Mastering the art of running a business means juggling multiple tasks. And let’s admit it: not all business tasks are enjoyable. In fact, 47% of professionals believe administrative tasks are tedious, and 48% think it’s a poor use of their skills.

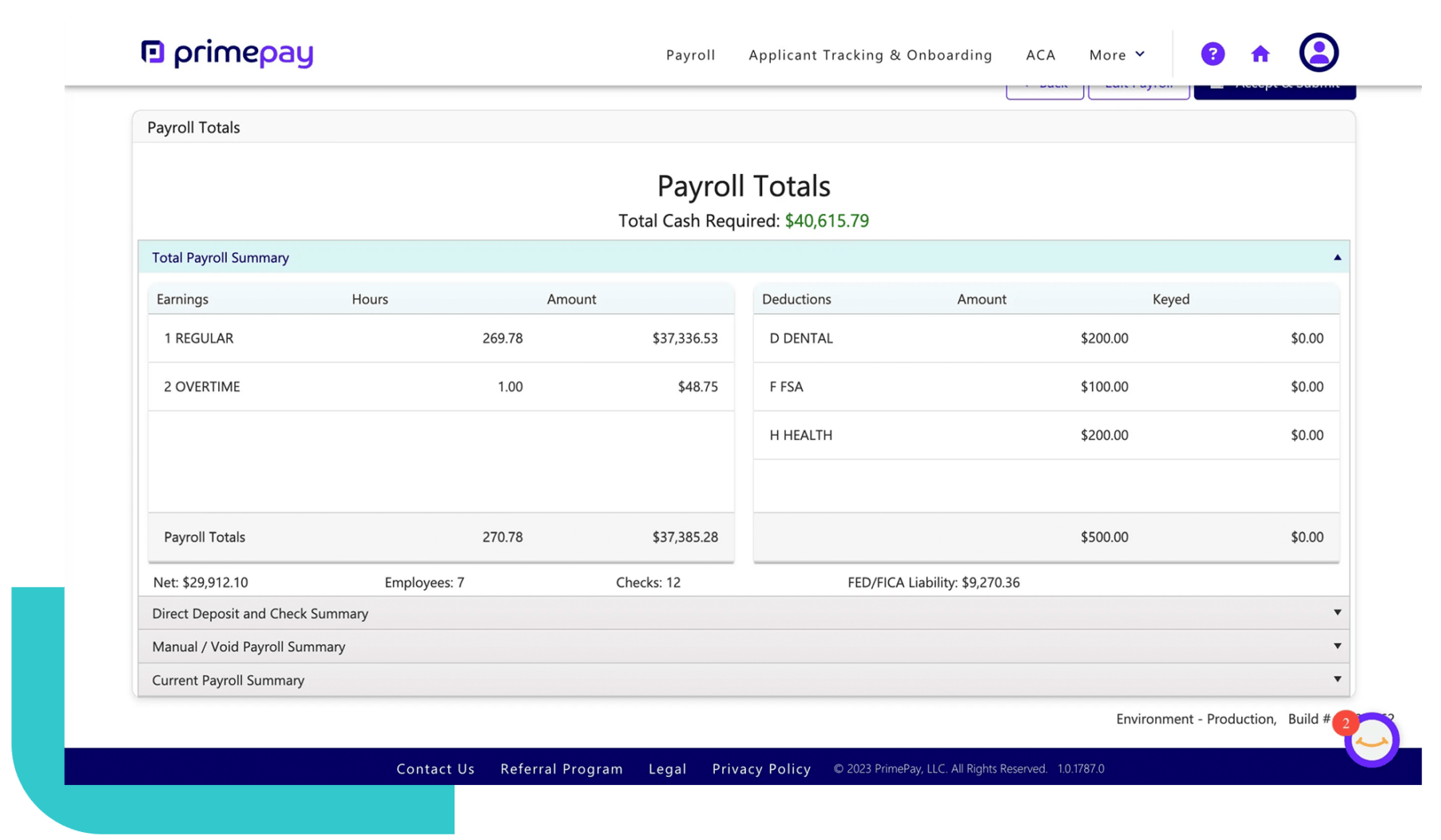

For most companies, payroll is one of the largest operating expenses, but 63% of organizations still struggle with spreadsheets or various systems to store and manage data. The result? Costly mistakes, including errors in payroll processing, delayed payroll, fines, compliance issues, and damaged employee trust.

Therefore, finance teams need to understand the payroll process—and the decisions that come with it—to secure the company’s financial health and create better experiences for all involved.

What is Payroll Processing?

Payroll processing is the administrative task of managing employee compensation. It includes calculating wages, withholding taxes, and ensuring that employees are paid accurately and on time. This process involves several critical steps, such as tracking employee hours, calculating gross pay, deducting taxes and other withholdings, and distributing payments.

What is Needed to Process Payroll

Processing payroll requires a thorough understanding of various components and responsibilities, such as the different types of payroll processing, typical payroll cycles, and the key responsibilities employers must fulfill.

Types of Payroll Processing

There are generally three main types of payroll processing methods that businesses can choose from:

- Manual Payroll Processing: This method involves calculating payroll manually, often using spreadsheets or other basic tools. While it’s cost-effective for very small businesses, it’s prone to errors and time-consuming. One survey found that employees waste over 40% of their day on manual digital administrative processes.

- Automated Payroll Software: Most businesses use payroll software to automate calculations, tax withholdings, and direct deposits. These systems reduce errors, save time, and ensure compliance with tax laws and other regulations. Software options range from simple desktop applications to comprehensive cloud-based solutions with advanced features like employee self-service portals and time and attendance integration. Software can also generate audits, budgeting, and other business needs reports.

- Outsourced Payroll Services: Some businesses choose to outsource payroll to professional payroll service providers. These providers handle everything from wage calculations and tax filings to issuing paychecks and managing benefits. This option can be more expensive but frees internal resources and ensures compliance with complex regulations.

At PrimePay, you’ll find both payroll software and managed payroll services to decide how involved you want to be regarding your payroll process.

Typical Payroll Cycles

Payroll cycles determine how frequently employees are paid and are a crucial part of payroll processing. The most common payroll cycles include:

- Weekly: Employees are paid every week, totaling 52 pay periods in a year. This cycle is typical in industries with hourly employees, such as retail and construction.

- Bi-weekly: Employees are paid every two weeks, resulting in 26 yearly pay periods. This choice is one of the most popular cycles in the United States.

- Semi-monthly: Employees receive payments twice a month, usually on fixed dates (e.g., the 15th and last day of the month), for 24 pay periods annually. Salaried employees often prefer this cycle.

- Monthly: Employees are paid once a month, totaling 12 pay periods annually. This cycle is less common in the U.S. but is frequently used in other parts of the world.

Make sure you’re extremely clear with employees about your payroll cycles. It not only allows people to budget effectively, but transparency is also crucial for employee retention. Global Payroll and People Leader Ian Giles explains, “A transparent payroll process demonstrates that the company values its employees and their financial well-being, which can boost job satisfaction and loyalty.”

Employers’ Responsibilities

Finance teams have several critical responsibilities to ensure compliance and employee satisfaction, no matter the payroll processor or cycle.

These duties include:

- Accurate wage calculation: Employers must accurately calculate wages, including regular pay, overtime, bonuses, and deductions for taxes and benefits. (This is where manual payroll processing’s time-consuming and error-prone negatives come to light.)

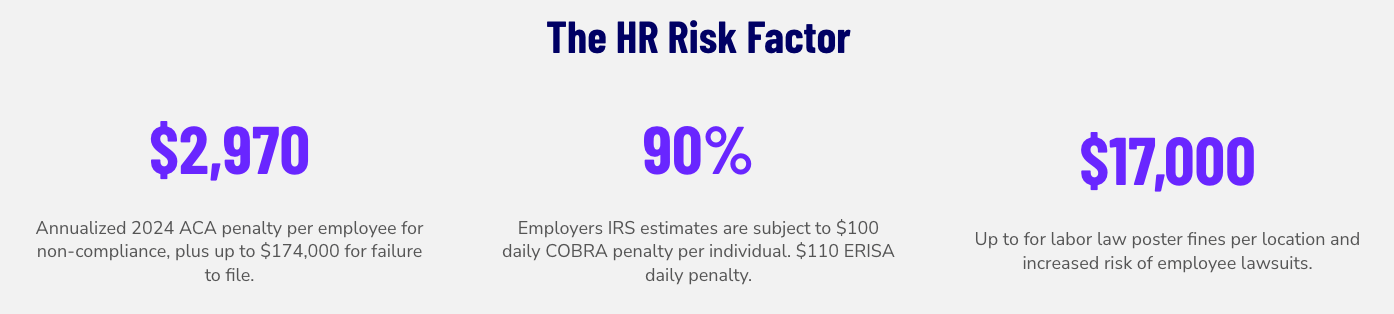

- Tax withholdings and filings: Employers are responsible for withholding the correct amount of federal, state, and local taxes from employees’ paychecks and remitting these taxes to the appropriate authorities on time.

- Compliance with labor laws: Employers must adhere to federal, state, and local labor laws, including minimum wage requirements, overtime rules, and record-keeping mandates.

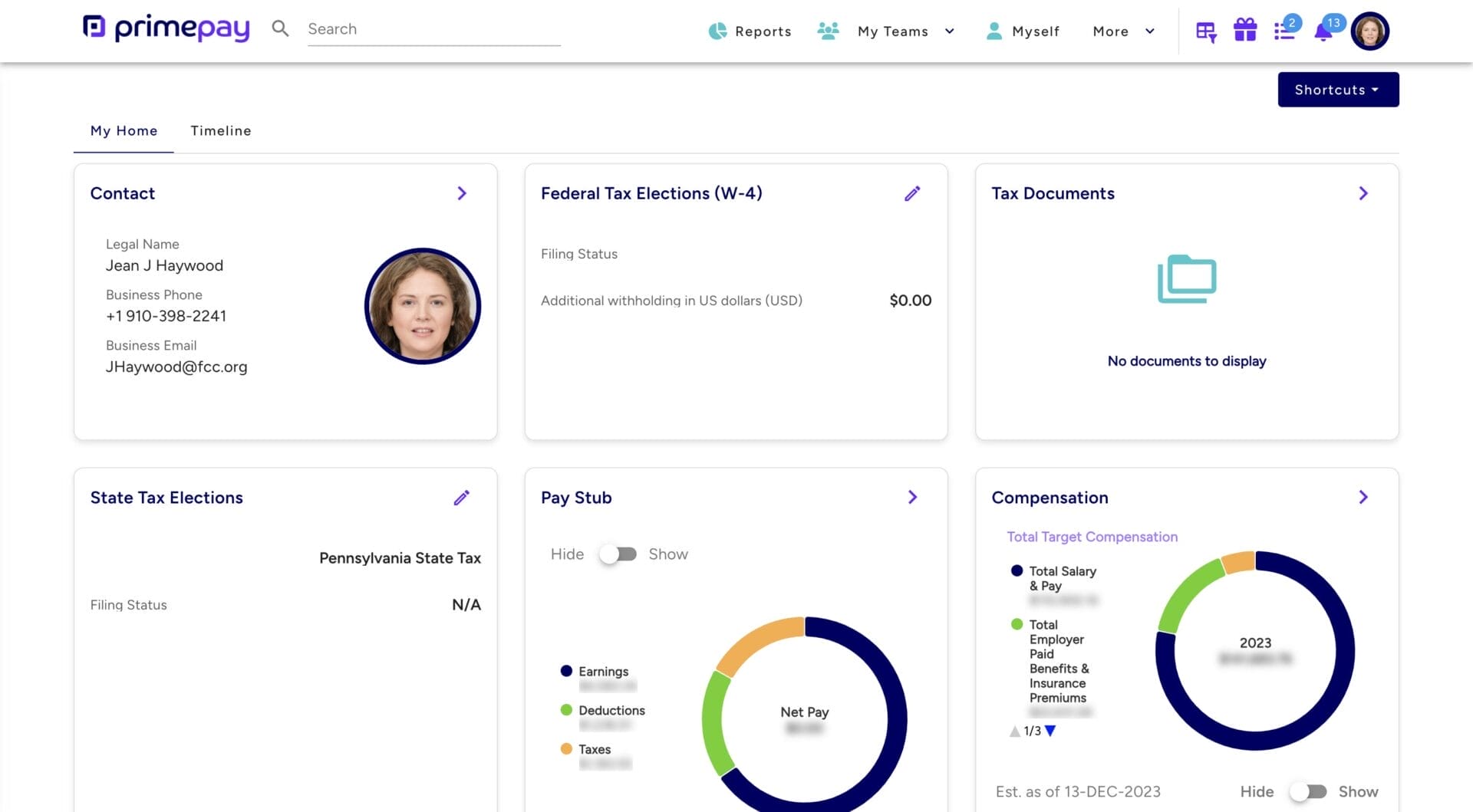

- Providing pay stubs and records: Employers must provide employees with detailed pay stubs showing earnings, deductions, and net pay and maintain accurate records of all payroll transactions.

Payroll Processing Best Practices

Effective payroll processing involves more than just paying employees on time; it also requires accuracy, compliance, and payroll security. Fortunately, adhering to best practices can significantly improve payroll operations and help prevent costly errors.

Maintain Updated Employee Information

Keeping employee information up-to-date is crucial for accurate payroll processing. Changes in employee status (such as address changes, tax withholdings, or benefits enrollment) can directly impact payroll calculations.

Implementing a system allowing employees to update their information through self-service portals can reduce the administrative workload and minimize errors. Regular audits and verifications of employee data, particularly before processing payroll, further ensure accuracy.

Equip employees with a self-service portal to save your team time and ensure accurate information.

Ensure Compliance with Payroll Rules

Compliance with federal, state, and local payroll regulations is essential to avoid penalties. Note that rules are bound to change, so you must stay informed and adjust your payroll process accordingly.

You must also keep thorough documentation and record-keeping of payroll transactions, including time sheets, pay stubs, and tax filings, to stay compliant and resolve any disputes arising during audits.

Choose a payroll provider that meets your compliance needs to adhere to deadlines and updated regulations.

Implement Secure Payroll Processing Methods

Protecting payroll data and other sensitive information from unauthorized access and cyber threats is crucial. Implementing secure payroll processing methods is essential to safeguarding this information.

- Use secure systems: Ensure payroll software and systems are safe, with strong encryption and regular security updates. Avoid using outdated or unprotected tools that could be vulnerable to breaches.

- Access controls: Limit access to payroll data to only those employees who need it for their job functions. Implement role-based access controls, which require strong passwords and two-factor authentication.

- Regular security audits: Conduct regular security audits to identify and address potential vulnerabilities in your payroll processing system. This includes reviewing user access, software updates, and backup procedures.

Choose the Right Payroll Processor

Choosing the right payroll process—or even changing providers altogether—may seem overwhelming. It’s a significant decision that affects every single person at your company. That being said, prioritizing your organization’s needs and allocation of resources will help narrow down your options.

Ultimately, no matter which avenue you choose, understanding the ins and outs of payroll processing and integrating best practices will support your overall organizational efficiency and employee trust.