Quick Wage & Tax Guide

2025 Payroll & Tax Blogs

Additional Resources

Previous Years' Guides

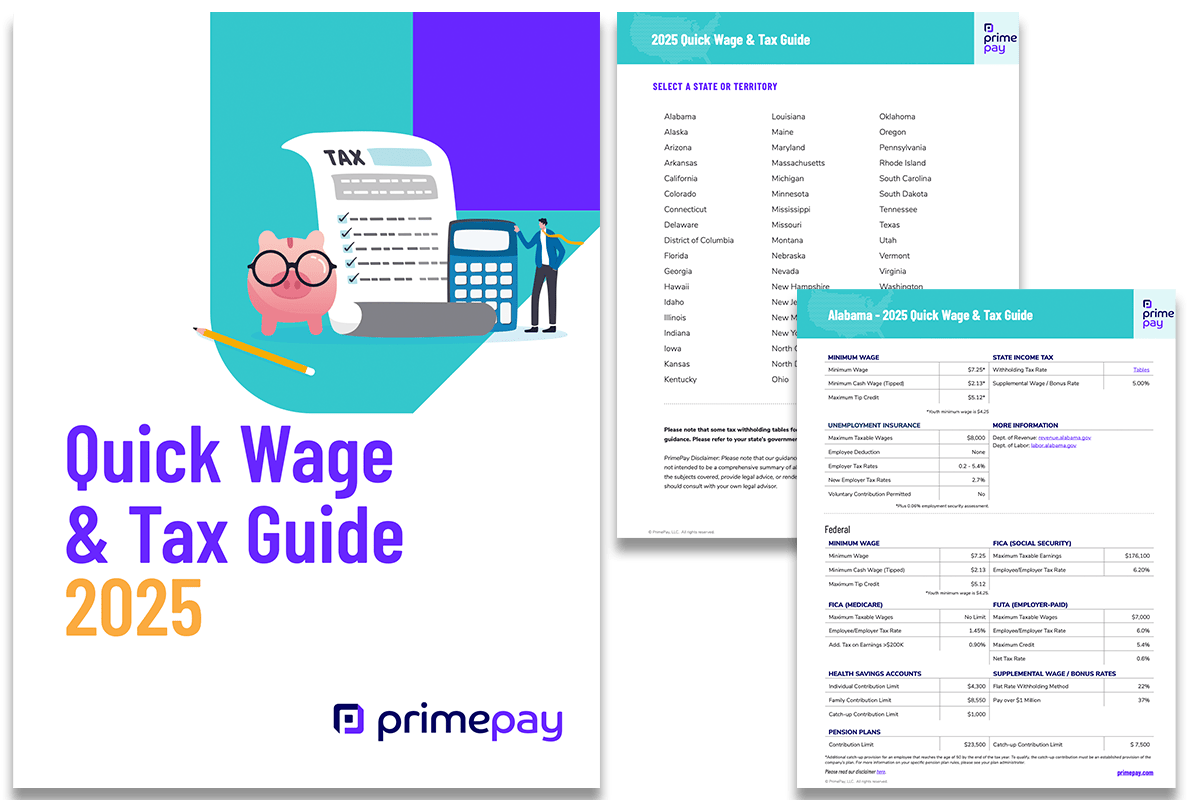

Introducing the 2025 Quick Wage & Tax Guide

A downloadable collection of the latest federal and state regulations, including the 25 state increases for minimum wage.

Previous Quick Wage & Tax Guides

2024 State Minimum Wage & Tax Facts

Did the minimum wage increase in your state? Here, we've collected all state minimum wages (and other tax information) in one place. Remember that while the federal minimum wage is $7.25 per hour, each state can set its own minimum wage for employees -- and sometimes these wages can even vary by city and county. Because of this, it can be challenging for businesses with employees across multiple states to stay on top of all the minimum wage changes.

2025 Payroll Calendar & Employment Tax Due Dates

Grab your 2024 payroll calendar, complete with payroll tax due dates and other important information so your business runs smoothly.

Federal Holidays in 2025: A Guide to Paying Your People

Are you prepared for federal holidays in 2024? Our guide covers which holidays affect payroll and how to create a holiday pay plan.

Federal Unemployment Tax Act (FUTA): Overview, Calculations, and Tax Rates

What is FUTA? Read an overview so you can calculate your FUTA taxes and determine state eligibility with ease.