What if we told you a single pre-tax benefit could attract more talent, increase retention rates, create a better employee experience, and reduce your company’s taxable income?

Enter Dependent Care Assistance Programs (DCAPs). Below we dive into the key features of DCAPs, benefits for employers and employees, and must-know information about compliance.

What Is a DCAP?

A DCAP, also called a Dependent Care FSA, allows employees to set aside pre-tax dollars to cover eligible dependent care expenses. These expenses must be necessary to enable the employee (and their spouse, if applicable) to work or actively seek employment.

Qualifying dependents typically include children under 13 and individuals who are physically or mentally incapable of self-care.

Key Features of DCAPs

DCAPs have three main features:

- Contribution limits: For the 2026 tax year, employees can contribute up to $7,500 if they are married filing jointly or as a single parent, and $3,750 if they are married filing separately.

- Eligible expenses: Funds can be used for various dependent care services, such as daycare centers, in-home childcare, and before- or after-school programs.

- Tax advantages: Contributions are made pre-tax, reducing taxable income and potentially saving employees tax.

TIP: Communicate these DCAP features during your open enrollment presentation so employees can make informed decisions about their benefits for the upcoming year.

DCAP Benefits for Employers and Employees

By offering a DCAP, employers not only provide meaningful financial support to their people but also create a more engaged and productive workplace, which benefits employers and employees alike.

Benefits for Employers

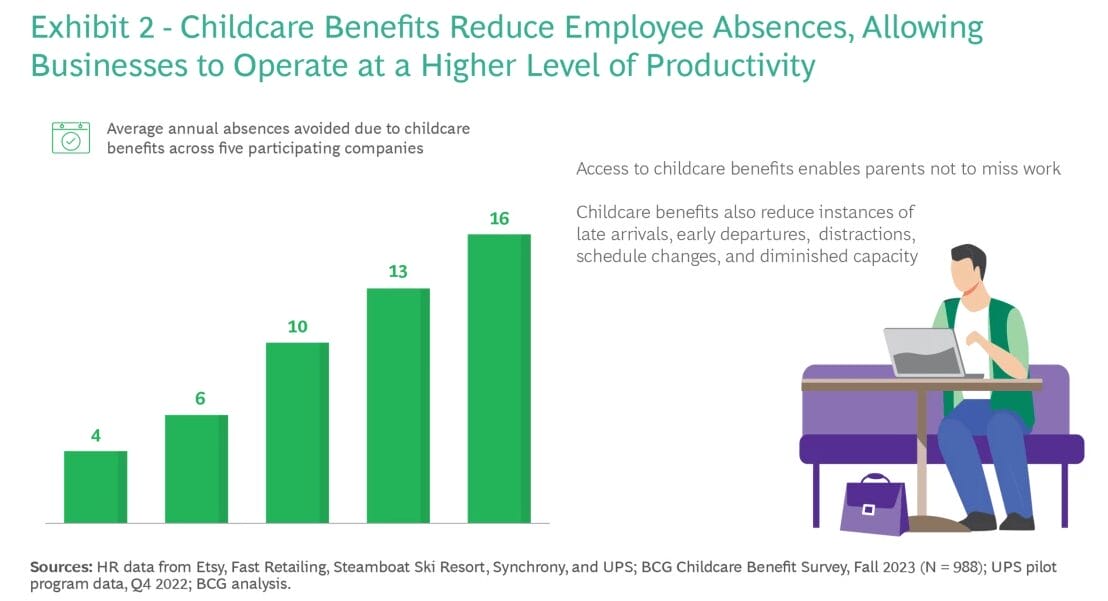

While many companies offer pre-tax benefits to employees, very few offer childcare benefits. According to research by BCG, only 12% of all full-time US employees and only 6% of part-time workers have access to childcare benefits through their employer.

Here lies a huge opportunity for organizations to stand out among competitors, especially since childcare costs continue to be a significant concern for employees. Jessica Chang, CEO and co-founder of Upwards, explains: “Employers realize that no longer is child care just a social issue but a business issue. When you have trouble attracting and retaining employees, it affects your bottom line.”

Some specific benefits for employers include:

- Payroll tax savings: Employer-sponsored DCAPs reduce taxable payroll, which can lower an employer’s share of FICA and FUTA taxes.

- Stronger employee retention: A competitive benefits package, including dependent care assistance, can enhance job satisfaction and reduce turnover. Research shows that 86% of employees say they’re more likely to stay with their employer because of its childcare benefit.

- Enhanced recruitment: DCAPs appeal to working parents, helping businesses attract top talent in a competitive job market.

- Greater workplace productivity: Employees with access to affordable dependent care are less likely to experience absenteeism and workplace distractions due to childcare concerns.

Benefits for Employees

It’s no secret that childcare is expensive, but did you know that most families spend between 10-20% of their income on childcare? And that’s just for one kid.

Unfortunately, 41% of workers report that their compensation isn’t high enough to cover their childcare costs, leading to increased absenteeism, disengagement, and higher turnover (not to mention resentment towards employers).

The good news is that companies can help offset costs by offering a DCAP so employees can realize:

- Lower child care costs: With the average cost of childcare exceeding $15,000 annually per child, employees can save up to $2,000 in taxes annually by using pre-tax dollars for these expenses.

- Increased take-home pay: Since DCAP contributions are made pre-tax, employees effectively reduce their taxable income, resulting in lower payroll taxes.

- Higher engagement: When employees have reliable child care, they’re more likely to be present, engaged, and productive. One employee told BCG researchers, “Having a place where I know my child is safe during the day gives me peace of mind and allows me to focus at work.”

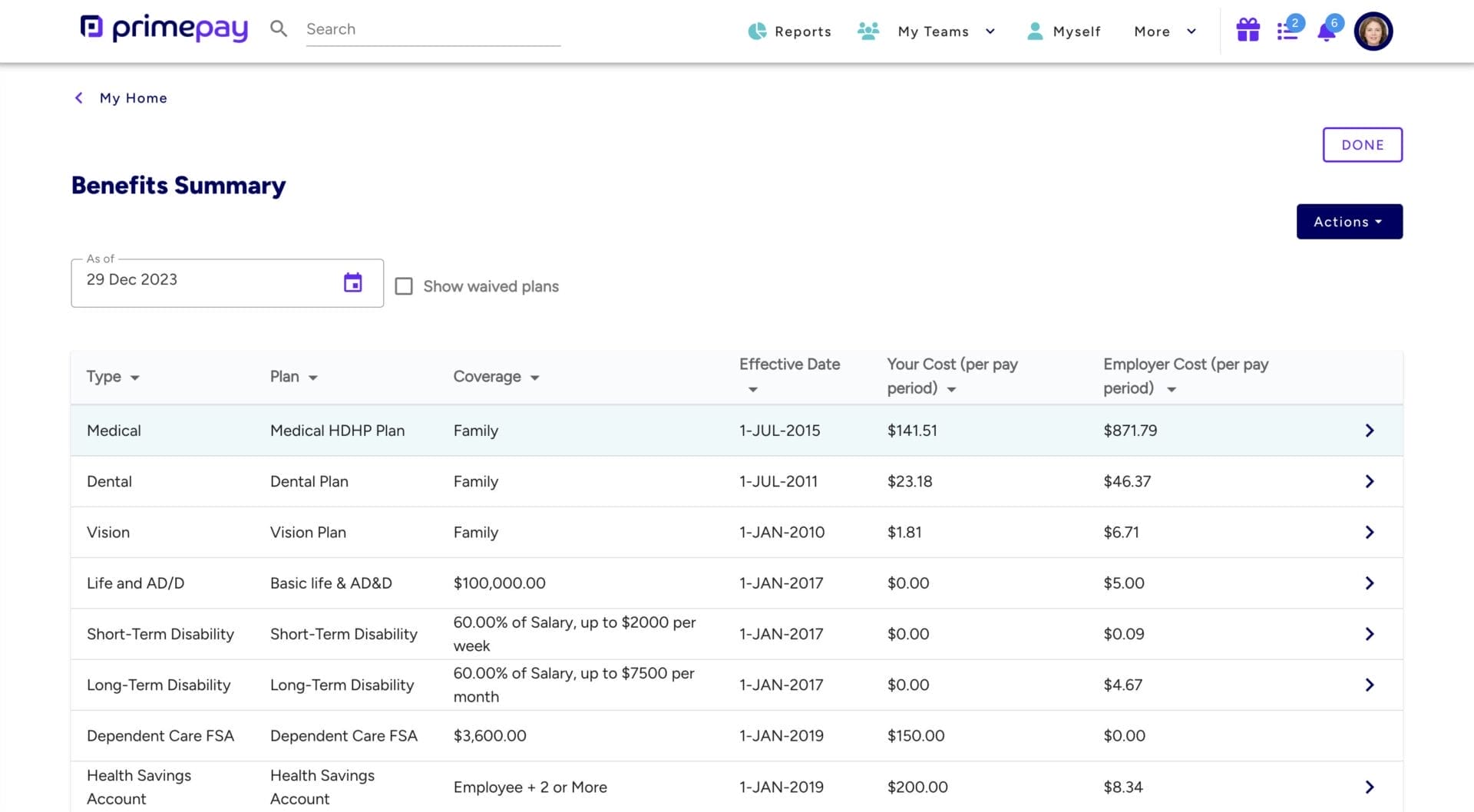

Employees should always have access to their benefits and payroll information. Equip them with an employee self-service portal so they can keep track of their contributions.

DCAP Compliance

DCAPs have to comply with the requirements in Internal Revenue Code Section 129 in order to provide tax-free dependent care assistance benefits. Also note that:

- DCAPs that allow employees to make pre-tax contributions are subject to the Code Section 125 rules for cafeteria plans, including some of the rules that apply to health FSAs (excluding the uniform coverage rule).

- A DCAP that reimburses employees for their dependent care expenses will rarely be subject to ERISA, so ERISA’s requirements (including the Form 5500 reporting requirement) don’t apply to DCAPs.

- DCAPs are not group health plans, which means they are not subject to requirements under many federal rules, such as: COBRA continuation coverage, the Affordable Care Act (ACA), or HIPAA. Because DCAPs are not group health plans, participating in a DCAP does not disrupt eligibility to make contributions to health savings accounts (HSAs).

Considerations for Employers

Implementing a DCAP can be a valuable addition to your benefits package, but it’s essential to be aware of your company’s employee population and administrative capabilities.

DCAPs must undergo annual NDT to ensure they don’t disproportionately benefit highly compensated employees (HCEs). For some employers whose employees are predominantly highly compensated or top-heavy, the program might add increased administrative burdens and minimal benefit due to a greater likelihood of NDT failures.

In fact, some of the most common NDT failures relate to DCAPs. Examples of these types of businesses include legal, engineering, and accounting firms as well as medical practices.

The good news is, if a plan discovers a potential failure mid-year, it can adjust employee withholdings to avoid that failure.

However, if a failure is not discovered until after the end-of-year tax, you must adjust employee withholdings or issue amended Forms W-2. Chances are noone will be pleased in this situation: Not only does this scenario create an administrative burden for employers, employees’ gross salary will be adjusted and they can’t utilize the full $5,000 benefit limit.

TIP: Because maintaining compliance with DCAP regulations requires diligent record-keeping and regular plan reviews, employers should be prepared to manage these administrative tasks or consider partnering with a third-party administrator, like a payroll provider.

The Bottom Line

Offering a DCAP can enhance your benefits package and support employees in managing the high costs of dependent care. However, it’s crucial to understand the associated compliance requirements and administrative responsibilities. By carefully implementing and managing a DCAP, you can provide meaningful assistance to your workforce while maintaining regulatory compliance.