Offering tax-advantaged benefits is a great way to attract and retain employees. But to keep these benefits truly fair—and to stay compliant with IRS rules—employers must pass nondiscrimination testing each year.

If a plan fails the test, it could mean serious tax consequences for both the company (such as costly penalties) and its top earners (such as losing their tax-free status).

The good news? You can avoid compliance headaches by understanding how these tests work and taking proactive steps to prevent issues before the plan year ends.

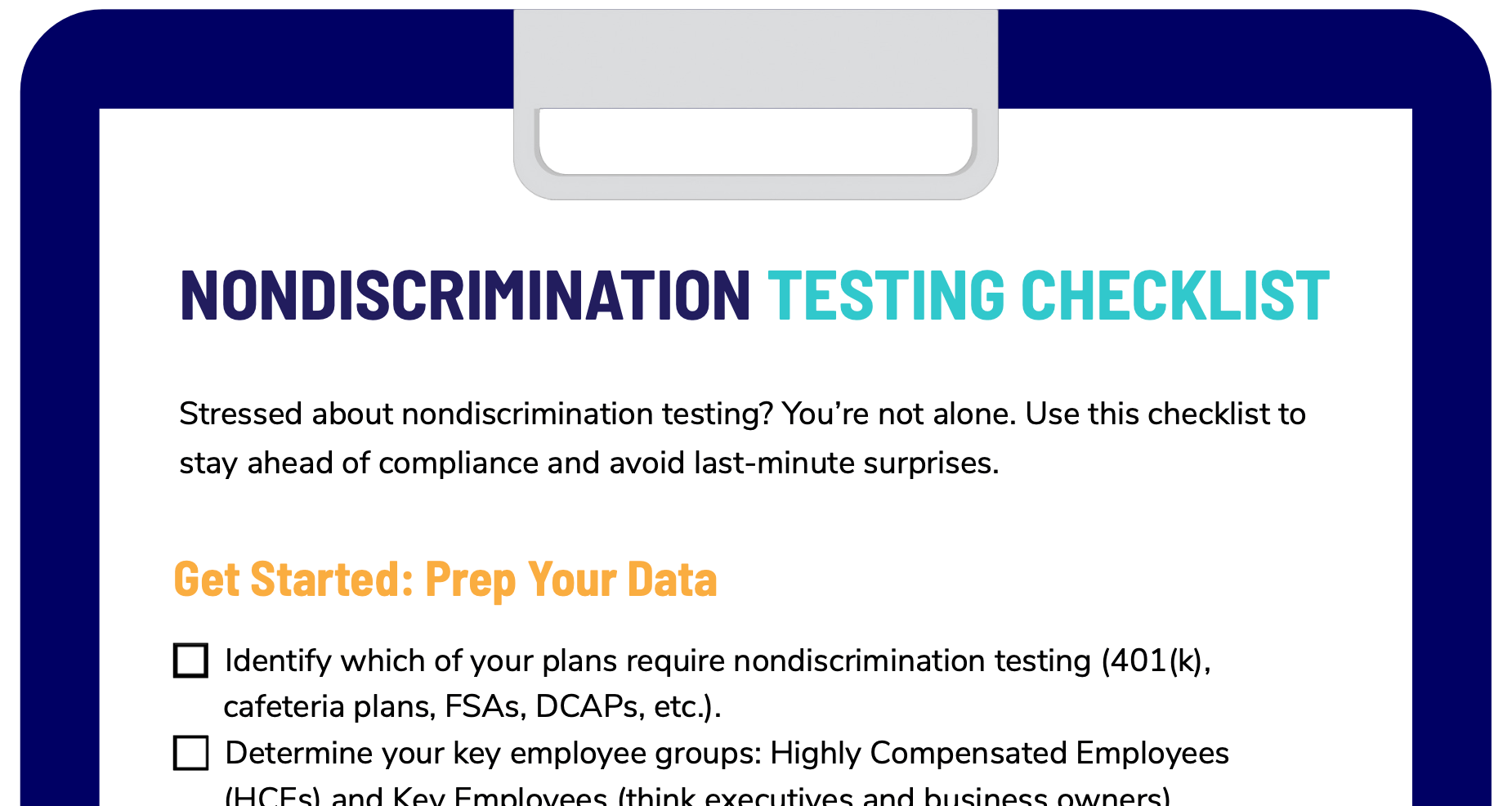

Download our Nondiscrimination Testing Checklist to help plan and maintain compliance.

What is Nondiscrimination Testing?

Nondiscrimination testing is a series of IRS-mandated tests designed to ensure that tax-advantaged benefit plans don’t disproportionately favor highly compensated employees (HCEs) over non-highly compensated employees (NHCEs).

These tests apply to various benefit plans, including:

- Cafeteria plans (Section 125 plans)

- Health flexible spending accounts (FSAs)

- Dependent care assistance programs (DCAPs)

- Health reimbursement arrangements (HRAs)

Since these plans offer pre-tax benefits, the IRS requires employers to prove that all employees, regardless of pay level, have equal access to participation and benefits.

Note: NDT tests vary for certain benefits (e.g., DCAPs have different requirements than the 125 plan), so the following information focuses on testing for the overall 125 plan and contributions.

Who is Considered a Highly Compensated Employee (HCE)?

The IRS defines highly compensated employees as anyone who owns more than 5% of the company, or an employee earning above a certain threshold (this amount changes annually; for 2025, it’s someone who earned $160,000 in 2024).

Employers must also identify key employees, which include officers earning above a specific threshold, major shareholders, and highly paid employees. Note that key employees are important for certain tests, especially in cafeteria plans.

Why is Nondiscrimination Testing Required?

The IRS mandates these nondiscrimination tests to ensure that tax-advantaged benefit plans don’t unfairly favor HCEs over rank-and-file employees.

If a plan fails, the consequences can be costly. Highly compensated employees lose the tax-free status of their benefits, meaning their pre-tax contributions become taxable income. Employers may also face compliance penalties and added administrative burdens, such as issuing corrected W-2s and amending tax filings for multiple years.

On the other hand, if organizations maintain compliance with IRS rules, they avoid unexpected tax liabilities, prevent payroll issues, and ensure fair access to benefits for all employees. This scenario is a win-win for employers and employees alike.

When is Testing Required?

Employers must conduct nondiscrimination testing annually, taking into consideration all changes made throughout the year up until the final day of the plan year. NDT often can’t be finalized until after the plan year is over because changes can be made throughout the year, but it should be completed soon after.

However, testing mid-year is a smart move because it allows you to identify potential compliance issues early and adjust benefit elections before it’s too late.

Why Work with a Compliance Expert?

Working with a payroll or benefits provider can help ensure accurate and timely compliance. Nondiscrimination testing requires precise calculations, and errors can lead to serious tax consequences. Many employers partner with providers and experts to handle compliance testing and avoid last-minute surprises.

How to Conduct Nondiscrimination Testing

As stated, companies must follow IRS guidelines to ensure their plans remain compliant and avoid costly tax consequences. While nondiscrimination testing might sound complicated, breaking it down into steps makes it more manageable.

- Identify HCEs and key employees: Determine which employees qualify as HCEs based on IRS thresholds. Then, identify key employees (owners, officers, and highly paid individuals) for cafeteria plan testing.

- Gather payroll and benefits data: Collect data on employee participation, contributions, and benefit elections for the plan year. Also, ensure accuracy in salary reduction amounts and employer contributions.

- Perform IRS-mandated tests: Each benefit plan has specific tests, so document and plan the ones you need to run. Some of the most common include:

- Eligibility test: Ensures a sufficient percentage of non-HCEs can participate.

- Contributions and benefits test: Confirms that HCEs don’t receive disproportionately higher benefits.

- Key employee concentration test: Checks whether key employees receive more than 25% of total benefits.

- Review the results: If the plan passes, maintain documentation for IRS compliance. Alternatively, if the plan fails, take corrective action before the end of the plan year, or as soon as possible if plan failure is not discovered until after the plan year ends.

- Make mid-year adjustments if needed: By testing early and making necessary adjustments, HR and Finance leaders can ensure their benefit plans remain equitable, compliant, and tax-advantaged for all employees. If a mid-year test indicates potential failure, employers can adjust HCE elections to rebalance the plan and ensure that it passes at year-end.

Common Reasons Plans Fail and How to Fix Them

Even well-structured benefit plans can fail nondiscrimination testing if employers aren’t proactive. Luckily, you can correct many issues if they’re caught before the end of the plan year.

Top Reasons Benefit Plans Fail Nondiscrimination Testing

- HCEs participate at higher rates: If more HCEs enroll in a benefit plan than non-HCEs, the plan may fail the eligibility test.

- HCEs receive more tax-free benefits: If HCEs elect significantly higher contributions (such as to an FSA or DCAP), the plan could fail the contributions and benefits test.

- Key employees control a large share of benefits: If key employees receive more than 25% of total benefits for cafeteria plans, the plan fails the key employee concentration test.

- Errors in plan administration: Mistakes in classifying employees, tracking contributions, or setting eligibility rules can lead to compliance failures.

How to Fix Nondiscrimination Testing Failures

- Conduct mid-year testing: By testing mid-year, employers can identify potential failures early and make necessary adjustments.

- Adjust HCE elections before year-end: If the plan is failing, employers can reduce HCE benefit elections to bring it back into compliance.

- Modify plan eligibility or contribution rules: Employers may adjust eligibility requirements or employer contributions to encourage greater non-HCE participation.

- Improve employee education: Increasing awareness about benefits can help boost non-HCE participation rates, improving the chances of passing eligibility tests.

Best Practices for Passing Nondiscrimination Testing

Staying ahead of nondiscrimination testing requires a proactive approach. By implementing best practices, companies can avoid compliance issues and maintain the tax-advantaged status of their benefit plans.

1. Test Early and Often

Waiting until the end of the plan year to conduct nondiscrimination testing can lead to compliance failures with no time for corrections. Running tests mid-year and toward the end of the year allows employers to make necessary adjustments before it’s too late.

2. Encourage Greater Participation from Non-Highly Compensated Employees (NHCEs)

Plans often fail because HCEs enroll at much higher rates than NHCEs. Employers can:

- Offer better employee communication about benefits to NHCEs.

- Use matching employer contributions to incentivize participation.

- Make enrollment automatic where allowed.

3. Monitor Benefit Elections and Contributions

Regularly reviewing the elections and contributions of HCEs can prevent a plan from becoming top-heavy. Employers should track contribution levels and make adjustments before they create compliance risks.

4. Work with a Third-Party Administrator (TPA) or Payroll Provider

Nondiscrimination testing involves complex calculations and IRS regulations. Many employers partner with a TPA, payroll provider, or benefits consultant to ensure accurate testing and compliance throughout the year.

5. Review and Update Your Plan Design

If your plan consistently fails testing, it may be time to update eligibility requirements, contribution structures, or employer match strategies. Even though pivoting will take time and resources, strategic design changes can help ensure long-term compliance.

By following these best practices, HR and finance leaders can reduce the risk of nondiscrimination testing failures and keep their benefit plans fair, compliant, and tax-advantaged.