip or delay them. Employees want timely and accurate pay. Governments expect correct tax calculations and prompt deposits.

Every pay period, you need to calculate wages. Then, withhold taxes and remit employer payroll taxes. Also, fund benefits and keep records.

And yet, many employers do not have a clear picture of what payroll actually costs. That’s true even though payroll can account for nearly a full third (30%, by one estimate) of total revenue. In fact, two-thirds (66%) of payroll professionals say they lack the information needed to understand total payment costs. Missing information includes data like provider fees and banking charges.

Payroll expenses impact profitability, hiring choices, pricing, and growth. This lack of visibility poses real challenges for business owners. It also poses a big compliance risk. Errors in payroll taxes, misclassifying workers, or missing costs can result in penalties. This can strain cash flow and cause unnecessary stress.

This guide will help you understand payroll expenses. We’ll discuss what they are, how they differ from other financial metrics, and share common examples. Then, we’ll explain how to categorize and calculate them accurately. These basics can help leaders make smart choices about hiring, pay, and future plans.

What Are Payroll Expenses?

Payroll expenses are the total costs a business incurs to compensate its workforce. Importantly, these expenses extend beyond what employees see on their paychecks. Payroll expenses typically include:

- Base salaries and hourly wages

- Overtime pay

- Bonuses and commissions

- Employer payroll taxes

- Employer-paid benefits such as health insurance and retirement contributions

- Mandatory contributions such as unemployment insurance

- Certain administrative payroll-related fees

In short, payroll expenses include all costs related to employing workers. This covers both direct and indirect financial obligations.

Payroll Expenses vs Employee Pay

It is important to distinguish between what employees earn and what employers spend.

An employee may earn $50,000 per year in salary. The employer’s total payroll expense for that employee is often much higher. This includes employer payroll taxes, benefit contributions, and insurance costs. In some cases, the true cost of an employee can be 20% to 30% higher than base pay!

True story: years ago, a newly-formed business called PrimePay Customer Service in a panic. They believed too much money was pulled from their account on payday. The issue? The owners forgot that there were other mandatory costs (beyond employee salaries) when running payroll, and didn’t budget appropriately.

Who Incurs Payroll Expenses?

Any organization that employs workers incurs payroll expenses. This includes:

- Small businesses with a handful of employees

- Mid-sized organizations operating in multiple states

- Large enterprises with complex compensation structures

Even nonprofits and startups must account for payroll expenses accurately. Only sole proprietorships without employees can skip traditional payroll costs. However, self-employment taxes still apply in those cases.

Why Payroll Expenses Continue to Rise

Payroll expenses rarely remain static, and they rarely go down. Salaries alone usually rise by a few percentage points each year (an expected 3.5% for 2026). With them, all the indirect costs go up too. Several factors contribute to steady increases:

- Annual wage and salary adjustments

- Rising healthcare costs

- Changes in employer payroll tax rates

- State-level unemployment insurance adjustments

- Competitive labor markets requiring higher compensation

Examples of Payroll Expenses

Payroll expenses fall into several core categories. Understanding each component helps business owners track costs accurately and avoid surprises.

Gross Wages and Salaries

The foundation of payroll expenses is the gross wage. That’s what an employee earns before any taxes or deductions. This can come in one or more of several different forms:

- Hourly pay

- Salaried compensation

- Overtime

- Bonuses

- Commissions

- Incentive pay

Employers calculate gross wages as the total pay owed to an employee for a pay period. Employees often think about net pay, or take-home pay. But employers start with gross wages to figure out all payroll costs.

For example, an employee might earn $1,000 in gross wages during a pay period. The employer calculates payroll taxes and contributions based on that amount. Gross wages serve as the starting point for determining total payroll expenses.

Payroll Taxes

Payroll taxes are a significant component of payroll expenses. They include amounts taken from employees and taxes paid by the employer.

Federal Income Tax Withholding

Employers are required to withhold federal income tax from employee wages based on information provided on Form W-4. The amount withheld depends on filing status, income level, and other factors. Withheld taxes aren’t really an employer expense. However, managing federal income tax withholding is a key part of payroll administration.

State Income Tax Withholding

Many states require employers to withhold state income taxes as well. Rates and regulations vary widely by state. Businesses in multiple states must follow the rules of each area. Not withholding correctly can lead to penalties and back taxes, just like with federal taxes. So, accurate calculation is crucial.

FICA, FUTA, and SUTA

Employer payroll taxes also include several mandatory contributions.

FICA covers Social Security and Medicare taxes. The standard FICA rate remains 7.65% of an employee’s gross wages, consisting of:

- 6.2% for Social Security

- 1.45% for Medicare

Employers must then match this 7.65% contribution, so the employer pays an additional 7.65% on top of gross wages. There is also an additional Medicare tax for high earners. That portion applies to employee withholding only, however.

FUTA, or the Federal Unemployment Tax Act, funds federal unemployment programs. Employers typically pay FUTA at a rate of 6% on the first $7,000 of each employee’s annual wages. However, most employers qualify for credits that reduce the effective FUTA rate.

SUTA, or State Unemployment Tax Act contributions, fund state unemployment benefits. SUTA rates and wage bases vary by state and by employer experience rating. Because rates differ widely, businesses must verify current state requirements each year.

Employee Benefits and Employer Contributions

Health Benefits

Employer-sponsored health insurance premiums can be a substantial cost. Many employers split premium costs with employees. However, the employer’s share still counts as part of total payroll expenses. This can include:

- Dental and vision insurance

- Health savings account contributions

- Employer-paid disability insurance

Retirement Contributions

If a business has a retirement plan like a 401(k), employer matching contributions count as payroll expenses. Even modest matching programs can significantly increase total payroll costs across a workforce.

Other Payroll-Related Costs

Finally, there are other miscellaneous expenses tied to payroll. Some of these costs may appear separately in financial statements. However, they are closely tied to workforce pay. For planning, these costs are often seen as part of overall payroll expenses. These can include:

- Workers’ compensation insurance

- Paid time off accruals

- Paid parental leave

- Training stipends tied to employment

- Payroll processing and compliance fees

Employee vs. Contractor Payroll Reporting

Not all workforce payments are treated the same way. The difference between employees and independent contractors changes how payroll costs are calculated and reported.

Payroll Expenses for Employees

For employees, payroll expenses include:

- Gross wages

- Employer payroll taxes

- Benefit contributions

- Unemployment insurance

- Workers’ compensation coverage

Employers must:

- Withhold income taxes.

- Calculate and remit payroll taxes.

- Provide year-end forms like Form W-2.

These extra obligations mean employees usually have higher total payroll costs than contractors.

Payroll Expenses for Contractors

Independent contractors are paid differently. Businesses generally do not:

- Withhold income taxes

- Pay employer payroll taxes such as FICA

- Pay unemployment taxes

- Provide traditional benefits

Instead, contractors are typically paid their agreed-upon fee. Then, businesses issue Form 1099-NEC at year end.

So, contractor payments are typically seen as a labor cost but not a payroll expense. However, worker classification must be handled carefully. Misclassifying an employee can result in significant tax penalties and back payments.

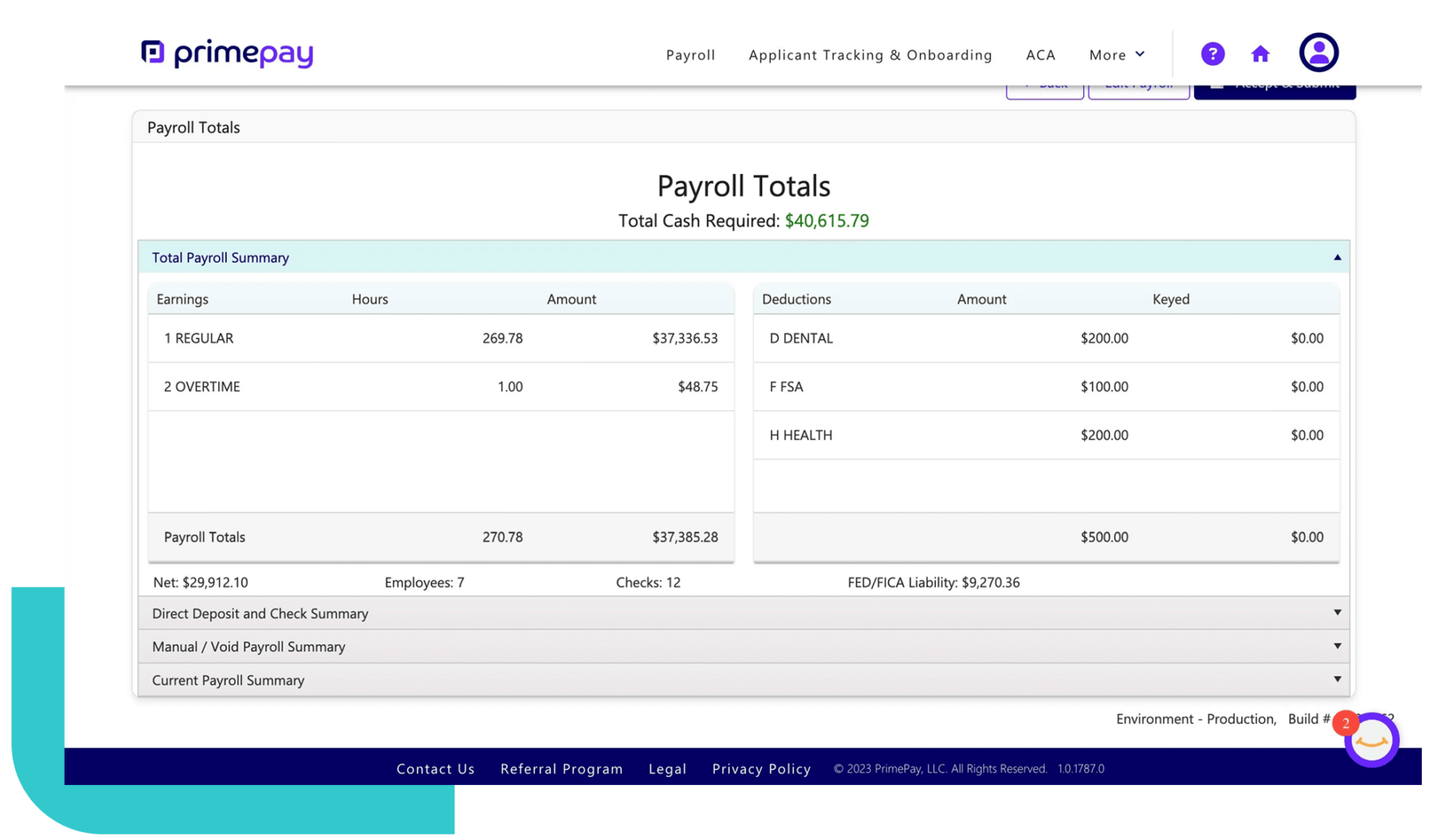

How to Calculate Payroll Expenses

Calculating payroll expenses accurately requires a clear, step-by-step method. This way, you can meet tax and compliance needs. Let’s walk through each step:

Step 1: Have Employees Complete a W-4 Form

Begin by having each employee fill out a W-4 form upon hiring. This form is key for figuring out federal income tax withholding. It includes the employee’s filing status, like single, married, or head of household. It also allows for any extra withholding amounts they may ask for.

Review W-4s often. Life changes, like marriage or new dependents, can affect withholding. Employers use the W-4 to figure out how much federal income tax to take from each paycheck.

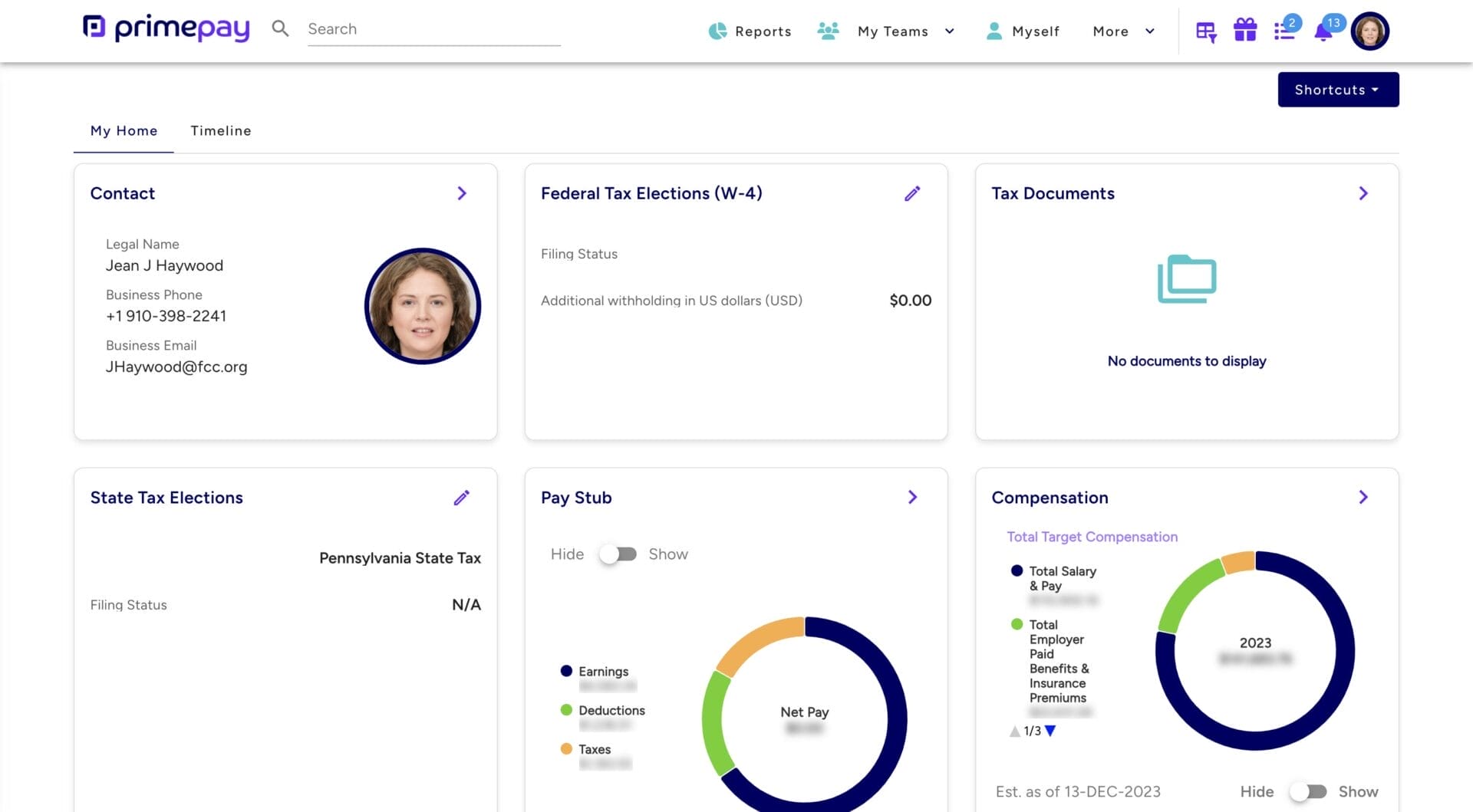

Many employers use self-service portals during employee orientation. These portals can guide new hires through mandatory filings and company training.

Step 2: Determine Gross Pay

Gross pay is the total amount an employee earns before any deductions.

- For hourly employees. Calculate gross pay by multiplying hours worked by their hourly wage. Include any overtime or shift differentials.

- For salaried employees. Divide the agreed-upon annual salary by the number of pay periods.

Gross pay may also include bonuses, commissions, and other types of additional compensation. Triple-check your calculations, since gross pay impacts all subsequent payroll calculations.

Step 3: Calculate Net Pay

Once gross pay is determined, it’s time to calculate net pay. Net pay is the actual amount the employee will receive after deductions.

- Subtract federal and state taxes. Use the employee’s W-4 details for this.

- Subtract FICA contributions for Social Security and Medicare. Both the employee and employer share this cost. Other deductions include retirement contributions, health insurance premiums, and garnishments. These amounts are also subtracted.

The remaining amount after all deductions is the employee’s net pay, or “take-home pay.”

Step 4: Submit Tax Deposit

Employers need to send payroll tax deposits to the IRS and state tax agencies after calculating net pay. Tax deposits are due on different schedules (weekly, bi-weekly, monthly, or quarterly) based on the business’s total tax liability.

Staying on top of deposit schedules is crucial, as late deposits can result in fines or penalties. The IRS usually needs electronic deposits. This makes things simpler and helps keep records organized.

Step 5: Complete Tax Forms

Employers need to file different payroll tax forms with federal, state, and local tax authorities all year. Make sure you know which your company is subject to!

Businesses often file IRS Form 941 every quarter. This form reports income tax withholdings and FICA contributions. Some states have similar forms and deadlines for state income tax withholdings.

By year-end, employers must give each employee a W-2 form. This form summarizes their yearly wages and withholdings. Employers also file it with the Social Security Administration. For contractors, a Form 1099-NEC is completed and submitted instead.

The right payroll software allows you to run payroll easily and automatically deduct taxes and withholdings for you.

Step 6: Notify Employees of Their Pay Amount

Once payroll is finalized, it’s time to issue paychecks or direct deposits. Employees should get a pay stub or earnings statement. This should show their gross pay, deductions, and net pay. This breakdown shows employees how their pay was calculated.

It can also lessen questions or confusion about withholdings or deductions. Digital or paper statements are fine. However, many businesses prefer electronic pay stubs because they are more convenient.

Step 7: Keep Payroll Records Filed

It is no less essential to document everything in payroll as it is in any other segment of the business. When you check payroll systems, ensure they have strong features for documenting payroll expenses.

Employers must follow IRS and state rules. They need to keep detailed records of payroll transactions. This includes gross pay, deductions, net pay, and tax filings.

Keep payroll records for at least three to seven years. The timeframe depends on the document type. Good recordkeeping protects your business during audits. It also helps keep future payroll calculations accurate and consistent.

How to Categorize Payroll Expenses

Now we know what payroll expenses are and have reviewed the payroll process. All of this is only the first step, however. To manage payroll costs well, business owners must categorize them correctly. Clear categorization supports accurate financial reporting, budgeting, and tax compliance.

Most businesses group payroll expenses into a few core categories:

- Direct Compensation. This includes gross wages, salaries, overtime, bonuses, and commissions. These are usually recorded as wage or salary expense on the income statement. For service-based businesses, direct compensation is often the biggest operating cost.

- Employer Payroll Taxes. Employer payroll taxes should be tracked separately from employee wage expenses. These include the employer portion of FICA, FUTA, and SUTA contributions. Separating these costs helps you see how much your business pays in taxes, apart from base wages.

- Employee Benefits. Health insurance premiums and retirement contributions are benefits. Other employer-funded perks also fall under benefits expense. Isolating healthcare and retirement costs helps leadership spot trends. This way, they can plan renewals wisely, even as costs change each year.

- Insurance and Mandatory Coverage. Workers’ compensation insurance and state-required disability coverage are typically categorized under insurance expenses. Even though these are tied to payroll, they may be tracked separately for clarity.

- Payroll Administration Costs. Fees for payroll providers, time and attendance systems, or compliance consultants usually count as administrative or professional services expenses. These costs might be smaller than wages, but they still add to total payroll costs.

Accurate categorization boosts bookkeeping and helps analyze business performance. This supports business owners in answering practical questions like:

- How much does each employee truly cost the business?

- Are employer payroll taxes increasing year over year?

- What percentage of revenue is being allocated to payroll expenses?

- Where can efficiencies be gained without compromising compliance?

Clear categorization also supports audits and simplifies year-end reporting. When payroll costs are classified correctly, tax filings, financial reviews, and budgeting get easier.

Payroll Plans That Fit Your Business

What payroll system will your organization use to manage its payroll expenses?

Some businesses stick to manual processes or simple accounting software. Others choose full-service payroll providers. These providers automate calculations, tax filings, and compliance reporting. Not all payroll systems are the same. Even high-performing systems might not fit your needs. The system used must match your business model, workforce size, and compliance requirements.

When evaluating payroll plans, consider the following factors:

- Workforce Complexity. Do you have hourly employees, salaried staff, remote workers in multiple states? Or do you have a mix of employees and contractors? Multi-state operations and mixed workforces increase compliance complexity.

- Growth Plans. A payroll solution that works for five employees might struggle with fifty. For example, a manual method can be tough to scale, making it hard to keep accurate and timely. As payroll expenses grow, automation and reporting capabilities become increasingly important.

- Compliance Support. Employer payroll taxes and reporting requirements change frequently. A payroll provider that updates tax tables and manages filings can lower risk.

- Reporting and Visibility. Many payroll professionals don’t clearly understand total payment costs. So, it’s important to choose a solution that offers detailed reporting. Business owners should clearly see data like:

- Gross wage

- Employer payroll taxes

- Benefits costs

- Administrative fees

- Integration with Benefits and HR Systems. If you offer health insurance or retirement plans, use integrated systems. They help reduce mistakes and duplication. Unified reporting helps ensure payroll expenses are calculated accurately and consistently.

Ultimately, the right payroll plan provides transparency, supports compliance, and gives business owners real-time insight into payroll costs. The right plan changes payroll from a reactive task to a proactive financial tool.

Payroll Expenses FAQ

What are payroll expenses for employers?

In short, payroll expenses for employers cover all costs tied to employee compensation. This includes more than just the wages that employees receive. These expenses usually cover gross wages, salaries, overtime, and bonuses.

They also include employer payroll taxes like FICA, FUTA, and SUTA. Employer-paid benefits include health insurance. Retirement contributions are also part of these costs. Workers’ compensation insurance and some payroll admin fees can be included in total payroll costs.

What is the difference between salary expenses and payroll expenses?

Salary expenses refer specifically to fixed compensation paid to salaried employees. Payroll expenses are broader. They cover salary expenses, hourly wages, overtime, commissions, payroll taxes, and employer-paid benefits.

For example, if a salaried employee earns $60,000 per year, that amount is the salary expense. Adding employer payroll taxes, retirement matching, and health insurance premiums can raise total payroll cost for that employee. Payroll expenses give a fuller view of workforce costs compared to just salary expenses.

What happens if I miscalculate payroll expenses?

Miscalculating payroll expenses can lead to several problems. Underpaying payroll taxes can mean penalties, interest charges, and audits. Overpayments can create cash flow challenges and require time-consuming corrections.

Errors in wage calculations can damage employee trust and morale. Repeated inaccuracies may also expose a company to legal risk.

Beyond compliance concerns, miscalculating payroll costs can distort financial reporting. For example, if total payroll expenses are too low, profitability projections might be wrong. That can have other effects too, like poor pricing strategies. Accurate calculations protect both compliance and strategic decision-making.

Should payroll be outsourced to save time and costs?

Outsourcing payroll saves time and eases admin tasks. This is especially helpful for businesses with complex payrolls or those operating in multiple states. A good payroll provider can automate calculations. It can:

- Manage employer payroll taxes

- Handle filings

- Offer detailed reports

- And far more

Outsourcing has service fees, but it can cut costly errors. This also lets internal staff focus on important goals. Many business owners find value in better accuracy, compliance help, and clearer views of payroll costs.

The right decision depends on business size, complexity, and internal expertise. For growing companies, outsourcing often provides both operational efficiency and peace of mind.